How to Start a Transportation Business

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’re inspired by the thought of helping to get people and cargo from point A to B and back again, so you’re starting your own transportation business. In addition to a reliable vehicle and sweet playlist, you’ll need to plan properly from the start to keep the customers (and profits) rollin’ in.

When the time comes to open up shop, having transportation insurance for your business is the key to maintaining smooth operations. All businesses come with risks (even the fun ones), so you’ll need to obtain protection during your preparation phase. Our independent insurance agents are here to help get you set up with the right coverage for your specific needs. But first, let’s talk transportation.

All about the Transportation Industry

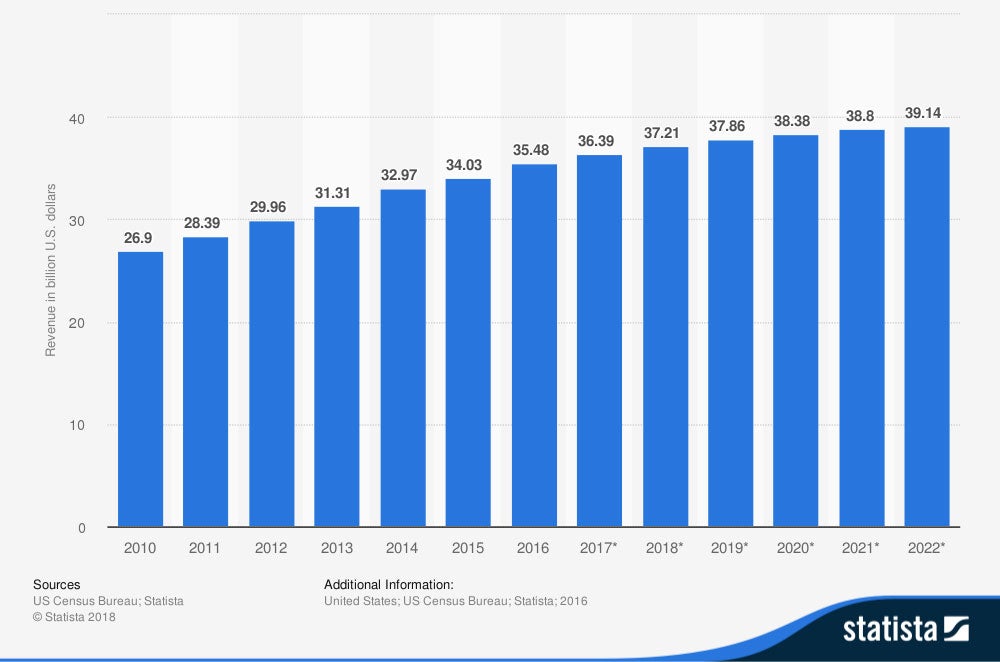

Transit and ground passenger transportation revenue in the US(in billion US dollars)

Ground transport has been steadily growing over the past decade, as has its revenue. And here’s even more good news — it looks like the trend is expected to continue. Transit and ground transportation annual revenue totaled $26.9 billion in 2010, and by the end of 2019, it’s projected to shoot up to $37.9 billion. As of 2022, revenue is projected to climb even higher, to $39.1 billion.

