Key Person Insurance

Valuable coverage for valuable employees

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Some businesses have an employee or two that they just couldn’t function without. These workers can be referred to as key persons. If a key person were to become permanently disabled or die, it could hurt your company in many ways. That’s why it’s so important to have the right coverage in place.

Fortunately, an independent insurance agent can help you find the right kind of key person insurance for your company. Even better, they’ll get you equipped with more than enough coverage long before the time comes to use it. But before we jump too far ahead, here’s a closer look at key person insurance.

What Is Key Person Insurance?

In your business, you may have one or two key employees who help things function smoothly, and your company needs to be protected from the risk of losing them. Key person insurance, sometimes called key man insurance, covers one important person in your company, like the owner or CEO.

In small businesses, the key person might be the owner, but the term refers to any essential employee for a business of any size. These workers are crucial to the company. Your business could not properly function without them or their knowledge or skill set. The business is the beneficiary and is responsible for paying policy premiums and receives a payout if the key employee dies.

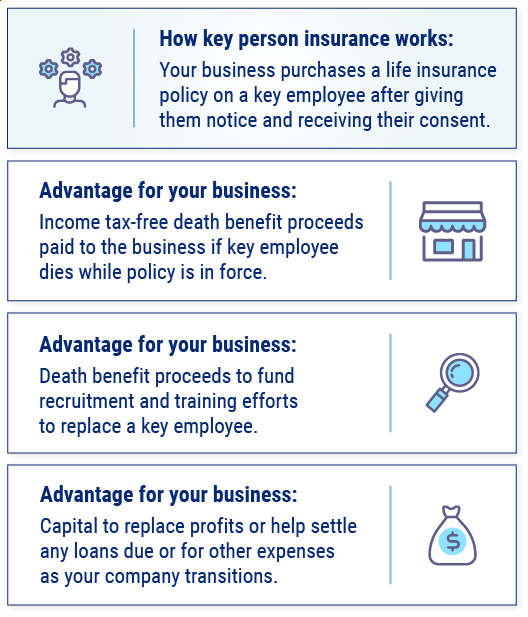

How Does Key Person Insurance Work?

Your company needs key person insurance if an essential worker dies suddenly or is incapacitated and unable to do their job. A key person policy can be one of the following:

- A standard life insurance policy, which covers a worker if they die during the time period specified in their insurance policy.

- Total and permanent disability insurance, which covers disabilities or injuries that may occur to an individual.

- Trauma insurance, which also covers injuries or disabilities that may occur because of an unexpected accident.

Key person insurance policies cover the untimely death, disability, or sudden departure of a key person, but they can also provide financial support while the person is recovering from an illness or injury and cannot work in their previous capacity.

The policy's term is for a specified time period or until the person being insured is no longer with the company in the capacity of a key person. While it can be difficult to put a monetary value on a person and the work they do, these policies are often for a specific amount that's agreed upon when the policy is purchased.

Who Sells Key Person Insurance?

Key person insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. They know which insurance companies to recommend to meet your needs and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could create a key person insurance policy for you, finding coverage could also depend on the area you live in. Here are a few top picks for key person coverage.

- Best for disability coverage: Guardian

- Best for term life coverage: Mutual of Omaha

- Best for small businesses: AIG Direct

- Best for self-employed: Haven Life

- Best for customizable coverage: Prudential Financial

One key person insurance company outshines its competitors:

- Best overall key person insurance company: Lincoln Financial

A Fortune 500 company, Lincoln Financial has been named the Best Life Insurance Company in the U.S. several times by World Finance magazine. The carrier has an "A-" rating from A.M. Best and has been around in the insurance industry since 1905. Their key person insurance offers the following benefits, according to the carrier's official website:

With such an extensive history and comprehensive key person coverage, it's certainly worth discussing with your independent insurance agent to determine whether Lincoln Financial is the right carrier to meet your business's needs.

