Rebuilding After Hurricane Katrina

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Insurance provides coverage for catastrophes of all kinds, even hard-hitting natural disasters. When Hurricane Katrina struck in 2005, it cost billions of dollars in damages and thousands of deaths. Fortunately, coverages like property insurance were able to help the victims get back to their lives.

An independent insurance agent can help you find the right coverage for your own disasters, even if they’re not quite as tragic as this one. But first, here’s a closer look at Hurricane Katrina and all the ways insurance was able to help victims recover.

What Was the Impact of Hurricane Katrina?

One of the deadliest hurricanes in the US’s history, Hurricane Katrina left thousands dead, hundreds missing, and millions homeless. The impact of this tragic storm is still felt today.

Quick stats about Hurricane Katrina:

- 1,833 deaths were reported

- 705 people are still reportedly missing today

- Hurricane Katrina was the largest hurricane to ever make landfall in the US

- Hurricane Katrina was the third strongest hurricane to ever make landfall in the US

- Winds up to 175 MPH were reported

- Hurricane Katrina peaked at a Category 5 hurricane, the highest possible

- Hurricane Katrina was the most destructive storm in US history

- $161 billion in damages were reported

- 85% total of New Orleans was flooded by the storm after levee failure

- 40% of deaths were caused by drowning

- 25% of deaths were due to complications from injuries

- Hurricane Katrina’s impact stretched about 90,000 square miles total

Though Hurricane Katrina was certainly a tragedy, fortunately the victims were able to receive financial aid through insurance and relief packages.

Hurricane Katrina’s Toll on the US Economy

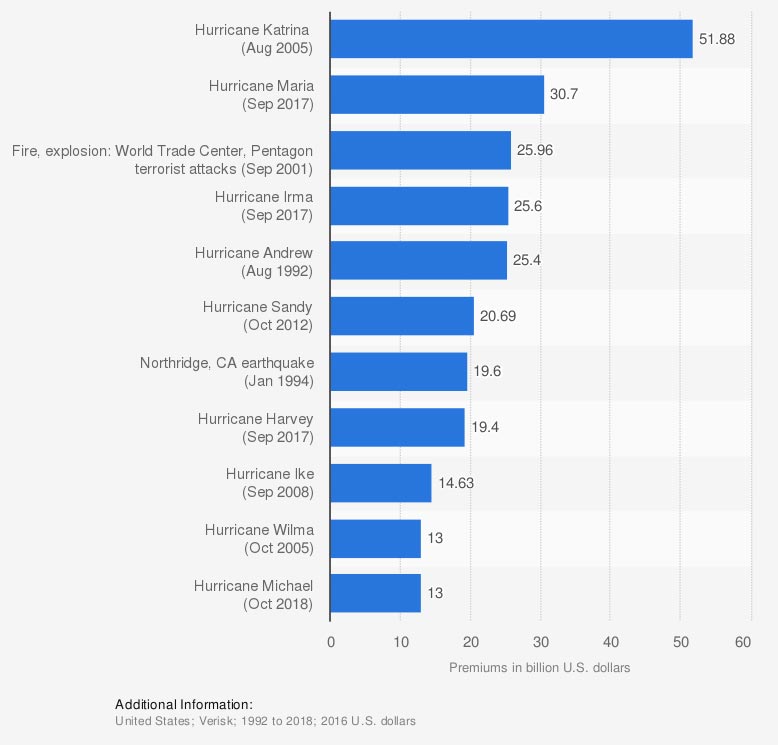

Most Expensive Catastrophes in the United States from 1992 to 2018, by Property Loss (in billion US dollars)

Insurance Information Institute: Verisk

©Statista 2020

In a nearly 30-year period, Hurricane Katrina ranked as the most expensive disaster to hit the US, costing $51.88 billion in property damages alone. Despite the time constraints displayed on this graph, Hurricane Katrina stands as the costliest storm in all US history.

