Variable Annuity Separate Account

(What They do Is Simple)

What variable annuities do is simple. Variable annuities are retirement products. They're a tax deferred investment vehicle designed to accumulate money and create a lifetime retirement income. How they work? Well that's a little more involved.

Variable annuities are a complicated mix of insurance and investments. They're regulated by each of the fifty state insurance departments and the U.S. Securities And Exchange Commission. If you are thinking about buying a variable annuity you don't have to know all the details, but it does help to know what the separate account is. Because that's where your retirement money is.

Independent insurance agents are annuity professionals. They help folks just like you every day make smart decisions.

First Things First What Are Variable Annuities?

Annuities are policies issued by insurance companies. They pay a regular guaranteed income for life or a period of years. You buy a variable annuity contract by making either a single payment or a series of payments.

Deferred variable annuities accumulate money for a period of time before the policy pays income. Immediate variable annuities pay income right away.

Variable annuities accumulate money in investments selected by the owner called subaccount funds. Like mutual funds, or other investments the value of the subaccounts are based on market performance. They aren’t guaranteed.

Why It's Called Variable

The value of variable annuities is represented by units. The value of each unit rises and falls with the investment it represents. The account value of a variable annuity rises and falls based on the value of the units, not because there are more or less units.

On the other hand, the value of fixed annuities is measured by dollars. When the value of a fixed annuity rises or falls it's because there are more or less dollars in the account.

Where Your Money Goes

When you contribute to a variable annuity you choose from a selection of subaccount funds that are similar to mutual funds, and how much money is invested in each one. The subaccount funds are part of (you guessed it) the separate account.

The variable annuity separate account is the foundation of a variable annuity. The insurance company offers, distributes, and sells a variable annuity through a separate account. It's called separate because it's not part of the insurance company's general account. The separate account is regulated as an investment company by the United States Securities And Exchange Commission (SEC), just like mutual funds are. Here's why a separate account is important to you.

The general account of an insurance company is largely a portfolio of corporate and government bonds. The money from fixed annuities and other products are invested in the general account. If the insurance company goes bankrupt, the general account is subject to the claims of creditors. That can be bad news for policyholders.

The separate account is not subject to the claims of creditors if the insurance company goes bankrupt. So, while the value of your retirement money in a variable annuity rises and falls with your investment selections, it is protected from a failure of the insurance company.

How Your Money Grows In A Variable Annuity

Variable annuities are a way investors can take advantage of professional money management and diversification. Variable annuities usually have a wide selection of investment options to choose from. Stock funds, bond funds, real estate, as well as other asset classes are often on the menu. Mutual funds of course offer these options as well, so why is a variable annuity different?

Variable annuities are tax deferred investment vehicles. There is no tax on capital gains and dividends until money is distributed. For investors who regularly rebalance their portfolios between asset classes, tax deferral is important. That's because there is no tax when one investment is sold and another purchased.

