Commercial Property Insurance

Your business's building, inventory, and equipment all need protection against numerous threats

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Your business depends on several different types of property to function. From the exterior building it’s housed in down to your inventory and products, all these kinds of property need to be protected against numerous risks. That’s why having the right commercial property insurance is so important.

Fortunately, an independent insurance agent can help you find the right kind of commercial property insurance for your company. They’ll get you equipped with more than enough coverage, long before you ever need to file a claim. But before we jump too far ahead, here’s a closer look at commercial property insurance.

What Is Commercial Property Insurance?

A critical aspect of business insurance is commercial property insurance. Coverage can be applied to business equipment as well as its structure, inventory, and/or products inside. Since commercial property is prone to numerous perils including theft, fire, and more, having the right protection for it is critical to your business’s success. An independent insurance agent can help your business get set up with the policy that works best for your needs.

What Does Standard Commercial Property Insurance Cover?

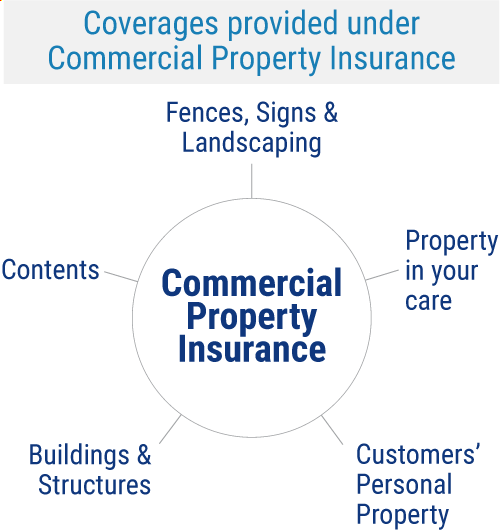

Commercial property insurance helps to protect many types of business property from numerous threats. This coverage is just one part of a complete business insurance package.

The core coverages provided by the commercial property insurance aspect include the following.

- Buildings and structures: These can be insured either for their replacement value at the time of a disaster, or for their actual cash value. Permanently installed items like fixtures, machinery, and more are covered as well.

- Contents: This includes business property that’s stored on or near the business’s main premise and used for the business’s operations. Contents can include business inventory, materials, furniture, computers, and other machinery or equipment.

- Fences, signs, and landscaping: Your policy may provide some automatic coverage for outdoor signs, fences, and landscaping, but you can increase these limits.

- Property in your care: If a business is legally responsible for property that belongs to others but is currently in their care, custody, and control, commercial property insurance can cover it from many perils.

- Customers' personal property: Personal property belonging to customers is also protected while they're on your business premises, and in some cases even when away from your premises.

An independent insurance agent can further explain the basic coverages included in commercial property insurance, and how these will benefit your specific business.

Who Sells Commercial Property Insurance?

Commercial property insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. Independent insurance agents know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could provide a commercial property insurance policy for you, finding coverage could also depend on the area you live in. Here are a few of our top picks for commercial property coverage.

| Top Commercial Property Insurance Companies | Star Rating |

| Liberty Mutual |

|

| The Hartford |

|

| Progressive |

|

| Nationwide |

|

| Farmers Insurance |

|

| Hiscox |

|

One commercial property insurance company outshines its competitors

- Best Overall Commercial Property Insurance Company: Nationwide

Nationwide is a leading small business insurer with an "A+" rating from AM Best. The carrier is on the Fortune 100 list and currently provides more than half a million customers across the US with quality coverage. Aside from their outstanding insurance catalogue, Nationwide offers superior customer service and 24/7 claims reporting.

Nationwide also provides comprehensive commercial property coverage for its customers. Nationwide's website states that their commercial property insurance covers the following.

- Your building

- Your outdoor sign

- Your furniture and equipment

- Your inventory

- Your fence and landscaping

- Others' property

An independent insurance agent can help you determine if Nationwide is the right carrier to meet your commercial property insurance needs.