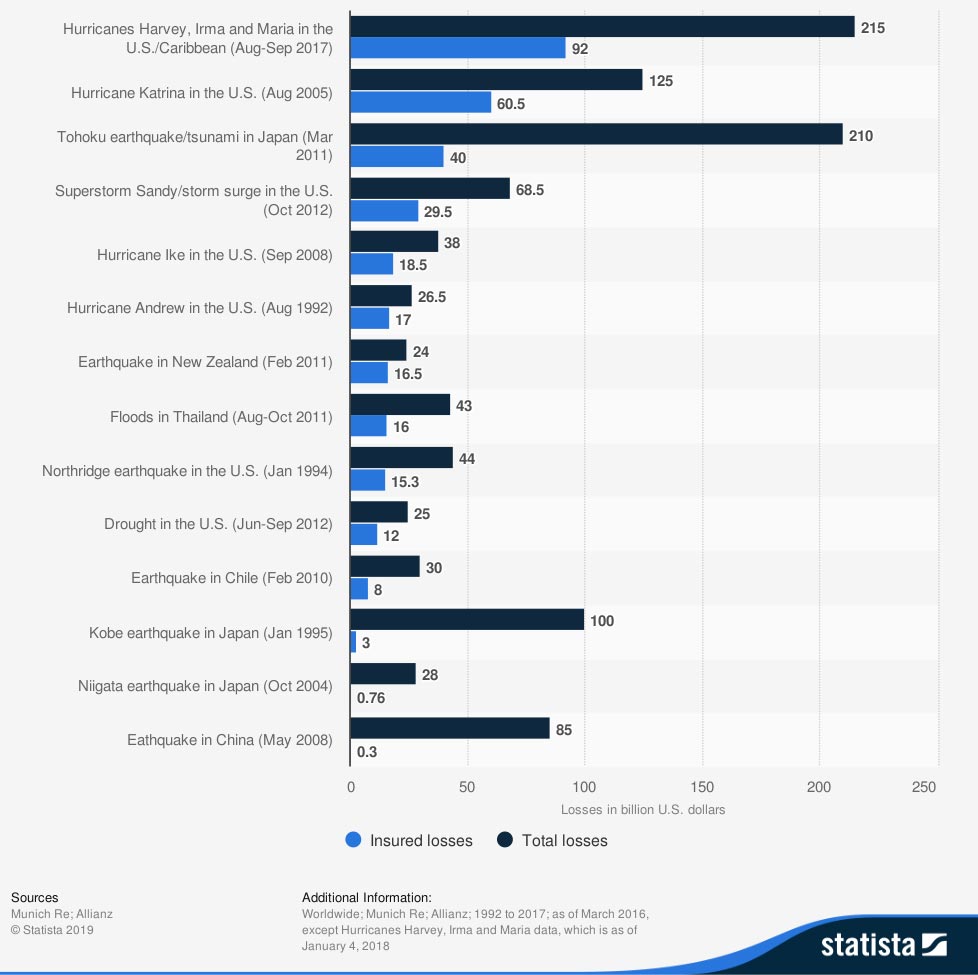

Most Expensive Natural Disasters for the Insurance Industry Worldwide from 1992 to 2017 (in billion US dollars)

As for the impact on the insurance industry, Hurricane Katrina ranks second for financial losses due to natural disasters worldwide. A total of $60.5 billion in insured losses was reported for Hurricane Katrina, which fell behind only Hurricanes Harvey, Irma, and Maria, which collectively cost the insurance industry a total of $92 billion.

Who Provided Help to the Victims of Hurricane Katrina?

While Louisiana’s government has been criticized for its response to Hurricane Katrina, fortunately insurance companies were there to aid victims after the devastation. Insurance companies paid an estimated total of $41.1 billion for claims relating to home, business, and vehicle damage. A total of 1.7 million different insurance claims were filed after the storm, with the vast majority coming from Louisiana.

The National Flood Insurance Program (NFIP) also provided relief for victims, paying out $16.3 billion in claims. However, the following year the Federal Emergency Management Agency (FEMA) was accused of giving out potentially fraudulent disaster relief payments, including at least $1 billion of those insurance claim payouts.

Former President George W. Bush also signed a $10.4 billion aid package for Hurricane Katrina within the first week of the impact. Over the next week, Congress approved another $51.8 billion in financial aid proposed by the former president.

How Did Car Insurance Help Victims Get Back to Their Lives?

Fortunately for victims of Hurricane Katrina, having auto insurance allowed them further assistance in resuming their lives. Auto insurance helped Hurricane Katrina victims in the following ways:

- Repairs: For victims whose cars were badly damaged by the storm, auto insurance covered repairs to their vehicles under the collision section of their policies.

- Replacement: Those victims whose cars were completely totaled by the hurricane were able to obtain new vehicles through the help of their auto insurance.

- Rental cars: While victims awaited repairs on their vehicles, auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: The victims who sustained injuries during Hurricane Katrina were able to be compensated by their auto insurance policy for medical payments while receiving treatment.

Though not all car insurance claims stem from damage caused by major hurricanes, it’s helpful to see just how auto insurance provided relief for victims of this huge tragedy in a myriad of ways.

How Did Property Insurance Help Victims Get Back to Their Lives?

Property insurance also helped Hurricane Katrina victims to rebuild and restructure their lives. For Hurricane Katrina victims, property insurance coverage provided protection in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered peril, such as a hurricane. Hurricane Katrina victims were able to rebuild homes that were destroyed by Hurricane Katrina’s harsh winds thanks to property insurance.

- Ending homelessness: Millions of Hurricane Katrina victims were left temporarily homeless following the storm. Fortunately, their property insurance coverage provided the financial assistance necessary to rebuild their homes.

- Replacing personal property: Hurricane Katrina victims were largely able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. following the storm. Property insurance typically covers personal property up to 50% to 70% of the insured value of the structure of the home if it’s lost/damaged/destroyed by a hurricane.

