Variable Annuity Taxation

(Less is definitely more)

Variable annuities, like most retirement products, offer some tax relief. If you're getting close to retirement, have maxed out contributions to your employer plan, or you just plain would like to pay fewer taxes, variable annuities may be a good option.

To use a matching tool that will find you the best insurance solution in your area, click here: independent agent Provide a few details about what you need, and the tool will recommend the best agents for you. Any information you provide will only be sent to the agent you choose.

How Variable Annuities Are Taxed

According to the IRS, there are 411 publications and forms related to variable annuity tax rules. Sound complicated? Well, like anything else tax-related, it can be. But there are some basics that will cover most situations.

Variable annuities are non-tax qualified or tax-qualified. Both are taxed at ordinary income rates. Annuities are not eligible for capital gains tax treatment.

Non-tax-qualified annuities are personally owned. They are paid for with after-tax dollars. Non-tax-qualified annuities generally don't have loan provisions.

Tax-qualified annuities are owned by a retirement plan for the benefit of the participant. Tax-qualified annuities can be part of an IRA, 403(b), and other types of plans. Contributions to qualified variable annuities are before-tax or tax-deductible, depending on the plan. Loans may be available if the retirement plan allows them.

Non-Qualified Variable Annuities and Taxes

Variable annuities allocate money to investments similar to mutual funds that are called subaccount funds. The value of the variable annuity account rises and falls with the performance of the subaccount investments. Capital gains and dividends are not taxed until distributions are made from the annuity. Variable annuity fees and expenses are not tax-deductible.

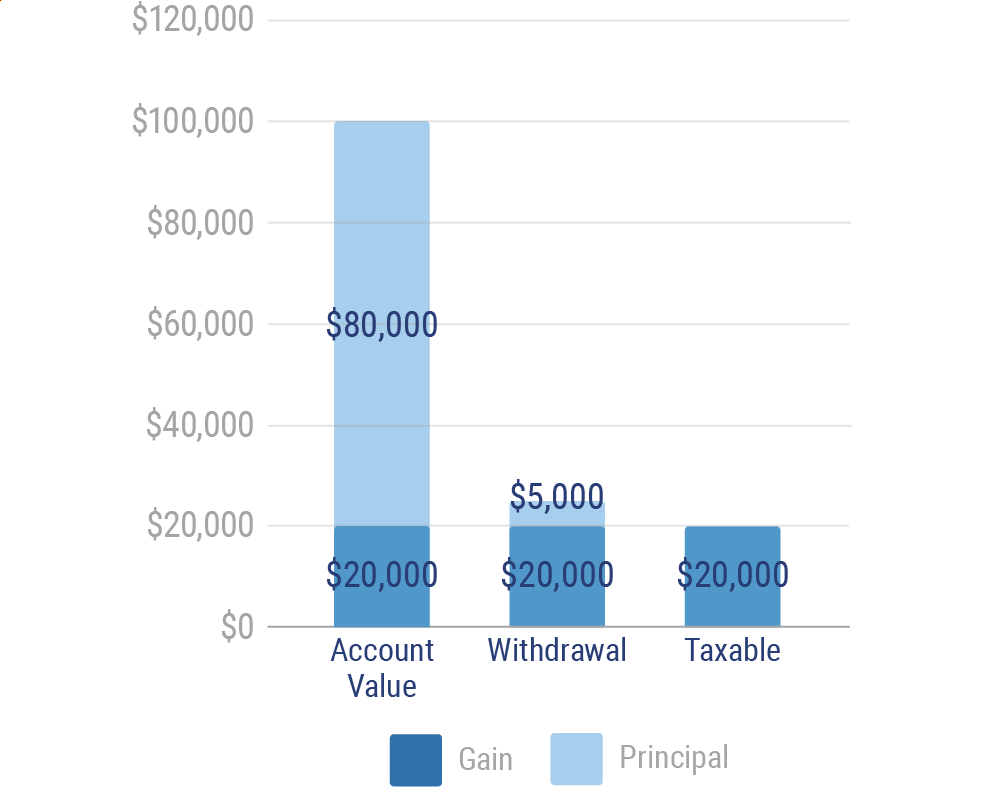

Withdrawals (also called non-periodic distributions) from a non-qualified variable annuity are made on a LIFO, or last-in-first-out, basis. That means withdrawals are fully taxable until all of the capital gains and dividends credited are withdrawn. The chart below illustrates LIFO withdrawals.

Variable annuities can also pay periodic income. The income options are defined in the annuity policy, and the payments are guaranteed. A portion of the income is excluded from taxes because it is considered return of principal. Periodic income is not considered a withdrawal.

