Equity Indexed Annuities

(And the answer is ... yes)

If you retired in 2009 on $100,000, you'll need $119,000 today to buy the same things. The impact of inflation is the number one financial concern of pre-retirees and retirees, according to the Society of Actuaries 2017 retirement risk survey. In today's environment of low interest rates, it's hard to keep up with inflation with CDs and other conservative investments.

All annuities are retirement products designed to build wealth and create lifetime income. Equity-indexed annuities are designed for investors who want protect their retirement savings and still benefit from market performance.

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick

Equity-Indexed Annuities Are Different

Why do people invest their hard-earned money? To make money of course. Investment returns usually come in the form of interest (bank products for example), dividends, and capital gains (mutual funds and stocks, for example). Equity-indexed annuity returns are measured by performance of a financial index, the S&P 500 for example, over a period of time. If the index is higher, the account value is credited. If the index is lower, the insurance company absorbs some or all of the loss.

Of course, in the investment world, nothing is free. In exchange for absorbing losses, the insurance company limits how much credit you can get when the index is higher.

Equity-Indexed Annuities: Fixed or Variable?

Equity-indexed annuities are available either as fixed or variable products. Fixed products are regulated by the state insurance department. Variable products are regulated by the Securities And Exchange Commission and the state insurance departments.

Today's fixed equity-indexed annuities have a primary focus on creating retirement income using living benefit riders. Variable indexed annuities, also called indexed-linked variable annuities, have a primary focus on building wealth.

Fixed Equity-Indexed Annuities

Fixed-index annuities offer growth potential without stock market risk. Index accounts credit some of the gains of a market index, like the S&P 500, and none of the losses. The portion of gains credited is measured by:

- Participation rate: A percentage of the gain

- Cap Rate: Gains up to a stated percentage

- Time Period: Usually 1, 3 or 5 years

Here's an example:

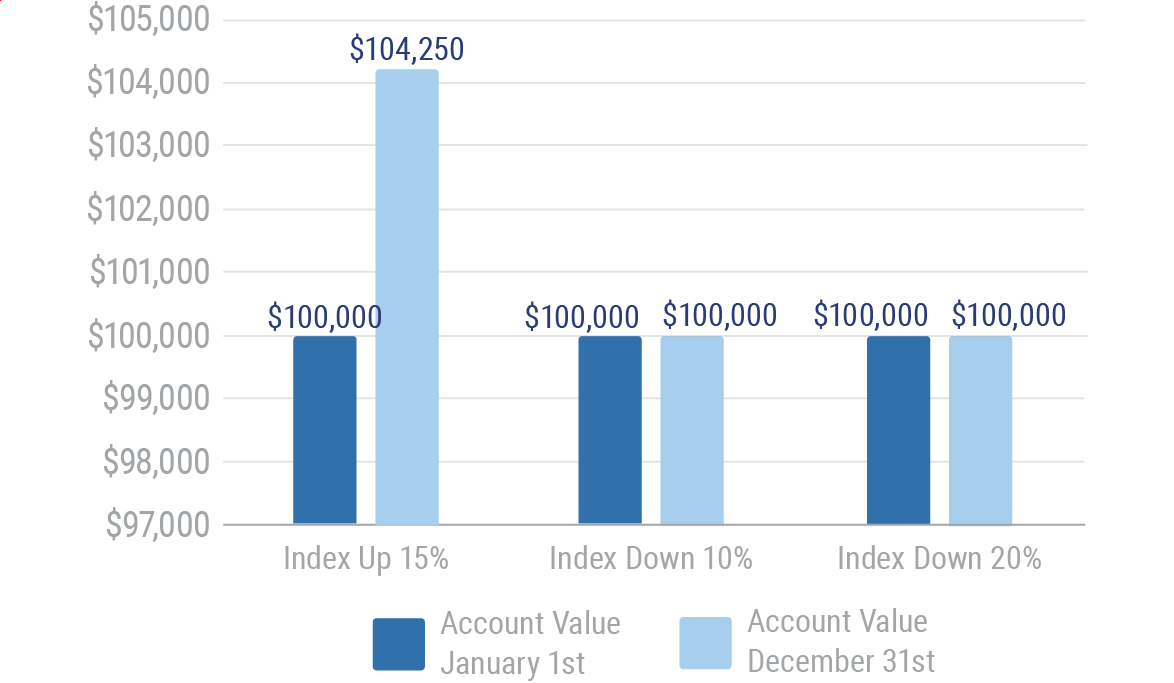

One Year S&P 500 with 4.25% Cap

Notice how the account never goes below the original $100,000. Participation and cap rates can change.