Taxes

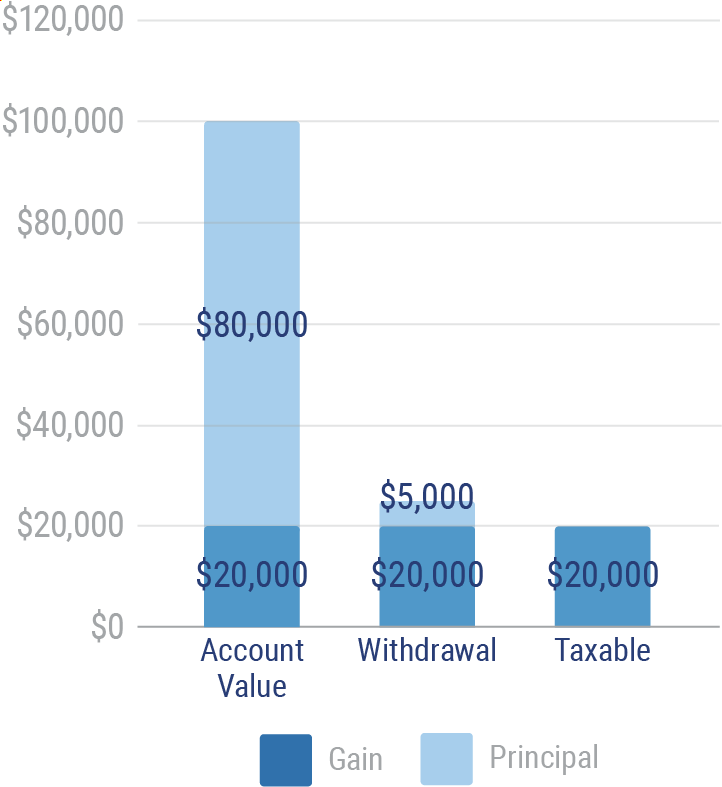

Variable annuities are taxed when distributions are taken. There are two different ways they are taxed. Withdrawals, or non- periodic distributions are assumed to be gain first. That means all of the distribution is taxed at ordinary income rates until the growth in the annuity is exhausted.The chart below illustrates how a withdrawal is taxed.

75% of $25,000 Withdrawal Taxed as Gain at Ordinary Rates

Periodic, or annuity options are considered part gain and part return of principal. Only the gain is taxable income.

In addition to ordinary taxes, distributions taken before age 59 1/2 are subject to a 10% penalty tax.

You should always consult your professional advisor for tax and legal advice.

Protection Features Of Variable Annuities

Living Benefits - Many variable annuities offer protection from down markets in the form of living benefits. Living benefits are optional riders that provide a guaranteed level of income at retirement based on interest rates specified in the policy.

Downside Protection - Some variable annuities called indexed, structured or buffered annuities offer a level of protection from down markets. The insurance company will absorb market losses up to a level selected by the investor. 10% and 20% protection levels are common options.

Creditor Protection - Each state extends creditor protections to variable annuities. For investors in high risk occupations (think doctors, lawyers, and corporate executives) this can be a valuable feature. Each state has different limits and conditions.

Contribution Levels - IRAs and qualified retirement plans have contribution limits. Variable annuities do not. For those who have maxed out their retirement contributions, or are not covered at work by a plan a variable annuity can be a good alternative.

Fees And Expenses

Nothing in the investment world is free, and variable annuities are no exception. Variable annuities have expenses for insurance cost, investment management, and riders. There are also administrative and surrender charges. The chart below illustrates common fees and expenses for variable annuities.

| Charge | Typical Charge | Description |

| Mortality & Expense | 1.25% of the account value | Cost of providing insurance |

| Management Fees | .25% - 2% of subaccount value | Fees paid to sub account investment managers |

| Administrative Fees | $25.00 - $50.00 per transaction | Cost of transactions and record keeping |

| Surrender Charges | 7%,6,5,4,3,2,1,0 | Charge declines over a period of years usually 5 - 7. Withdrawals up to 10% of the account value are usually free of surrender charges |

| GMIB, GLWB | 1% and up of benefit base | Charges for guranteed minimum income riders |

| GMAB | 1.4% and up of the benefit base | Charge for optional guaranteed minimum accumulation benefit |

| Enhanced Death benefits | .65% and up of the benefit base | Charges for stepped up death benefit option |

| Premium Tax | Premium Based | 8 states charge a premium tax. CA,FL,ME,NV,PR SD, WV,WY |

How To Buy A Variable Annuity

You can only purchase a variable annuities from registered representatives who are licensed to sell insurance. Variable annuities can be an important part of your retirement plan. What variable annuities do is simple. How they work isn't. While they have many features and benefits they are not for everyone. Talk to a professional independent insurance agent. They can help you decide if a variable annuity is right for you.

SEC Fund Disclosure at a glance

SEC.gov laws and rules

Protecting Investors A Half A Century Of Investment Company Regulation Division Of Investment Management SEC