- Replacing property stored elsewhere: Property insurance also covered Hurricane Katrina victims’ personal belongings stored off premises, such as in storage units, following the disaster. Limits on off premises stored property are sometimes 10% of the total value of personal property coverage, but additional coverage can be added.

- Mending foliage around homes: Property coverage also includes reimbursement for foliage around the home, including trees, plants, and shrubs if they are damaged or destroyed by a hurricane. Limits typically cap at $500 per plant, but coverage amounts can be increased. Hurricane Katrina victims were able to repair their gardens and general appearance surrounding their homes thanks to property insurance.

Hopefully you’ll never have to submit property insurance claims for major hurricane damage, but it’s still useful to note all the relief this coverage provided to victims of Hurricane Katrina.

Is Hurricane Coverage Part of Every Homeowners Policy?

While windstorm damage is often included in standard homeowners insurance policies, there are some exceptions, including for victims of Hurricane Katrina. Additionally, Hurricane Katrina brought a lot of heavy rainfall along with it, leading to severe flooding. Sadly, flood damage is not a covered peril under homeowners insurance, meaning victims would have needed an additional flood insurance policy.

Hurricane Katrina victims needed the following coverages in addition to their homeowners insurance:

- Flood insurance: For those who live in areas known to be at high risk for flooding, mortgage lenders often require them to purchase flood insurance, so many of Hurricane Katrina’s victims may have already had adequate coverage. Flood insurance covers damage to homes and personal property due to flood waters, and is only available through the National Flood Insurance Program (NFIP), which is a part of the Federal Emergency Management Agency (FEMA).

- Windstorm insurance: Certain states that are prone to heavy winds require homeowners to purchase an additional windstorm insurance policy to protect against hurricanes, cyclones, etc. Of these 19 states, Louisiana and Mississippi, the two hit hardest by Hurricane Katrina, are required to place mandatory windstorm deductibles on homeowners insurance. Windstorm insurance protects against damage due to heavy winds beyond the limit available in a standard homeowners policy, so Hurricane Katrina victims absolutely needed to rely on this coverage.

Without adequate flood and windstorm insurance, victims of Hurricane Katrina would have been forced to rely on the limitations of their homeowners insurance policies. Homeowners insurance would not have covered victims whose homes were destroyed or damaged by flood waters, nor homes affected by heavy winds up to the amount of the mandatory windstorm deductible. Victims would have had to pay for the damage out of pocket.

How Did Business Insurance Help Owners Get Back to Work?

Not all Hurricane Katrina victims were just homeowners, many were business owners as well. Luckily, business insurance provided additional coverage that allowed business owners to reopen their doors and get back to work.

Business insurance helped Hurricane Katrina victims in the following ways:

- Loss of income: Business insurance includes coverage for lost income suffered during temporary closings due to covered disasters, including hurricanes. Business owners who were victims of Hurricane Katrina were able to recover lost income thanks to business insurance.

- Property repairs: Business insurance covers damage to or loss of your business’s physical property, including the structure of the building and often the inventory inside of it, due to a covered disaster like a hurricane. Hurricane Katrina victims were able to rely on their business insurance to help them rebuild their businesses from the ground up, repair less major damages, and recover lost property such as inventory.

- Lost employee wages: Business insurance also helps pay employee wages that are lost while a business is closed due to covered perils like hurricanes. Victims of Hurricane Katrina were able to compensate their employees during long shutdowns thanks to business insurance coverage.

Businesses close for all kinds of reasons, not just due to catastrophes like Hurricane Katrina. That being said, knowing all the ways business insurance provided relief to business owners following this disaster proves just how important coverage is to have for all potential disasters.

Are Hurricane Katrina Victims and the States Impacted Back to Normal Now?

Fortunately for many of Hurricane Katrina’s victims, life has largely returned to normal. Payouts from homeowners, windstorm, and flood insurance claims allowed victims to repair or rebuild their homes and end homelessness. Car insurance allowed victims to repair or replace lost or damaged vehicles, and business insurance allowed professionals to recover lost income and wages and get back to work. However, many victims understandably relocated permanently.

Unfortunately for New Orleans, things still aren’t quite the same. Though it’s been nearly 15 years since the storm hit, the city continues to rebuild. Many housing plots are still vacant and have not been maintained, reportedly overgrown by weeds to this day. Certain businesses have also chosen not to reopen or rebuild. Unfortunately, New Orleans still considers its recovery following Hurricane Katrina to be a work in progress.

Here’s How an Independent Insurance Agent Can Help Protect You from Your Own Disasters

You’ll hopefully never encounter a natural disaster as devastating as Hurricane Katrina, but independent insurance agents can certainly help protect you from your own disasters. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

dosomething.org

cnn.com

livescience.com

politico.com

eesi.org