Business Insurance Discounts: Ways to Save

Find out how to get cheap business insurance through some of the most common discounts offered by many insurance companies.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Business insurance premiums shouldn't have to weigh you down. There are tons of ways for you to save money on business insurance by way of common discounts, and getting them can be pretty simple when you know how. From holding safety trainings to bundling your policies together, simple practices can help you reduce your business insurance rates considerably.

A local independent insurance agent can also help you find cheap business insurance. Your agent can apply any discounts your business qualifies for on its coverage automatically. Until then, here's a breakdown of some of the most common business insurance discounts available.

How Do I Get Business Insurance Discounts?

You can get business insurance discounts by shopping online, calling an insurance company directly, or working with an independent insurance agent in your town. Working with an independent insurance agent can be the easiest way to score all the discounts your business qualifies for. Before contacting one, start by having the following information ready:

- Your business's niche and operations

- What population your business serves

- The age of your business

- How many employees you have

- The estimated number of customers you have

- What kind of safety training and equipment you provide

- Details about your property, including buildings, vehicles, equipment, inventory, etc.

- Your relevant work history; for example, if you worked in this industry before starting your business

- Whether you're a veteran, especially if you're part of the government's official veteran-owned business program

Your independent insurance agent will gather pertinent information about your unique business and then shop and compare policies and rates from multiple carriers in your area. They'll also use the information you provided to search for any discounts and savings your business is eligible for.

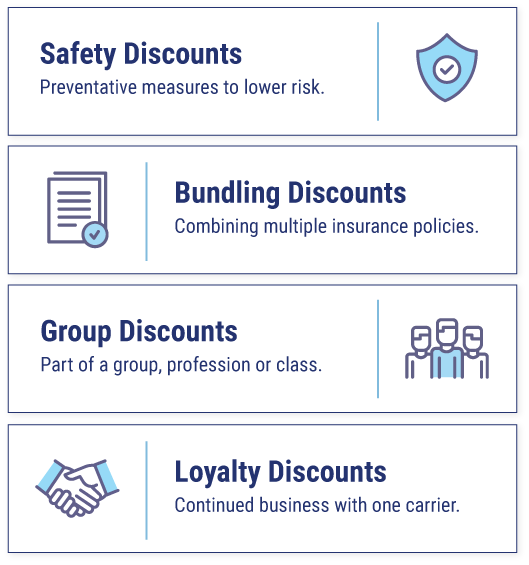

The Four Major Business Insurance Discounts

There are almost as many business insurance discounts available as there are business insurance companies, but they can all be divided into four major types:

Safety discounts

Safety discounts are applied if an insurance company sees evidence that you take good care of your commercial property or if your business has special features that keep its assets safe. Examples can include burglar alarms, sprinklers, or a high-quality roof.

Sometimes, safety discounts aren’t obvious. When an insurance inspector visits your property, they’ll probably take notes on how it looks. Things like nice landscaping and fresh paint can actually drive insurance costs down, even if they don’t spell it out in your policy.

Workers' compensation insurance can be an expensive portion of your business insurance, so providing a safe environment for your employees can help save you a lot of money. Practices such as providing standing or ergonomic desks and high-quality personal protective equipment can reduce your workers' comp. rates. Holding mandatory safety trainings is another great way to reduce the cost of your business insurance.

Bundling discounts

Bundling discounts are available from most carriers and are applied if you buy multiple types of insurance with the same company. Say you need to insure your personal car or home as well as your business. If you get both car insurance or homeowners insurance and business insurance with the same company, they're likely to offer you a bundling discount.

Group discounts

Group discounts are available based on your business sector. It’s common for an insurance company to specialize in a business niche, like farms or grocery stores. An insurance company will often offer special discounts to that type of business.

Group discounts may also be available if you belong to certain organizations. These can include various occupations, services, or memberships. Educational and government workers are also often eligible for group discounts on business insurance.

Loyalty discounts

Loyalty discounts are offered to customers who stick with the same insurance company over time. These discounts often start to be offered after a handful of years or when you have renewed your coverage. You might also get loyalty discounts for referring friends, family, and colleagues to your insurance company.

Additional Ways to Get Cheap Business Insurance

Most insurance companies offer many additional business insurance discounts along with the ones mentioned above. Here are several other common business insurance discounts that can easily help you bring down the cost of your premiums.

Shop around

One of the biggest mistakes businesses make when hunting for cheap business insurance is taking the first offer they see. It's always wise to shop and compare policies and quotes before ultimately selecting your policy. An independent insurance agent can do this process for you and present you with a handful of quotes from different carriers.

Choose a higher deductible

Selecting a higher deductible is a simple way to reduce your policy's monthly or annual premiums. This means you'll pay less for your coverage each month or year, but you'll have to pay more out-of-pocket per claim occurrence.

You're required to meet your policy's deductible before you start to receive reimbursement from your carrier after filing each claim. Just keep this in mind when determining if a higher deductible is worth the lower premiums.

Pay in full

Many insurance companies offer paid-in-full discounts for customers. If you pay your business insurance premiums for the entire year upfront in one lump sum, you can earn a nice break on your overall policy costs. Consider your business's budget and whether this is an affordable option for you.

Remain claims-free

Claims-free discounts are offered by most insurance companies to customers who haven't filed a claim within a certain period of time. Though this period can vary, it's often at least three to five years. Not only can avoiding filing claims help you save money on your insurance, but keep in mind that your policy's premiums are actually likely to increase each time you file a claim.

Reduce your risks

Any measures you can take to reduce your business's risks, not only of filing claims but within the workplace in general, can help you save money on business insurance. If your business takes measures to reduce its risk of fire, break-ins, employee theft, lawsuits, and other common threats, your insurance company is likely to reward you with cheaper premiums.

What About Home-Based Businesses?

If you run a business out of your home, you shouldn't count on your homeowners insurance to cover it if disaster strikes. In fact, some home insurance policies specifically exclude home-based businesses. Luckily, there are still ways to score discounts on home-based business insurance.

Installing a fire extinguisher or a security system is an easy way to get discounts on home-based business insurance. These measures show insurance carriers that you're serious about protecting your inventory from fire and theft, two of the biggest causes of business insurance claims.

Independent Insurance Agents Make Finding Business Insurance Discounts Easy

Independent insurance agents stay on top of the industry and all the latest business insurance discounts so you don’t have to. That means they’ll help you find the right coverage for you at the right price.

They’re not just there at the beginning, either. If disaster strikes and you need to file a claim, they’ll be with you every step of the way. Your agent can even help you update your coverage as necessary over time.