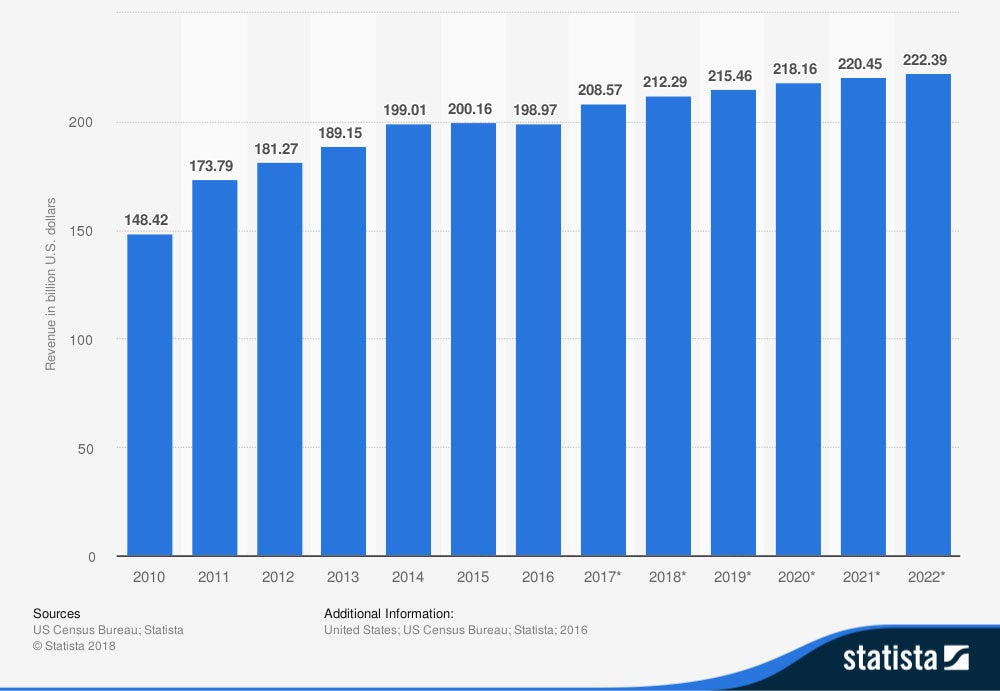

Air transportation revenue in the US(in billion US dollars)

If takin’ it to the skies is more your thing, luckily the air transportation industry has also been gaining traction, for the most part, over the past decade. As of 2010, the industry’s annual revenue totaled $148.4 billion, and save for a brief dip in 2016, it’s been on the rise ever since. By the end of 2019, revenue is projected to reach $215.5 for the year, and as of 2022, it’s projected to skyrocket up to $222.4 billion.

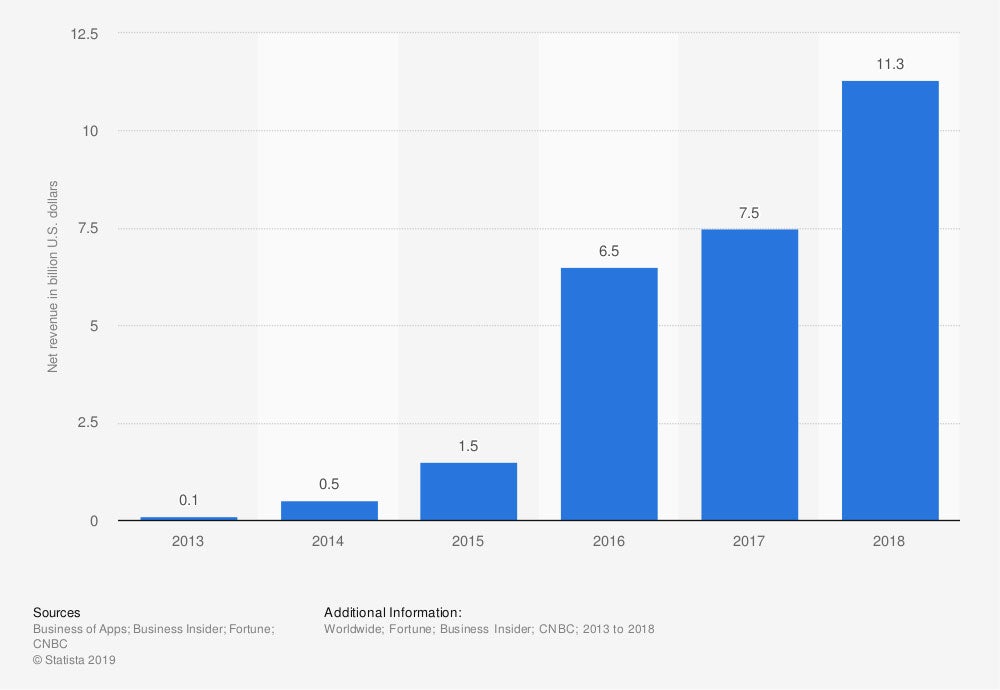

Global net revenue of Uber (in billion US dollars)

One increasingly popular ground transportation service, Uber, has seen a tremendous amount of growth in just five years. In 2013, Uber’s revenue was only $0.1 billion, and as of 2018, the company had delivered enough travelers to rake in $11.3 billion.

