BOP Insurance

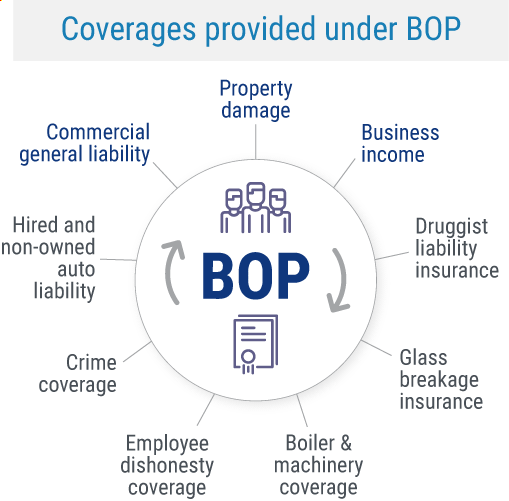

A business owners policy (BOP) is a convenient package of essential coverages for your unique business.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

If you've been scouring the internet for business insurance, you know there are many options. You need to find the best insurance option for your needs, and you've heard of a business owners policy, or "BOP," and might be wondering if it's the right choice for your business.

Fortunately, BOP insurance provides critical protection for small to medium-sized businesses. An independent insurance agent can help you find the right coverage for your specific business. But first, let's break down BOP insurance a bit further.

What Is Business Owners Policy (BOP) Insurance?

A business owners policy allows businesses that meet certain criteria to combine business property and business liability insurance into one convenient policy. BOPs are created for businesses that face similar risks, and they often appeal to small and medium-sized businesses. Many businesses these days, from hair salons to hardware stores, choose BOPs for their coverage.

BOPs are low-cost solutions for low-risk businesses. These policies combine protection for liability risks and commercial property together in one bundle. BOPs are also typically sold at a discounted premium when compared to purchasing individual coverages separately. An independent insurance agent can give you even more insight into these convenient policies.

What’s the Advantage of a Business Owners Policy?

Every business needs insurance, but separate policies can get pricey. BOPs can be less costly than individual policies. Further, if there's damage to your property or the property of others, employee theft, mechanical difficulties, or an everyday accident at your business that causes a loss of income, a BOP can keep you from having to close your doors as a result.

Potential hazards of not having a business owners policy:

- Financial ruin: There's no reason to risk paying out of pocket and possibly going bankrupt when you could instead purchase a BOP that's fairly inexpensive.

- Lawsuits: Legal issues can not only be costly, but they can also be very time-consuming, and just one accident has the potential to completely bring down your business.

- Losing your belongings (or others' belongings): Recovering the costs of theft, damage to buildings, or broken equipment could send your company into a downward spiral.

Overall, BOPs are designed to offer many crucial coverages for businesses of all kinds in one convenient package. BOPs are also topped off with specialized coverages that apply to your unique business niche, to give you the fullest picture of protection you need.

What Is Covered in a Business Owners Policy?

Small to mid-sized businesses often choose BOP insurance for their coverage needs. Many smaller businesses face similar types and degrees of risk, which makes this precrafted package an ideal choice for companies of all kinds. Larger businesses tend to find the coverage they need through commercial package policies for their unique risks.

BOPs are set up to protect owners of small to medium businesses by offering an important selection of coverages needed by all businesses and then topping it off with specific coverages needed by certain types of businesses. So, depending on your unique company, your package will vary.

Here are the standard coverages offered in BOPs:

- Commercial general liability: Protects your business against property damage or bodily injury claims made by a third party.

- Property damage: Covers loss of or damage to your physical property, including your office space, and often the inventory inside it, against things like fires, storms, vandalism, etc. Coverage often extends to permanent changes you make to the interior of a building as well, such as installing light fixtures.

- Business income: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other covered disasters.

Once the standard coverages needed by business owners across the board are taken care of, your business still needs additional protection tailored to your unique niche. The following are just a few examples of additional separate coverages that supplement a BOP:

- Hired and non-owned auto liability: If your employees drive their personal cars to perform company operations but you don’t have company vehicles, you might need this coverage.

- Crime coverage: Covers losses due to criminal activity such as theft or fraud. Coverage even applies to employees who steal from the company.

- Employee dishonesty coverage: Covers harm to the business caused by employees with questionable motives.

- Boiler & machinery coverage: Also known as "equipment insurance," this coverage applies to electric equipment in the building (e.g., AC units and boilers) that breaks down due to power surges, etc. Property insurance may cover these disasters, but not always.

- Glass breakage coverage: Covers the glass windowpane of your business’s storefront, where applicable, from incidents like vandalism and car crashes.

- Professional liability insurance: Covers liability resulting from professional advice and/or services.

This list of available add-ons to a BOP is far from exhaustive. The more complex the business, the more types of coverage it’s likely to require. Working together with an independent insurance agent is the best way to ensure that your business has every aspect covered against all potential risks.

