Burns & Wilcox Insurance Company Review

Burns & Wilcox Insurance Company at a Glance

- Founded in 1969

- Coverage available nationwide

- Offers a huge variety of coverages

- Offers both individual and business policies

- “A+” (excellent) rating by Better Business Bureau (BBB)

- Not rated by AM Best

- Large network of independent insurance agents

- The US’s leading wholesale insurance broker

- The US’s leading underwriter manager

- Strong financial stability

Burns & Wilcox Pros: This is a long-standing carrier with more than half a century’s worth of experience in the insurance industry. There have been no customer complaints filed through the BBB. There is an extremely wide range of coverage options including umbrella insurance, inland marine insurance, products liability insurance, special event insurance, kidnap & ransom insurance, and more. Burns & Wilcox has strong financial stability with coverage offered nationwide.

Burns & Wilcox Cons: It is not BBB accredited and the customer reviews are dismal across the board. There is no official claims time frame promise and no official claims process listed. The customer service contact options are extremely limited and confusing. There is a lack of basic customer service abilities provided by official website. The company is not rated through AM Best.

What Type of Insurance Does Burns & Wilcox Offer?

Burns & Wilcox offers a wide variety of commercial and personal coverages. Their products include:

- Kidnap & ransom insurance

- Personal accident insurance

- Special event insurance

- Products liability insurance

- Umbrella/excess liability insurance

- Premises liability insurance

- Primary and excess auto insurance

- Contractors pollution liability insurance

- Builders risk insurance

- Inland marine insurance

- Commercial auto liability

- Agricultural insurance

- Retail insurance

- Health & beauty insurance

- Errors & omissions insurance

- Executive/management liability insurance

- Media liability insurance

- Medical liability insurance

- Small business insurance

This list of insurance coverages offered by Burns & Wilcox is far from exhaustive. An independent insurance agent can help you find even more options available from this carrier.

Using our insurance company directory can help you find the best insurance companies that specialize in your specific coverage needs. The company directory can also help you get connected to an agent near you.

What to Know about Burns & Wilcox

Burns & Wilcox was founded in 1967, making the carrier a well-established presence in the insurance industry today. The carrier is known as the US’s leading wholesale insurance broker, and the leading underwriting manager. Burns & Wilcox is a part of the H.W. Kaufman group.

The carrier provides coverage through many different avenues, big and small. Aside from just large insurance brokers, Burns & Wilcox also conducts business through independent insurance agents. In fact, Burns & Wilcox is associated with more than 30,000 independent insurance agents across the globe.

Burns & Wilcox has more than 2,000 employees today. The carrier has more than 50 offices in the US and Canada. Burns & Wilcox also draws more than $1 billion in premiums annually.

Thanks to its rich history, massive size, and amount of insurance in-force, Burns & Wilcox has become known as a trustworthy and reputable insurance carrier. The carrier caters to all kinds of insurance customers including professionals and individuals. Its catalog of insurance offerings includes more than 300 products.

What Discounts Does Burns & Wilcox Offer?

