Are Fixed Annuities Risky?

(What are the chances....)

Benjamin Franklin is famously quoted as saying, "But in this world nothing can be said to be certain, except death and taxes." In other words, most things in life have some kind of risk—and risk is relative. According to National Geographic, in the US, there is 1 death every 2 years from a shark attack. So does that mean there's a high risk of shark attack when you go in the water? No, not really. All investments have some level of risk, whether it's as remote as a shark attack, or as likely as taxes.

Independent insurance agents are experts. They’ll help guide you through all your options, weigh the good and the bad, and even see you through it all from start to signature. Pretty easy, isn’t it?

Investment Risk

Investment risk measures uncertainty. Investments with higher risk will have greater swings in value than investments with lower risk. Investments with higher risks have higher potential for gain as well as higher potential for loss, including loss of principal.

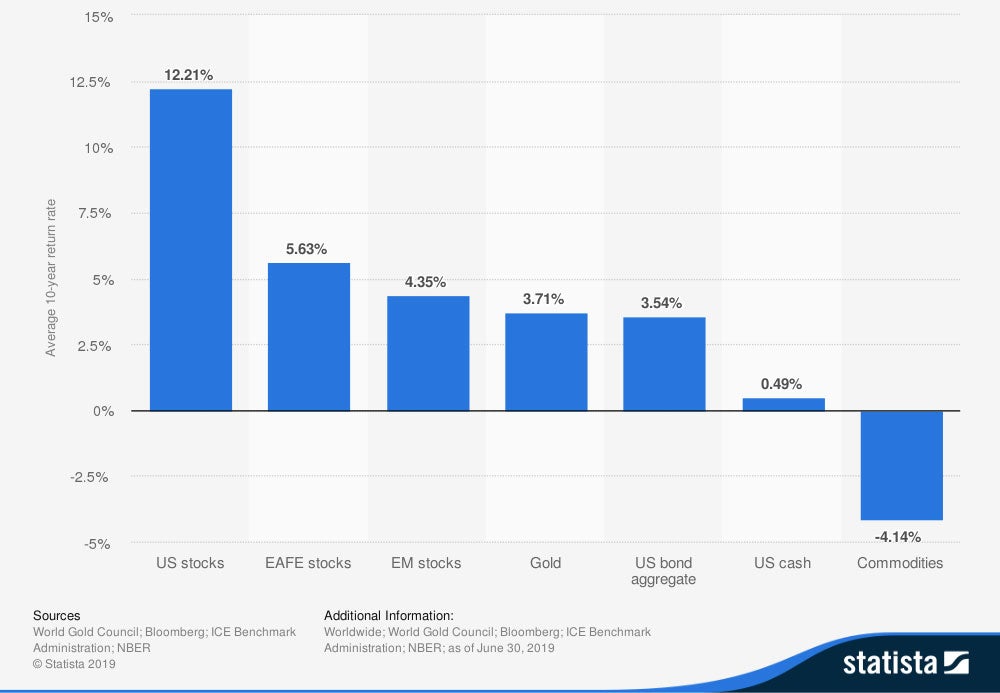

Over longer periods, investments with higher risk, like stocks, tend to perform better than investments with lower or no risk.

10-Year Average Return of Gold and Other Assets Worldwide 2019

Over shorter periods, though, investments with higher risk can be very painful. Think 2008-2009, when stocks lost more than 50% of their value.

Some assets have little or no investment risk. CDs pay a fixed rate of interest. The principal is guaranteed by the FDIC up to $250,000 per bank, per depositor. Fixed annuity interest rates and account values are guaranteed by the insurance company that issues it.

