Ready to Take on New Employees? 10 Ways to Know for Sure.

In the life of a small business, the first hire is a major milestone and can absolutely make or break your company. If you jump the gun, you could wind up strapped for cash, and if you miss the boat, you could drown in some deep and dirty water. Either way, you should always make sure you're covered with an affordable business insurance policy.

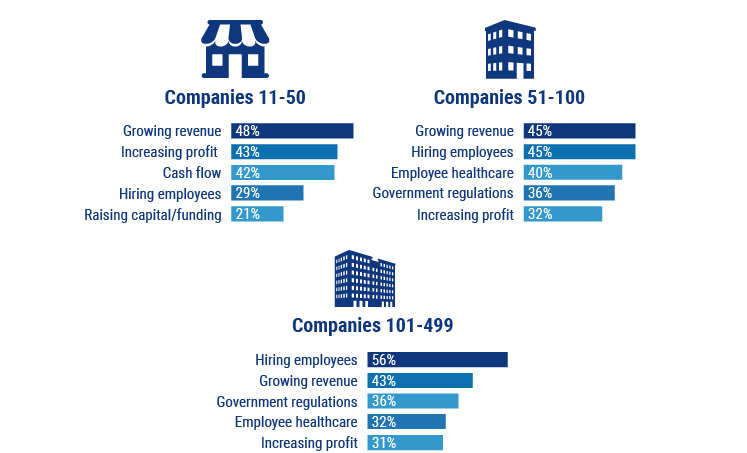

A recent survey by Wasp Barcode found 42% of businesses see hiring as their biggest challenge.

Finding the right moment to face it requires a firm grasp of your workload, income stream, future growth and current financial state. It also requires an understanding of what that employee will actually cost you, because it isn’t just the salary you offer.

To help answer your business’s biggest question, we talked to our friend Priyanka Prakash, a business expert with Fundera and total know-it-all in situations like this. Together, we came up with 10 key questions you should ask yourself as you look at your business straight on in the mirror.

1. Can You Afford It?

“Although many small businesses make the mistake of thinking so, an employee's wages are not equal to the cost of hiring them,” according to Prakash.

“It’s more complicated than that.”

“You have to add up recruiting costs, training costs, wages, insurance costs (e.g. workers' compensation insurance), and health insurance or other benefits that the employee is eligible for,” she says.

According to HubSpot, hiring for a position with a $50,000 base salary might come to about $80,000. This business software provider breaks it down this way:

- Base salary: $50,000

- Benefits and taxes: $12,000 to $20,000

- Annual training: $1,500

- Recruiting costs: $7,600

That doesn’t include the revenue loss that comes with a new employee's learning curve.

If you have enough money in the bank to cover these costs for at least a year, hiring someone is economically feasible.

That’s only part of it, though. Just because you can hire someone doesn’t mean you should. When you’re trying to grow a small business, every penny counts; before hiring, make sure there’s not a cheaper way to get the job done.

2. Can I Make an App for That?

Often, that means automation. Technology can handle a lot of different tasks, and it’s sure to cost less than a living, breathing human in the long run.

“Don't hire someone when software or an app can do the work for you,” advises Prakash. “For example, payroll software can prevent the need to hire a staff member for running payroll.”

Before deciding you need an employee to take over some of the workload, “Automate as many things as possible using software to maximize efficiency,” she says.

Do the research–or talk to a consultant–to make sure you’ve exhausted your software options. It can free you up to focus on the actual product or service you provide to clients, which is why you’re in business in the first place, isn’t it?

3. Are You Turning Down Work?

If you’re not taking on every sweet piece of work that comes your way, you’re not doing it right.

“Especially in the early stages of a business, turning away prospective customers or reverting to a waitlist for orders can kill your momentum,” Prakash tells us.

Once you turn customers away, they’re probably gone for good. If there aren’t enough hours in the day to manage it all, it makes sense to hire–but first, make sure you’re using all of your available hours efficiently. Prakash suggests a methodical approach to the assessment.

“[K]eep an informal timesheet about what you work on during different parts of the day. If you find that something that should take you one hour is taking three hours, try to get faster,” she states.

“But if it's an area like accounting or bookkeeping, where you'd rather just trust a professional, that's fine, too,” Prakash adds, as long as you have the cash, and especially if hiring a pro will free you up to address the work only you can do.

4. What Job Do You Want to Hand Off?

Part of that is the “bigger-picture strategic planning” a business needs to thrive, according to Prakash. It can fall by the wayside when you’re swamped with practicalities and grunt work—and if you can’t think ahead, you can’t grow.

“If you're doing so many day-to-day tasks that you're unable to focus on business development, then it's time to hire an employee and delegate some of the more detailed work to them,” she says.

But this isn’t “day-to-day tasks” in a general sense. This is “day-to-day tasks” you have specifically identified as worth paying someone to do so that you can devote more time to other specifically identified tasks and big-picture thinking.

Flesh it all out in a detailed list, and then assess your needs.

5. Can All These Extra Tasks Fit in the Same Box?

If you find the tasks on your list fall under a single job category or specific skill set, you could be in a good position to hire.