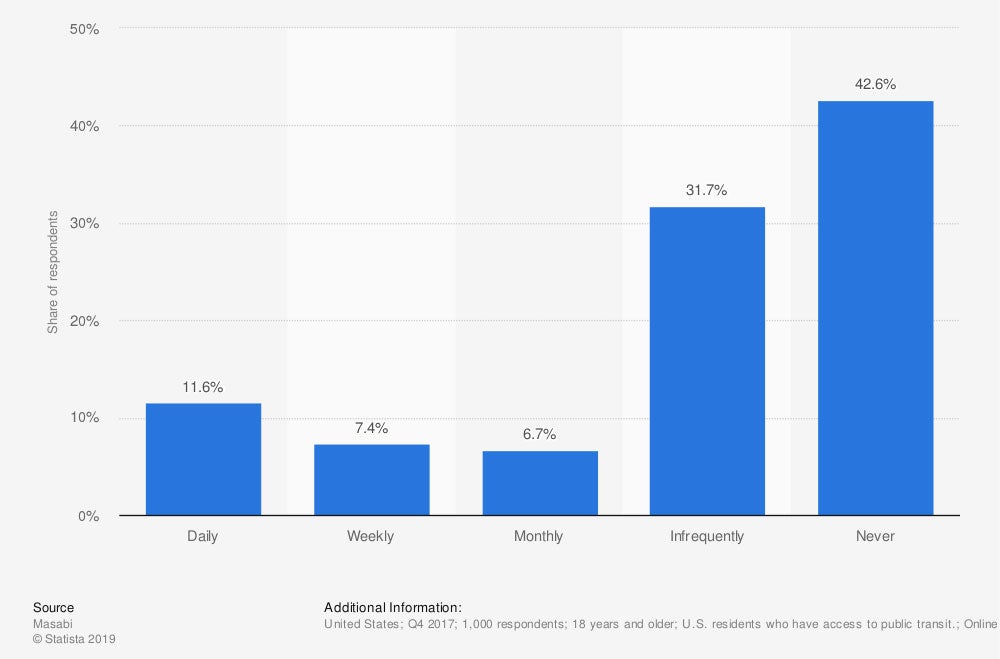

How often do you use public transit service such as the subway, train, bus or ferry?

How to Start a Transportation Business

Your ambition to start a new business is a great motivator, but it’s far from all you need to bring that dream to reality. Of course your vision will be specific and unique (as it should be), but we’ll take a look at some general steps to starting a transportation business:

- Step One: Planning. No successful business can begin without a solid plan—we’re willing to bet on that. First up, you’ll need to determine all kinds of stuff like your start-up costs, target market, business name, the products and services you’ll offer, and how long it’ll take you to break even and start turning a profit. You’ll also need to decide what kind of business you want to be (i.e., cross-country or local only, if you’ll be working solo or starting a huge company, what kind of transit you want to focus on, etc.). Last, you’ll need to scout out a location for your headquarters, and actually purchase or rent said property, once you’ve found it.

- Step Two: Legal stuff. Next, you’ll decide what kind of business entity you want to be (e.g., LLC, partnership, etc.), and then go through the proper channels for making it legal by registering with the government. You’ll also need to register for taxes and obtain any required permits and licenses.

- Step Three: Money stuff. This phase involves opening a business bank account so you can accurately monitor your business’s financial performance, and it will also make your life a heck of a lot easier when it comes time to file your annual taxes. Then, it’s time to obtain your start-up costs and determine how much you’ll be charging customers/clients for any goods and services your business will offer.

- Step Four: Define and build your brand. What will your business stand for? How do you want the world to perceive it? These are just a couple of questions you’ll answer in order to define your brand. A solid, unique branding of your business will help it stand out from the competition. Once the nitty-gritty has been figured out, it’s time to get to work building that brand. This generally involves designing business cards, building a website, and establishing a social media presence. If you’re clueless when it comes to Twitter or any of the other platforms, you can always hire (or beg) someone to take care of that aspect for you.

- Step Five: Build your team. You’ve made all kinds of progress, and now it’s time to find people to actually do the work. Determine what kind of team you need, the different roles you need to fill and how many positions there are in each, then go about hiring your staff/employees/minions. You can advertise online, in your local newspaper, or go the old-school word-of-mouth route. Once you’ve got a solid team established, it’s time to get them trained.

