Rebuilding After the San Francisco Earthquake

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When natural disasters shake things up, insurance coverage steps in to provide important protection. When the Loma Prieta earthquake struck the San Francisco Bay Area in 1989, it left in its wake billions of dollars in damage and dozens of tragic deaths. Fortunately for victims of this catastrophe, coverages like property and business insurance were able to help them get back to their lives.

An independent insurance agent can help you find the right coverage for your own worst disasters, even if they’re not quite as tragic, destructive, or deadly as this one. But first, here’s a closer look at the San Francisco earthquake and all the ways insurance was able to help victims recover.

What Was the Impact of the San Francisco Earthquake?

The San Francisco Bay Area was rocked by a particularly destructive earthquake on October 17, 1989. The Loma Prieta earthquake still ranks as one of the most destructive and powerful earthquakes to strike a populated area of the US to this day. Also known as the San Francisco-Oakland earthquake, the Loma Prieta earthquake was given its name for having been centered around Loma Prieta Peak in the Santa Cruz Mountain Range near San Francisco.

Quick stats about the Loma Prieta earthquake:

- 63 deaths were reported

- More than 3,700 injuries were reported

- $6 billion in property damage was reported — equivalent to about $38 billion today

- The Loma Prieta earthquake had a magnitude of 6.9

- The quake lasted only around 15-20 seconds

- Gas mains and pipes burst as a result of the quake, causing fires in the Marina District

- 42 fatalities from the quake stemmed from the collapse of the San Francisco-Oakland Bay Bridge’s upper deck onto the lower deck

- An estimated 18,3000 houses were damaged

- 963 homes were destroyed

- An estimated 2,600 businesses were damaged

- 147 businesses were destroyed

- The San Francisco earthquake disrupted the start of Game 3 of the 1989 World Series between the San Francisco Giants and the Oakland Athletics

Though the San Francisco earthquake was certainly devastating, fortunately the victims were able to receive financial aid through insurance and relief packages.

The San Francisco Earthquake’s Toll on the US Economy and Population

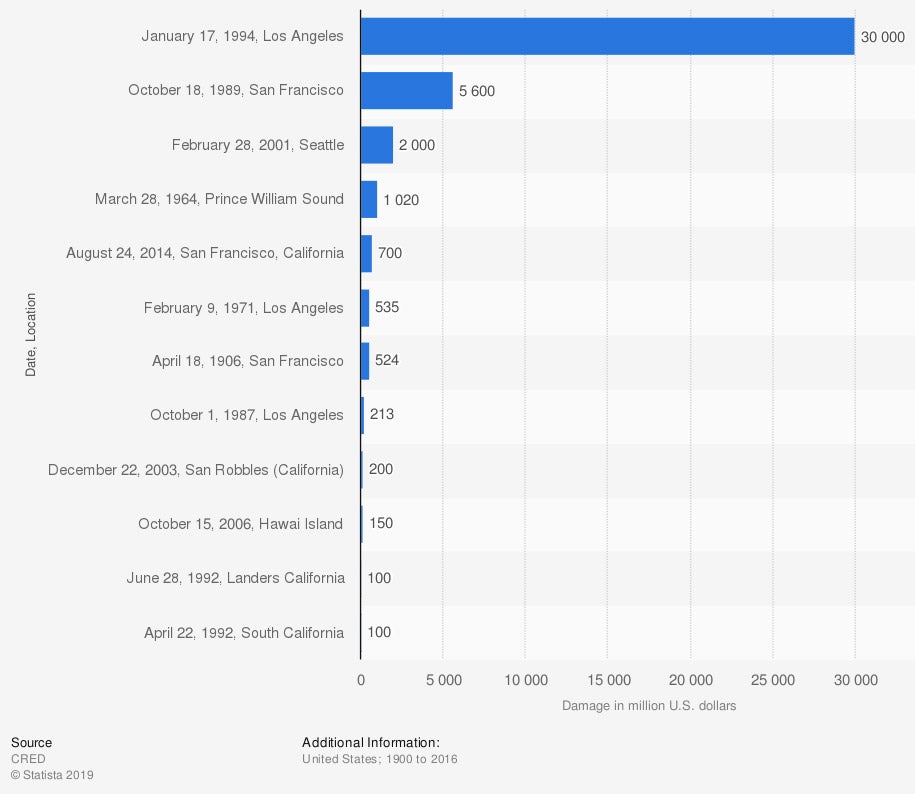

Costliest Earthquakes in the United States from 1900 to 2016, by Economic Damage (in billion US dollars)

In more than a century, the San Francisco earthquake, which struck in 1989, ranks as second overall for the costliest earthquakes to ever hit the US. The Loma Prieta earthquake cost a reported $5.6 billion in damage, coming second only to the 1994 earthquake which struck Los Angeles, costing a reported $30 billion in total damage.