If the tasks are all over the board – bookkeeping, proofreading, answering phones–don’t do it. Piecemeal work could mean an employee who just sits there half the day, waiting for something to pop up, and you can’t afford to pay workers' comp for someone who’s not working.

To justify bringing someone on-staff, you need to have enough work to fill every minute of a part- or full-time position. Otherwise, you’re just wasting money. The idea is to bring someone on who will help increase revenue and/or decrease expenses, not drain your petty cash.

6. Will This New Role Increase Revenue?

To that end, don’t hire someone to vacuum the floors, even if they’re really bad.

If it won’t make you money, do it yourself. And don’t hire someone for tasks that might make you money if your hunch is right. It doesn’t make sense to spend the extra money on staff to “[test] a possible new income stream or a new market,” Prakash says. Best to contract that out.

Focus is critical. When you’re starting out, you have two primary goals: developing your product/service and getting people to buy it.

Consider hiring for roles related to:

- Marketing

- Sales

- Customer support

- Product creation/refinement

7. Do You Lack a Particular Skill Set?

While it doesn’t make sense to take on an employee for a possible revenue stream, it does make sense to take one on to improve a current revenue stream. That might mean taking your product or service above and beyond what customers expect, or it might mean providing your customers with a feature they want–a feature your competition provides.

According to Prakash, if you’re lacking a particular skill set that would make your product or service more appealing, it’s worth the risk to take on an employee who could totally nail it.

“The best teams are composed of people with complementary but different skill sets,” she says. “For example, maybe you're a marketing visionary, but in need of a copywriter or designer to help make your ideas a reality.”

8. Are Your Customers Unhappy?

Those probably won’t be the first roles you fill, though. More often than not, customer service takes the lead “because their need is usually apparent to the business,” notes Prakash.

In that 2015 Wasp Barcode survey, 56% of small businesses said customer experience and retention are the keys to growth. Angry clients are one of the clearest signs it’s time to hire—and fast, too. If your clients aren’t satisfied–or better yet, thrilled–not only with your product or service, but also with the support you offer, they’ll simply leave. And once they do, they’re not coming back. And word travels quickly, especially when it ain’t good.

Start recruiting help if:

- You’re missing deadlines.

- Your work quality is suffering.

- Client calls are piling up.

- Clients start to take their business elsewhere.

Depending on your line of work, you might find it makes more sense to devote more of your own time to customer support and hire someone else to deal with, say, writing press releases.

But even then, taking on an employee may not be the best move. If you’ve always done everything yourself, it makes more sense to test the waters with something a little less permanent.

9. Have You Already Worked with a Contractor?

“The best way to know that you're ready to hire an employee is when you've outsourced the work that the person will be doing to an external firm or contractor,” says Prikash.

She adds, “Hiring an external consultant or contractor for three to four months is an easy, relatively inexpensive way to assess if a particular role is vital to your company's growth."

According to Prakash, it costs 20% to 30% less to hire a contractor than to hire a staff member, because all you’re paying is wages.

It’s a good way to get a feel for what it’s like to hire, delegate and manage without a long-term commitment. You may end up realizing you can handle the work yourself. Or you can’t stand giving up control. Or the work you hired out isn’t benefiting your business enough to balance the costs.

Or, you might find it’s the best thing you ever did. In that case, notes Prakash, “It's a good idea to bring the role in-house to get more control over it.”

“In the long term,” she says, “hiring in-house often results in more longevity, less turnover and higher-quality output for your business.”

10. Do You Have the Time to Find Help?

Just make sure you have the time to find the right employee. If you hire the first person who comes along, it could kill your bottom line. According to a 2016 Monster report, it takes an average of four months to find the right fit for your business.

“The only thing worse than not hiring someone when you need the help, is hiring the wrong person for the job,” Prakash notes.

Go the wrong way on a new hire, and you’ll be worse off than when you started. Not only will you be without the help you need, but you will also have to start over on recruitment and training and, if you're the one who ended it, now you'll be paying severance, too.

It's a critical piece of the hiring puzzle. Don't take it lightly, advises Prakash.

“If you don't have the time or money to screen and interview candidates,” she notes, “…then now isn't the right time to hire."

What’ll It Be?

After taking the time to look deeply at how your business would answer these 10 questions, we hope you’re feeling good about what needs to be done. Maybe it’s the right time, and maybe it isn’t. And if it isn’t, keep asking yourself these questions as your business continues to move forward. Maybe next year will be the right time. Just make sure you're covered with an affordable home insurance policy.

http://guides.wsj.com/small-business/hiring-and-managing-employees/how-to-hire-your-first-employee/

https://www.entrepreneur.com/article/251736

https://www.score.org/blog/is-it-time-to-hire-your-first-employee

https://www.inc.com/jessica-stillman/3-signs-you-re-ready-to-hire-your-first-employee.html

http://www.waspbarcode.com/static/waspbarcode/images/pdf/small-biz-report-0115-web.pdf

https://www.monster.com/about/a/more-than-half-of-surveyed-u-s-small-business-owners-recognize-the-risks-of-making-the-wrong-hire

https://business.linkedin.com/content/dam/me/business/en-us/talent-solutions/resources/pdfs/linkedin-global-recruiting-trends-report.pdf

https://sloanreview.mit.edu/article/getting-new-hires-up-to-speed-quickly/