Church Insurance

Religious organizations need the right protection against many common threats, including lawsuits, property damage, theft, employee misconduct, and more.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Churches provide many services in addition to Sunday Mass. By hosting other services like pre-school or daycare and more, churches face many of the typical risks associated with all businesses, as well as their own unique perils. That’s why it’s critical to equip your business with the right church insurance.

Fortunately, an independent insurance agent in your area can help you get set up with the right church insurance for your business. These agents can assess the needs of your unique church and determine which specific types of coverage fit best. But first, here’s a closer look at what church insurance covers and why it's necessary.

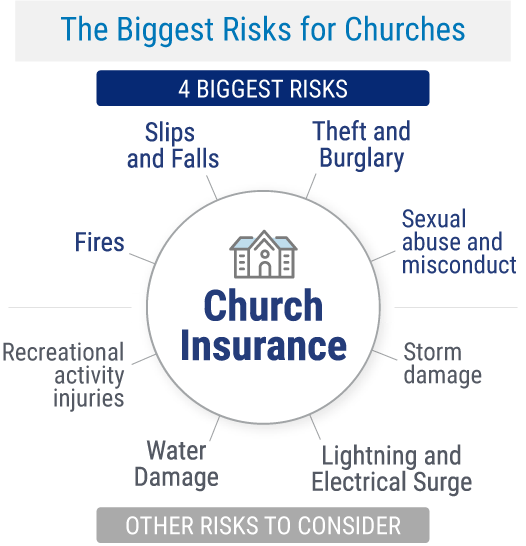

The Biggest Insurance Risks Churches Face

Churches encounter a number of different risks, but thankfully, many can be minimized with the right protection. The biggest risks include:

- Fires: Roughly 1,300 fires occur every year in religious properties, causing over $38 million in property damage. Church insurance covers both fire damage and any resulting liability or medical issues.

- Slips and falls: Like pretty much all businesses, one of the most common risks that churches file claims for are slips and falls. Church insurance protects against medical bills and legal fees that come from injuries that occur on church property or at functions.

- Theft and burglary: Unfortunately, churches are frequent targets of burglary and theft. Both can result in financial loss and damage to valuable church property. Church insurance covers items such as stained glass windows and other religious artifacts, which may not be protected by a normal property policy.

- Sexual abuse and misconduct: Sexual abuse and misconduct can happen in any business, and churches are not exempt. If a church owner or employee is accused of sexual harassment or sexual misconduct, the liability portion of a church insurance policy can protect your church and its members.

- Storm damage: Damage from hail, floods, and lightning can be expensive. The property damage portion of a church policy can help cover those costs.

- Water damage: Frozen pipes and leaking faucets can cause extensive damage to your church. Flooding and interior wall damage are common and expensive. Repair costs are covered under a church policy.

- Lightning and electrical surge damage: A lightning strike or power surge can damage computers, sound systems, and other electrical equipment. Church insurance can cover the cost of repairs or replacement.

- Recreational activity injuries: Children can be injured in a daycare center, camp, or other recreational activity hosted by your church. A church policy can help cover medical costs and any liability issues.

Finding the right church insurance can help protect your business and your team from a wide range of disasters, from common to completely unexpected. An independent insurance agent can help you find enough church insurance to guard against the extensive list of disasters that could befall your business.

Types of Insurance Churches Should Consider

Houses of worship often have different insurance needs from houses of business. Church insurance accommodates these differences and offers a variety of liability and property coverages you can select to construct the perfect policy for your needs.

While there are many options, it’s easy to tailor a policy that includes only the coverage your religious institution needs. Special church coverage options include:

- Ministers and pastors liability insurance: This coverage is essential for religious organizations and offers spiritual counseling liability protection. Policy terms vary, but coverage often extends to clergy, church leadership, and paid or non-paid sanctioned volunteers.

- Employee practices liability insurance: This covers full and part-time paid employees and workers on stipends. If an employee sues your church for sexual harassment, discrimination, or wrongful termination, this insurance can cover damages and legal costs.

- Directors, officers, and trustees liability insurance: Your board of directors, trustees, and officers can be protected by this coverage if members of your church or employees sue them.

- Ordinance or law insurance: If your building is over 20 years old, this coverage is important. It can pay for the costs to bring your building up to current building codes if necessary.

- Religious freedom insurance: This coverage can protect your church from discrimination suits.

An independent insurance agent can further explain the basic protections needed by churches and detail their specialty coverage options.

Other Church Insurance Options

Churches may need several forms of protection. Not all the coverage required by churches is unique to the industry. Like all other businesses, churches need property protection and legal protection. Here are a few additional types of church insurance to consider for your policy:

- General liability insurance: Coverage provides protection for church members, officials, staff, volunteers, and employees who get sued for third-party claims of bodily injury or personal property damage. It also offers protection if third parties are injured while performing duties for the church.

- Commercial auto insurance: Covers the cost of lawsuits related to accidents and can pay for physical damage to company vehicles and medical treatments to company drivers and passengers.

- Church-sponsored activities liability insurance: This coverage offers protection for off-site activities that your church may sponsor, like picnics and softball games. These are one-off policies and must be purchased separately before each event.

- Daycare and preschool liability insurance: Many churches provide daycare or preschool options. This type of church liability coverage will handle any lawsuits unhappy parents bring.

- Commercial property coverage: Property coverage is part of all church policies and can protect church property from damages due to severe weather, fire, falling objects, vandalism, and theft.

- Inland marine coverage: This coverage can protect any valuable artifacts owned by the church during transport or shipping if it's sent to another church or museum.

