Comprehensive vs. Collision Insurance Explained

Discover the differences between these two types of coverage.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

You need your car to get you where you want to go, and you also need to be protected – physically and financially – when you drive. That’s where auto insurance comes in. But what type of insurance do you need, and how much coverage should you have?

Let’s explore two different types of auto insurance: comprehensive and collision. We’ll also explain how each type of insurance works and the specific protections they offer so you can make a smart choice and have peace of mind when you get behind the wheel.

What’s the Difference Between Comprehensive and Collision Coverage?

Simply put, collision coverage pays for damage to your car when you collide with an object – a fence, a guard rail, a post, or another vehicle. Comprehensive insurance covers damage to your car from everything else, including theft and vandalism.

Both comprehensive and collision coverages go above and beyond the legal minimum of liability coverage, which pays for damage you might cause to other drivers, passengers, or pedestrians.

While collision and comprehensive insurance aren’t required by law, they both offer valuable protection and should be considered when you’re deciding what insurance to get.

The term “comprehensive coverage” shouldn’t be confused with “full coverage,” which includes liability, collision, and comprehensive coverage. Comprehensive is only one type of coverage. In some states, comprehensive coverage is called “other than collision” to avoid confusion.

What Is Comprehensive Insurance Coverage?

Comprehensive coverage offers added protection for your vehicle and generally costs less than collision coverage. If you get into an accident, comprehensive coverage will pay to repair or replace your vehicle if the damage wasn't caused by a collision with another car or object.

Comprehensive generally covers:

- Natural disasters including earthquakes, floods, hurricanes, and tornadoes

- Fire

- Riots and vandalism

- Theft

- Falling objects such as trees, branches, and ice

- Broken windshield

Comprehensive coverage is commonly called "other than collision." However, some collisions are still covered under this policy, such as colliding with an animal.

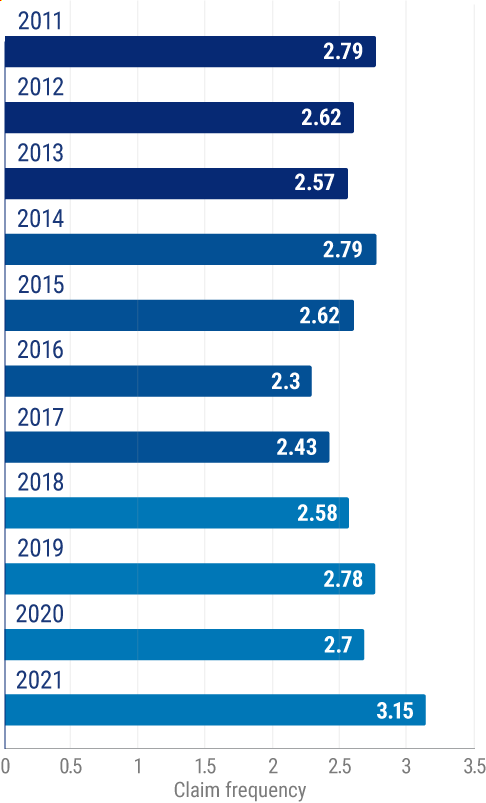

Frequency of private passenger comprehensive auto insurance claims for physical damage in the United States

Each year, 2.94 private passenger comprehensive auto claims for physical damage are filed in the United States, per 100 cars.

What Is Collision Insurance Coverage?

Collision coverage pays for damage to your car if you hit another vehicle or an object like a telephone pole, a fence, or a mailbox. Collision coverage reimburses you for the costs of repairing your car, minus the deductible, which is the amount you pay before insurance kicks in.

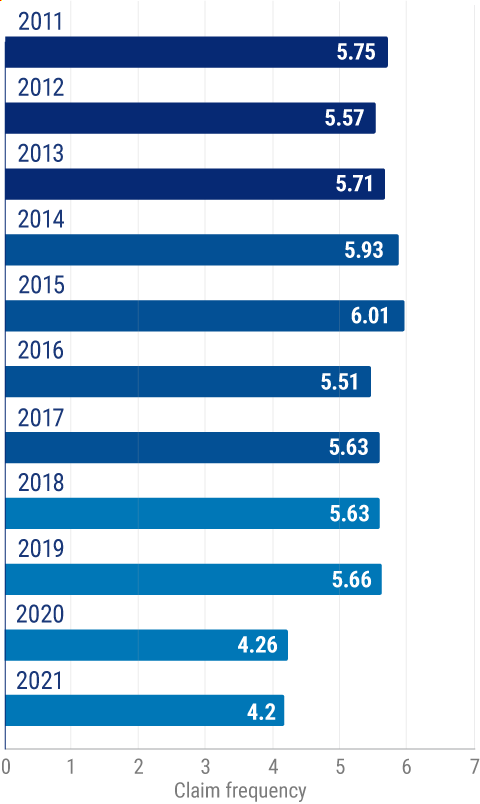

Frequency of private passenger auto collision insurance claims for physical damage in the United States

Each year, there are roughly six auto collisions between private drivers per every 100 cars that result in insurance claims for physical damage.

How Much Does Comprehensive vs. Collision Coverage Cost?

Collision and comprehensive coverage are often purchased together, but you can choose to have just one or the other. Generally, comprehensive coverage costs less than collision.

Collision vs. Comprehensive

| Collision | Comprehensive | |

|---|---|---|

| Average annual cost | $290 | $134 |

Quick note: Every driver is different, and those costs will scale up or down depending on these factors:

- Car value: Expensive cars are more expensive to insure because replacement and repair costs are higher. The opposite is true for cheaper vehicles.

