Disability Insurance Elimination Period

(Choosing the right elimination period for your disability insurance can be the difference between financial stability and catastrophic debt for you and your family)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

How long could you afford to wait between losing the ability to work and getting disability benefits? Choosing the right elimination period is one of the most crucial factors in shopping for disability insurance. It's the difference between financial stability and catastrophic debt for you and your family.

Luckily, this painless guide is here to answer all your questions about disability insurance elimination periods. When you’re ready to shop, expert independent insurance agents are here to answer your questions and find you the disability coverage you need at the right price.

What Is a Disability Insurance Elimination Period?

An insurance elimination period is just a fancy way of saying waiting period. It’s the time between when you become disabled and file a claim and when your benefits actually begin being paid out to you.

The difference between a short and long elimination period is the difference between going into catastrophic debt or not if you become disabled:

- A short elimination period means less time scrambling to cover bills while you can't work.

- A too-long elimination period could mean a major credit hit, eviction, or worse.

Luckily, you can choose your policy's elimination period when shopping for disability insurance, balancing what you can afford in premiums with how fast you want your disability insurance to leap into action.

How Do Elimination Periods Work?

Elimination periods are there to lower administrative costs for the insurance company (or government, in the case of SSI and SSDI benefits) which keep your premiums (and taxes!) lower. Elimination periods work differently depending on what type of disability insurance you have.

| Type of Benefit | Length of Time |

| SSDI Benefits (Gov't) | At least 5 months after onset of disability |

| SSI Benefits (Gov't) | No waiting period, but can take years to get approved |

| Short-Term Disability Insurance | 0-90 days |

| Long-Term Disability Insurance | 2 weeks to 9 months |

Source: iii.org and Nolo's Guide to Social Security Disability

Government disability benefits have fixed elimination periods. When shopping for private disability benefits, you can choose your own elimination period. Policies with shorter elimination periods will cost more in premiums than policies with longer ones.

Elimination Periods: Government Disability Benefits

There are two sources of disability insurance: government programs and private insurance companies. You don’t have to enroll in government disability benefits (though you do pay taxes towards them that work like premiums). You just need to apply for benefits when you need them.

However, government benefits can be tricky and invasive to apply for. While the formal elimination periods may not seem that long (SSDI benefits have a 5-month waiting period and SSI benefits have no waiting period at all), the court process to get them can take much longer.

Elimination Periods: Private Disability Benefits

Private disability benefits are more flexible than government benefits. You can choose the elimination period you want when you buy the policy. Private disability insurance elimination periods typically range from 2 weeks to 6 months. Some policies have no elimination period.

Private disability insurance is sold individually or in groups (such as through your workplace). It comes in two durations: long-term and short-term.

Elimination Periods: Group vs. Individual Policies

“Group” and “individual” refer to the different ways private disability insurance can be sold:

- Group policies are sold to a group of people such as to you and your coworkers at your job, or to members of professional or social organizations.

- Individual policies are sold individually via insurance agents.

If you buy a group policy, you’re entering into a risk pool with other people in that group (which can be a good thing if you’re older or at higher risk of disability than other people in that group, or a bad thing if you’re younger and less at risk).

If you buy individually, you’re still entering a risk pool, but one that’s more tailored to your individual situation, which can save you money.

Here’s a quick rundown of the pros and cons of buying a group disability insurance policy vs. an individual one:

| Type | Benefits Offered | Benefits Period |

Pros and Cons |

| Individual | Flat income amount | Short Term: 1-5 years Long-Term: From 2 years until retirement |

Pros: Full control over the coverage; no loss of coverage when you change jobs; can shop from any company for the best offerings Cons: Can be expensive if your risks are higher |

| Group | Percentage of income | Short Term: Less than 1 year Long Term: From 2 years until retirement |

Pros: If you're at high risk for disability, pooling coverage with others can be cheaper Cons: Limited options; you lose coverage when you switch jobs |

Source: Principles of Life and Health Insurance

Some people choose to split the difference and buy a small group policy and a small individual policy to get maximum coverage. If you’re unsure which option is right for you, an independent insurance agent can take a look at your insurance needs with you and help you decide.

What is the Elimination Period for Long-Term Disability?

Long-term disability insurance policies usually have elimination periods that last between 2 weeks and 9 months. After the elimination period, long-term disability insurance lasts between 2 years or until retirement (age 65-70) depending on the policy.

What is the Elimination Period for Short-Term Disability?

Short-term disability insurance may have no elimination period. If it does have a waiting period, it’s typically between 1 week and 90 days. After the elimination period, coverage lasts from 3 months to 5 years, depending on your policy.