- Computer fraud coverage: If your church is a victim of computer fraud by a non-employee, this insurance can cover related losses.

- Employee dishonesty coverage: If an employee steals or embezzles church funds or property, this policy will cover the losses.

Additional Liability Protection for Your Church

- Cyber liability insurance: If your church’s computer system is compromised, sensitive or personal data may be stolen or sold to third parties. Aside from having to pay to fix your network’s security, your church could also face a lawsuit. This coverage protects against financial and legal ramifications after a cyberattack.

- Premises liability insurance: This coverage protects against costs associated with third-party injuries and property damage sustained on your business premises. Common injuries include slips and falls.

- Advertising injury liability insurance: Covers any copyright or trademark infringement by your church’s advertisements, as well as legal claims of libel or slander against your business by a third party.

- Professional liability insurance: This coverage protects against claims made by customers or clients who suffer financial loss due to the work they've hired you for. This coverage is crucial for churches that offer advice or counsel to the public.

Your church may need liability coverage extending even beyond this list, such as for the following:

- Harmful pastoral counseling services

- Church security breaches

- Compromised volunteer and youth safety

- Infectious disease outbreaks

In each case listed above, your church liability insurance can pay for damages and related defense costs. An independent insurance agent can help you assemble a church insurance package that protects your church from every possible angle.

What Does Church Insurance Cost?

For small churches, the cost of general liability coverage can range from $700 to $3,000 annually. This is just one aspect of the entire church insurance policy, though. The cost of your church insurance will be impacted by several factors, including:

- The location and size of your church

- The number of vehicles used by your church

- Your church's exposures

- The age and value of the property

- How many employees your church has

- The type and amount of coverage you need

- Your church's claims history

An independent insurance agent can help you find exact church insurance quotes for your area and any applicable discounts.

Why You Need Church Insurance Coverage: Claims Scenarios

Church insurance covers your business in the event of many incidents. Here's a breakdown of a few common examples and how church insurance coverage applies to various common claims.

| Incident | Coverage | How it Works |

|---|---|---|

| Accident involving a church van on a daycare field trip | Commercial auto insurance | Covers the cost of lawsuits after accidents, as well as physical damage to company vehicles and medical payments for driver and passenger injuries. |

| Stained glass window gets vandalized | Stained glass coverage | Covers this special type of church property by reimbursing for repair/replacement of stained glass up to policy limit. |

| Your church is sued for speaking its beliefs | Religious freedom protection coverage | Covers legal fees related to lawsuits against your church for expressing its religious views. |

| A member of your leadership board is sued for misconduct charges | Directors & officers coverage | Covers legal fees related to lawsuits against directors, officers, and board members of your church for various lawsuits. |

Who Sells Church Insurance?

Church insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. They know which insurance companies to recommend to meet your needs and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could create a church insurance policy for you, finding coverage could also depend on the area you live in. Here are a few of our top picks for the best church insurance companies.

| Top Church Insurance Companies | Overall Carrier Star Rating |

| Progressive |

|

| Nationwide |

|

| Brotherhood Mutual |

|

| GuideOne |

|

- Best overall church insurance company: Progressive

Progressive has been a part of the insurance industry since 1937 and is highly rated by AM Best, the BBB, and customers. The insurance company also offers a comprehensive church policy option, including:

- General liability coverage

- Business owners policy coverage

- Commercial auto coverage

- Workers' comp. coverage

An independent insurance agent can help you decide if Progressive has the right type of church insurance for your business's needs.

Frequently Asked Questions about Church Insurance

Church insurance isn't mandatory by law. Regardless of whether church insurance is legally required, your church needs to be protected before it ever opens to the public. Your property, workers, and business all need protection against numerous threats, including property damage, theft, lawsuits, and more.

Church insurance can protect you in numerous ways, including paying legal costs in case of a lawsuit, paying for repairs in the event of property damage, paying to fix computer systems in the event of a breach, and much more.

The cost of your church insurance will depend on many factors, including the age and size of your church. General liability policies for churches alone can range from a few hundred dollars annually to $3,000 or even more.

Yes, larger churches that offer more services and have more valuable property are more expensive to insure than smaller churches with fewer services, which may also have older or otherwise less valuable property.

When buying church insurance, you'll need to look for coverage for your property, your team, and all your legal exposures. This means several forms of insurance will be necessary. An independent insurance agent will help ensure you get set up with them all.

Your church insurance can protect your employees against injury, illness, and death on the job, as well as against lawsuits for claims of theft against the business or misconduct towards patrons.

Another crucial coverage for churches is mission insurance, which provides coverage for these disasters that can occur in a mission:

- Kidnapping

- Injuries and illnesses

- Lawsuits

If you're unsure of whether your church or other religious business needs mission insurance, work together with a local independent insurance agent. They'll ensure your business gets covered by all the right types of protection.

Why Work Together with an Independent Insurance Agent?

When it's time to protect your church with the right coverage, no one's better equipped to help than a local independent insurance agent. They have access to multiple insurance companies, ultimately finding you the best church insurance coverage, accessibility, and competitive pricing while working for you. And down the road, your agent will be there to help you file church insurance claims or update your coverage as necessary.

https://www.irmi.com/whats-new/product-update/churches-and-religious-institutions-exposures-and-risk-management-discussions-pli

https://www.progressivecommercial.com/business-insurance/professions/church-insurance/

https://www.securityinstrument.com/fire-and-life-safety-solutions-for-churches/#:~:text=The%20Federal%20Emergency%20Management%20Agency,most%20other%20kinds%20of%20structures.

https://churchpropertyinsurance.com/blog/2023/04/how-much-does-church-insurance-cost/