- Safety record: One or two fender benders won’t hurt you too much, but major offenses like DUIs will cause your costs to skyrocket.

- Experience and age: The longer you’ve had your license, the less you’re likely to pay. Age is also a factor. Most drivers see a big drop-off in costs after age 25.

- Location: Different regions (called “rating territories”) have different risks that affect costs. For example, drivers in congested cities will likely pay more for insurance because heavy traffic is a risk factor for accidents, even if you’re otherwise a good driver.

Comprehensive vs. Collision Cost by State

The cost of comprehensive and collision insurance can vary depending on where you live.

| State | Collision | Comprehensive |

|---|---|---|

| Alabama | $390.19 | $180.11 |

| Alaska | $401.87 | $155.11 |

| Arizona | $327.86 | $208.38 |

| Arkansas | $372.65 | $240.54 |

| California | $495.18 | $96.53 |

| Colorado | $332.26 | $298.01 |

| Connecticut | $412.78 | $134.01 |

| D.C. | $539.48 | $221.94 |

| Delaware | $354.76 | $221.94 |

| Florida | $355.69 | $153.00 |

| Georgia | $420.60 | $180.37 |

| Hawaii | $370.53 | $106.29 |

| Idaho | $270.36 | $142.89 |

| Illinois | $351.27 | $144.65 |

| Indiana | $288.97 | $138.86 |

| Iowa | $250.96 | $221.72 |

| Kansas | $285.92 | $286.48 |

| Kentucky | $307.91 | $168.11 |

| Louisiana | $485.01 | $252.34 |

| Maine | $297.60 | $115.26 |

| Maryland | $430.21 | $168.01 |

| Massachusetts | $447.05 | $149.86 |

| Michigan | $478.54 | $162.01 |

| Minnesota | $274.20 | $214.55 |

| Mississippi | $364.63 | $238.95 |

| Missouri | $318.44 | $223.94 |

| Montana | $268.02 | $313.27 |

| Nebraska | $272.97 | $269.19 |

| Nevada | $374.59 | $119.19 |

| New Hampshire | $334.15 | $120.48 |

| New Jersey | $422.29 | $129.97 |

| New Mexico | $315.88 | $222.43 |

| New York | $469.82 | $172.85 |

| North Carolina | $344.07 | $138.40 |

| North Dakota | $284.09 | $264.98 |

| Ohio | $303.55 | $131.37 |

| Oklahoma | $338.87 | $270.19 |

| Oregon | $281.69 | $109.76 |

| Pennsylvania | $383.01 | $171.18 |

| Rhode Island | $491.19 | $141.03 |

| South Carolina | $317.95 | $211.29 |

| South Dakota | $248.09 | $347.61 |

| Tennessee | $353.43 | $168.07 |

| Texas | $434.46 | $285.56 |

| Utah | $308.40 | $127.15 |

| Vermont | $338.38 | $148.88 |

| Virginia | $323.76 | $149.42 |

| Washington | $325.38 | $121.13 |

| West Virginia | $352.97 | $225.50 |

| Wisconsin | $250.73 | $168.52 |

| Wyoming | $292.37 | $335.04 |

Note: These costs are averages. An independent agent can give you a personalized quote that’s based on where you live.

Comprehensive vs. Collision Cost by Vehicle Model

What you pay for comprehensive and collision insurance also depends on the type of vehicle you drive.

Cost of Collision and Comprehensive by Vehicle

| Vehicle | Collision | Comprehensive |

|---|---|---|

| Camry | $1,939 | $185 |

| Honda Accord | $2,304 | $168 |

| Honda Civic | $2,029 | $131 |

| Nissan Altima | $2,043 | $177 |

| Toyota Corolla | $1,875 | $153 |

| Honda CR-V | $1,522 | $146 |

| Ford Escape | $1,622 | $118 |

| Ford F-150 | $1,569 | $189 |

| Ford F-150 | $1,569 | $189 |

| Chevrolet Silverado | $2,696 | $184 |

| Ram 1500 | $2,086 | $188 |

Note: These costs are averages. An independent agent can give you a personalized quote based on the vehicle you drive.

Comprehensive vs. Collision Deductible

Collision and comprehensive coverages have separate deductibles, and you can choose different deductible amounts for each type. For example, you might adjust your collision deductible based on what you can afford for a collision claim. You can also choose the same deductible for both collision and comprehensive coverage. That way, you’ll have a rough idea of how much you’ll have to pay for all repairs.

Do I Need Comprehensive or Collision Coverage?

The type of coverage you need depends on the value of your car, how you drive it, and whether you can afford to repair or replace it if you have an accident.

Examples:

- If you’re driving a car where the value is so low that repairs or replacement would be cheaper than the premiums of additional policies, then you probably don't need more than the minimum liability coverage.

- If your car is worth more than $5,000, then full coverage (comprehensive AND collision) might be worth the premiums if you can afford it. And at a minimum, you should be carrying one of the two.

- If you need to choose between comprehensive and collision coverage, you should base your decision on the way you drive your car. If you commute in heavy traffic, collision coverage is probably the better choice, whereas comprehensive is better in disaster-prone or high-crime areas.

Finding Comprehensive vs. Collision Insurance Coverage Quotes

Instant online insurance quotes are nice, but algorithms are designed for the lowest common denominator and can miss important details. An independent insurance agent does the hard work behind the scenes so you can enjoy a policy that strikes the perfect balance between meeting your needs and saving you money.

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance#:~:text=purchase%20these%20coverages.-,Collision%20coverage,your%20car%2C%20minus%20the%20deductible

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

https://www.statista.com/statistics/830102/car-collision-claim-frequency-for-physical-damage-usa/

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/