What Does a Key Person Policy Cover?

A key person policy can cover an extended period after a key person is incapacitated and unable to work or dies unexpectedly. The policy can be used to provide temporary staff for your company or to hire and train a replacement. The key man policy can also be used to make up for a temporary loss of profits due to the loss of an important staff member.

Another use for key person insurance is as a guarantee for business loans. Additionally, the policy can be put toward shareholdings or partnership interests. For taxation purposes, the policy can be used to claim a deduction on business taxes under the category of business expenses.

Why Do Businesses Need Key Person Life Insurance?

The costs of losing an important member and leader of your business can be devastating. Without a business owner or key leaders, your company risks folding or going downhill. Key person insurance ensures that your company will be protected after a key person’s death or severe injury so you can recover from the loss.

Key person insurance can help your business cover future hiring or training a replacement for the lost key person. It also allows lost profits to be recovered during this time.

The payout from the policy goes directly to your business. Payouts from losing a key person can also be used to cover closing costs, investor payoffs, and severance pay for workers if your business closes.

A Closer Look at Key Person Coverage

Key person insurance has many benefits and many coverage areas. The main ways in which key person insurance protects your company are as follows:

- Covers lost profits: By compensating for lost sales and business opportunities, as well as canceled projects.

- Covers a shareholder or partnership: By allowing any company shareholders or partners to buy the key person’s shareholdings or interests. This is sometimes known as buy-sell insurance.

- Covers losses from extended absences: By paying the costs to recruit new employees or temporary workers.

- Covers business loans: By covering the value of any loans or guarantees the key person was responsible for.

An independent insurance agent can further explain how key person insurance operates and how it could benefit your business.

What Are the Benefits of Key Person Life Insurance?

Key person life insurance helps a business ensure that they can financially recover in the event of the loss of their top-performing employee. The death benefit received by the business from a key person life insurance policy can be used in the following ways:

- To compensate for lost revenue generated by the key person

- To pay off business debts

- To buy out remaining shareholders’ interest

- To fund the search and hiring process of a new employee

An independent insurance agent can further explain the numerous benefits of key person life insurance, and which apply to your specific business.

When Should My Business Get Key Person Insurance?

There are several instances when getting key person insurance would make sense for your business. Some of the most common include:

- If your business's reputation or profits are heavily tied to a key employee's name, knowledge, or unique skill set, and the loss of that employee could end the business.

- If the loss of a key person could threaten your business financially in any way.

- If losing a key person would cause stress for your business during hiring and training a replacement.

An independent insurance agent can further explain the many cases in which having key person insurance would make sense for your business.

Key Person Insurance Policies for Small Businesses

Small businesses often have the most to lose regarding key staff members. If your small business loses its leader or another important person, there’s a chance that the company will close its doors for good. These irreplaceable workers are the most important to take out key-person policies on.

However, if you're a business owner who runs your business alone, you won’t need key person insurance. In this case, your regular life insurance policy will be enough to cover you in case anything should happen unexpectedly.

How Much Coverage Should My Business Get?

That depends because there's no specific formula for determining the monetary value of a key employee. To determine how much coverage you'll need, you should evaluate the financial losses that could result in your business from that key employee's death or disability, or other loss.

You'll need enough coverage to replace a key person's sales income if you lose them, as well as to cover costs of the hiring and training process for their replacement. An independent insurance agent can greatly assist you in calculating how much coverage you should get for your business.

What Isn’t Covered by Key Person Insurance?

Key person insurance provides many crucial benefits for businesses when they lose an essential worker, but they can't cover all causes of loss. Common exclusions under key person insurance are:

- Fraud

- Misrepresentation

- Suicide (typically within the first two years of the policy)

If you're concerned about key person insurance exclusions, speak with an independent insurance agent.

What Types of Key Person Insurance Exist?

Life insurance and disability insurance are the two main types of key person coverage. Life insurance for your business can be purchased as a term, permanent, or return of premium policy.