- Step Six: Iron out the details. For your transportation business, this could involve ordering supplies or vehicles needed to perform your services, doing maintenance on said vehicles, determining prices for the services you offer, designing eye-catching signage, purchasing and updating GPS software, putting the finishing touches on your website, brushing up on traffic laws and then quizzing the appropriate staff, advertising and scouting for clients, etc. Basically, any of the specifics needed to make your transportation business come to life will fall into this step.

- Step Seven: Get coverage. The final step, and perhaps the most important, is to obtain the proper coverage. You’ll need business insurance to protect not only your transportation business, but also your employees—and yourself. Business insurance is the pièce de résistance that’ll keep your transportation business delivering people and goods to their next destination for years to come.

What Is Transportation Insurance?

Boiled down, transportation insurance is a well-fueled and fully serviced insurance package designed to meet the specific needs of transportation business owners. All the coverage offered by a basic small business insurance plan, as well as policy options tailored for the unique needs of transportation businesses, are rolled into one.

A transportation insurance package simplifies the process of obtaining all necessary coverages for transportation business owners while eliminating confusion and stress. Basically, it’s the best way to go.

What Does Transportation Insurance Cover?

A transportation insurance policy is typically the easiest option when it comes to knocking out your extensive list of coverage needs all together in one tidy package. These policies offer the basics of business insurance coverage, including most of the liability insurance you’ll need, plus specific coverages tailored to your unique niche.

Here are several transportation insurance coverage options:

- General liability: This coverage protects you against property damage or injury claims made by a third party.

- Workers' compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Depending on the type of work being performed, this coverage is often mandatory in most states.

- Property insurance: Covers loss of or damage to your physical property, including your office space, and often the inventory in it. Protected mishaps include fires, storms, and more.

- Cyber risk & privacy liability: Covers the loss or theft of customers’ sensitive data, including credit card numbers and more. This coverage can also save your business in the event a deposit or money transfer is intercepted by cybercriminals.

- Endorsements for company vehicles: A regular commercial/business auto policy may not cover the vehicles your company uses, so special endorsements might be needed. Also, policies will differ for limos and airplanes, for example. These endorsements will vary by insurance company, but your agent will know what to hook you up with.

- Public liability insurance: Provides coverage should one of your customers suffer injury or damage to their stuff while being transported by your business.

- Employment practices liability: Covers fees for lawyers and other financial ramifications if any of your employees are involved in harassment cases against coworkers or customers. Can also provide protection in the event the public harasses your employees.

Your transportation insurance package will be assembled by selecting the coverages that work for your unique business from a big list of available options. Coverage applies to everything from lost business revenue to potential legal/court fees and beyond.

Who Needs Transportation Insurance?

whatever the fleet size or weight load of your transportation business, if you’re hauling the public or other cargo and paying employees, you’ll need protection. Transportation comes with a set of unique risks, both obvious and hidden, so coverage is essential if you own or operate any of the following:

- Taxi service

- Limousine service

- Product transportation

- Specialty transportation

- Livestock transportation

- Ground transportation

- Air transportation

- Marine transportation

- Medical transportation

Transportation insurance will cover all aspects of your business, regardless of the specific type you own. It’s always important to have protection for your workers, your equipment, your inventory and your property, but protection against potential lawsuits is also crucial. Transportation businesses of all wheel sizes and vehicle types can be sued, so don’t risk not having coverage.

How Much Does Transportation Insurance Cost?

Truthfully, it depends. On quite a few things. A solo worker who offers an Uber-style transport service might pay less than $250 annually. However, a much larger transportation business, like an airline, might pay in the thousands (or even millions) annually in combined liability insurance, workers’ comp, endorsements, and more.

Of course, it’s hard to offer an average figure, since each transportation business is unique. But really, it all depends on a number of factors, like:

- The type of transportation business: This involves more than just if you’ll be offering local or cross-country transportation services. The kind of equipment and vehicles your business uses and the services offered will affect the risk involved in operations. Obviously, more danger means more money for insurance.

- The location of the transportation business: Larger cities tend to have higher costs for insurance, but it goes beyond that. Depending on where you are in the country, your location may be subject to various weather-related risks. Transportation businesses along the Atlantic Coast, for example, may have premiums up to 20% higher due to risk of hurricane damage.