What’s Not Covered by Commercial Property Insurance?

Like all other forms of insurance, commercial property coverage also comes with its own set of exclusions. Many commercial property policies exclude these perils.

- Equipment breakdown

- General wear and tear

- Flood and earthquake damage

- Commercial vehicles and watercraft

- Animals

- Valuable papers

To guard your business’s property against flood or earthquake damage, you’d want to work with your independent insurance agent to get set up with a flood insurance and/or earthquake insurance policy. Also, to cover your business’s fleet, you’d need commercial auto insurance, since commercial property insurance does not cover vehicles.

What Does Comprehensive Commercial Property Insurance Cover?

Commercial property insurance also comes in a comprehensive form, which provides the coverages offered by a standard policy with some important additions that may be needed by many businesses, including specialized niches.

Here are some additional coverages provided by comprehensive commercial property insurance.

- Documents: Important documents and accounting records can be insured, though the base coverage you’ll receive could be around $10,000. You might want to increase this amount to cover the cost of replacing the lost information through an endorsement or add on.

- Customers' care, custody, and control: Businesses that routinely have customers' personal property in their care need a special form of coverage. Repair shops that temporarily keep customers’ items especially rely on this aspect of comprehensive commercial property insurance.

- Spoilage: Businesses that have perishable inventory or other property, such as food or flower shops, require a special type of coverage against spoilage to protect it.

An independent insurance agent can further explain the coverages included in a more comprehensive commercial property insurance package, and which additional coverages would make sense for your business, even if they're not on this list.

Who Needs Commercial Property Insurance?

Pretty much any business needs commercial property insurance. Coverage is critical to protect your business’s buildings, contents, and property temporarily in your custody. All commercial property is vulnerable to many threats, from theft to explosions and beyond.

Without the right commercial property coverage, your business could end up losing a ton of money to repair or replace a critical component of its structure or interior workings after just one disaster. An independent insurance agent can further explain why your business could benefit from commercial property insurance.

How Will My Building Be Valued by Commercial Property Insurance?

Insuring your building isn’t as simple as just picking a number and getting the full coverage amount. There are three types of property valuations that are used in commercial property insurance.

- Replacement cost: Replacement cost will pay to fully replace and repair your building with materials of similar type and quality. Your building’s replacement cost may increase over time due to rising construction costs and inflation. Insurance companies typically require you to insure your building for a minimum of 80% of its replacement cost number.

- Actual cash value: Actual cash value coverage factors in the age, condition, and depreciation of your building when paying out a claim. It’s often used for older buildings that might not be replaced the way it was originally built.

- Functional replacement cost: Functional replacement cost can serve as a nice alternative to actual cash value, particularly for older buildings. This coverage will replace lost or damaged covered property with materials that serve the same purpose.

Your independent insurance agent can advise on which type of property valuation coverage would work best for your business's unique needs.

Why Do I Need Commercial Property Insurance?

Commercial property insurance can help get a business back up and running if it suffers a loss such as a fire, tornado, or destructive power outage. Without insurance, your building and all of your business’s contents and equipment could be lost after a harsh disaster.

Common consequences of not carrying commercial property insurance include the following.

- Bankruptcy: If you have a fire loss or other large claim, it could cost your business millions of dollars to rebuild without insurance. Your business could be forced to close and declare bankruptcy after a huge loss if you lacked the proper coverage.

- A ruined reputation: If a customer suffered personal property damage at the hands of your business, the negative publicity could also harm your business’s chances of survival. Commercial property insurance can help your customers know that you operate a legitimate business and care about their well-being.

- Legal trouble: Failing to carry adequate commercial property insurance could result in legal issues for your business. If you default on loans or can’t pay vendors or employees, you could face lawsuits that could have been avoided with adequate commercial property insurance.

- Spoiled inventory: If you have perishable inventory like food or flowers, all that’s needed to wipe it out is a power outage that lasts a couple of hours. You can insure this loss with commercial property insurance.

