Long-Term Disability Insurance

(It works when you can't)

The top financial concern of Americans in 2018 was paying for unexpected expenses. What would you do if you were unable to work because of an illness or injury? Would you be able to pay your bills? Would you continue to save for retirement or college funding?

The financial impact of disability can be devastating. Long-term disability insurance protects your financial security if you can’t work because of an illness or injury.

Contact an independent insurance agent and learn how to protect yourself and your family if a disability keeps you from working.

Yes, It Can Happen To You

American workers see the chances of becoming disabled as very small. One study shows that 65% of workers believe that the chance of becoming disabled is 2% or less. In fact, the chances of becoming disabled before retirement are shocking. A 28-year-old worker has a 28% chance of becoming disabled before retirement.

What Is Long-Term Disability Insurance?

Long-term disability insurance pays a benefit if you can’t work because of illness or injury. All long-term disability plans have a few things in common.

The “Definition of Disability” describes when long-term disability benefits are payable. The benefit period is how long the disability benefits are payable. Long term disability insurance benefits are paid for 2 years, 5 years, or to age 65 depending on the policy.

The elimination period is how long after disability occurs do benefits get paid. It is anywhere from 30 days to 1 year. Disability plans also have exclusions that describe when benefits aren't payable If you can’t work.

The insurance company will expect you to prove you are disabled and can’t work. They want to know three things:

- Are you under the care of a doctor?

- Does the injury or illness prevent you from doing your job?

- Are you receiving any income from employment?

If the answers are yes, yes, and no, then the insurance company pays the benefit. It's that simple, but there are a few other things you might want to know.

What You Need to Know about Long-Term Disability Insurance

There are three definitions of disability to choose from. True own occupation, modified own occupation and any gainful employment. True own occupation is the most expensive. Benefits are payable if you can’t do your specific job. It doesn’t matter if you are receiving income from a different job. It is designed to protect professionals and specialists.

Modified own occupation is very common. It pays benefits if you can’t do your specific job. You cannot receive income from any other employment. Any gainful occupation is the least expensive and offers basic protections. It pays benefits if you can’t do any job that you are “reasonably suited for”.

- Noncancelable coverage means the insurance company can’t drop you or change your premium.

- Guaranteed renewable coverage means the insurance company can’t drop you, but they can change the premium.

- Partial/residual disability are the benefits payable for working part-time.

Do I Need Long-Term Disability Insurance?

For most families the answer is yes. A long-term disability without coverage can be catastrophic, Here’s why.

The average long term disability lasts about 3 years. For an American household with annual expenses of $60,060 per year, that means an income shortage of $158,000. The average family savings account of $16,042 would be exhausted after 14 weeks.

Families can face bankruptcy or a reduced standard of living. College funding and retirement plans can also be disrupted.

Social Security Benefits

Anyone covered by Social Security may be eligible for disability benefits. If you are eligible, you can collect long-term disability and social security benefits. Social Security Disability benefits are based on the worker’s contributions, but they are also difficult to get.

Only 34% of people who apply are awarded benefits. Minor children and a spouse caring for them may also be eligible for benefits. The average SSDI payment in 2019 is only $1,234 per month.

Long-term disability plan benefits are often "bundled" with social security to reduce cost. The insurance company reduces your benefit by any social security benefits that you receive. You will have to repay any long-term disability payments made by the insurance company that were also paid by social security.

How Much Does Long-Term Disability Insurance Cost?

Well, the answer of course is “it depends”. Group long-term disability is less expensive than individual long-term disability. Premiums for individual coverage are based on age, sex, health, occupation, and benefits.

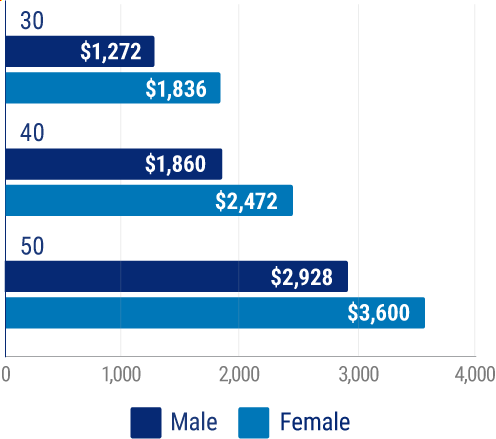

Individual long term disability premiums for men and women ages 30, 40, and 50

Long-term disability insurance quotes are available from your independent insurance agent.

Women and Long-Term Disability Insurance

52% of single female workers have no disability insurance. A study by The Council For Disability Awareness found:

- One in four women reported they are “extremely unprepared” for a period of disability lasting three months.

- Women have a higher incidence of disability during their careers than men.

- Single women can expect a greater chance of financial difficulties then men in the event of disability if they do not have some form of coverage.

Can I Be Terminated while on Long-Term Disability?

Unfortunately, the answer is it depends. Your employer has to comply with the Americans with Disabilities Act as well as any state regulations that apply. Your disability coverage does not protect you from termination.

If you are terminated while on disability, benefits will continue to be paid as long as you are eligible.

Is Long-Term Disability Taxable?

Individual long-term disability benefits are usually tax-free. Disability insurance premiums aren’t deductible as a medical expense. If you have group disability insurance the benefits aren’t taxable if you pay the premium. If the employer pays the premium, the benefits are taxable.

Social Security disability benefits are taxable.

Protect Your Most Valuable Asset

Most people insure important assets against loss. Homeowners insurance, auto insurance and umbrella policies all provide protection. Fifty percent of working Americans don't have long-term disability insurance to protect their most valuable asset — the ability to earn income.

A college graduate with a bachelors degree can expect to earn $2.4 million over their lifetime!

Three Steps to a Solid Plan

How your benefits are taxed makes a difference. If your benefits are taxable, you need more of them to pay your expenses. Here are three simple steps to take for a solid plan for disability:

1. Review your budget. Determine how much money is coming and going out each month.

2. If you were disabled, what are your sources of income? When do they start and end? Remember, taxable benefits provide less money.

- Employer sick pay

- Short- and long-term disability

- Social security

- Other household income

- Savings

Do your expenses exceed your income? If not, great job! If they do, by how much?

3. Build an action plan. Consider buying personal disability insurance to supplement your income.

Why Go It Alone?

Disability insurance is an important part of smart financial planning, but there is a lot to know about the coverage. Get the most out of your disability insurance policy by getting a disability insurance quote from your local independent insurance agent. They can simplify the process for you.

SSA, council for disability awareness,statista,ACLI,guardian life