How the Right Insurance Helped Victims after Hurricanes Irma and Maria

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

To protect against the worst imaginable disasters, the right insurance is crucial, especially in the case of two back-to-back hurricanes. When Hurricanes Irma and Maria struck the US Virgin Islands and Puerto Rico in 2017, they left behind billions of dollars in property damage and several tragic deaths in their paths. Luckily for the victims of these ruthless storms, important coverages like car and business insurance were able to help them get back on track.

Fortunately for you, an independent insurance agent can easily find the right coverage for your own worst disasters, even if they’re not quite as large-scale as a Category 5 hurricane. But first, here’s a deep dive into Hurricanes Irma and Maria and how insurance played a critical role in helping victims to recover.

What Was the Impact of Hurricanes Irma and Maria?

Irma and Maria were both Category 5 hurricanes that struck the US Virgin Islands and Puerto Rico in September of 2017. Hurricane Irma also made landfall on the continental US, affecting the states of Florida, Georgia, Alabama, Mississippi, South Carolina, and Tennessee.

The storms hit close to one another, with Irma striking on September 6th, and Maria following behind on September 20th, just two weeks later. The impact of this tag team of devastating hurricanes is still felt to this day.

Quick stats about Hurricanes Irma and Maria:

- The 2017 hurricane season cost the US $94 billion in insured losses

- Both storms had wind gusts of up to 178 mph at their centers

- The regions of St. Thomas, St. John, and St. Croix were most severely impacted

- Both storms rank among the most expensive US catastrophes of the past three decades

- Hurricane Maria caused 26 direct deaths and 29 indirect deaths in Puerto Rico

- Hurricane Maria caused 2 direct deaths and 1 indirect death in the US Virgin Islands

- Hurricane Maria’s rainfall is the second highest ever recorded among Puerto Rico’s tropical cyclones, with a peak of 37.9 inches

- Hurricane Irma caused 44 direct deaths and 85 indirect deaths across the Caribbean and southeastern US

- Hurricane Irma’s peak rainfall was estimated to be close to 20 inches

Though Hurricanes Irma and Maria were unquestionably devastating, fortunately the victims were able to receive financial aid through insurance and relief packages.

Hurricanes Irma and Maria Toll on the US Economy and Insurance Industry

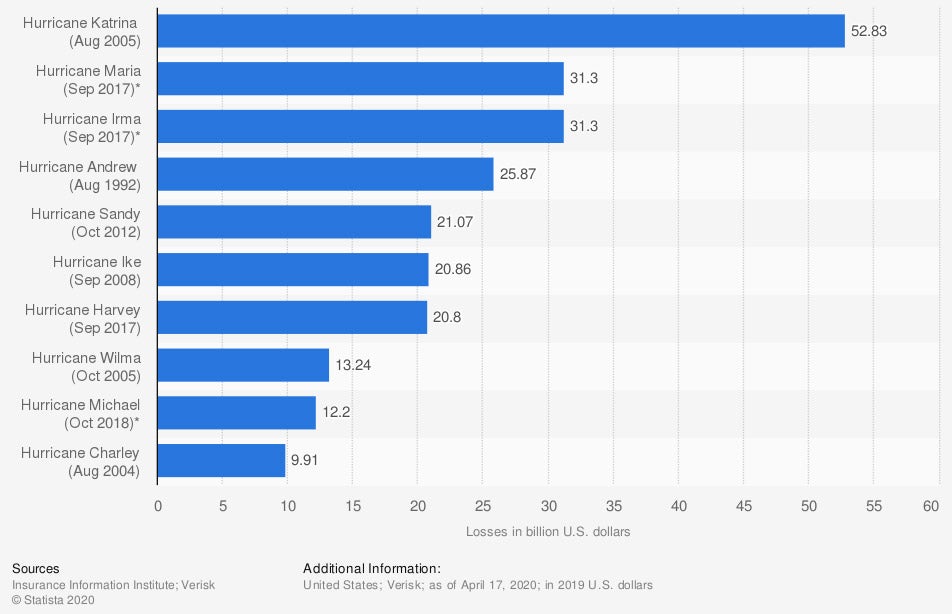

Most Expensive Hurricanes in the United States as of April 2020, by Insured Property Losses (in billion US dollars)

When it comes to the most expensive US hurricanes of all time, Maria and Irma tie for second place, falling behind only Hurricane Katrina. Hurricanes Maria and Irma both cost the insurance industry $31.3 billion in property losses, while Katrina cost $52.83 billion in property losses 12 years earlier, in 2005.

