Index-Linked Variable Annuity

(Maybe even a little more)

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

If you’re looking to invest your money for retirement, you may have heard about annuities. Annuities can provide regularly occurring income in your later years in exchange for making regular premium payments over a period of time or by investing a lump sum.

Annuities come in a variety of “flavors”. One of these tasty flavors is an index-linked variable annuity. But you may be asking yourself, What is an index-linked variable annuity?

In this article, we’ll cover that question and a number of other relevant topics to help you make a smart decision for your retirement.

Of course, index-linked variable annuities are complex financial instruments that require much forethought to make an informed decision. That’s where independent insurance agents can make the process simple. As you’ll read throughout this article, independent insurance agents can:

- Explain difficult concepts in easy-to-understand terms

- Offer unbiased advice that isn’t tied to a specific insurance company

- Answer any questions you may have about your unique financial situation

What Are Index-Linked Variable Annuities?

To begin, you may have already heard of index-linked variable annuities under other names, such as:

- Variable indexed annuities

- Structured annuities

- Registered indexed-linked annuities

- Buffered annuities

Indexed-linked variable annuities offer a level of protection against market losses selected by the investor. 10% and 20% downside protections are common. In exchange the growth in the account is limited or capped by the insurance company.

How Do Index-Linked Variable Annuities Work?

Indexed-Linked variable annuities and variable annuities both have risk of market losses, but the investment options are very different. A variable annuity has a selection of investments called subaccount funds similar to mutual funds. The value of the subaccount funds rises and falls based on the performance of its portfolio. An indexed-linked variable annuity has segments. The segments track the performance of a financial index, like the S&P 500 for a period of time, usually 1 to 5 years. If the index has risen during the segment, the investor receives credits to their account value. If the index has fallen the investor is protected from a portion of the losses. The investor reallocates their account value at the end of each segment.

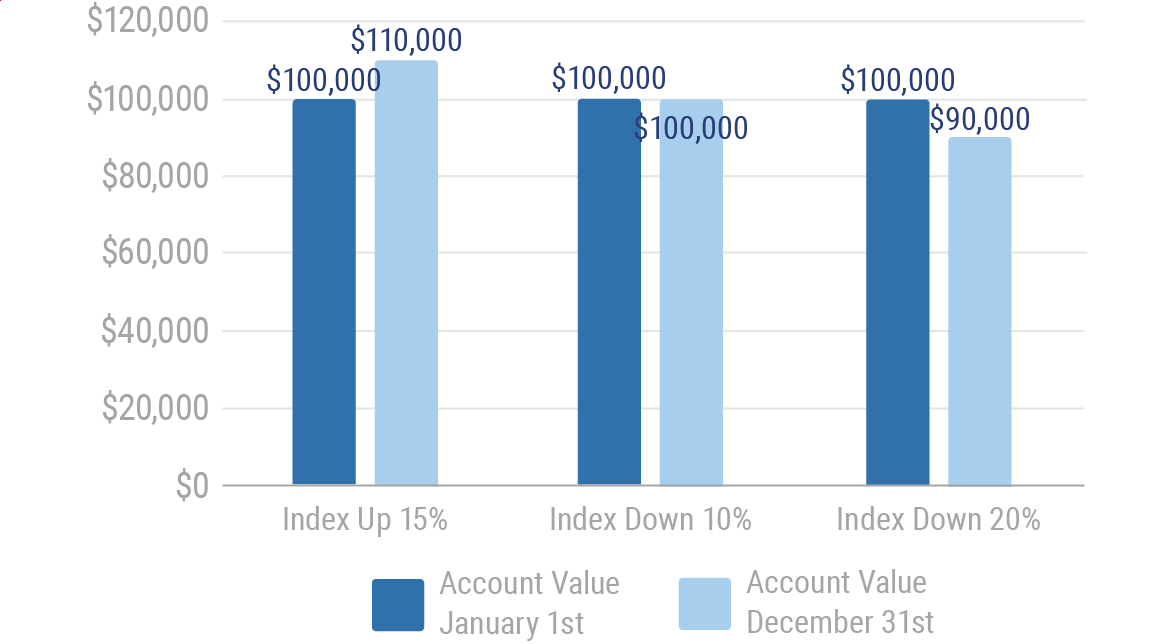

Each segment has a buffer against market losses, and a growth limit set by the insurance company. The buffers are usually 10% or 20%. The insurance company will absorb any market losses up to the buffer percentage. Performance caps, and step rates are the most common limits. Performance caps limit the growth to a flat percentage. Step rates pay a stated return as long as the index is not negative for the segment. The chart below illustrates what happens to an index-linked variable annuity with a 10% performance cap and 10% buffer when the index is up 15%, down 10% and down 20%

10% Performance Cap 1 Year Segment With 10% Buffer

See what happens? The account value is limited to a 10% increase when the index is up 15%. When the index is down 10% the account value remains the same. When the index is down 20% the insurance company absorbs the loss up to 10%.