- Term life insurance: Term life policies come with coverage limits for the amount of time during which they'll cover a person's life, such as 10, 15, or 20 years. Key person insurance is often purchased with a term that will extend into that employee's retirement.

- Permanent life insurance: Permanent life insurance covers an essential worker as long as the business pays the premium. In addition to the policy's death benefit, they also offer a cash savings value that could be used as collateral for a business's loan.

- Return of premium life insurance: This policy is essentially a type of term life insurance that offers a cash value component. It can also be formatted as a rider that gets added onto a regular term life policy.

The other main form of key person insurance is a type of disability coverage:

- Key man disability insurance: This option will pay out monthly benefits to the business or a single lump sum if their key person is unable to work during an injury or illness. The business can use these funds to stay afloat during the key person's absence in a number of ways.

An independent insurance agent can recommend the type of key person insurance that would work best for your specific business.

Who Owns the Key Person Policy and Who Benefits?

Often, the business will pay the premiums for key person insurance and is, therefore, the designated beneficiary if the key employee dies. However, the key employee must provide written consent to the business. In order for the key employee's family to receive a death benefit, they'd need to purchase a personal life insurance policy.

Examples of Key Person Insurance in Action

It's helpful to consider real examples of how key person insurance could operate in a business when shopping for your own policy. Check out some hypothetical scenarios and how key person insurance would work in each case.

- Scenario One: The key employee dies, and the surviving business member has no idea how to run the business. They have to hire a CFO to take their deceased partner's place and use the life insurance proceeds to hire top talent.

- Scenario Two: The key employee gets disabled, and the business owner lacks customer skills. The business will suffer until the key salesman gets back on their feet. Disability insurance can help the business replace some of the lost sales income during this time.

- Scenario Three: The key employee and the business owner need a large business loan for new equipment. The bank requires life insurance on both of these workers to close the loan. Key person insurance can help cover this.

An independent insurance agent can provide even more examples of how key person insurance could benefit your company.

How Much Does Key Person Insurance Cost?

DID YOU KNOW?

The cost of your key person coverage will vary based on several factors, and it can range from as little as about $100 per month or $1,000 per year up to $1,000 per month or even more.

The cost of your key person coverage will vary based on several factors, and it can range from as little as about $100 per month or $1,000 per year up to $1,000 per month or even more.

These factors will influence the cost of your coverage:

- Age, gender, and health status of the key person being insured

- Occupation and industry of the key person being insured

- Total compensation of the key person being insured

- Total amount of coverage purchased by your business

Riskier professions typically come with a higher cost of key person insurance due to the increased risk of death or injury to the employee. An independent insurance agent can help find exact quotes for key person insurance in your area.

Frequently Asked Questions about Key Person Insurance

That depends on the type of coverage you select. Term policies will cover a key employee for a chosen amount of time, such as 10 or 20 years. "Permanent" policies are available and remain active as long as the business continues to pay the coverage premiums.

Unfortunately, no. The IRS states that businesses cannot deduct premium payments for key person insurance.

Key person insurance is basically a special form of life insurance on an essential employee, but the death benefit pays out to the business, rather than the insured's family. The business is the beneficiary with key person insurance.

There are several types of key person insurance to choose from, and they're often a type of life insurance or disability insurance for your business. An independent insurance agent can review your specific business's needs and operations to determine which type would work best for you.

The cost of your policy will depend on several factors, including the age and health of the insured employee, but costs can range from $100 to $1,000 monthly or even more.

Key person disability insurance pays out monthly benefits to the business or a single lump sum if their key person is unable to work during an injury or illness.

What Are the Benefits of Independent Insurance Agents?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

There’s no business too small for our gifted independent insurance agents. They have access to multiple insurance companies, ultimately finding you the best key person coverage, accessibility, and competitive pricing while working for you.

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/life-insurance-for-key-employees