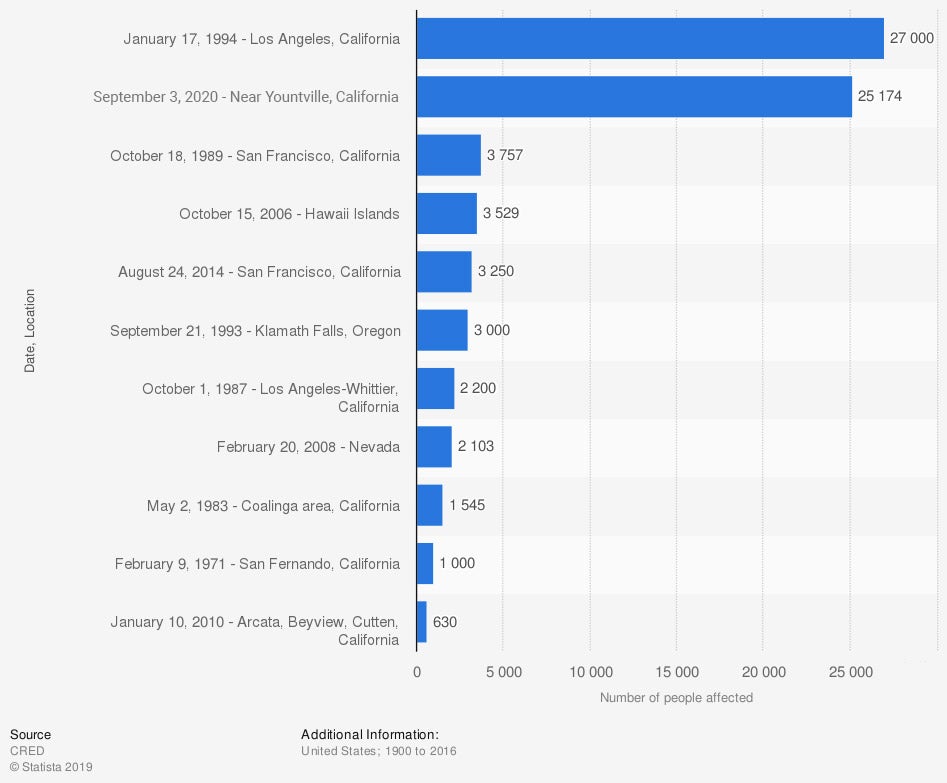

Earthquakes that Affected the Most People in the United States from 1900 to 2016 (in billion US dollars)

When it comes to the effect on the US population, the San Francisco earthquake of 1989 reportedly impacted the lives of 3,757 people total, ranking third overall for the most people affected by an earthquake in over a century of the nation’s history. Ranking above the Loma Prieta earthquake are the 2000 earthquake that struck near Yountville, California, affecting 25,174 people, and the 1994 earthquake that struck Los Angeles, affecting 27,000.

Who Provided Help to the Victims of the San Francisco Earthquake?

Organizations like the Red Cross stepped up to help victims in the aftermath of the devastating Loma Prieta earthquake. The Red Cross provided immediate disaster assistance to almost 15,000 families and opened 45 shelters, which housed almost 65,000 people. Almost 23,400 homes were surveyed for damage from the earthquake by the Red Cross as well.

The San Francisco earthquake cost an estimated $960 million in insured losses. The Loma Prieta earthquake was responsible for creating the mandatory earthquake bill, called the California Residential Earthquake Recovery Act. The bill went into effect in 1992 to help cover costs (up to $15,000 per homeowner) from the deductible gap in homeowners insurance policies. The bill was only in effect for that year.

A Federal relief package of $3.45 billion was signed by former president George H.W. Bush to aid victims of the Loma Prieta earthquake on October 26, 1989. The package allowed victims of the earthquake to recover and replace damaged or destroyed property and pay off loans.

What if Victims Didn’t Have Earthquake Insurance?

Standard homeowners insurance policies do not include coverage for earthquake damage, except for resulting fire damage from the quake, and additional living expenses in the event someone is temporarily displaced from their home and must stay at a hotel. The California Earthquake Authority provides earthquake insurance policies to residents of California to cover all resulting damage from earthquakes, such as to personal property and home structures.

Earthquake coverage can also be added to a homeowners insurance policy in the form of an endorsement. Without adequate earthquake coverage, victims of the San Francisco earthquake would have had to pay out of pocket for resulting damage and destruction to their homes and property following the disaster. Aside from cracked foundation and collapses, earthquakes can also cause water damage in homes due to burst pipes.

How Did Property Insurance Help Victims Get Back to Their Lives?

