Variable Annuity vs. Mutual Fund

(The hows and whys)

Why do people invest their hard-earned money? The answer, of course, is to make more money. Like most things in life, the basics are pretty simple. It's the details that get you into trouble.

Variable annuities and mutual funds are very popular investments. They both offer the average investor the benefits of professionally managed money and diversification. The big difference? Mutual funds are part of an investment strategy while variable annuities are an investment strategy. Intrigued? Thirsty for more? This article is for you.

Variable annuities have many features and details. Searching through the options can be time-consuming. A professional independent insurance agent can simplify the process and guide you through it.

What's a Mutual Fund?

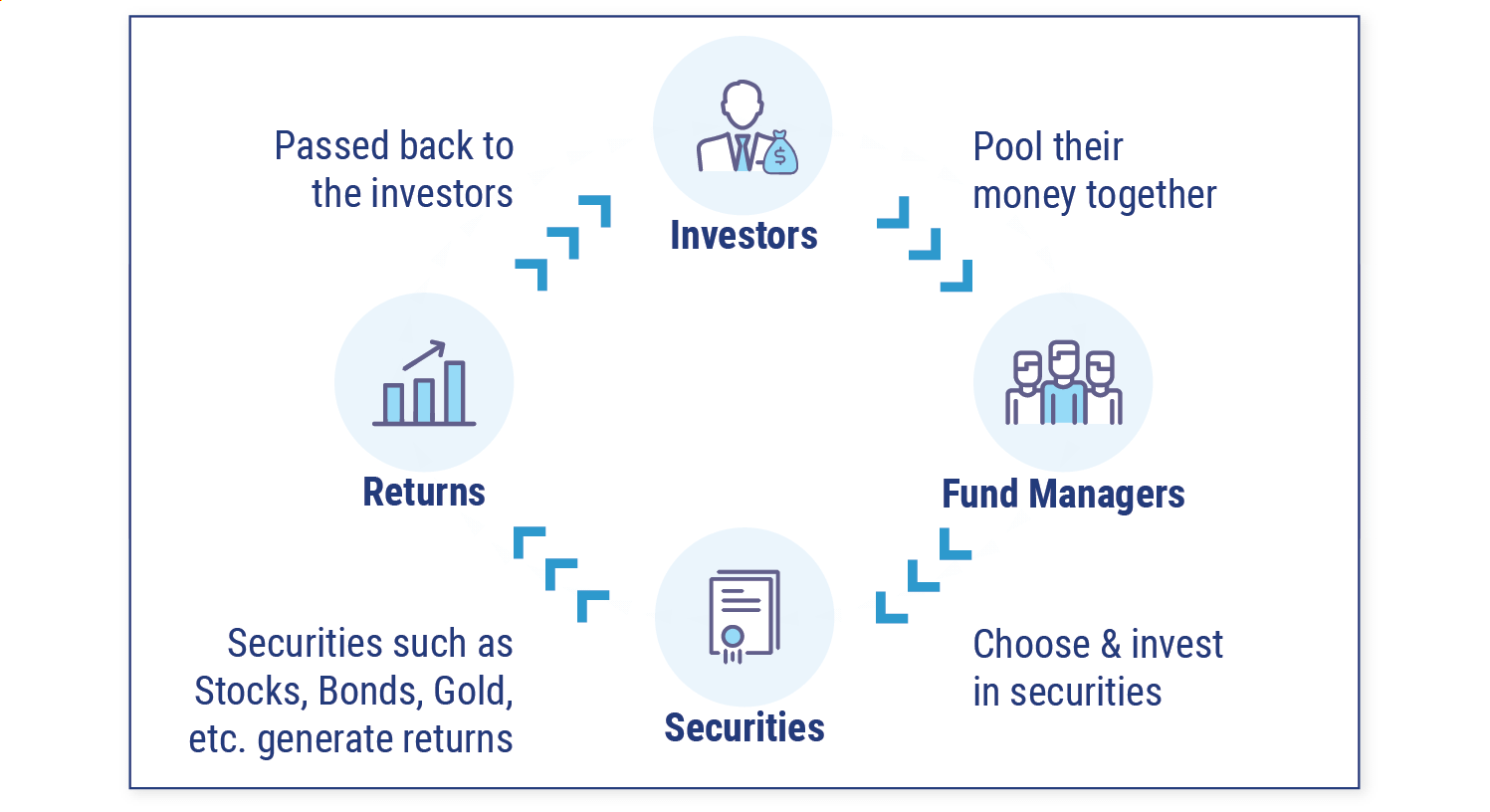

Mutual funds are a way for the average investor to buy a portfolio of professionally managed stocks, bonds, and other securities based on an investment objective. Investment objectives can be capital appreciation, capital preservation, income, or a combination. Shares of a mutual fund represent shares in an investment company that buys and sells stocks and bonds on behalf of the investors. Mutual fund shares are purchased directly from the investment company, or through a brokerage firm or other financial intermediary. Mutual fund shares are redeemed by the mutual fund investment company. The share price is always value of all the securities and cash-fund liabilities (net asset value) divided by the number of shares at the end of each day.

Mutual funds have been around since 1929. In fact, one of Vanguard's funds, the Wellington fund, has been in continuous operation since 1929. Mutual funds are investment companies and are regulated by the Investment Company Act of 1940, and the Securities Acts of 1933 and 1934. The US Securities And Exchange Commission is the enforcement agency.