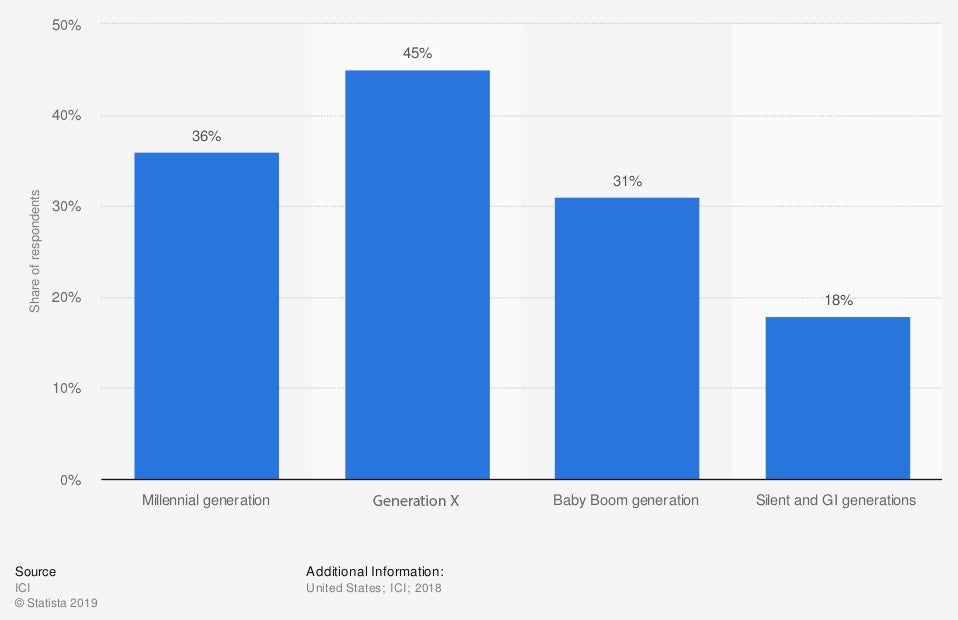

Investors come in all shapes and sizes when it comes to taking risk. It's not surprising that appetite for investment risk changes as people get older.

Willingness To Take Investment Risks in the US 2018 by Age of Household

What Does the Insurance Company Do with the Money?

When you contribute to a fixed annuity, the insurance company puts the money into its general account. The general account is mostly a portfolio of corporate and government bonds. The interest the insurance company pays to you is based on what they earn from the portfolio.

Here's why that's important. When you invest in bonds, the value can change up or down depending on interest rates. The insurance company guarantees your fixed annuity account value and rate of interest regardless of how their bond portfolio performs.

What that means is when you purchase a fixed annuity, you are getting the benefits of a large, professionally managed bond portfolio with very little risk. Insurance companies take some additional steps for indexed annuities, but the basic concept is the same.

The bad news? If the insurance company goes bankrupt your money can go with it. That's why it's important to buy a fixed annuity from a reputable and financially strong insurance company.

Are Fixed Annuities Risky?

Fixed annuities don't have investment risk like stocks, bonds, or other investments. There are, however, other risks:

Counterparty risk. This is the risk of the insurance company going bankrupt or otherwise being unable to meet policyholder obligations. Life insurance companies are regulated and monitored by the insurance department of each state they do business in.

Life insurance companies have to maintain sufficient reserves to meet policyholder obligations. They also have to meet other financial standards set by state insurance commissioners. Most states use the standards recommended by the National Association o.f Insurance Commissioners.

Each state has a guarantee fund to reimburse policyholders if the life insurance company fails. The limits are different for each state.

Financial ratings of insurance companies are available from A.M. Best, Fitch, Moody’s and Standard & Poor.

Inflation risk.The trade-off for low-risk investments is lower returns. Inflation can have a significant impact on purchasing power over time.

If your fixed annuity return or income does not keep pace with inflation, you are actually losing money in terms of purchasing power.

Liquidity risk. Fixed annuities have surrender charges, tax penalties, and withdrawal limitations.

The chart below illustrates the rewards and risks for different types of investments.

| Financial Asset | Risk Default, Capital Loss, Inflation Liquidity |

Reward Interest, Dividend, Capital Gain |

| Treasury Bonds, Bills, Notes | Inflation (if not indexed) | Interest |

| Certificates of Deposit | Inflation | Interest |

| Fixed Annuities | Inflation, Liquidity, Default | Interest |

| Corporate bonds | Inflation, Liquidity, Capital Loss | Interest, Capital Gain |

| Real Estate Investment Trusts (REITs) | Inflation, Capital Loss | Dividends |

| Mutual Funds, Exchange-Traded Funds | Inflation, Capital Loss | Capital Gains, Dividends |

| Stocks | Inflation, Capital Loss | Capital Gains, Dividends |

| Collectibles | Liquidity, Capital Loss | Capital Gains |

Is a Fixed Annuity Right for Me?

Fixed annuities are financial tools. Whether they are right for you depends on the job you want them to do. Here are some considerations:

Tax-deferred growth is a major benefit of annuities. Is tax control important to you? Can you benefit from tax-deferred growth?

Fixed annuities offer competitive returns. Are you a conservative investor? Are you looking for an alternative to CDs or savings accounts?

Fixed annuities have surrender and tax penalties. Do you have adequate resources for emergencies and other short term needs?

Fixed annuities can guarantee an income for life. Do you want a fixed guaranteed income for life instead of income that may benefit from market returns?

Benefits of Independent Insurance Agents

Fixed annuities can be an important part of your retirement plan. While they have many features and benefits, they are not for everyone. Annuities are complex, and searching through options can be confusing, time-consuming and frustrating. An independent insurance agent's role is to simplify the process and help you make smart choices.

statista

Federal Reserve Bank Of Dallas

Advisors guide To Annuities Olsen