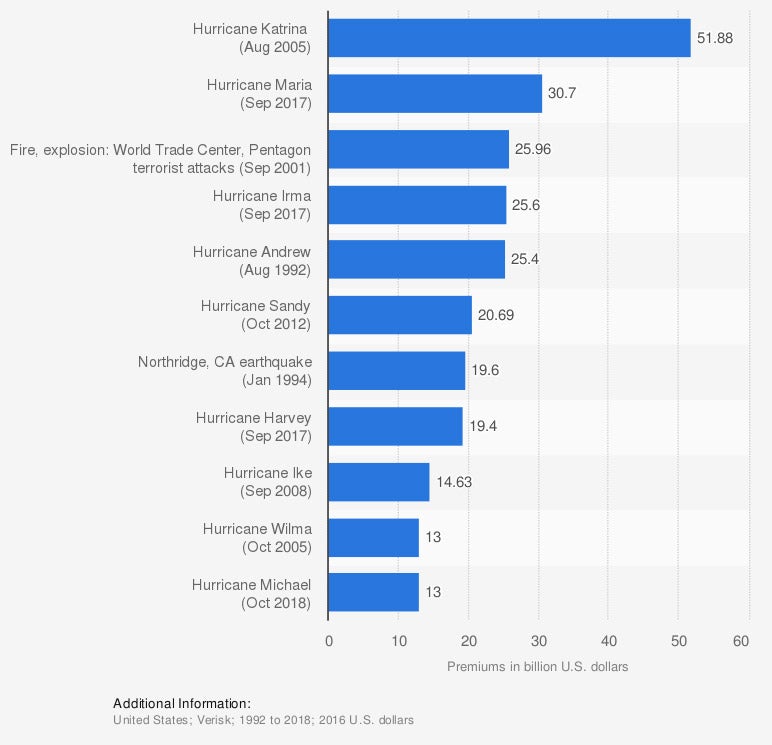

Most Expensive Catastrophes in the United States from 1992 to 2018, by Property Loss (in billion US dollars)

Sources: Insurance Information Institute; Verisk ©Statista 2020

Not only do Maria and Irma rank among the most expensive hurricanes in US history, but also the most expensive catastrophes to plague the nation, period. Once again, Hurricane Katrina claims the top spot, with a total of $51.88 billion in property losses. Hurricane Maria comes in second, with $30.7 billion in property losses. Hurricane Irma places fourth, slightly behind the World Trade Center disaster of 2001, with a reported total of $25.6 billion in property losses.

Who Provided Help to the Victims of Hurricanes Maria and Irma?

The Red Cross awarded $15 million in grants to recovery efforts in the communities hit hardest by Hurricane Irma. The organization provided more than 6,300 damaged or destroyed households with financial assistance, served more than 1.6 million meals to victims in need, and donated more than 1.8 million relief items for victims. Volunteer Florida also raised more than $27.15 million in funding for those impacted by the storm.

Additionally, the Florida Division of Emergency Management allocated $77 million to citrus growers who were impacted by Hurricane Irma. The Foundation for Puerto Rico approved more than $3.2 million in grants for Hurricane Maria victims. One year after Hurricane Maria struck, the Red Cross had raised $71.7 million to help victims by way of donated goods and services. The organization allocated about $42.3 million for other recovery efforts for victims as well.

How Did Property Insurance Help Victims Get Back to Their Lives?

Fortunately, property insurance also helped victims of Hurricanes Maria and Irma to rebuild and get back to their lives. Property insurance coverage provided protection for victims in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered disaster, such as a hurricane. Victims of Hurricanes Maria and Irma were able to rebuild homes that were destroyed by harsh winds from either storm thanks to property insurance.

- Ending homelessness: Many of Maria and Irma’s victims were left temporarily homeless following the hurricanes. Fortunately their property insurance coverage provided the financial assistance necessary to rebuild their homes.

- Replacing personal property: Victims of Hurricanes Maria and Irma were able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. thanks to their insurance. Property insurance typically covers personal property up to 50% to 70% of the insured value of the structure of the home if it’s lost/damaged/destroyed by a hurricane.

- Replacing property stored elsewhere: Property insurance also covered victims’ personal belongings stored off-premises, such as in storage units, following the disaster. Limits on off-premises stored property are sometimes 10% of the total value of personal property coverage, but additional coverage can be added.

- Mending foliage around homes: Property coverage also includes reimbursement for foliage around the home, including trees, plants, and shrubs if they are damaged or destroyed by a hurricane. Limits typically cap at $500 per plant, but coverage amounts can be increased. Victims of Hurricanes Maria and Irma were able to repair their gardens and other foliage surrounding their homes thanks to property insurance.

Hopefully you’ll never have to file a property insurance claim for major hurricane damage, but noting how this coverage helped victims of Hurricanes Irma and Maria helps demonstrate how your policy can protect you from other disasters.

Is Hurricane Coverage Part of Every Homeowners Policy?

Windstorm damage is often included in standard homeowners insurance policies, but there are some exceptions, including for victims of Hurricane Irma. Both storms also brought a lot of heavy rainfall and caused severe flooding. Unfortunately, flood damage is not covered under homeowners insurance, meaning victims would have needed an additional flood insurance policy.