Tax-Qualified Variable Annuities and Taxes

Tax-qualified variable annuities follow the rules for IRAs and other retirement plans. The contributions are made with before-tax dollars. All income from a tax-qualified annuity is 100% taxable.

Required minimum distributions (RMDs) have to be taken from a tax-qualified annuity, just like any other retirement plan. The SECURE Act, which went into effect January 1, 2020, raised the starting age for RMDs from 70-1/2 to 72.

Tax-qualified variable annuities in Roth plans follow Roth plan rules. Contributions are made with after-tax dollars. The income is tax-free.

Tax-qualified variable annuities can provide lifetime retirement income. However, they have no additional tax benefit.

Inherited Variable Annuities and Taxes

Non-qualified variable annuities are typically inherited as a death benefit paid to a named beneficiary. The death benefits are included in the estate of the owner. The big picture is that any proceeds in excess of the contributions made by the owner are taxable to the beneficiary. The insurance company offers several options for beneficiaries, depending on whether the variable annuity was accumulating money or paying out income. Whatever option is selected dictates when the income tax is paid. Qualified annuities follow the rules of inherited retirement plans. Generally, all proceeds from an inherited retirement plan are 100% taxable.

Tax-Free Death Benefits

Non-qualified annuities: Tax-free death benefits are limited by the total contributions made to the annuity by the owner. Beneficiaries don't pay tax, however, until they have received an amount that is equal to the total contributions. Any withdrawals made by the owner treated as principal will be subtracted from the calculation.

Qualified annuities: Taxes on qualified annuities follow the rules of inherited IRAs and retirement plans. Death benefits are fully taxable. It's just a question of when the tax gets paid.

Taxable Death Benefits — Non-Qualified Variable Annuities

Non-qualified annuities: Uncle Sam doesn’t want to let the proceeds sit in a tax-deferred account forever. The rules are that annuity death benefits must be distributed at the death of the owner. If you are a surviving spouse, you can take ownership of the annuity, including any riders and death benefits, within one year of your spouse's death. There is no income tax due until distributions begin.

Other options for beneficiaries are:

Five-year deferral: Take up to five years from the owner's death to withdraw the inheritance. Taxes are not due until withdrawals are taken. The money will continue to accumulate tax-deferred.

Lump-sum distribution: Taxes are due in the year taken.

Stretch distribution: The distribution is taken as a percentage over time. Taxes are due as you receive the payments. The distributions may be partially or fully taxable.

Annuitization: The assets are converted into income. The payments will be partially taxable according to an exclusion ratio.

Your beneficiary can decide what option to take based on their immediate needs and tax situation.

Taxable Death Benefits — Qualified Variable Annuities

The SECURE Act, passed by Congress and signed by the president in 2019, took effect January 1, 2020. Among other things, the SECURE Act changed the age at which minimum required distributions begin from 70-1/2 to 72. It also eliminated stretch IRAs for non-spouse beneficiaries. Non-spouse beneficiaries must take distribution of the entire inherited IRA within 10 years.

A surviving spouse has a lot of flexibility when they inherit a retirement plan. The options are different depending on when the owner dies, before age 72 (the age when required minimum distributions begin) or after age 72.

Distribution options for Roth plans are the same as the options for traditional plans when the owner dies before age 72.

Variable Annuity Loans and Taxes

Annuities are retirement products. By design, they are long-term investments. Using your non-qualified annuity as collateral for a loan is potentially very expensive. In addition to the interest charged, the loan can result in unexpected taxes and penalties.

Borrowing from your qualified annuity can also be very expensive, because you will be paying tax twice on the same money. The loan is repaid to your retirement account with after-tax dollars. When you eventually withdraw those dollars, you will pay tax on them again. Before you borrow from an annuity, be sure to speak to your professional tax adviser.

How to Report Income from a Variable Annuity

Distributions from non-qualified and qualified variable annuities are reported on Form 1099R. The 1099R will be provided to you by the insurance company. 1099R income is entered on Lines 4A-D on Form 1040. You should consult your professional adviser for any tax or legal advice.

Why Choose an Independent Insurance Agent?

Variable annuities can be an important part of your retirement plan. While they have many features and benefits, they are not for everyone. Independent insurance agents are annuity professionals. They have the experience and knowledge to help you decide if a variable annuity is right for you.

Required Minimum Distributions for IRA Beneficiaries IRS.Gov

Key SECURE Act Provisions and Effective Dates

BY NAPA NET STAFF DECEMBER 17, 2019

IRS publication 575