Short-term group policies usually have longer elimination periods than short-term private policies. Once they take effect, they also tend to pay benefits for a shorter time than private policies do, which is rarely more than one year.

Can I Work during the Disability Insurance Elimination Period?

Probably not, but it depends. When accessing disability insurance, you will need to prove that you either can’t work or that your ability to work has been substantially altered, forcing you to take lower-paying work. That’s true even during the elimination period when you’re not yet receiving benefits.

After all, the point of disability insurance is to replace your work income if you can no longer work. If you can work, you’d be double-dipping.

However, private insurance policies sometimes have a little wiggle room. If you’re forced to move to a lower-wage job or part-time hours because of your disability, you might still be able to get benefits to cover the lost income — just not as much as you’d get if you weren’t working.

The Disability Income Gap

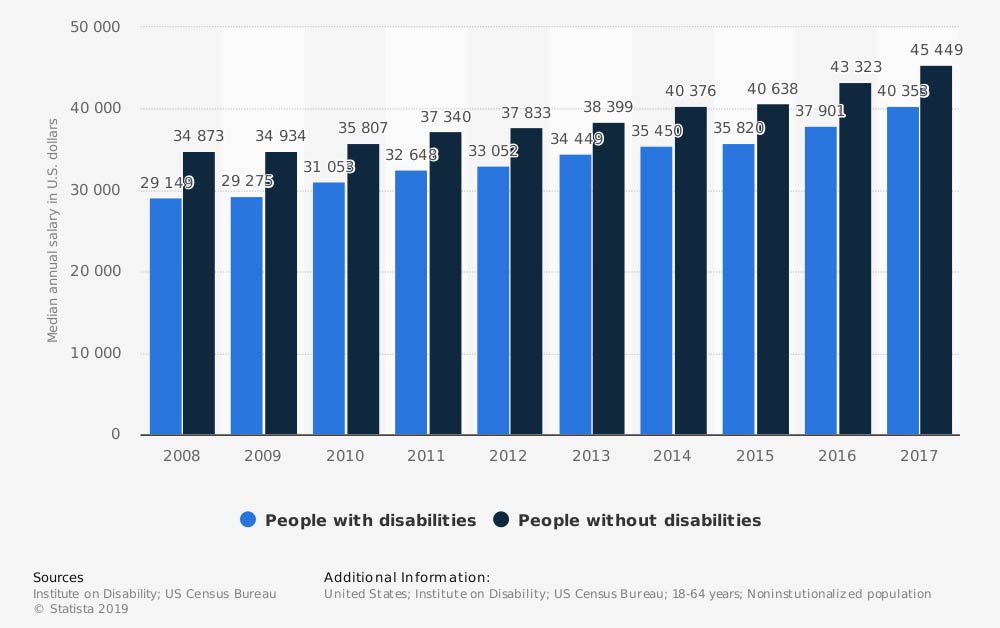

Annual median earnings for people with and without disabilities in the US from 2008 to 2017 (in US dollars)

Disabled workers make about $5000 less per year on average than abled workers. Disability insurance can help make up for the lost hours, lost jobs, and loss of marketable job skills that can go along with disability.

How Long Do Elimination Periods Last?

It depends! Now that you know the types of disability insurance out there, let’s take a look at this chart again:

| Type of Benefit | Length of Time |

| SSDI Benefits (Gov't) | At least 5 months after onset of disability |

| SSI Benefits (Gov't) | No waiting period, but can take years to get approved |

| Short Term Disability Insurance | 0-90 days |

| Long Term Disability Insurance | 2 weeks-9 months |

Source: iii.org and Nolo's Guide to Social Security Disability

In short, government disability benefits have either no elimination period (SSI) or a 5-month elimination period (SSDI). Private disability benefits can come with a variety of elimination periods depending on what you choose when you buy the policy.

When buying disability insurance, you should choose the shortest waiting period you can comfortably afford. Short waiting periods will raise your premiums, but they also make your disability insurance more effective.

How an Independent Insurance Agent Can Level Up Your Disability Insurance

Shopping for disability insurance yourself can be a downer. It’s hard to know where to look, how much insurance you need, or how to find a good deal. Luckily, independent insurance agents are here to handle the hard parts for you.

Independent insurance agents are industry experts who aren’t bound to any one company. They can compare quotes from multiple insurers to find you the coverage you want at the right price. Shopping for disability insurance with an independent insurance agent is shopping smart.

iii.org

SSA.gov

The Long Term Care Handbook (3rd edition) by Jeff Sadler

Nolo’s Guide to Social Security Disability: Getting and Keeping Your Benefits (8th edition) by David A. Morton III, M.D.

Principles of Life and Health Insurance (2nd edition) by Dani L. Long and Gene A. Morton