Yurt Insurance

Because nontraditional homes need protection, too.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

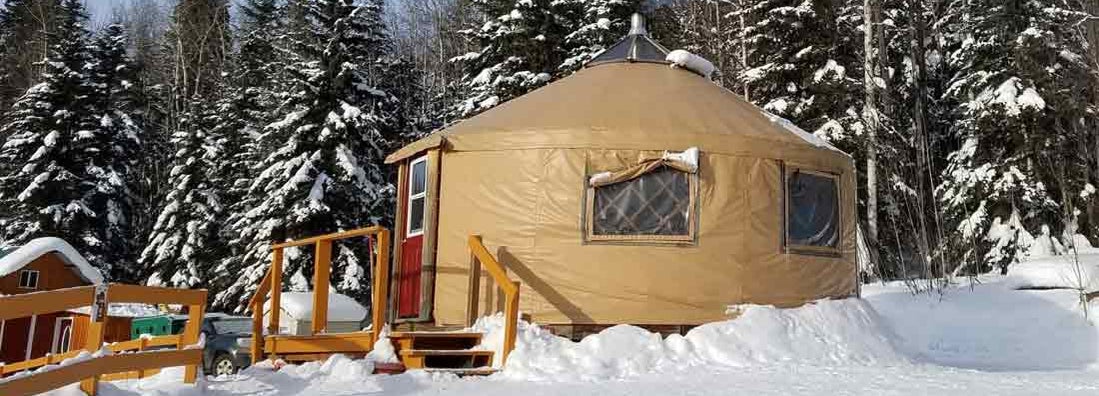

Yurts are ancient structures, but they’re enjoying a very modern renaissance in the US. Sturdy, cheap to construct, and eco-friendly, yurts are an attractive choice for adventurous would-be homeowners. But living off the grid doesn't mean your home is free of risks. Yurt owners face many of the same daily hazards as traditional homeowners like natural disasters, vandalism, fire damage, and more. Fortunately, that’s where a type of home insurance known as yurt insurance comes to the rescue.

Yurts can present special insurance challenges, but not as many as you might think. Yurt insurance helps off-grid homeowners enjoy peace of mind and a sense of security within their homes. An independent insurance agent can help you get set up with the right yurt insurance for your specific needs. But first, here’s a closer look at this unique coverage.

What Is Yurt Insurance?

Regardless of where your particular home is located, yurt insurance is essentially an agreement between the yurt owner and an insurance company in which the insurer agrees to cover financial losses relating to damage and liabilities. Only the specific perils stated in the policy will be covered by the insurance company. Yurt insurance is designed to help protect owners from losing their home should disaster strike. Yurt insurance isn’t one specific insurance product, but rather refers to any coverage that applies to a yurt.

A yurt insurance policy might cover only the structure of the yurt, or it might cover the structure and any belongings you keep inside. Yurt insurance protects you from having to pay for the full cost of repairing or replacing your yurt, or needing to pay for lawyers and legal damages yourself if you run into legal trouble. Yurt insurance may be a separate policy, especially if it’s the only structure on your property and you live in it full-time. It could also be added to a standard homeowners insurance policy if it’s maintained as an outbuilding on a property where you also have a permanent home.

Who Needs Yurt Insurance?

Some yurt owners may decide it’s not worth insuring their yurt. They may have deliberately chosen building materials that were cheap and easy to replace, or are careful not to keep any valuables inside. Not insuring your yurt is a valid choice, especially if you have enough savings on hand to pay for repairs or replacements yourself if something goes wrong. However, there are a few important situations in which it’s important to make sure you have coverage, such as:

- If you maintain your yurt as an outbuilding: It could cause problems with your existing homeowners insurance. You should always make sure your insurance company is aware of your yurt and any special risks it may present (e.g., any special fire risk if you cook inside your yurt).

- If you offer your yurt for short-term rentals: You need to carry business insurance that will insure both the structure itself and protect you from liability if you’re sued by a guest/tenant.

- If you keep valuable items in your yurt: Such as artwork, musical instruments, or special cooking equipment, you should make sure that those belongings are covered unless you’re completely comfortable with paying to replace them out of pocket.

- If you live in your yurt full-time: If you don’t have anywhere else to go if it’s damaged or destroyed, you should buy insurance coverage so you can have the money to quickly rebuild.

An independent insurance agent can further advise on when you need to make sure your yurt is covered by the right kind of insurance policy.

What Does Yurt Insurance Cover?

While yurts unquestionably have unique construction, they’re still essentially just an alternate form of houses. That’s why yurt insurance is set up pretty much the same way as traditional homeowners insurance with a couple of unique caveats tailored to your specific living style. Yurt insurance is designed to protect all elements of your home, including not only the structure, but also the contents and family members living inside.

Yurt insurance packages often include the following coverage:

- Dwelling coverage: Covers your unit’s structural components, including the lattice, felt or other fabric, windows, and the slab it all rests on.

- Personal property coverage: Covers your personal belongings like furniture, clothing, electronics, knickknacks, silverware, etc., that are stored within the yurt against perils such as fire or theft. Property stored off-premises, such as in a storage unit, is often covered as well but comes with a lower limit.

- Liability coverage: Covers legal expenses such as attorney and court fees if you get sued for bodily injury or property damage to a third party. Settlements you’re ordered to pay if you lose the case are covered as well. Coverage extends to all members of the family living within the yurt, including pets.

These three components compose the core of yurt insurance packages. Working together with an independent insurance agent is a great way to get the right amount of coverage in each category for your unique home.