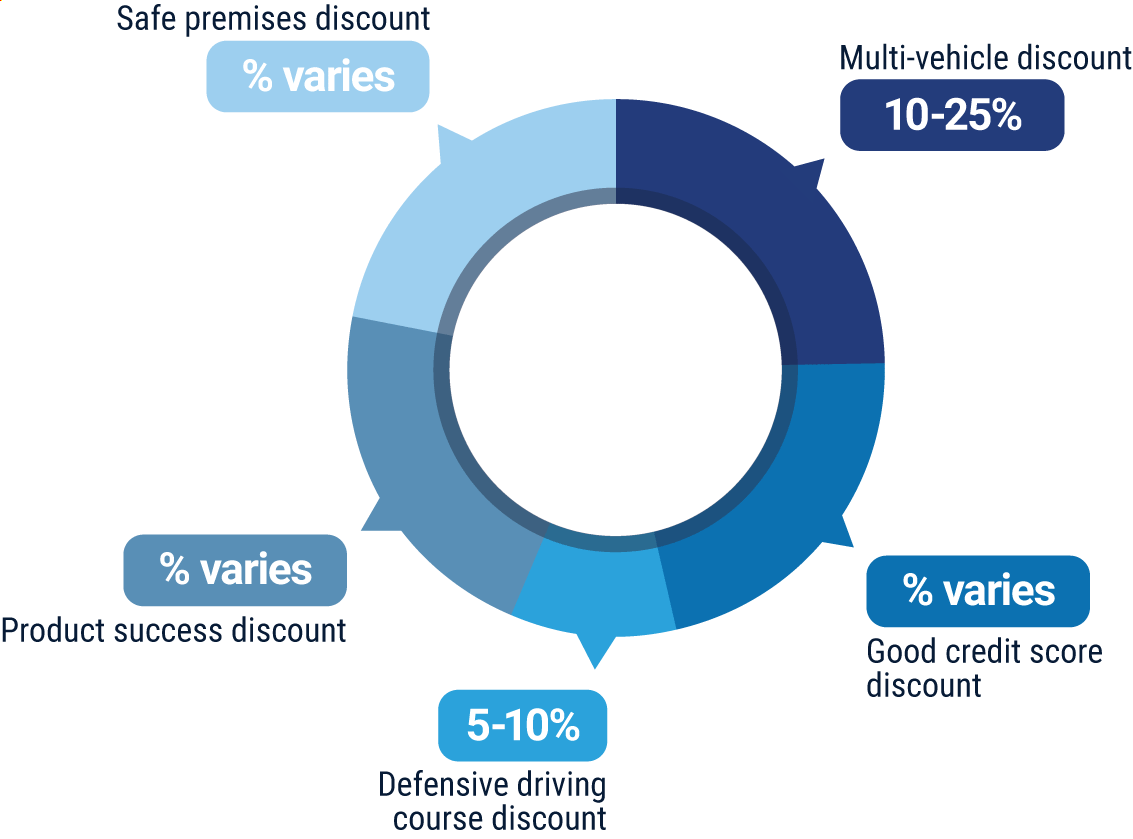

While Burns & Wilcox does not make information about their specific discounts readily available, many modern insurance carriers offer common discounts on comparable coverages. These discounts may include:

- Multi-vehicle discount: Burns & Wilcox does advertise that it offers discounted rates for car insurance customers who insure more than one vehicle at a time.

- Good credit score discount: This is offered to auto insurance customers who maintain a good credit score.

- Defensive driving course discount: This is offered to auto insurance customers who complete an approved defensive driving course.

- Product success discount: This is offered to commercial liability customers who have a good track record of product success.

- Safe premises discount: This is offered to commercial liability customers who provide a safe premises for employees and customers.

Your independent insurance agent can help you find more information on exact discounts offered by Burns & Wilcox.

Burns & Wilcox Customer Service

Burns & Wilcox operates differently from many modern insurance carriers in that they do not have one department to contact for customer inquiries or claims reporting. The official website is set up to direct customers to their insurance provider’s local office, and from there a phone number is listed for contact. A general contact form is available through the website as well. The phone numbers listed on specific office locations’ pages do not list contact hours, nor does the carrier’s Facebook page.

The following customer service options are available through the carrier:

- Mailing addresses provided for many office locations

- Phone contact options available for all offices

- Email contact options available for many office locations

The best way to get your customer service needs met is to work with your independent insurance agent. Independent insurance agents can help make customer service much easier for you by handling claims and other concerns.

Burns & Wilcox FAQ

What is Burns & Wilcox's average claim response time frame?

Burns & Wilcox does not provide specific hours or instructions for filing claims. The carrier also does not provide a specific claims response time frame promise.

What is Burns & Wilcox's customer service availability?

Burns & Wilcox redirects customers to their specific local office’s webpage to get in touch directly for any concerns or issues. Once redirected to a specific office’s page, no hours availability is listed. Many times in this case, an insurance carrier provides customer service hours on their Facebook page. This is not true of Burns & Wilcox. However, Burns & Wilcox does have a social media presence on Twitter and LinkedIn as well, which makes them more accessible to customers.

What is Burns & Wilcox's claims process?