Fixed-indexed annuities offer the potential to outperform CDs or their fixed annuity cousins, while still offering guarantees. Most fixed-indexed annuities have living benefit riders which are designed to create a predictable lifetime retirement income.

Not familiar with fixed equity indexed annuities? Click here to learn more.

Living Benefits

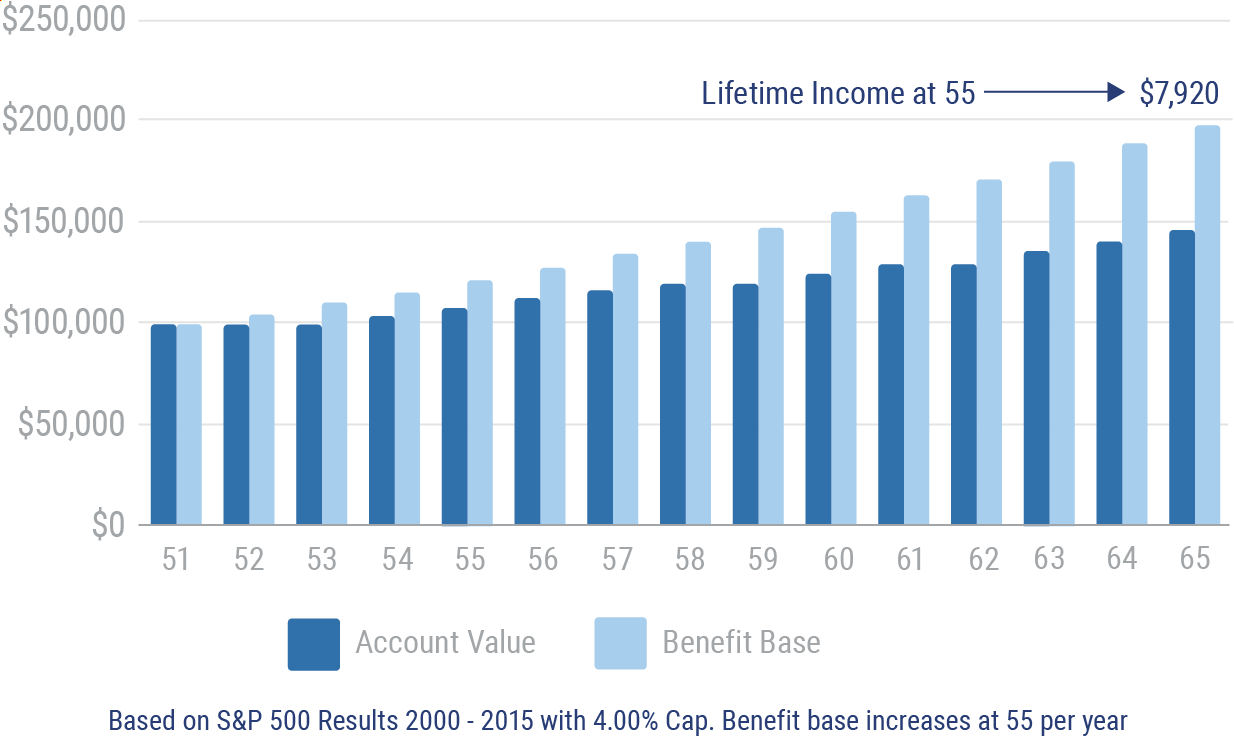

Living benefits are a predetermined schedule of guaranteed lifetime income. Living benefits use a benefit base to calculate the income. The benefit base starts out equal to the purchase payment. Each year the benefit base increases by the greater of the increase in the account value, and a fixed percentage. The benefit base can never be less than the account value. At retirement, the insurance company guarantees that you will be able to withdraw from the annuity a percentage of the benefit base for the rest of your life, even if the account value is exhausted. Your beneficiaries will receive any remaining account value at your death. Here's how it works:

Fixed-indexed annuity guaranteed lifetime withdrawal benefit

There is a charge for living benefits riders that is typically around 1%. The benefit base is only used for calculating retirement income. It's not available for withdrawal.

Variable Equity-Indexed Annuities

Indexed-linked variable annuities and variable annuities both have risk of market losses, but the investment options are very different. A variable annuity has a selection of investments called subaccount funds similar to mutual funds. The value of the subaccount funds rises and falls based on the performance of its portfolio. An indexed-linked variable annuity has segments. The segments track the performance of a financial index like the S&P 500 for a period of time, usually 1 to 5 years. If the index has risen during the segment, the investor receives credits to their account value. If the index has fallen. the investor is protected from a portion of the losses. The investor reallocates their account value at the end of each segment.