If you're unsure whether or not your business needs commercial property insurance or how not having coverage could negatively impact you, an independent insurance agent could easily explain several more risks of not getting a policy.

Is Commercial Property Insurance Mandatory?

If you’re taking out a commercial loan to purchase your property, your bank or finance company will likely require you to have commercial property insurance. Similar to banks requiring homeowners insurance, if you’re taking out a mortgage, banks simply want to know that their money won’t be totally lost if something does happen to your building.

Even if it’s not required by a bank, commercial property insurance can be a valuable form of protection for your business. Starting and operating a business requires a lot of money and capital. Operating a business without commercial property insurance could force you to have to start over from scratch after a devastating loss.

Commercial property insurance protects you from the following common mishaps.

- Your customer damages their personal property after slipping on your business's floor

- One of your employees damages your customer's property while trying to repair it

- Lightning from a severe thunderstorm strikes your business and damages the building

You also need commercial property insurance to protect your business from common everyday mistakes and mishaps. Sometimes the simplest disasters can actually be the most destructive, both to property, and to your business's checkbook.

How Much Does Commercial Property Insurance Cost?

The cost of commercial property insurance varies and largely depends on the following factors.

- Size, age, and condition of the business's building(s)

- Loss settlement option

- Value of the building(s)

- Value of your business’s contents

- Location and cost of building supplies in your area

- The business's specific operations and risk

The median cost of this coverage, however, is $755 annually for $60,000 worth of coverage. You can buy commercial property insurance from many different insurance companies, some of which may offer more discounts than others. An independent insurance agent can help find exact quotes for coverage in your area, as well as scout out discounts you may qualify for.

Bundling Commercial Property Insurance with Other Essential Business Coverages

A business owner's policy (BOP) is a convenient insurance package that provides many essential coverages needed by small to mid-sized businesses. BOPs include commercial property coverage and combine it with other coverages like commercial general liability insurance and business income insurance. BOPs can also be customized and tailored to your specific business's needs, and numerous additional coverages can be stacked on top of the basic protections included in most policies.

How to Limit Your Business's Commercial Property Risk Exposure

Though having the right coverage to protect your business from disaster is certainly important, it's also important to try to prevent disasters from happening in the first place. These simple tips can greatly help reduce your business's commercial property risk exposure.

- Create a safe work environment: The safer your job site, the less likely commercial property damage is to occur, through preventing customer and employee fumbles and more.

- Help reduce loss together: When your whole team works together to take care of your business's property, it's much more likely to remain fully functional or otherwise intact throughout its intended lifespan.

- Improve business operations: If your business operates efficiently, it can help your commercial property stand the test of time. Ensure that employees carry out operations according to their training and monitor the use of equipment and machinery like computers regularly to help prevent unnecessary damage and loss.

You can further discuss your unique business's risk exposures with your independent insurance agent. They'll address all your areas of concern and get you set up with all the coverage you need, including commercial property insurance and more.

Frequently Asked Questions about Commercial Property Insurance

To file a commercial property insurance claim, you can contact your independent insurance agent. This is the easiest and most efficient way to file any type of insurance claim, since your agent will contact the insurance company for you and keep you updated on every step of the claims process. They'll let you know all the documentation and other input needed from you.

The median deductible of commercial property insurance is $1,000. Of course, your deductible amount could vary based on your specific policy and needs.

Only the actual owner of the business's building can purchase the commercial property insurance required to cover it.

No, to get the full picture of liability protection for your business, you'll need to at least get a commercial general liability policy (coverage is usually included in standard business insurance policies as well as BOPs). Your business may also require other forms of liability protection, such as professional liability, etc.

The Benefits of an Independent Insurance Agent

Independent insurance agents are kind of like the Google of insurance quotes. You tell them what you’re looking for, and they bring in the results. And since they aren’t tied down to one carrier, they’re free to shop around and bring multiple policy options to the table.

iii.org

investopedia.com

irmi.com