Employee Benefits: A Complete Guide

Offering employee benefits is a great way to attract new workers and retain them for many years to come.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Finding quality workers can be challenging for business owners. Keeping employees once you've hired them can present another set of challenges. Being proactive and offering employee benefits is a great practice for retaining valuable workers on your team.

An independent insurance agent can help you find the best coverage for your business if it's in need of business insurance. However, it's up to you to offer attractive benefits to your staff. Here's a complete guide to employee benefits and why they're necessary.

Navigation

- What Are Employee Benefits?

- Why Do Employee Benefits Matter?

- Why Do Employers Offer Benefits to Employees?

- What Are the Four Major Categories of Employee Benefits?

- What Other Types of Employee Benefits Can Be Offered?

- What Are Legally Mandated Benefits?

- Common and Best Employee Benefits?

- What Are Good Benefits for Employees?

- How Much Do Employee Benefits Cost a Business?

- How to Effectively Manage Employee Benefits

What Are Employee Benefits?

Employee benefits are designed to offer additional compensation beyond a regular paycheck. For qualifying employees, the business will contribute a specified amount of money towards a certain type of insurance, retirement fund, or both.

Employee benefits are also sometimes called "fringe benefits." Medical insurance, dental insurance, and life insurance are commonly added perks to an employee's salary. However, businesses might offer benefits in other forms, such as startup perks, training opportunities, or stock options.

You can technically count anything beyond typical wages as an employee benefit. This can include various workplace perks, such as gyms. Anything that can improve your workers' job experience can fall under the employee benefits category.

Why Do Employee Benefits Matter?

As an employer, you need to stay relevant and competitive in the market. Making your job offers more attractive by offering employee benefits can help you hire the right candidates and retain current employees.

Employee benefits can make a huge difference to a candidate contemplating multiple job offers. A nice benefits package can mean the difference between obtaining a future employee or losing them to a competitor.

Offering employee benefits is a practice that can help businesses hire top-quality employees from the start. A job position can be much more enticing to a qualified individual if it offers not only a salary but benefits, as well.

Further, employee benefits provide a higher-quality work life for a business's staff. They can increase a worker's job satisfaction and contribute to a more positive workforce for your company.

Employee benefits can sway workers into staying in their current job positions. In fact, a study conducted by the Society for Human Resource Management reported that 60% of workers cited employee benefits as being either very important or extremely important in determining whether they'd remain in their current jobs. If your business has a workforce it would hate to lose, offering employee benefits could greatly improve your chances of retaining it.

Why Do Employers Offer Benefits to Employees?

Employers offer employee benefits for a few reasons. Here are the top five most common reasons businesses offer benefits to employees:

- To attract talent: Persuading candidates to take a job with your business can be much easier when benefits are offered. Even if another business is offering a job with a similar salary, a benefits package can be the deciding factor for a candidate contemplating who to work for.

- To improve worker retention: Employees tend to stay in a job when they feel their needs are being met, and benefits can help achieve this. In fact, employee turnover is 56% lower in businesses that rank highly in terms of compensation and employee benefits.

- To create workplace inclusion: Catering to your employees' needs helps them feel seen and included in the workplace. Beyond traditional benefits like insurance, offering other incentives like floating holidays and flexible scheduling can help foster a sense of workplace inclusion for your team.

- To promote a strong workforce: Providing benefits that allow employees greater access to healthcare or wellness programs can improve their health on multiple levels. When your employees are healthier, they're much more likely to come to work regularly and be productive team members.

- To increase worker satisfaction and loyalty: Employee benefits can help your workers feel appreciated, which can foster a stronger sense of job satisfaction and fulfillment. Offering benefits can lead to a 70% greater chance of an employee remaining loyal to their employer.

Offering employee benefits can improve your business's workforce in numerous ways, and the positives don't stop once the hiring process is complete. Employee benefits can lead to a stronger, healthier, happier, and more loyal workforce for years to come.

What Are the Four Major Categories of Employee Benefits?

There are endless possibilities for employee benefits that can be offered. However, most common employee benefits fall into four distinct categories. These include:

- Insurance policies: Many employers entice prospective workers with various insurance plans. Whether the employees are completely covered under a group policy or workers receive discounts on their coverage, offering insurance for your team can be a major incentive considering the high cost of many policies today. Many companies offer one or more of the following types of coverage:

- Health insurance: Employers can offer their workers group health insurance plans to help cover medical expenses or contribute towards their health insurance premiums.

- Dental insurance: Dental insurance is a separate policy from health insurance, and employers may be able to lessen the financial burden of maintaining their employees' dental hygiene.