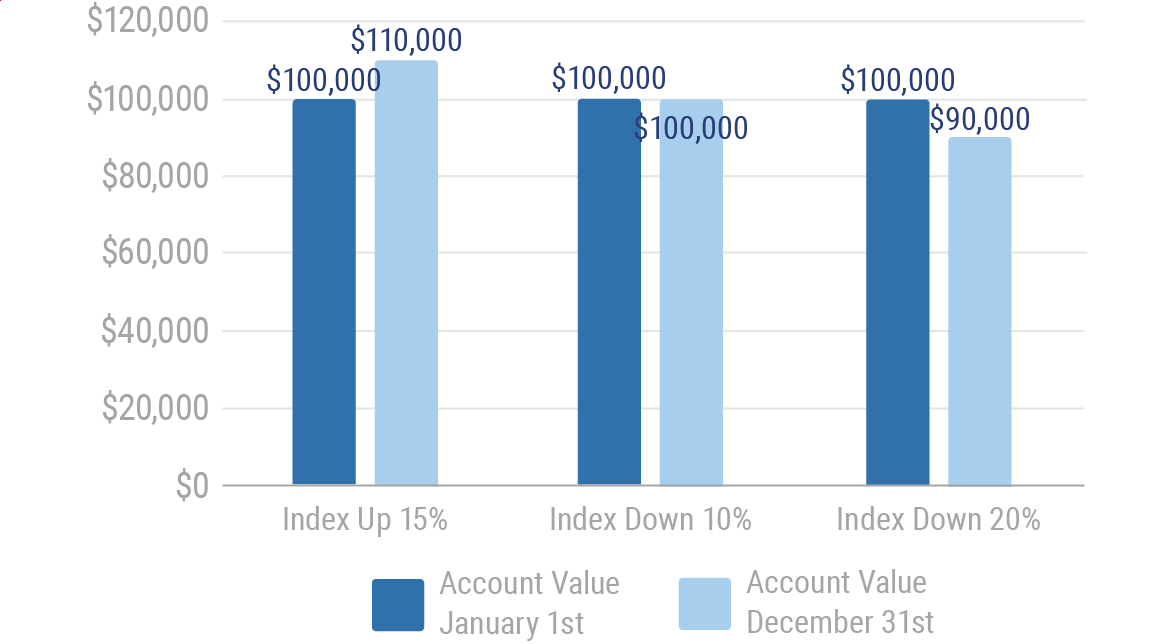

Each segment has a buffer against market losses, and a growth limit set by the insurance company. The buffers are usually 10% or 20%. The insurance company will absorb any market losses up to the buffer percentage. Performance caps and step rates are the most common limits. Performance caps limit the growth to a flat percentage. Step rates pay a stated return as long as the index is not negative for the segment. The chart below illustrates what happens to an index-linked variable annuity with a 10% performance cap and 10% buffer when the index is up 15%, down 10%, and down 20%.

10% Performance Cap One Year Segment with 10% Buffer

See what happens? The account value is limited to a 10% increase when the index is up 15%. When the index is down 10%, the account value remains the same. When the index is down 20%, the insurance company absorbs the loss up to 10%.

At the end of each segment, the limits can change.

Indexed-linked variable annuities usually don't have mortality and expense charges or investment management fees.

Want more on indexed linked variable annuities? Click here.

Equity Indexed Annuities vs. Variable Annuities

Variable annuities offer a menu of investment choices. Your money is allocated to the investments that you select. There are no limits to gains and losses.

Equity-indexed annuities have a menu of financial indexes that measure performance. You get to choose how much you are willing to limit your gains in exchange for limiting losses. The insurance company has to pay gains and absorb losses as agreed, but they can invest the money however they want.

Are Equity-Indexed Annuities Less Risky than Variable Annuities?

Equity-indexed annuities have built in features to limit losses or guarantee principal. Variable annuities have no limits on losses, so in that sense the answer is yes. But there is more to the story.

Most variable annuities today also have living benefit riders. So from an income perspective, variable annuities could be viewed as similar to equity indexed annuities.

Here's what's important. Equity-indexed and variable annuities are retirement planning tools. The decision to use them or any other type of investment should fit into the goals and objectives of your plan.

Independent Insurance Agents Can Help

Independent insurance agents are annuity professionals, and their job is to simplify the process. Every day they help folks just like you make smart decisions.

annuityratewatch.com

Society of actuaries 2017 retirement risk survey