Hurricane Irma and Maria victims needed the following coverages in addition to their homeowners insurance:

- Flood insurance: For those who live in areas known to be at high risk for flooding, their mortgage lenders often require them to purchase flood insurance, so many victims of Hurricanes Irma and Maria may have already had adequate coverage. Flood insurance covers damages to homes and personal property due to flood waters, and is only available through the National Flood Insurance Program (NFIP), which is a part of the Federal Emergency Management Agency (FEMA).

- Windstorm insurance: Certain states prone to heavy winds require homeowners to purchase an additional windstorm insurance policy to protect against hurricanes, cyclones, etc. Unfortunately for victims of Hurricane Irma, Alabama, Florida, Georgia, and South Carolina are among the 19 states required to place mandatory windstorm deductibles on homeowners insurance. Windstorm insurance protects against damage due to heavy winds beyond the limit available in a standard homeowners policy, so victims of Hurricane Irma absolutely needed to rely on this coverage.

If victims of hurricanes Irma and Maria lacked adequate flood and windstorm insurance, they would’ve had to rely on their homeowners insurance’s limitations. Victims would not have been covered if their homes were damaged or destroyed by flood waters, and in areas with the mandatory windstorm deductible, would not have been covered for damages due to heavy winds up to that amount. Victims would’ve been forced to pay these damages out of pocket.

How Did Car Insurance Help Victims to Get Back to Their Lives?

Even more relief was provided to victims of Hurricanes Irma and Maria by their auto insurance. Car insurance helped victims in the following ways:

- Repairs: For victims whose cars were badly damaged by the storms, repairs to their vehicles were covered under the collision section of their auto insurance policies.

- Replacement: Those victims whose cars were completely totaled by the hurricanes were able to obtain new vehicles through the help of their auto insurance.

- Rental cars: While victims awaited repairs on their vehicles, their auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: Victims who sustained injuries were able to be compensated by their auto insurance policy for medical payments while receiving treatment.

While many car insurance claims aren’t filed due to damage caused by major hurricanes, it’s helpful to see exactly how this coverage provided relief for victims of these huge disasters in a myriad of ways.

How Did Business Insurance Help Owners Get Back to Work?

Many victims of Hurricanes Irma and Maria were not only homeowners, but business owners too. Fortunately for them, business insurance provided additional coverage to help reopen their doors.

Business insurance helped victims in the following ways:

- Loss of income: Business insurance includes coverage for lost income suffered during temporary closings due to covered disasters, including hurricanes. Business owners who were victims of Hurricanes Maria and Irma were able to recover lost income thanks to business insurance.

- Property repairs: Business insurance covers damage to or loss of your business’s physical property, including the structure of the business and often the inventory inside of it due to a covered disaster like a hurricane. Maria and Irma victims were able to rely on their business insurance to help them rebuild their businesses from the ground up, repair less major damages, and to recover lost property such as inventory.

- Lost employee wages: Business insurance also helps pay employee wages that are lost while a business is closed due to covered perils like hurricanes. Maria and Irma victims were able to compensate their employees during long shutdowns thanks to business insurance coverage.

Aside from major hurricanes, businesses close for all kinds of reasons. However, seeing all the ways business insurance provided relief to business owners following these major storms shows just how important coverage is for all possible disasters.

Is Everything Back to Normal Now?

Unfortunately for Puerto Rico, recovery efforts after these major hurricanes is moving along at a slow pace, even years later. Though Congress has approved about $42 billion for recovery efforts for Puerto Rico since the hurricanes struck in 2017, FEMA has only green lighted funding for nine of the 10,000 or so damaged structures along the island.

States that were impacted by Hurricane Irma on the US’ mainland have not fully recovered to this day either, including Florida. Many homes that were damaged by the storm had to be demolished and have not been rebuilt. Some residents who lost their jobs were unable to recover them. The Florida Keys, which were impacted hardest by the storm, are still struggling in the tourism industry, which is a critical revenue draw for the area.

Still, many victims have been able to resume life as they knew it before the Category 5 hurricanes struck. Thanks to homeowners, windstorm, and flood insurance, many homes were able to be repaired or rebuilt. Many vehicles were repaired or replaced thanks to auto insurance, and businesses were able to recover lost income and wages and reopen their doors thanks to business insurance.

Here’s How an Independent Insurance Agent Can Help Protect You from Your Own Disasters

You’ll hopefully never encounter disasters as destructive as Hurricanes Irma or Maria, but independent insurance agents can help protect you from your own catastrophes. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

fema.gov

bls.gov

first.bloomberglp.com

redcross.org

citrusindustry.net

foundationforpuertorico.org

usatoday.com

sun-sentinel.com