- Life insurance: In exchange for an employer paying the insurance company, the carrier will pay a designated beneficiary, such as a spouse or child, a death benefit of the same amount if an employee dies.

- Long-term disability and short-term disability: This kind of coverage can protect employees from losing income should they become unable to work due to injury or illness for an extended period of time.

- Voluntary vision insurance: Vision is a necessity to do most jobs properly. Offering your employees vision insurance can be an attractive benefit.

- Health savings accounts and flexible spending accounts: HSAs and FSAs are different types of healthcare plans that allow employees to pay for medical expenses and have reduced tax liability. They work similarly to personal savings accounts, but the money in them must be used for medical expenses.

- Retirement plans: Businesses can match employees’ contributions to their 401(k) retirement plans by a percentage of their contribution or by a specified percentage of their total annual salary. Retirement benefits are attractive to many prospective employees to help them feel secure about their future after leaving the workforce.

- Additional compensation: Any extra income offered to employees beyond their standard salary can be considered additional compensation. This can come in the form of sales commissions, awards, or lump sum gifts for outstanding effort on the job. Additional compensation offers a huge incentive for many employees to remain loyal to the business they work for.

- Paid time off: Offering workers paid holidays, vacations, sick days, etc., can be a huge perk for signing onto a company and remaining loyal to them over the years. In fact, 9 out of 10 employees said that being offered paid time off was an important factor in overall job satisfaction.

There are many ways to attract new employees and keep current employees satisfied. While these are some of the most common types of employee benefits offered by businesses, your options for fostering greater workplace satisfaction for your team are practically endless.

What Other Types of Employee Benefits Can Be Offered?

It can pay to get creative with the benefits you offer your employees. The more your employees view the workplace as inclusive, positive, and even fun, the greater the chance of them remaining loyal to your business. Here are just a few additional types of employee benefits to consider:

- Holiday or birthday parties

- Food and beverages, including coffee or snacks

- Extended parental leave

- Game nights

- Group activities in public, such as escape rooms or movies

- Grocery delivery services

- Onsite childcare

- Restaurant reservations

- Dry cleaning services

- Event and travel planning services

- Employee assistance programs

- Mental health services like therapy and counseling

Your business might even conduct an employee survey to ask team members what kinds of benefits they'd like to see offered. Any actions your business takes to improve employee job satisfaction are likely to decrease your chances of staff turnover.

What Are Legally Mandated Benefits?

Federal, state, or local laws mandate certain employee benefits. Employers are legally required to offer these benefits to employees, regardless of their business's industry. Some of the most common legally mandated employee benefits include:

- Minimum wage: Currently, federal minimum wage is $7.25 per hour. This is the lowest amount that any employer is legally allowed to pay its employees. However, many states have chosen their own minimum wage limits. State minimum wages can be higher or lower than the federal minimum wage, but all businesses must pay their workers the higher of the two amounts.

- Overtime: This is a type of additional or increased compensation awarded to employees who work more than 40 hours within a workweek. Federal overtime is time and a half, meaning that any hours worked past the 40 mark are calculated as 1.5 times the employee's typical rate. State overtime pay laws may vary from the federal amount, but all businesses are required to pay their workers whichever rate is higher.

- Unemployment insurance: This type of coverage provides government assistance to former employees who lost their jobs. Coverage is only designed to cover individuals while they are in between jobs and actively searching for new work. To qualify for this type of assistance, a worker must have been released from a company through no fault of their own, such as if a company went out of business.

- Family and Medical Leave Act (FMLA): This is a federal law that provides unpaid leave for employees in case of health or family-related issues. FMLA allows employees to take unpaid leave for up to 12 consecutive weeks or intermittently. Employees cannot exceed a total of 12 weeks of unpaid leave within a 12-month period under the law. To qualify for FMLA, an employee must have worked 1,250 hours for their employer and have worked for them for at least a year. Businesses with 50+ employees for at least 20 weeks in the same or previous year are eligible for FMLA.

- Consolidated Omnibus Budget Reconciliation Act (COBRA): This is a federal law that offers employees a way to continue receiving group health insurance after leaving a company or losing coverage from their employer. COBRA is available to businesses with at least 20 employees and is usually available for up to 18 months.

- Workers' compensation insurance: This is a state-mandated type of coverage that can cover medical bills and partial wage replacements of employees who get injured or ill due to their job duties or work environment. Coverage can also pay out death benefits to surviving family members if an employee dies due to their job.