Burns & Wilcox does not provide specific instructions for their customers to file claims, nor do they detail their claims process. Unless a customer wishes to contact their local insurance provider’s office directly, they are encouraged to go through their insurance agent to handle any issues or file claims. The carrier also does not provide a FAQ about claims reporting or processing on their official website, which is something many modern insurance providers offer.

Does Burns & Wilcox create a user-friendly experience for customers?

While Burns & Wilcox’s official website provides great information about the company itself and the insurance products they offer, when it comes to services that both prospective and current customers are in need of, it is sorely lacking. Customers can make an insurance payment through the website, but that’s about it. Claims filing is not available online, nor is getting matched with an agent. There is also virtually no information provided about filing claims at all, or any sort of claims process from the carrier. Customer service hours are not listed, and having to be redirected to a specific office before being given a contact number makes getting in touch with the carrier at all seem difficult. In comparison to many other modern insurance carriers, Burns & Wilcox is sorely lacking in terms of user-friendliness.

Burns & Wilcox Customer Reviews

| Better Business Bureau |

|

| “This company has an underwriter who took $1,285 dollars from us for 70 days’ worth of insurance because we had to close paid them $1,285 for 70 days they gave us back $364. Took $921. What a rip-off company and underwriter. Unbelievable that a company can take advantage of a person like this, it is criminal. Do not go to them for insurance, trust me. They are a no good, dishonest business. They are only out for themselves (...) VERY disappointed in this company and how they do business like they are THIEVES.” |

| Better Business Bureau |

|

| “I have had this terrible company since 2013. I filed a claim after I had hail damage. Every neighbor was able to get a new roof due to damage and some got siding fixed, etc.. I had 3 roofers come out and all said I needed a new roof. Burns and Wilcox sent their guy to evaluate the damage and he said I didn’t have enough damage for a claim. I asked for another adjuster and the company refused. This went on for months. Then, a person showed up at my door with no appointment and said they were there to inspect my house. I said absolutely not, as advised by my lawyer. The company waited until I can no longer get my roof fixed due to time limits and sent me a certified letter saying they are dropping me in 30 days. I still have a lawyer and we are taking action against them for a fraudulent inspection.” |

| Yelp |

|

| “Be careful before sending them money. There is a high probability that they will cancel your homeowners policy within a month or two, then only give back part of your payment. Then you can start all over trying to get insurance.” |

|

| “Spent over $6,000 on policies in the last 2 years on a home with no claims only to be told 3 weeks before the current policy ends that they will not be renewing my policy. Do NOT count on this company to be loyal to you.” |

|

| “I need to have my mortgage insurance company increase the amount of coverage so I can close and my insurance broker has to go through Burns and Wilcox. It should have taken approximately 20 minutes. Three days later and I am still waiting to hear that they (Burns and Wilcox) have completed the simple task!” |

TrustedChoice.com's Final Review

We award Burns & Wilcox Insurance Group a final rating of 2 out of 5 stars. The carrier has several decades of experience within the insurance industry, which is certainly a pro, however, many carriers have also been around for much longer. Burns & Wilcox received an excellent rating through the BBB and currently has no complaints filed against them, but are not an accredited business through the organization. The carrier undoubtedly earns points for having such an extensive catalog of insurance product offerings, offering coverage nationwide, and working with independent insurance agents. Burns & Wilcox have made themselves accessible to many prospective insurance customers of all kinds across the map this way. The carrier also has impressive financial strength, which is important when comparing insurance providers today. However, it was impossible to find even one glowing customer review of the carrier, which is something that can’t be ignored.

Bottom Line: While Burns & Wilcox may earn impressive marks for financial strength and amount of in-force insurance, as well as their extensive product catalog, we’re more concerned about whether a carrier keeps their customers happy. Reliable coverage is absolutely important, and if a customer can’t count on their insurance company to meet their needs or deliver on their promises, no amount of financial strength can make up for that. The lack of basic customer service options or details about claims process on the official website is downright unsettling. If you’re looking for a user-friendly experience with a carrier that prioritizes its customers, we recommend working closely together with your independent insurance agent to survey your other options before entrusting Burns & Wilcox to meet your coverage needs.

burnsandwilcox.com

bbb.org

yelp.com

facebook.com