Understanding Why Your Business Needs Cyber Liability Insurance

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

No matter if your business is big or small, a growing threat in today's world is cyber security. Protecting your business against cybercrimes and data breaches is not only critical for your sake, but also for that of your customers. Being prepared against digital threats is a small price to pay to avoid devastating damage to customers, creating mistrust, losing business, and other major repercussions.

Since most everything is digital today and many businesses store personal and banking information, make sure to speak with an independent insurance agent about adding cyber liability insurance ASAP. They'll help you add it to your business insurance if you haven't already. But for starters, here's a breakdown of cyber liability insurance and why you need it.

Why Is Cyber Liability Insurance so Important?

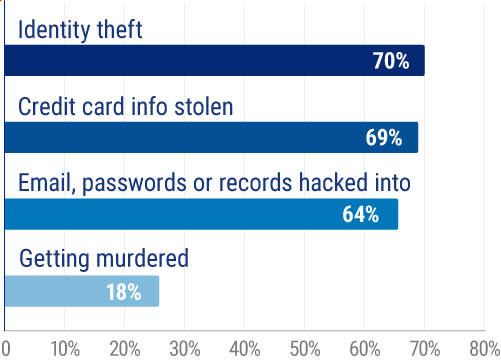

Recent studies found that the crime Americans most worry about is identity theft. Following closely behind that are concerns over having their credit card and personal information stolen, and then having email accounts, passwords, or records hacked into. Americans are more than three times more concerned about their digital safety and security than they are about being murdered.

Surprisingly, the smaller your business is, the more of a risk it carries of being hacked because cybercriminals assume that your security measures won't be up to par with major corporations. Small businesses can be a huge target for data breaches, etc. That's why no matter your size or annual revenue, having cyber liability insurance is key for helping your business stay protected in the digital world.

What Does Cyber Liability Insurance Cover?

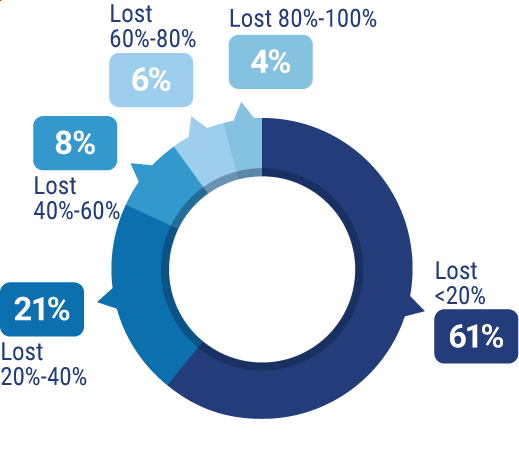

Since just one cyber attack can cause your business to lose part or all of your customer base, it's critical to prepare for these disasters before they happen. While 61% of businesses reported losing less than 20% of their customers after a cyber attack, 4% of businesses reportedly lost between 80% to 100%, and 6% of businesses lost 60% to 80% of their customer base.

Cyber liability insurance provides a lot of critical protection for businesses, including:

- Legal expenses: Reimburses for lawsuits (i.e. including attorney, court, and settlement fees) that result from a data breach or cyber attack.

- Costs due to damaged reputation: Reimburses lost income as a result of media coverage following a data breach or other incident.

- Loss of income: Reimburses potential losses in profits due to suspended or limited operations caused by a data breach or other cyberattack.

- Cyber extortion: Reimburses the costs of meeting ransom demands and system improvements to avoid future attacks.

- Hired professionals: Reimburses for the costs of hiring professionals to investigate and repair damage to computer systems after a data breach or other attack.

While cyber liability coverage is now included in more and more business insurance policies, that doesn't mean yours has it by default. Make sure to review your business's coverage together with an independent insurance agent and ask them about adding cyber liability insurance if you don't have it already.

What Doesn’t Cyber Liability Insurance Cover?

Cyber liability insurance can help businesses recover after a data breach or other cybercrime, but it can't cover everything. Just like every other type of coverage, it comes with its own set of specific exclusions that you need to be aware of.

Cyber liability coverage typically excludes:

- Bodily injury or property damage claims: Coverage excludes claims of bodily injury or property damage. That’s what a general liability policy is for.

- Property losses: Commercial property insurance covers losing a piece of property, not your cyber liability insurance.

- Criminal activity: Coverage typically excludes incidents of robbery, employee theft, or other crimes. Commercial crime insurance offers this coverage, though.

- Social engineering: Many policies exclude incidents of social engineering, or a technique hackers use to trick people into transferring company funds to their accounts. However, additional coverage may be available and come with a smaller coverage limit or be sold as an optional add-on.

Ask your independent insurance agent to help you review your cyber liability coverage with you so can be certain of what's not covered by your policy.

The Most Common Misconceptions about Data Breaches

Having a good awareness of cybercrimes and the type that are most likely to affect your business can help you prepare for and even avoid incidents entirely. This can start by clearing up some common misconceptions about data breaches, including:

- You can detect a data breach immediately: It might take several weeks for your business to find out it's been the target of a data breach. Typically a bank flagging fraudulent activity is the first indicator.

- Big businesses are the most common targets: Small businesses actually are targeted three times more often than big businesses are since they often don't have the same amount of security measures in place.

- Hackers attack you directly: Actually, hackers tend to take roundabout routes to attack their target, which makes them less likely to be detected in the process.

- Hackers are just identity thieves: Hackers are more like workers for identity thieves, as they steal information and then later charge their customers, identity thieves, before they hand it over.

Inform yourself as much as possible about the current data breach and cyber security threat trends so that your business can have the best possible chance of staying protected from incidents.

The Importance of Having an Incident Response Plan

Your business needs an incident response plan in place well before a cybercrime or data breach ever happens. An incident response plan ensures that you can maximize your time and resources and prevent unnecessary loss. Many businesses formulate and implement their incident response plans with the help of a professional cybersecurity company, if they don't already have a strong IT department or tech wizards on staff.

How Else Can I Help Keep My Business Safe from Digital Attacks?

Protecting your business against cybercrimes requires more than just a solid cyber liability insurance policy. A good offense against digital threats can help you prevent your business from ever needing to file a claim or deal with an incident at all.

Follow these action steps to help prevent digital attacks on your business:

- Implement strong passwords: Experts recommend passwords that are at least 10 characters long and contain a combination of special characters, numbers, and uppercase and lowercase letters. Use strong passwords for all company logins, to access documents that contain private data, etc.

- Schedule software updates: Take the time to routinely update your company's software on all devices to better limit your chances of being a target of digital crimes. Software that's been around for a while has given hackers ample time to figure out how to breach it, but updates come with important fixes for any holes.

- Require two-factor authentication: Many email and other accounts now allow you to require two-factor authentication before they fully log you in. Make sure to set this up through as many services as you can that offer it, and from then on you'll be asked to provide codes that you've been texted or emailed to another account before you can gain access.

- Use spam filters: Using a good spam filter can seriously decrease your chances of opening a phishing email by mistake. Though they look like they were sent by one of your contacts, phishing emails are actually crafted and sent by hackers and other cybercriminals who can end up stealing sensitive data if you don't catch them fast enough.

Following these action steps can help your business greatly reduce its chances of being the victim of a cybercrime. Regardless, make sure to ask your independent insurance agent about adding cyber liability insurance to your business's coverage sooner rather than later. The stronger your defenses against cybercrimes, the better chance your business has at maintaining smooth operations for many years to come.

Why Choose an Independent Insurance Agent?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you'll know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best insurance coverage, accessibility, and competitive pricing while working for you.

https://www.iii.org/article/cyber-liability-risks