Victims who added earthquake endorsements to their homeowners policies were also able to rebuild and restructure their lives thanks to property insurance. For the Loma Prieta earthquake’s victims with the necessary coverage, property insurance coverage provided protection in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered peril, which with the help of an endorsement, would include earthquakes. The San Francisco earthquake victims were able to rebuild homes that were destroyed in the disaster.

- Ending homelessness: Many of the earthquake’s victims were left temporarily homeless following the disaster. Fortunately, their property insurance coverage provided the financial assistance necessary to rebuild their homes, as long as they had the necessary endorsement. Temporary housing was also provided by homeowners insurance to victims through additional living expenses.

- Replacing personal property: The San Francisco earthquake’s victims with the earthquake endorsement on their homeowners insurance were largely able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. following the disaster.

- Replacing property stored elsewhere: Earthquake endorsements on homeowners policies also provided coverage for victims’ personal belongings stored off premises, such as in storage units, following the disaster.

While you may never have to submit property insurance claims for major earthquake damage or destruction, it’s still helpful to learn all the relief this coverage provided to victims of the San Francisco earthquake. Be sure to speak with your independent insurance agent about necessary endorsements for earthquakes or other applicable natural disasters in your area, to guarantee that your coverage doesn’t have any gaps.

How Did Car Insurance Help Victims to Get Back to Their Lives?

Fortunately for victims of the San Francisco earthquake, having auto insurance allowed them further assistance in resuming their lives. Comprehensive auto insurance helped the Loma Prieta earthquake victims in the following ways:

- Repairs: For victims whose cars were badly damaged by the quake, such as in the bridge collapse, their comprehensive auto insurance covered repairs to their vehicles.

- Replacement: Those victims whose cars were completely totaled by the quake, also such as in the bridge collapse, were able to obtain new vehicles through the help of their comprehensive auto insurance.

- Rental cars: While victims awaited repairs to their vehicles, their comprehensive auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: The victims who sustained injuries during the earthquake were able to be compensated by their comprehensive auto insurance policy for medical payments while receiving treatment.

Though not all car insurance claims stem from damage caused by high-magnitude earthquakes, it’s helpful to see just how comprehensive auto insurance provided relief for victims of this huge tragedy in a myriad of ways.

How Did Business Insurance Help Owners Get Back to Work?

Not all victims of the San Francisco earthquake were just homeowners. Many were business owners as well. Earthquake coverage can be added to standard business owners policies in the form of endorsements, similarly to how coverage is added to homeowners policies. Fortunately, those victims with the proper earthquake endorsements on their business insurance were able to reopen their doors and get back to work.

Business insurance helped victims of the Loma Prieta earthquake in the following ways:

- Loss of income: Business insurance with an earthquake endorsement includes coverage for lost income suffered during temporary closings due to quakes. Business owners who were victims of the San Francisco earthquake were able to recover lost income thanks to this endorsement on their business insurance.

- Property repairs: Business insurance with an earthquake endorsement covers damage to or loss of your business’s physical property, including the structure of the business and often the inventory inside of it, due to a quake. The Loma Prieta earthquake’s victims were able to rely on their coverage to help them rebuild their businesses from the ground up, repair less major damage, and to recover lost property such as inventory.

- Lost employee wages: Business insurance with an earthquake endorsement also helps pay employee wages that are lost while a business is closed due to a quake. Victims of the Loma Prieta earthquake were able to compensate their employees during long shutdowns thanks to this endorsement on their business insurance coverage.

Businesses close for all kinds of reasons, not just due to catastrophes like the Loma Prieta earthquake. That being said, knowing all the ways business insurance provided relief to business owners following this disaster proves just how important coverage is to have for all potential disasters. Speak with your independent insurance agent to ensure that your business is set up with all the important endorsements it may need to protect against natural disasters.

Are the City of San Francisco and its Earthquake Victims Back to Normal Now?

Thanks to the right insurance and generous relief efforts, life for many of the victims of the San Francisco earthquake has returned to normal. Payouts from homeowners insurance claims allowed victims to repair or rebuild their homes and end temporary homelessness. Comprehensive car insurance allowed victims to repair or replace damaged vehicles and business insurance allowed professionals to recover lost wages and get back to work.

The new east span of the San Francisco-Oakland Bay Bridge finally reopened in 2013, 14 years after the Loma Prieta earthquake caused the upper deck to collapse onto the lower deck. Though the original estimate for the project was $250 million, the complete reconstruction ended up being closer to $6.5 billion. Thanks to the now completed Bay Bridge, traffic can once again flow as efficiently as it did before the Loma Prieta earthquake struck.

Here’s How an Independent Insurance Agent Can Help Protect You From Your Own Disasters

You’ll hopefully never encounter a natural disaster as destructive as the San Francisco earthquake, but independent insurance agents can help protect you from your own disasters. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

redcross.org

nbcbayarea.com

britannica.com

history.com

air-worldwide.com