Jewelry Insurance

Get the coverage you need to protect your valuables the right way.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When you've got expensive or otherwise valuable jewelry, it deserves to be protected with the right coverage. The limits of your homeowners insurance might not be enough to fully protect jewelry, especially if you have a lot of it. That's why you might need additional coverage.

Fortunately, an independent insurance agent can help you find all the jewelry insurance you need. They'll make sure each piece you have gets the appropriate amount of coverage. But for starters, here's a breakdown of jewelry insurance.

What Is Jewelry Insurance?

Simply put, jewelry insurance is a policy designed to cover your jewelry against a number of threats, including theft, mysterious disappearance, and damage or destruction by elements like fire. In exchange for the premiums you pay, your insurance carrier will reimburse your financial losses or even replace the item up to its specified value.

Is My Jewelry Covered by Homeowners Insurance?

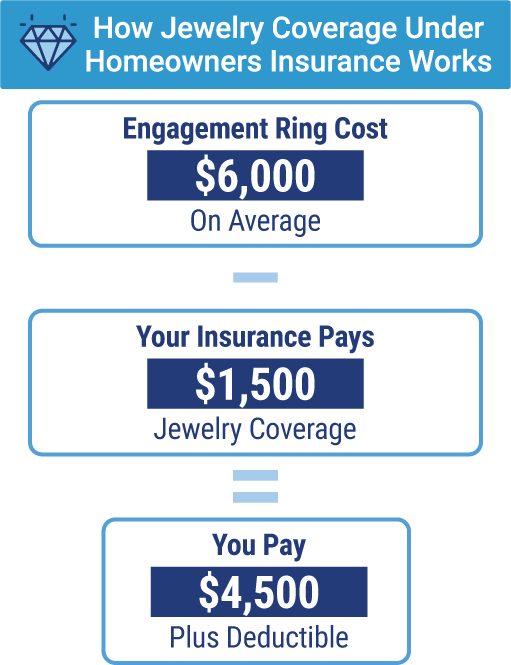

Yes, jewelry is covered by homeowners insurance, but only to an extent. Coverage for jewelry under your homeowners policy is limited to only a small number of causes, like theft, and has a cap of $1,500. You'll need an additional policy or endorsement if you want to ensure you’re covered for the full value of a piece of jewelry or several different pieces together.

A more comprehensive coverage option is to "schedule" personal property coverage. This covers a greater number of risks and will generally cover the full value of higher-priced items that exceed the regular policy's limit. The scheduling process involves listing each specific item to be covered and its value, which is determined by an appraisal.

When and How Does Homeowners Insurance Cover Jewelry?

A standard homeowners insurance policy provides jewelry coverage in a few scenarios. Jewelry falls under the personal property category of homeowners coverage, and it’s treated the same way as many other things under the policy, with one major difference.

Jewelry has its own special coverage limit under your personal property category, but we’ll get more into that later. First, we’ll take a closer look at the most commonly covered scenarios.

Homeowners insurance covers jewelry in the following scenarios:

- Someone breaks into your house and steals your jewelry.

- You misplace your jewelry and can’t find it again. This coverage is known as “mysterious disappearance.”

- Your jewelry is destroyed or lost due to a covered natural disaster.

Natural disasters commonly covered by homeowners insurance include:

Natural disasters typically not covered by homeowners insurance include:

- Floods

- Earthquakes

- Mudslides

If you’re worried about protecting your more expensive jewelry, you’ll want to schedule each separate piece on a jewelry floater. A jewelry floater is a special type of inland marine insurance designed for valuable jewelry.

You’d first have to get your specific pieces appraised by a professional jeweler, then send that appraisal to an independent insurance agent. The agent would then be able to help you get the right coverage for your pieces, probably for their full value.

How Much Do I Have to Pay If Homeowners Insurance Does Cover My Jewelry?

After paying your deductible, you’ll be responsible for paying any amount exceeding your homeowners policy’s limit for the jewelry category under personal property coverage. This limit will vary by each specific policy.