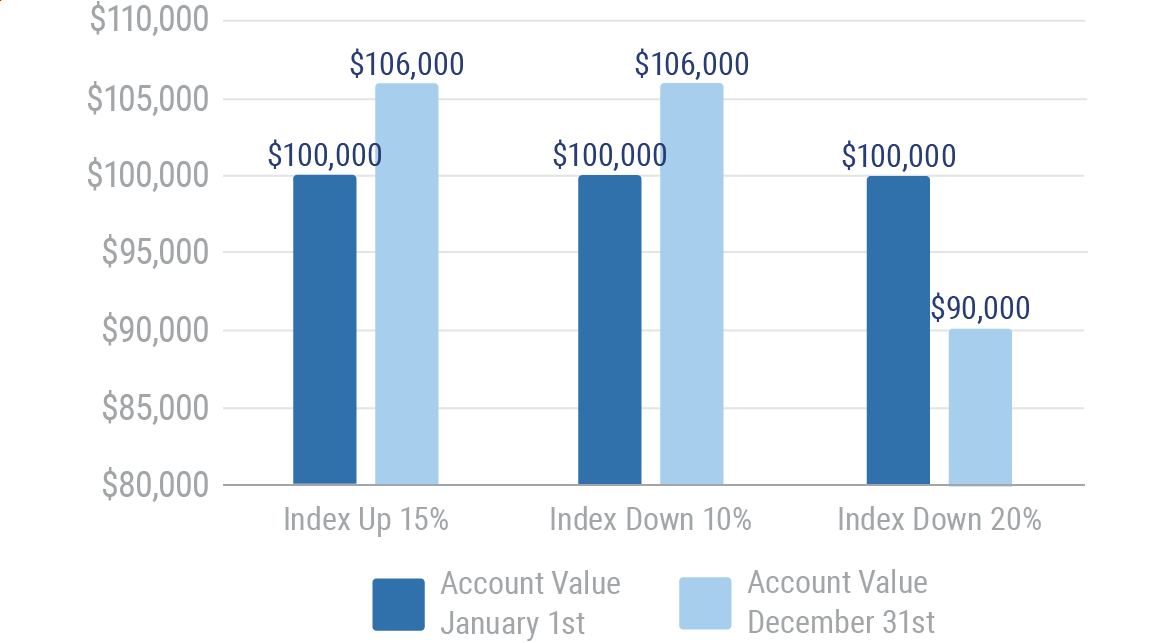

This chart illustrates a 6% step rate segment with a 10% buffer.

6% Step Rate 1 Year Segment With 10% Buffer

Even though the index was only up 2% the account value grew by 6%.

At the end of each segment, the limits can change.

Indexed-Linked variable annuities usually don't have mortality and expense charges or investment management fees.

What are the Pros and Cons of Index-Linked Variable Annuities?

The following are some positive and negative things to know as you consider an index-linked variable annuity:

Pros of an Index-Linked Variable Annuity

- Guaranteed retirement income: You can select from a variety of lifetime payout options when you retire.

- Growth opportunity: Take advantage of market based performance with downside protection.

- Tax Deferral: Index-linked variable annuities are tax deferred investment vehicles. Taxes are not paid on gains until distributions are made. So instead of Uncle sam getting the money it stays in your account and grows until it is withdrawn or paid out as income.

- No Fees – Indexed linked variable annuities usually don’t have the management or mortality and expense fees associated with variable annuities

Cons of an Index-Linked Variable Annuity

- Complexity: All variable annuities are complicated financial products. Indexed-linked variable annuities are no exception. It pays to do your research and talk to a professional, like an independent insurance agent

- Lack of Liquidity: Indexed-Linked variable annuities are retirement products. They are long term investments. If you need access to the money, they are not a good choice. Indexed-linked variable annuities have surrender charges, often for 6 to 10 years. There is a penalty tax for withdrawals prior to age 59 ½.

- Limited Choices: Index-linked variable annuities don’t have the same broad menu of investment choices that many variable annuities have.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. Find an independent insurance agent in your community here.

https://tradingeconomics.com/united-states/inflation-cpi

https://inflationdata.com/Inflation/Inflation_Rate/Long_Term_Inflation.asp

https://www.greatamericaninsurancegroup.com/for-individuals/tools-resources/understanding-annuities/types-of-annuities/variable-indexed-annuities