How to Survive the Biggest Financial Threats to Your Business

Stuhlemmer has more than 30 years of experience in small business and has owned three businesses of her own. In addition to BLITZ, she founded The CEO Elite, a consulting service for entrepreneurs in service and manufacturing industries.

When you own a business, the ups are as good as it gets: Employees on the ball, cash pouring in, clients lining up around the block for what you’ve got.

Because you’re awesome, and you’re good at this.

But if you’re smart, you’re also on guard, because the downs can really take the wind out of your sails — and sales. According to Barb Stuhlemmer, business strategist and CEO of BLITZ Business Success, any way you look at it, “[g]oing into business for yourself is a financial risk. No business is 100% certain [to] survive and make you money.”

The financial downs can come on fast, hard, and from any direction, no matter your awesomeness. It’s the reality of owning a business — thus the boatload of MBA classes on risk management.

Stuhlemmer, who advises CEOs of small businesses, describes something of a minefield: “Every threat to you, your employees, your time, your product, your location, the economy, even unexpected growth … can be a financial threat to your small business,” she wrote in an email.

Global Financial Threats

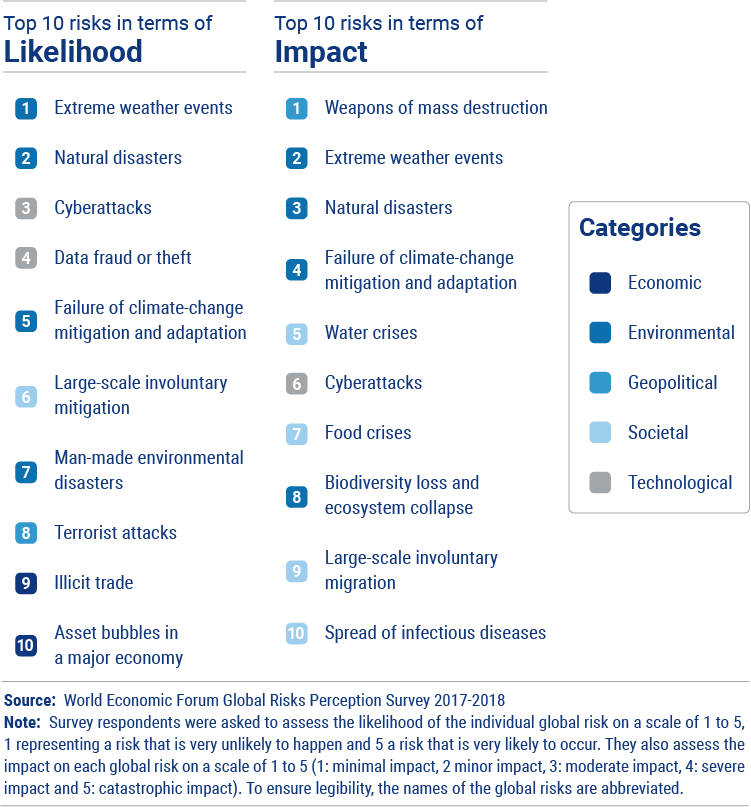

Threats come in all shapes and sizes. On the grand scale, a 2018 analysis by the World Economic Forum (WEF) found that the biggest threats facing businesses around the globe include:

- Cyberattacks

- Data breaches

- Effects of climate change

Political conflict, asset bubbles, and terrorist attacks also ranked high on the list.

Top Financial Threats by Likelihood and Impact

Cyberattacks and Data Breaches

These terms are often used interchangeably, but technically, a cyberattack involves hacking into a secure system — like robbing a house after disabling the alarm on the back door. A data breach involves negligence or failure on the part of the business to properly secure its data – like robbing a house after strolling through an unlocked back door.

In 2017, the Ponemon Institute, an information security research center, found that 61% of small-to-medium businesses had experienced a cyberattack, and 54% had experienced a data breach. But the same year, in a survey by CNBC/SurveyMonkey, only 2% of small business owners rated cybercrime at the top of their threat lists.

