Golf Course & Country Club Insurance

Golf courses and country clubs come with unique risks, such as liquor liability lawsuits, equipment damage and theft, and golf cart accidents, that require protection.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Even activities and venues associated with leisure must have the right coverage. While hitting the putting green can be a joyous and relaxing occasion for many folks, there are still unique risks present that need to be considered. Golf course and country club insurance cover your course and club in case of disaster, helping you stay solvent and make repairs fast.

Luckily, a local independent insurance agent can help you find the right golf course and country club insurance. They'll consider your unique business's exposures and get you set up with the ideal amount of coverage. But first, here's a closer look at golf course and country club insurance and why it's necessary.

What Does Golf Course and Country Club Insurance Cover?

Golf course and country club insurance is a type of business insurance specially designed to cover the needs of a golf course or country club. These policies include a blend of several different types of coverage. Here are the most common types of insurance that may be included in a golf course and country club insurance policy:

- General liability insurance: Covers legal expenses in case of a lawsuit related to third-party claims of bodily injury or personal property damage.

- Liquor liability insurance: Covers legal expenses related to serving alcohol to customers at your golf course or country club, such as DUI claims.

- Directors and officers insurance (D&O): Covers board members and other senior leaders if they’re sued based on decisions they made for your organization.

- Commercial property insurance: Covers your business's buildings and other property, like equipment and inventory, in case of natural disaster or other damage.

- Flood insurance: Covers natural flood damage to your golf course or country club, which is excluded by commercial property insurance.

- Commercial auto insurance: Covers company vehicles, like maintenance trucks or courtesy cars, in case of accidents, lawsuits, theft, and other threats.

- Inland marine insurance: Covers equipment while in transit, such as golf carts or lawn tractors. May also cover the putting green or special course features like trees that aren’t covered by commercial property insurance.

- Workers' compensation insurance: Covers worker expenses like medical exams if they get injured or ill due to the job or work environment.

- Business umbrella insurance: Increases the limit of liability coverage included in an existing policy, such as general liability or liquor liability, which can help your business avoid hefty financial losses related to larger lawsuits.

Larger golf courses and country clubs need more insurance, especially if you host special events like weddings or tournaments. An independent insurance agent in your area can help you build a complete policy.

Why Is Golf Course and Country Club Insurance Necessary?

Golf courses and country clubs face many unique business challenges. Golf course and country club insurance helps you handle or even avoid them altogether. Here are a few examples of common risks faced in this industry:

- Lawsuits: Liability insurance pays for a lawyer and legal defense costs if you’re sued and protects your golf course or country club from being on the hook for major legal settlements if you’re found liable, such as in these scenarios:

- You’re sued for racial, gender, or similar discrimination, which is especially important if you run a country club or another members-only organization.

- You’re sued because a customer was overserved at a bar and got into an accident.

- You’re sued because a customer was injured by a flying ball or another feature of your course or club.

- Natural disasters: If your buildings, equipment, vehicles, or putting green get damaged in a wildfire, hailstorm, or other natural disaster, your coverage can pay for repairs or replacements.

- Theft and vandalism: As with natural disasters, insurance has you covered if your course or club is the target of thieves, vandals, or rioters.

- Car accidents: If a company vehicle gets into an accident, your regular car insurance won’t cover it, but commercial auto coverage will.

- Worker injuries: If your employees get hurt on the job, workers' compensation can cover everything from a golf caddy’s sprained ankle to a kitchen worker’s burn.

- Special events: If you dream of hosting weddings, tournaments, or charity fundraisers at your course or club, this insurance can shield you from the cost of lawsuits in case of an incident at a special event.

- Business loans and financing: If you’re planning to finance your business, your bank will likely require you to have insurance, so they're certain you'll continue to make payments even if there’s a disaster.

Ultimately, the cost of your golf course and country club insurance can be considered a small price to pay for the long-term stability and success of your business.

Who Needs Golf Course and Country Club Insurance?

Many different types of businesses rely on golf course and country club insurance. You might need a policy if you own or run any of the following:

- City clubs

- Golf communities and HOAs

- Local, state, or national golf associations

- Private or semi-private golf, tennis, or country clubs

If you're unsure whether your business could benefit from golf course and country club business insurance, ask a local independent insurance agent to help review your unique exposures and coverage needs.

How Much Does Golf Course and Country Club Insurance Cost?

The cost of golf course and country club insurance can vary considerably from one business to the next. Some of the most common factors that may impact the cost of your coverage include:

- The size of your golf course or country club

- The location of your business

- The number of customers your business has

- Specific risk factors at your business

- Your business's past claims history

- Whether your business serves alcohol to customers or members

Larger golf courses and country clubs can expect to pay much more for coverage than smaller courses and clubs. An independent insurance agent can help you find the most affordable policy.

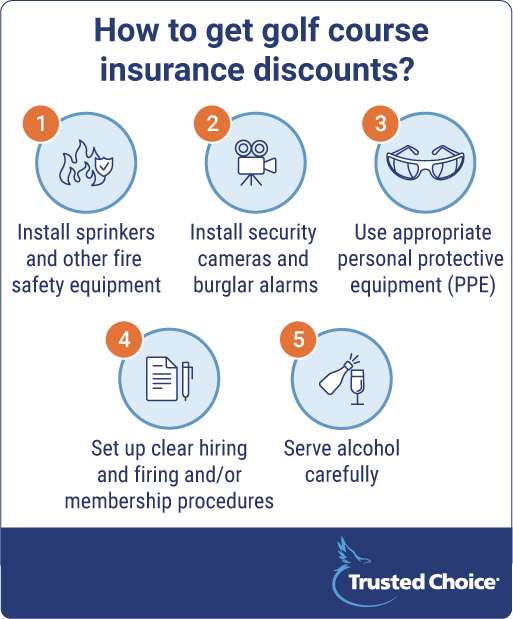

How to Get Golf Course and Country Club Insurance Discounts

Fortunately, there are several simple practices you can implement at your golf course or country club that can help you save a great deal of money on your business insurance. Here are a few easy ways to increase your chances of getting a golf course and country club insurance discount:

- Install sprinklers and other fire safety equipment: This step can reduce the risk of fire and reduce damage if a fire does occur.

- Install security cameras and burglar alarms: This deters criminals and can help your business identify prosecutors if an incident occurs.

- Use personal protective equipment: This keeps employees safe during potentially dangerous jobs like lawn care and deep cleaning, reducing the risk of filing workers' compensation claims.

- Implement clear employee and membership procedures: Having transparent rules regarding hiring and firing employees and course or club membership reduces the risk of discrimination lawsuits.

- Serve alcohol carefully: Train bartenders to avoid overserving the public to reduce the risk of liquor liability claims.

Be sure to ask your independent insurance agent or carrier about any golf course and country club insurance discounts your business qualifies for to help reduce your premium rates.

The Benefits of Working with an Independent Insurance Agent

When it's time to insure your golf course or country club, no one's better equipped to help than an independent insurance agent. These agents have access to multiple carriers in your area, so they're free to shop and compare policy options and quotes and present you with only the best results. And down the road, your agent can help your business file insurance claims or update your coverage as necessary.

https://www.rpsins.com/products-and-programs/signature-programs/golf-and-country-club-insurance/