If you have a bad break-in and many of your belongings get stolen, the values for all that property will add up quickly. You might want to increase your coverage or get special jewelry floaters if you have several highly valuable pieces.

A standard homeowners policy has a deductible that’s typically 1% of the home’s value. So, if your home is worth $300,000, you might have to exceed $3,000 in stolen or damaged personal property before your insurance will start paying.

You could easily lose a lot of money this way. If you have valuable jewelry or other kinds of property you want to be covered, it’s a good idea to work with an experienced independent insurance agent to get a policy with a lower deductible.

If Homeowners Insurance Doesn’t Cover My Jewelry, What Will?

Your jewelry will be covered up to your homeowners policy’s limit for the jewelry category under personal property, but your jewelry might easily exceed that, especially if it’s lumped in with other property you need to get reimbursed for at the same time.

Consider looking into special jewelry floaters for valuable pieces. Having this extra, specialized coverage will help you get reimbursed for the jewelry’s full value, so you don’t have to worry about losing money.

What Does Jewelry Insurance Cover?

Most everyone's main concern when it comes to jewelry is theft. But jewelry owners are also often concerned about losing their valuable pieces. Luckily, jewelry insurance covers the following disasters for all types of jewelry:

- Theft (from break-ins to pickpocketing)

- Mysterious Disappearances (AKA dropping/losing/misplacing)

- Damage (such as a gemstone that’s fallen out of a necklace or an accidentally smashed antique watch)

- Fire destruction/damage

An independent insurance agent can further explain the incidents in which your jewelry would be covered by jewelry insurance.

How Do I Insure My Jewelry?

First, you'll want to contact an independent insurance agent. They’ll help walk you through the entire process of getting coverage. But here's a sample of what the process of getting jewelry insurance involves:

- List which jewelry pieces you want to be covered: Have an idea of which jewelry items you want coverage for before you look into getting coverage.

- Schedule an appraisal: Every local jeweler probably has expertise in conducting appraisals. Your insurance company will need to know the exact value of your jewelry, so an appraisal is often necessary.

- Fill out the paperwork: Submit the official, verifiable documents from the appraisal to your insurance company when you apply for coverage.

- Call your independent insurance agent: They'll be able to help you take it from here.

Though there are a few steps to getting jewelry insurance, it can be well worth the effort when you consider how much your valuables might otherwise cost to repair or replace without coverage.

How Much Does Jewelry Insurance Cost?

The cost of jewelry insurance depends on the kind and amount of coverage you want, your jewelry's total value, your location, and a few other factors. You also might want to consider increasing your theft coverage through your home insurance first.

"Increasing the theft limit on your homeowners insurance from $1,500 to $10,000 would only add about $25 to your premium."

Insurance expert Paul Martin said it's typically rather inexpensive to increase theft coverage under your home insurance policy. He added that the cost to insure a single piece of jewelry will be around $1-$2 for every $100 in replacement cost.

If the jewelry in question would cost around $10,000, then the premium would be around $150, on average. However, if you need to get lots of valuable items scheduled, the cost can quickly add up to thousands or even millions per year.

Is Jewelry Insurance Worth the Cost?

If your entire jewelry collection has a value of over $1,500 and you're worried about losing it, damaging it, or having it stolen or destroyed, then yes, jewelry insurance is worth it. Further, Martin points out that a lot of jewelry has sentimental value in addition to monetary value. So, protection could be worth it because the items have meaning for you alone.

If you’re still weighing your decision, it’s best just to ask yourself, "How easily can I afford to replace an item or all the items if something happens to them?" If the answer is “Not very easily,” it might be wise to get jewelry insurance.

Why Work with an Independent Insurance Agent?

Independent insurance agents are experts in finding you the right kind of jewelry insurance and any other type of coverage you need. They can shop and compare policies from many different insurance companies for you, then present you with only the best quotes together in one place. Also, they're available down the road to help you file claims if you ever need to.