Mutual funds are either "diversified" or "non-diversified". Diversified funds can't have more than five percent of the fund's total value invested in any one issuer. Non-diversified funds usually concentrate in particular industries, and invest in fewer companies, for example, a technology fund. Some mutual funds invest in other mutual funds to achieve a specific objective. These mutual funds are called fund of funds.

Mutual funds distribute capital gains and dividends to shareholders. They are taxable in the year they are distributed. Mutual funds are eligible for capital gains tax treatment.

How Mutual Funds Work

What's a Variable Annuity?

Variable annuities are policies issued by insurance companies. They're designed for retirement savings and income. Variable annuities are regulated by the United States Securities and Exchange Commission just like mutual funds are. They pay a regular guaranteed income for life or a period of years. You buy a variable annuity contract by making either a single payment or a series of payments.

Deferred variable annuities accumulate money for a period of time before the policy pays income.

Immediate variable annuities pay income right away.

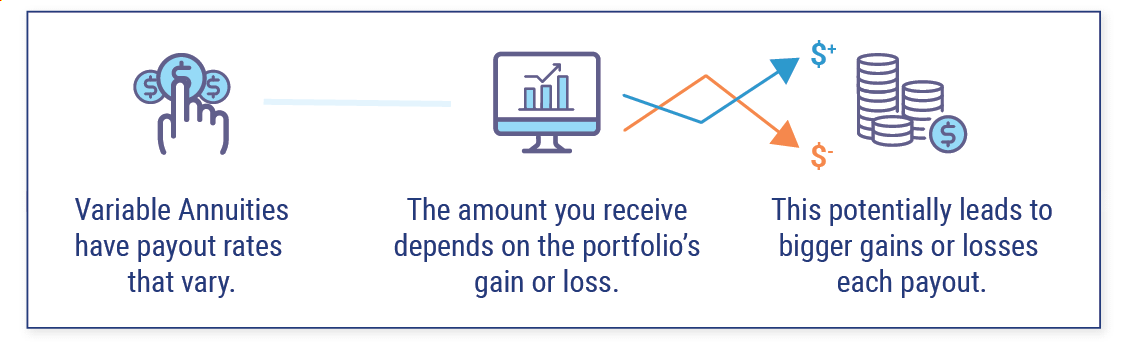

Variable annuities accumulate money in investments selected by the owner called subaccount funds which are similar to mutual funds. When you purchase a variable annuity, your payment is allocated to the subaccount funds of your choice. The value of the subaccount investments is represented by units, not shares. Like mutual funds or other investments, the value of the subaccounts is based on market performance.

How Variable Annuities Work

Variable Annuity Features

Variable annuities are retirement vehicles. They are a combination of insurance and investments. Variable annuities also have a combination of features that are not available with other investments.

Living benefits: These protect retirement savings from down markets (think 2008 to 2009). Guaranteed minimum income (GMIB) and guaranteed lifetime withdrawal benefits provide a minimum amount of lifetime income regardless of what the account value is.

