Who's Responsible if a Shared Fence Falls on Your Swing Set?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When it comes to property, it’s not always easy to define who’s responsible for what. In the case of homeownership, sometimes it’s not obvious who owns a fence on the property line. So what happens if you and your neighbor share a fence that falls on your swing set and destroys it? Who has to pay for this mess, anyway?

Luckily, independent insurance agents can help get you both the answers and the coverage you need. Since they’ve heard and handled all types of claims, including the most bizarre scenarios you could imagine, they know exactly what type of coverage is necessary for risks you might not be anticipating. They’ll help you get set up with all the protection you need, long before you need it. Here’s how they’d help you get covered from a shared fence destroying your swing set.

Who’s Responsible if a Shared Fence Falls on Your Swing Set and Destroys it?

Though you may not like the answer, most likely you will be held responsible for filing a claim for the damage. While the fence may technically belong to both you and your neighbor, it could be extremely difficult to prove negligence on their part in order to have a case against them, unless their section of the fence was in obvious disrepair. You’ll most likely end up just going through your own homeowners insurance to repair or replace your swing set in this scenario.

Who Does the Fence Belong to, Anyway?

Honestly, it’s tough to say. It depends entirely on the circumstances of why it’s considered a shared fence between you and your neighbor. If you were the one to add onto and finish an existing fence when you moved in, then the sections you added belong to you, and the rest belong to your neighbor. But there are instances of just shared property, such as fences that straddle both property lines. This may be the case for you and your fence.

How Does Property Coverage Help in This Case?

Though you may be upset about the destruction of your swing set, it may at least come as some relief that the property damage section provided by your homeowners insurance can help to clean up the mess.

Property coverage would help with your smashed swing set in the following ways:

- Removal of the fence and smashed swing set: The property coverage in your homeowners policy would pay for the removal of not only your smashed swing set but also the fallen fence, as long as the cause was due to a covered peril. Depending on the policy, covered perils often include hail, ice, snow, sleet, or wind.

- Removal and cleanup of debris: Along with the removal of the fence and swing set, homeowners insurance property coverage would pay to clean up the debris left behind, whether it’s pieces from the fence or your swing set.

If a shared fence falls on your property, it most likely would have been due to wind or other storm damage. In this case, you’d file a wind damage claim through your homeowners insurance for your swing set. Your independent insurance agent can help walk you through the process if you have any questions.

What if Someone Got Hurt? How Would Liability Coverage Help?

In the event the shared fence didn’t just smash your swing set, but also injured someone on your property who then sued you for it, you’d need to use the liability coverage section of your homeowners policy. Liability coverage protects homeowners from expensive legal fees in the event they are sued, whether they end up being held liable for the injury or not.

Liability coverage protects homeowners in the following ways:

- Payment of legal fees: Liability coverage reimburses homeowners for court and attorney fees, as well as any settlements they’re ordered to pay in the event they are held responsible for an incident such as someone getting injured by a fallen fence or smashed swing set on their property.

- Medical payments: Liability coverage also takes care of fees associated with treating any third party injuries that occur on your property due to a covered peril.

Since lawsuits are already stressful enough to deal with, it’s important to have adequate homeowners insurance and liability coverage to help protect you from any potential financial ramifications.

Is Umbrella Insurance a Good Idea?

To extend the liability coverage limits under your homeowners insurance, you may want to considering adding an umbrella policy. Umbrella insurance stacks on top of underlying liability coverage included within homeowners policies and typically comes with a limit of $1 million. If someone gets injured on your property by a smashed swing set or fallen fence, their injuries could be expensive. But there are other good reasons to consider umbrella coverage too.

The most common lawsuits homeowners face that could benefit from umbrella coverage include:

- Hired help injuries: In the event a domestic worker, such as a maid or gardener, is injured on your property due to your failure to maintain a safe premises, the resulting lawsuit and medical payments required could get expensive, fast.

- Fallen trees: If a tree on your property falls and damages your neighbor’s home, the resulting damages could easily reach into the ten-thousands.

- Intoxicated guests: When you throw a party and it gets a little out of hand, you as the homeowner are still held responsible for any property damage or bodily injuries an intoxicated guest causes to other guests.

- Dog bites: Even injuries caused by a family pet can cost an average of $30,000 in claim settlements.

Umbrella insurance is extremely helpful in the case of many common, costly lawsuits that homeowners may have to deal with at some point.

What if I Don’t Have Insurance?

Even if you’re not insured, you can still be sued by someone who gets injured on your property. However, being sued doesn’t mean you’ll actually be held liable. But even if you’re not found guilty for a third party’s injury, without insurance, you’ll still be responsible for paying court fees out of pocket, and lawyers can be expensive. That’s why it’s best to work with an independent insurance agent to get set up with the right coverage long before you ever need it.