What Does BOP Property Insurance Cover?

The "building coverage" provided in BOPs can actually refer to several forms of property. Policies cover listed perils relating to:

- Completed property additions

- Permanently installed fixtures

- Structures aside from buildings on the premises

- Equipment and machinery

- Outdoor fixtures

- Business personal property (BPP) in insured structures

Additionally, certain forms of property can be covered by a BOP if they're not currently insured under another policy, including:

- Property alterations

- Equipment and materials used for making alterations to insured property

- Property additions currently under construction

An independent insurance agent can further explain the types of commercial property covered by a BOP.

What Is Classified as Business Personal Property?

The business personal property (BPP) category encompasses more than the items inside an insured structure. BPP can be located within 100 feet of the business premises and still be covered, and in certain cases, can be covered while in a vehicle.

The following can be classified as BPP:

- Property belonging to others that's currently in the insured's care, custody, and control

- Property currently leased by the insured

- Property used for tenant improvement or betterment

- Property owned by the insured business and used for the business

Excluded property (not covered):

- Money and securities

- Bullion

- Watercraft while afloat

- Contraband

- Outdoor fences

- Radio or TV antennas and satellites

- Detached signs

- Trees, shrubs, and other plants

- Aircraft and business vehicles

If your business requires extra coverage to insure excluded property, an independent insurance agent can help you get equipped with all you need.

What Isn't Covered in a Business Owners Policy?

Like any other coverage, BOP insurance comes with a list of specifically covered perils and a list of non-covered perils. While these exclusions depend on your individual policy, two things not covered under BOP insurance in general are flood and earthquake damage. Special flood insurance and earth movement policies would be required to protect your business from risks caused by these disasters.

Flooding is a major concern in coastal states. To protect your business from natural flooding, look into getting flood coverage, especially if your town is at an especially high risk of hurricanes. Flood insurance policies are only available through the National Flood Insurance Program, which is a part of FEMA, but your independent insurance agent can help point you in the right direction.

Additionally, BOP insurance excludes the following coverages:

When it comes to professional errors and negligence, company vehicles, and the safety of your employees, you’ll need to work with your independent insurance agent to purchase separate policies to cover these important areas, if they apply to your business.

What Kinds of Businesses Are Considered "Low-Risk"?

Insurance companies determine a business's level of risk based on claims history, conditions such as safety and health concerns, the likelihood of theft, burglary, or damage from a natural disaster, and whether the business is in a high-risk industry. The lower the risks of your company, the less complicated insurance coverage you need. This makes it convenient to go with a BOP.

What Types of Businesses Are Good for a BOP?

While a BOP is good for nearly any business, there are some businesses that are generally classified as "low-risk," and therefore well-suited for a BOP. Insurance expert Jeffery Green added that BOPs are typically available for businesses that make less than $5 million in annual revenue.

The following businesses are good candidates for a BOP:

- Retail stores

- Restaurants

- Salons

- Professional services

- Pet groomers

- Veterinarians

- Caterers

- Coffee shops

- Delis

- Auto repair shops

- Florists

BOP policies are known to be convenient, one-size-fits-all, and quick to set up. They're not intended for complicated, risky businesses. Your independent insurance agent can help you determine whether your specific business would be a good candidate for a BOP.

What Kinds of Businesses Are Considered "High-Risk" and Should Not Purchase a BOP?

For companies in high-risk industries, a BOP policy would not be the best fit. Companies that run at high risk or are in unique industries require a specific insurance package and a certain amount of coverage. These are just a few examples of business types that would not be a good pairing for a BOP:

- Agricultural

- Mining

- Construction

- Health care

- Gun shops

- Computer stores

Businesses that need professional liability can often be good candidates for BOP insurance.

What Is the Difference between BOP Insurance and General Liability Insurance?

Commercial general liability insurance (CGL) is designed to protect businesses from legal claims, including for bodily injury or property damage to third parties. But a BOP includes CGL coverage and more, such as commercial property insurance and business income insurance, together in one convenient package for business owners. Here's a deeper breakdown:

BOPs:

- Offer liability protection for your business against third-party injuries and property damage

- Offer product liability

- Offer commercial property coverage

- Offer business interruption coverage

- Cost an average of $350 to $3,000 annually

- Are designed for small to medium-sized businesses

- Are designed to cover low-risk industries

General liability policies:

- Offer liability protection for your business against third-party injuries and property damage

- Offer product liability

- Cost an average of $400 to $600 annually

- Are designed for most businesses

- Are made to cover most industries

An independent insurance agent can further explain the key differences between BOPs and general liability insurance for businesses.

What Is the Difference between a BOP and a CPP?