Climate Change

According to the US National Climate Assessment, climate change – the warming of the Earth due to increased carbon dioxide levels in the atmosphere – is upping the frequency of natural disasters and extreme weather events. That, in turn, has led to food and water crises and forced migration, all of which are predicted to increase in the coming years.

For businesses, this means property destruction, supply-chain interruptions, agricultural losses, and collapsing tourism industries. Industry Today reported that about 30% of the small businesses that were in the path of Hurricane Sandy in 2012 closed for good.

Despite the risks on the table, most businesses aren't preparing themselves proactively. According to a 2017 survey by risk-management organization DNV GL, 50% of businesses see climate change effects as an immediate threat, but only 25% are planning ways to survive it.

Day-to-Day Financial Threats

It’s not all just famines and phishing scams. Financial threats come in all sorts of different packages. There’s personal conflict, employee error, complacency, tax changes, unexpected growth… Stuhlemmer offers some examples:

- You are the key person in the business and you become seriously ill, putting you out of commission for months.

- You misunderstand a contract and suddenly owe more time, resources, or money than you’d planned.

- You spend a fortune to print branding copy and then discover a significant typo, so you have to print again.

- You pay to have a new product manufactured before realizing the supplier doesn’t produce the level of quality you want, but you can’t get out of the contract. You have to sell the low-quality product, hurting your reputation, or lose the whole investment.

- The import laws change and the price of your product goes up, but your clients are unwilling to pay more, so your profit margin shrinks.

- You get three new clients at the same time but can only handle one. You scramble to find support for the others but have never handled multiple projects. You overspend, underdeliver, and miss out on referrals and repeat business.

- Some financial threats are simply beyond your control. Some can shut you down. Others just hurt a lot. But many threats, wrote Stuhlemmer, “If properly planned for, may be easily mitigated.” In her experience, the most significant threats to the day-to-day health of your business are the ones you bring on yourself, including:

- Underinvesting in marketing

- Underestimating your resource needs

- Skipping the business plan

Lack of Planning

“The number one financial threat to a small business is not having a plan,” Stuhlemmer wrote. It’s how you ensure your demise.

"You can’t anticipate every possible event that might tank your bottom line, but not planning at all is building a business by ‘winging it' -- and winging it is a sign of incompetence in a business.”

Without a plan, you’re drifting on a sea of hopes and dreams, and hopes and dreams won’t pay the contractor to rebuild your warehouse after a flood.

Underestimating Resource Needs

Those same hopes and dreams also won’t bother paying your employees to design the product you plan to sell. Failing to accurately analyze your costs and time-to-market poses a significant financial threat to the future of your business. If you think you’ll be selling your product in six months, and it actually takes two years, you’re done.

To demonstrate, Stuhlemmer looks to the medical device manufacturing industry.

“[S]tart-up companies land venture capital funding to do the R&D for new products. Because they cannot go to manufacturing until they have FDA or Health Canada approvals, which can take years, they are not producing products, selling, or making any money,” she wrote.

In R&D-driven businesses, notes Stuhlemmer, this threat is obvious. But a poor understanding of your cash flow is hazardous no matter what your line of work. It comes down to money-in, money-out, and timing.

“If you run out of money before you make enough money to pay your loans, pay your employees, pay yourself, and reinvest into the business, then your business will not survive.”

Insufficient Marketing

Stuhlemmer puts poor marketing near the top of the threat list, too, since there’s not a single business that can survive without customers.