Other Options for Insuring a Yurt

To insure a yurt, customers and insurance agents have to get a little creative. Here are the most likely options you’ll have to choose from when insuring your yurt:

- Mobile home insurance: Mobile and prefabricated homes have similar insurance challenges to yurts, namely because of their size, lower value, and nontraditional building materials. Some insurance companies may allow you to customize a mobile home insurance policy to suit the needs of your yurt.

- Business insurance: If your yurt primarily functions as a business (i.e., as a rental property, event venue, or something else), your best bet is buying a business insurance policy customized for your yurt.

- Home insurance riders: If you use your yurt for personal use only, you may be able to cover it as part of your homeowners insurance, especially if it’s on the same property. Though you may be able to do this even if it’s on a separate property.

Independent insurance agents are familiar with all these options and more. They can help you pick the one that’s the best fit for your unique situation.

What Doesn't Yurt Insurance Cover?

Just like any other kind of homeowners insurance, yurt insurance comes with a list of specified covered perils, as well as non-covered perils. Becoming familiar with what your yurt insurance policy doesn’t cover can save you the hassle of filing home insurance claims that are bound to get denied, and in the event of certain non-covered natural disasters, help you find the right kind of policy to protect your home.

Yurt insurance does not cover the following perils:

- Certain natural disasters (e.g., floods, earthquakes, and mudslides)

- Maintenance-related losses

- Wear and tear damage (i.e., failure of the homeowner to maintain upkeep)

- Insect damage or infestations

- Damage from war or nuclear fallout

- Business-related liability

If you run a business out of your home, yurt insurance won’t cover any liability-related mishaps. To protect your home against flood or earthquake damage, you’ll need a flood insurance or earth movement policy. Yurt owners located in areas prone to flooding may want to seriously consider getting a policy.

Insuring a Yurt You Allow Others to Stay in

Homeowners insurance specifically excludes any damage incurred while a structure is being used for business use. Since most yurt insurance is a version of homeowners insurance, that’s bad news for people who routinely allow other people to stay in their yurt, whether you’re charging money or allowing them to stay for free.

Insuring a Yurt Rental Business

If you’re renting out your yurt for money, you need business insurance. As long as the amount you’re earning is small, this insurance should be fairly cheap. The cost will scale with the size of your business. The most important part of business insurance for yurt rentals is liability coverage, since you’re putting yourself at risk for a lawsuit every time someone stays in your yurt. Liability coverage pays for legal representation and any legal damages you may owe.

Another important type of business coverage to consider is commercial property insurance. This covers the yurt’s structure and contents in case of physical damage or theft.

Insuring a Yurt That You Let People Use for Free

If you’re allowing others to stay in your yurt for free, it’s less a matter of buying extra insurance coverage and more a matter of making sure that your insurance company knows the situation and is okay with the extra risk. Extra risks could include a higher chance of theft and vandalism, especially if strangers are staying in the yurt, or events like accidental fires if people aren’t familiar with the cooking or heating equipment inside the yurt.

You may be able to add a special rider to your yurt insurance allowing for these risks in exchange for paying higher premiums. Alternatively, the insurance company may refuse you certain types of coverage. Either way, it’s better to let them know upfront rather than trying to lie or hide the situation, since that could result in your coverage being voided entirely.

What Are the Benefits of Yurt Insurance?

You know that your home is more than just a physical structure to protect you from the elements, it’s also your happy place. If you’ve taken the time to build a yurt and move away from traditional living, you’ll want to protect your efforts and keep your home safe so you can reap the rewards of off-grid living. Having adequate insurance coverage can help prevent yurt owners from losing their homes or being unable to replace their stuff following a disaster.

Yurt insurance typically provides coverage for the following perils:

- Theft

- Vandalism

- Explosions

- Fire and smoke

- Water damage

- Aircraft or vehicle damage

- Riots

- Falling objects and trees

- Certain natural disasters (e.g., windstorms, hail, lightning, and blizzards)

Your independent insurance agent can help you review your yurt insurance policy to answer any remaining questions about your coverage. They’ll also be able to help you figure out whether you’ve got enough coverage, or if you should purchase more.

How Much Does Yurt Insurance Cost?

Many factors influence the cost of a yurt insurance policy, including the size and location of your home, the value of the structure and the contents inside, and any upgrades you’ve made. Owners of yurts located in areas prone to severe weather or other risks like crime will be required to pay more for their insurance policies than those who live in calmer, safer areas.

The cost of yurt insurance depends on your area and the structure of the yurt itself, including whether it’s made of modern materials or traditional materials like leather and felt. It also depends on whether you’re buying a special policy just for a yurt, adding on yurt insurance coverage to a homeowners insurance policy, or buying business insurance for a yurt rental business.

Depending on all these factors and more, the cost is likely to range from a couple of hundred dollars to a couple of thousand dollars per year. While it’s hard to offer an exact figure without knowing your unique living situation, your yurt insurance policy is likely to be much less expensive than traditional homeowners insurance because of the unique construction involved. An independent insurance agent can help find more exact quotes for you.

How Do I Get Yurt Insurance?

The real trick with yurt insurance policies is finding an insurance company that offers coverage for these nontraditional homes. Because writing yurt insurance is much less profitable for insurance companies than other forms of homeowners insurance, it may be a struggle to find a policy available in the admitted insurance market. You may have to look to the specialty market or surplus lines.

An independent insurance agent can help you find coverage by conducting research on your behalf. They know the types of coverage you need, what to look for, and where to find it.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. They'll shop and compare quotes and present you with only the best options for yurt insurance.

iii.org