Commercial package policies, or CPPs, are similar to BOPs because they bundle many types of business coverage together in one convenient policy. CPPs are available to a much wider range of businesses and include more flexibility for customization by business niche. CPPs include the basics of property insurance, general liability insurance, business income insurance, business vehicle insurance, and equipment breakdown insurance, but can be expanded with several other forms of coverage. A CPP can include coverage for business crime, employment practices liability, pollution, excess liability, and much more.

Who Sells BOP Insurance?

BOP insurance is available from many different insurance companies, and the best way to find the right carrier for you is by working with an independent insurance agent. These agents know which carriers to recommend based on your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could provide a BOP insurance policy for you, finding coverage could also depend on the area you live in. Here are a few of our top picks for BOP coverage.

| Best BOP Insurance Companies | Star Ratings |

| Nationwide |

|

| Progressive |

|

| The Hartford |

|

| Liberty Mutual |

|

| Farmers Insurance |

|

| Hiscox |

|

One BOP insurance company outshines its competitors:

- Best overall BOP insurance company: Nationwide

Nationwide is a leading small business insurer with an "A+" rating from AM Best. The carrier is on the Fortune 100 list and currently serves more than half a million customers across the US with quality coverage. Aside from its outstanding insurance catalog, Nationwide offers superior customer service and 24/7 claims reporting.

Nationwide's BOP policies include commercial property insurance, general liability insurance, business income insurance, and equipment breakdown insurance. The carrier also provides specific, prepackaged BOPs designed for the following industries:

- Auto

- Retail

- Food

- Service

- Office

- Wholesale

Beyond that, Nationwide offers several optional add-on coverages to BOPs, including the following and more:

- Cyber liability insurance

- Inland marine insurance

- Umbrella insurance

- Crime insurance

- Workers' compensation

- Professional liability insurance

With all their convenient coverage solutions for business owners, Nationwide is our top pick for BOP insurance. An independent insurance agent can further help you decide if Nationwide is the right insurance company for your business's coverage needs.

Finding Discounts and Savings on BOP Insurance

Though the costs of BOP insurance can vary greatly and certain policies will be more expensive than others, many insurance companies offer a handful of competitive discounts and other ways to save money on coverage. An independent insurance agent is experienced in finding money-saving hacks for BOP insurance customers.

Here are a few examples of common discounts offered on BOP insurance:

- Annual premium discount: Businesses can qualify for a discount on their BOP insurance if they opt to pay premiums annually in one lump sum, rather than in monthly installments.

- Insurance package discount: Businesses can save quite a bit on BOP insurance if they shop for a specially packaged product with all the protections they need, rather than purchasing each required type of coverage separately.

- High deductible discount: Businesses can lower the cost of their BOP insurance by opting for a higher deductible amount on their coverage.

- Safe construction discount: Businesses can earn a discount on the property coverage section of their BOP insurance if the business's property is rated as safely constructed and better able to withstand various perils.

An independent insurance agent can not only help you find all the BOP coverage your business needs to maintain smooth operations, but also find the most affordable rates by browsing a number of different products offered by insurance companies.

How to Compare BOPs

When shopping for a BOP, it's helpful to work with an independent insurance agent. These agents can help you compare costs and coverage from multiple insurance companies, so you know you're getting the right policy for you and your business.

Frequently Asked Questions about BOP Insurance

The cost of a BOP depends on the coverage limits and a number of other factors like size, location, and materials used. The average price of BOPs for small businesses (with a coverage limit of $1 million to $2 million) is about $42 monthly, but some companies pay $62 or more. Basically, the safer and smaller the company, the cheaper the premium.

To answer that, you'll have to address the needs of your specific business. It's beneficial to review your business's setup and operations with an independent insurance agent to help ensure that you get matched to a policy that covers all of your business's risk areas.

The actual package of insurance known as a BOP may not be legally required to run your business, but you must carry coverages such as CGL insurance to protect yourself. Certain mortgage lenders will also require you to carry commercial property insurance. So, while a BOP itself may not be mandatory, the important coverages it provides often are.

You may not be able to tell if your business will be accepted for a BOP by an insurance company based on its NAICS code alone. Rather, insurance companies will determine if your business qualifies for BOP insurance based on location, size, business class and annual revenue.

Eligible businesses can receive a package of insurance coverage through the ISO Businessowners Coverage Form. After selecting the coverage amount for business property, the policyholder is granted several additional coverages together in one convenient package.

Why Should I Work with an Independent Insurance Agent for My BOP Insurance?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent agents work for you and not one insurance provider. They’re the only agents who can check policies from multiple carriers. Plus, you’ll never outgrow an agent. They have the flexibility to find the right coverage as your business continues to expand and evolve.

Get the Information on a BOP for Your Business

There’s no business too small for our independent insurance agents. They have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you.

iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

iii.org/article/understanding-business-owners-policies-bops

iii.org/article/what-does-businessowners-policy-bop-cover

investopedia.com/best-business-owners-policy-insurance-5069985

https://www.iii.org/article/understanding-commercial-package-policies