Compare Health Insurance

(Explore your coverage options.)

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Doing a health insurance comparison can help you find the best healthcare plan for you and your family. Just like when shopping for consumer goods, shopping around for the ideal health plan can help you find coverage at a price and quality that meets your needs.

You will want to be sure to compare health insurance companies to see the different benefits, premiums, co-pays and hospital networks they are part of. You will also have to review several health insurance plans and calculate which might provide the best coverage for you and your family.

Of course, this process can be time-consuming and confusing. One of the best ways to compare health plans is to find an independent agent who specializes in health insurance.

These agents can advise you about which options you will want to look for in a policy and can help you compare health plans from several different providers.

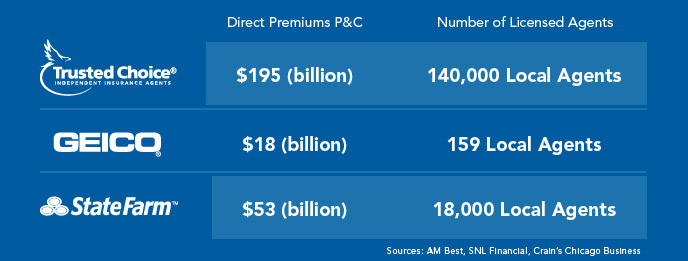

Trusted Choice vs. Big Brands

The Trusted Choice brand is built on the customer-focused integrity of more than 300,000 business owners, agents and employees nationwide. With more local insurance agents than State Farm and GEICO, this network of agencies serves more consumers and pays out more claims

Choosing the Best Individual Healthcare Plan

Trying to compare health insurance companies and choose the best health plan for you can be an overwhelming task. Here are some important tips to consider as you compare health plans:

- Compare several different plans. Be sure to look at premiums, co-pays, drug costs and hospitalization costs.

- Note that the lowest premium rate may not be the cheapest policy overall.

- Even the best policy with the best coverage can have important “fine print” details and exclusions.

- Buy only the benefits you need. Do not overbuy.

- If you have a favorite healthcare professional, shop for a health plan and network that includes that physician.

- Make sure your plan will cover your medications.

- Check for limitations of services and coverage.

- Factor in the needs of your dependents.

- Make sure you can continue your health insurance benefits even when your marital, job or life status changes.

What Is the Best Health Insurance Plan for You?

Performing a comprehensive health insurance comparison can be challenging and time-consuming, especially since no two plans are alike. In other words, it is nearly impossible to compare “apples to apples.”

The best health insurance plan is likely to be one that provides you and your family with coverage for the health services you use most, offers a good choice of physicians, and spares you from the high cost of medical care in the event that you or one of your family members becomes chronically ill or severely injured.

Here are some tips for getting started:

- Make a list of regular care you and your family typically use.

- List any upcoming anticipated medical events, such as having a baby or needing to have certain tests or procedures done.

- Make a list of potential unexpected healthcare needs, such as injuries and major illnesses.

- Find out how all of these costs are managed within the plan you are considering. For example, what happens in the event of an emergency room visit, an emergency appendectomy, or an ambulance ride?

To find the best health insurance for your needs, compare the costs of these different events, and review all materials from the various healthcare plans you are considering. Also be sure to determine whether your preferred practitioners, clinics or hospitals are covered under each plan you compare.

To get help performing these healthcare plan comparisons, you can work with an independent agent who can help you compare multiple plans side-by-side and review the ratings of the doctors in the network.

How an Independent Agent Compares the Best Rates

When you are ready to compare health insurance companies, your best bet is to work with an independent insurance agent who specializes in health insurance.

Unlike captive agents who provide the coverage products of only one insurance company, independent insurance agents are free to shop around and compare health plans.

Because they work with multiple insurers, independent agents are skilled at comparing products and helping you find the best rates and options.

Many people start their search for healthcare insurance online today, but when they are ready to compare health plans from their short list, they find that an independent agent can be the best resource.

An agent near you can work with you to learn about your healthcare needs, and can shop for the right coverage on your behalf. They can then help you compare health plans that are right for you.

Your agent will know which insurance companies have the best reputation for delivering services and paying claims. Contact an independent agent today for personalized assistance and help as you compare health insurance companies.