Downside protection: Some variable annuities, called indexed linked variable annuities, offer protections from down markets. Account values are protected from losses, and gains are limited to a maximum level. Ten and twenty percent protections are commonly available.

Death benefits: These protect beneficiaries. Many variable annuities on the market today offer death benefits that are the higher of the account value or the original purchase payment.

Tax deferral: Capital gains, dividends, and interest are not taxable until money is taken out of the variable annuity account.

Tax-free transfers: Money can be transferred from one subaccount fund to another without taxes on capital gains. This feature is valuable to investors who regularly make changes to their portfolio.

Creditor protection: Each state provides variable annuities some level of protection against creditors. This feature is valuable to investors in "high risk" occupations like doctors, lawyers, and corporate executives.

Variable Annuities vs. Mutual Fund Taxes

Mutual funds: These periodically distribute capital gains and dividends to shareholders. The gains and dividends are taxable in the year that they are received. Capital gains from the sale of mutual fund shares are also taxable in the year they are received. Mutual fund capital gains are taxed at the more favorable capital gains rate if they are "long-term" gains. Dividends and "short-term" gains are taxed at the higher ordinary income tax rates.

Variable annuities: These are only taxed when distributions or income is taken. Distributions will be considered "gain first." That means distributions are 100% taxable until the account value has been reduced to the amount of money contributed to the variable annuity. Variable annuities are always taxed at ordinary income rates.

Variable Annuities vs. Mutual Fund Fees and Expenses

Variable annuities and mutual funds both have fees and expenses. Variable annuities typically have more of them because of the insurance features.

Mutual funds: The expense ratio is the fund's ongoing cost of doing business. The percentage includes portfolio management, administration, distribution,, and other expenses. Shareholder fees include sales charge, purchase fees, and redemption fees. There are many mutual funds on the market today that are "no load" and do not include a sales charge.

Variable annuities: Common variable annuity expenses are mortality & expense, Investment management, surrender charges, sales loads, and rider charges.

Both mutual funds and variable annuities have share classes that have different schedules for the fees and expenses. Share classes that have front end sales charges have lower expense ratios.

So which product is less expensive? In general, mutual funds cost less than variable annuities. According to Vanguard, the average expense ratio for mutual funds is .58%. Variable annuity expenses can range from .50% for a low cost option to over 3% including optional riders.

Mutual Funds Pros and Cons

There are 9,599 mutual funds available in the US today. For most investors, they cover the spectrum of investment objectives and asset classes. Combinations of mutual funds can be used as convenient "building blocks" for investment strategies. Active investing, passive investing, asset allocation, and rebalancing are all examples of common investment strategies.

The biggest advantage to mutual funds is that they are an affordable way to diversify and professionally manage investments. Mutual funds are even more attractive as part of a retirement plan like 401(k)s or IRAs because of the tax advantages.

Mutual funds are always liquid. The mutual fund always has to redeem shares at net asset value at the close of the business day.

Some mutual funds have significantly higher fees than others. Actively managed funds that seek to outperform the market often have higher fees, one percent or more. The fees can make a significant difference over time.

Variable Annuities Pros and Cons

Variable annuities offer a menu of fund options that typically cover most objectives and asset classes. Whatever investment strategies you decide to use are enhanced by the two key features of variable annuities: tax deferral and downside protection. For investors who want to supplement their tax advantaged retirement plans, or want downside protection for their portfolio, variable and indexed linked variable annuities may be a good choice.

Variable annuities are long term investments, most of them have surrender charges for seven to ten years. While there are some low cost variable annuity options available, many of them carry fees between one percent and two percent. Optional charges for living benefit and other riders can push the cost to over three percent.

Variable Annuities vs. Mutual Funds: Putting It All Together

Mutual funds are a versatile and affordable way to invest. They offer professional money management and diversification. They can be used for many investment strategies both inside and outside of qualified retirement plans and IRAs.

Variable annuities are retirement planning vehicles. They have a menu of subaccount fund investment options and unique features for tax efficiency and downside protection strategies. They are a way to supplement retirement plan contributions.

Want to know more about variable annuities? Independent insurance agents are annuity professionals. Every day they help folks just you to make smart decisions.

Statista

Vanguard

Fundamentals Of Investments Wilson and Hopkins