Make sure to become familiar with all the types of mandated employee benefits. This can help your business avoid potential penalties, such as fines or mandatory suspensions in operations, that can arise, for example, if your business is found to have not offered workers' compensation though it was legally required to do so.

Common and Best Employee Benefits

Your business can benefit from offering its employees many different types of incentives. However, certain types of employee benefits are widely recognized across the globe as being the best options. These include the following:

- Private healthcare insurance plans (i.e., vision, medical, and dental)

- Life insurance plans

- Retirement and pension plans

- The ability to work from home

- Company equipment (e.g., laptops, phones, and vehicles)

- Flexible hours

- Extended vacation or sick leave

- Food and snacks

- Stock option plans

- Training and development

- Bonuses

- Awards

- Surprise gifts

Offering any of these employee benefits is a great way to increase your team's sense of job satisfaction. Satisfied employees are much more likely to remain loyal to your business over time.

What Are Good Benefits for Employees?

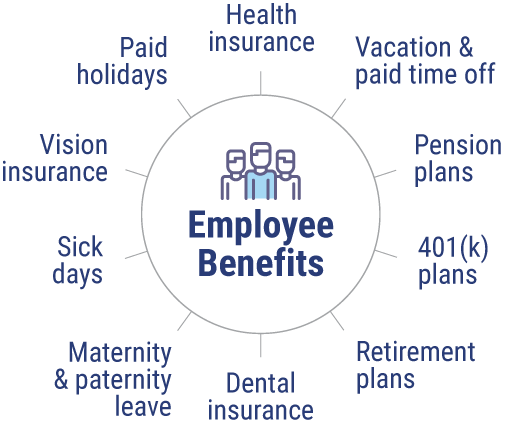

All benefits can be considered good for your employees in various ways. However, you can compare certain studies to determine which benefits are valued most by large groups of surveyed employees. In the recent Benefits Review Survey by Glassdoor, the following employee benefits ranked highest in terms of promoting job satisfaction:

- Health insurance

- Vacation and paid time off

- Pension plans

- 401(k) plans

- Retirement plans

- Dental insurance

- Maternity & paternity leave

- Sick days

- Vision insurance

- Paid holidays

After reviewing more than 50 different employee benefits, these were found to have been the most valued by workers. Consider these findings when determining which types of employee benefits to offer at your company.

How Much Do Employee Benefits Cost a Business?

In one recent year, it was reported that employee benefits account for 30% of all compensation costs for businesses. Of these costs, insurance policies accounted for 8% and legally required benefits accounted for 7.7%.

Though employee benefits may seem expensive at first look, consider the alternative of not offering them and the potential drawbacks that may come with that choice. Failure to provide attractive employee benefits could make it much more difficult for your business to find and retain workers, which could lead to a lot more time and money spent in the hiring/firing process.

The more time and resources your business has to allocate for hiring/firing, the less it has remaining to conduct its daily operations and focus on the task at hand.

How to Effectively Manage Employee Benefits

Effectively managing your business's employee benefits can greatly help your HR department's administrative team. Keep these tips in mind to handle employee benefits effectively:

- Hire an employee benefits specialist: These professionals excel in helping businesses determine the best benefits to offer and can help you budget accordingly.

- Find designated software: Fortunately for businesses, employee benefits information software exists to help you organize and track which workers receive benefits, what kind they receive, and more.

- Weigh benefits and costs often: Make sure to weigh the cost of your employee benefits offered with the cost to your company, and conduct such an assessment often.

- Include benefits in the employee handbook: Update your business's Employee Handbook to contain any pertinent information about the benefits available to them from your company.

- Study your employees' wants and needs: It's important to consider what benefits are right for your unique team. If you have older employees, benefits like retirement plans and vision insurance might be more enticing than holiday parties and an on-site gym, for example.

If your business designs a system to evaluate and track its employee benefits before it starts offering them, you'll be setting yourself up for long-term success. Employee benefits are no good to the worker or the employer if they're not properly managed.

Here's How an Independent Insurance Agent Can Help

Employee benefits are one important piece of your business, but you also need the right protection against many kinds of threats, including fire damage, lawsuits, and more. That's why having the right business insurance is critical, and a local independent insurance agent can help you find it.

These agents are free to shop and compare policies from a number of different carriers. They'll present you with quotes that represent the best blend of coverage and cost and can even help you file business insurance claims or update your policy down the road.

https://resources.workable.com/tutorial/employee-benefits-guide

https://www.glassdoor.com/research/how-50-benefits-correlate-with-employee-satisfaction

https://www.forbes.com/advisor/business/employee-benefits/

https://www.aihr.com/blog/types-of-employee-benefits/