Other Common Risks Worth Considering Coverage For

Not all homeowners are concerned about shared fences falling, but there are plenty of common risks that warrant having the proper coverage. Check out these stats regarding common home insurance claims.

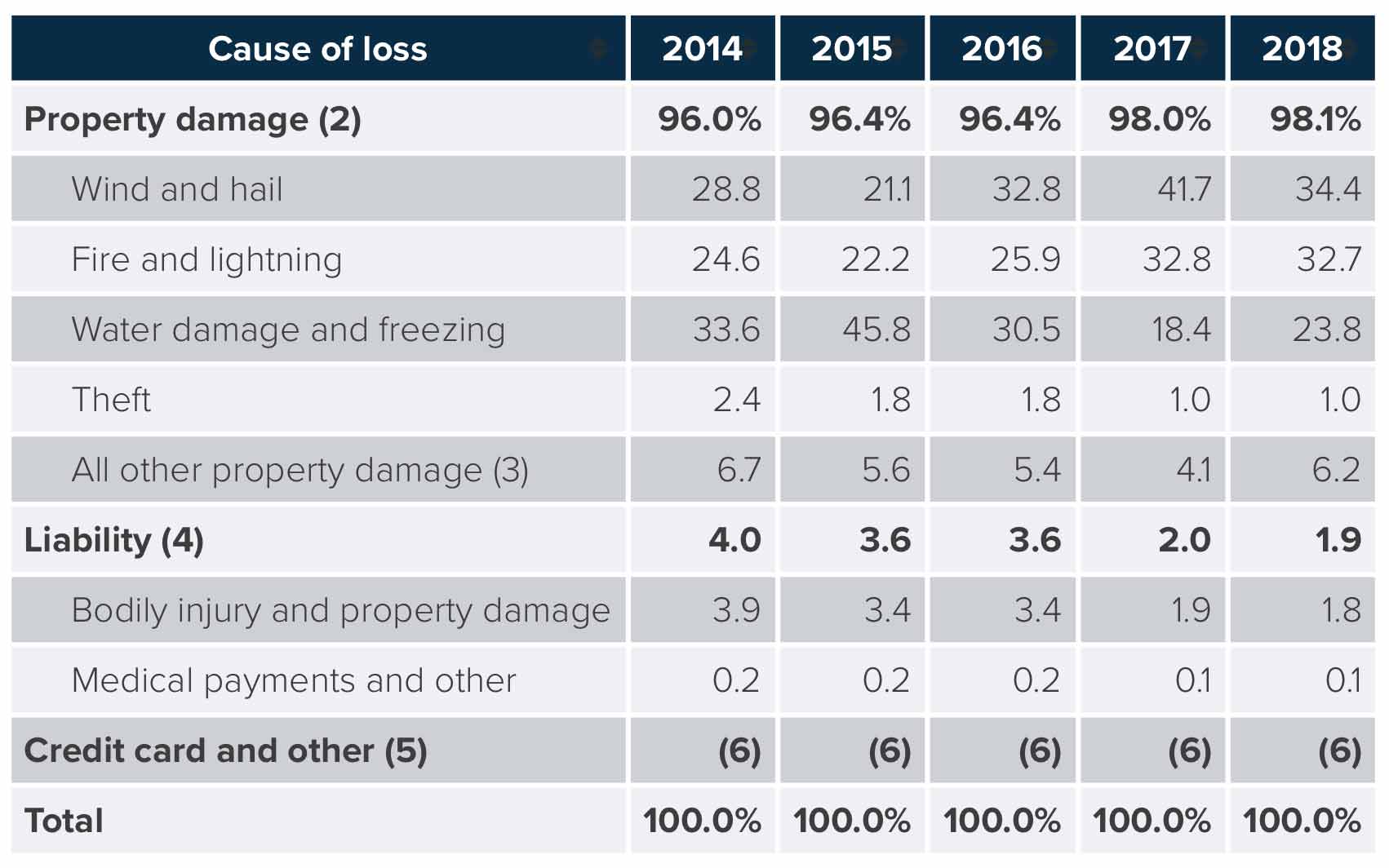

Homeowners Insurance Losses by Cause, 2014 to 2018

Property damage claims were by far the most frequently reported claims for home insurance between 2014 and 2018, with water damage and freezing specifically accounting for 33.6% of all claims in 2014. In 2018, wind and hail claims took the top spot for frequency, accounting for 34.4% of all home claims reported that year. Liability related claims account for less than 4% of total claims each year during the observed period.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting against shared fences smashing your swing set and all other unique incidents, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

iii.org

Statista