- The number of employees: The more you've got, the more workers' comp you’ll need. Simple as that.

- How much business you generate: Premiums are calculated based on business projections for the upcoming year. If your workload doubles, so will your premium, most likely.

Top 5 Business Insurance Claims

From potential injuries to property damage and lawsuits, business insurance is definitely a must-have. In order to keep all operations running smoothly, you’ll need to consider not only the risks unique to your trade, but also those that apply to all kinds of businesses. Here’s a quick look at the most common business insurance claims across the board:

- Theft/Burglary: Whether they’re after money, merchandise, your company vehicles or anything else, thieves and burglars commonly target businesses. Anything you have that could be stolen is worth protecting—before ever opening your doors to the public.

- Weather-related damage: Windstorms and hailstorms create the type of weather damage most often reported by businesses across the map. Whether it’s shattered windows, broken signage, destroyed products or anything else, Mother Nature can wreak havoc when she gets angry. Plan for disasters before they happen, and secure coverage up front.

- Fire damage: Another common/costly claim is fire damage. Be it destruction caused by natural wildfires or resulting from employee negligence (such as with a kitchen fire), these disasters can be devastating. Fire damage can result in lost property, inventory, and even revenue, especially if your business is forced to close. Also, fires are obviously a huge hazard for your workers and customers alike. Take as many proactive measures as possible, such as installing sprinkler systems and extinguishers.

- Employee injury: Even the most well-trained employees on record run the risk of being injured on the job, regardless of the line of work they’re in. Employees may get injured while carrying out daily tasks, due to the negligence of a coworker, while making service deliveries, or in a myriad of other ways. Protecting your workers with workers’ comp is crucial, not to mention mandatory in most states.

- Customer injury: Of course, your business’s customers are also at risk of injury while on your property. Slips and falls are some of the most commonly reported business insurance claims, but customers can also be injured due to unsafely stocked shelves, employee negligence, faulty products, and much more.

Top 5 Business Insurance Discounts

Owners of businesses of every size, color, and flavor love scoring discounts however they can. And fortunately, there are some discounts out there to help obtain a significantly lower premium, like:

- The safety discount: Insurance companies love working with clients who put safety first. Put practices in place to keep your employees, equipment, and physical office space as safe as possible, and you're likely to be rewarded by your insurance company. Installing sprinkler systems and burglar alarms are just a couple of examples of easy ways to score this discount.

- The quality discount: Establishing a track record of quality goods, services, and customer interactions will not only keep your business running strong, but also help reduce your insurance costs. Essentially, keeping your clients happy is the key to keeping your insurance company happy, and they just might slash your premium as a thank-you in return.

- The low claims history discount: Along the same lines as maintaining a safe and efficient business, having a low claims record is another way to seriously please your insurance company—and over time they’ll probably reward you for it. Plus, if you ever need to switch insurance policies or companies, having a low or even squeaky-clean claims record will definitely help you land a lower premium.

- The professionalism discount: Sometimes insurance companies send out inspectors to observe your business during a typical day of operation. If your equipment is clean and well-maintained, your employees are following necessary safety protocols, and your customers/clients seem happy, you’ll get a good report. A favorable evaluation could reward you with a reduced premium.

- The bundle discount: Purchasing multiple types of insurance with the same company is a tried and true way to save money, but so is purchasing specialty insurance packages. These packages, made up of multiple policies tailored to a specific kind of business, are designed to save you money—and just generally make life easier. And since they exist, you might as well take advantage.

How to Find the Best Transportation Insurance

In order to get the protection you need (and deserve), you’ll want to work with a trusted expert. Independent insurance agents will not only know where to find the best coverage and price, but also help to make sense of the fine print.

Consider your business’s unique needs, then connect with an agent to help you take it from there. Have a list of your specific concerns and desires handy before you reach out, to help make the process even smoother.

Compare Transportation Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From business insurance packages to special add-on policies, our expert independent insurance agents will help you determine which types of coverage make the most sense for you and your new business.

Our independent insurance agents stay on top of the insurance industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help walk you through the claims process and make sure you are getting the benefits you’re entitled to. Now that’s thinking ahead.