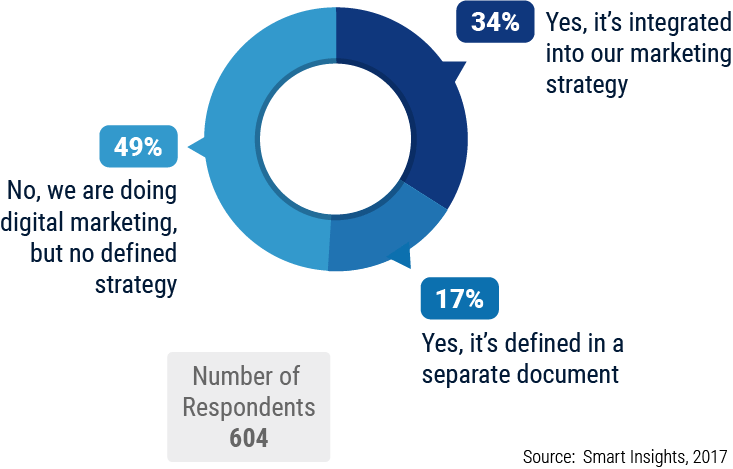

In 2017, research by Smart Insights revealed that almost half of businesses that plan to market digitally have no actual strategy for doing so.

“So many business owners have tremendous faith in their product or service and their expertise to make that product or service work,” she wrote, “but lack the process or budget to ensure others know about them.”

Is Your Digital Marketing on Track?

Stuhlemmer witnessed marketing failures in the content management system business in the early 2000s when “there was a huge explosion of thousands of small companies wanting to be the next ‘Microsoft’ of content.”

Companies had been focused on the CMS space for years, but small businesses couldn’t afford it. The market was ready and waiting, and the race to tap it was speeding up.

Stuhlemmer, a technical writer at the time, wrote CMS help systems for three companies. All of them, she wrote, “had an amazing product with their own unique selling proposition, but only one had a marketing budget. Guess which one is still in business?”

The company that took the risk of investing big in marketing their product avoided the threat of no one knowing it existed.

Surviving a Financial Blow

According to Stuhlemmer, there’s only one way to deal with all the many different flavors of financial threats that face a small business. Expect them. Plan for them. Assess them periodically.

“You need to know what you will do if it takes longer than expected to make money, your expenses are higher than expected, or there are unexpected costs, having access to more money to invest at the right time will help you get through the challenging times.”

So plan ahead: Establish a pool of resources to tap in a jam; invest in cybersecurity; buy extra flood, hurricane, and fire insurance in case carbon dioxide wins.

Think of growing a business like raising kids, Stuhlemmer advises.

“It takes a lot of time, money, effort, and energy to build the foundation,” she wrote, but a “child with a great foundation can fend for themselves as an adult.”

The ups are heady. The downs are terrifying. And the downs are part of doing business.

You may not be able to avoid them all, but you can build a business with a good chance of withstanding a direct hit. As Stuhlemmer sees it, the greatest financial threat to the future of your business is acting like threats don’t exist.

Now Go Protect Yourself

As we’ve just uncovered, the financial threats and risks in business are many, but the right plan can help you steer clear of them or at least brace for impact and minimize the damage should something bad happen. It’s all a part of planning properly, as Stuhlemmer said. So get busy, prepare for the worst, and good luck.

Big thanks to Barb Stuhlemmer, CEO of Blitz Business Success, for her generous assistance with this article.

Sources

Barb Stuhlemmer, CEO of BLITZ Business Success

https://keepersecurity.com/assets/pdf/Keeper-2017-Ponemon-Report.pdf

https://www.cnbc.com/cnbc-survey-monkey-small-business-survey/

https://blog.dashlane.com/hack-vs-data-breach/

https://www.forbes.com/sites/manishbapna/2012/04/17/3-things-businesses-need-to-know-about-extreme-weather-risks/

https://www.dnvgl.us/news/businesses-failing-to-adapt-to-climate-change-despite-exposure-to-extreme-weather-risks-according-to-dnv-gl-report-105278

https://www.smartinsights.com/digital-marketing-strategy/percentages-businesses-digital-marketing-plan/

https://www.smartinsights.com/digital-marketing-strategy/percentages-businesses-digital-marketing-plan/

https://www.cnbc.com/2017/07/25/14-million-us-businesses-are-at-risk-of-a-hacker-threat.html

http://fortune.com/2018/01/17/american-business-risks-wef-davos/

https://www.sba.gov/sites/default/files/files/PARTICIPANT_GUIDE_RISK_MANAGEMENT.pdf

https://nca2014.globalchange.gov/highlights/report-findings/extreme-weather