What Happens if Falling Sky Debris Damages My Garage?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

As a proud homeowner, you’re rightfully concerned about keeping your structure intact. But what happens when a more unusual incident occurs, such as an object falling out of the sky and smashing your garage? Who’s responsible for this mess, anyway?

Fortunately an independent insurance agent can help you consider any and all risks before they ever happen, from the common to the obscure. They’ve seen and handled all kinds of claims when it comes to property damage, and they know how to hook you up with the exact protection you need, long before you ever need it. Here’s how they’d help you get covered against falling objects.

What if Something Falls from the Sky and Damages My Garage?

Though it may seem unlikely or even laughable, objects can and sometimes do fall from the sky and smash into people’s houses. When it comes to larger objects like airplanes and meteorites, the impact could cause severe destruction, including totally wiping out your garage or other sections of your home or property. Fortunately standard homeowners insurance policies provide protection for these incidents.

It’s not just larger objects that are covered either. From space debris to your neighbor’s child’s drone, if an object falls on your home, you’re likely covered under your homeowners insurance. Your independent insurance agent can help further reassure you about any specific object concerns you may have.

Do Homeowners Actually Believe Their Insurance Covers Falling Objects?

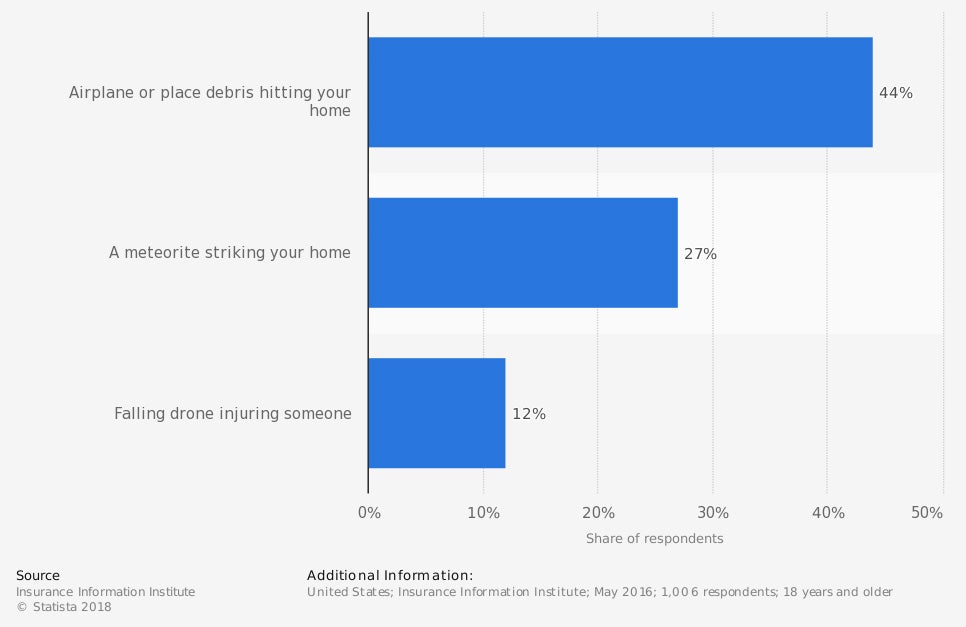

Share of Homeowners Who Correctly Believe That Their Homeowners Insurance Covers Airborne Perils in the United States in 2016

This graph proves that less than half of homeowners surveyed in 2016 believed that their insurance policy provided coverage for falling objects. Only 44% believed homeowners insurance would protect them against airplane or place debris striking their home, 27% believed they’d be protected against impact from a meteorite, and just 12% believed they’d be covered against a rogue drone attack.

As it turns out, the vast majority of homeowners may be happy to learn that their homeowners insurance does provide protection against falling objects of all kinds. Never hesitate to check in with your independent insurance agent about what all is included in your coverage, even if a potential claim may seem particularly strange or unlikely.

How Often Does Weird Stuff Fall out of the Sky?

While you may have never thought your home would be at risk of impact from objects shooting out of the sky, you might be surprised at how often it actually does happen. Check out these stats for random/weird objects falling from the sky:

- More than 200 pieces of “space junk” (e.g., satellites and debris) re-entered Earth’s atmosphere in 2016 alone.

- More than 600 pieces of space debris was sighted in Earth’s atmosphere in 2014.

- An average of 200-400 space objects reenter Earth’s atmosphere annually.

- More objects are being set into orbit each year, which means the risk of future collision back to Earth is continually increasing.

- Asteroids strike the Earth once every 500,000 years, on average.

- The ground is struck by about 6,100 meteors annually.

- About 17 meteors strike the ground daily.

- Boeing received reports of 200 structural parts falling off its airplanes in a five-year span.

- Most plane collisions happen to homes located near airports.

- Homes are more likely to be struck by small/private jets than commercial airliners.

Since the possibility of falling objects is a very real one, it’s a good thing that home insurance policies provide coverage against airborne impact under their property insurance section.

How Does Property Insurance Protect against Falling Objects?

An aspect of standard homeowners insurance policies is property insurance coverage. Property insurance is designed to protect against many perils that can befall a homeowner’s physical property, including the structure of their house and garage and their contents, and often also detached structures like sheds. Falling objects are just one of many perils covered under property insurance.

As a homeowner, you’re responsible for paying your deductible and any amount that exceeds your policy’s limit for the dwelling category of your coverage, which is often 10% of your home’s total value. So, if your home is worth $300,000, damage to your garage by a fallen aircraft may be limited to $30,000. Of course, you can work with your independent insurance agent to increase your coverage limits at any time.

What if Someone Gets Injured by a Falling Object?

Say you were having a barbeque or other get-together in your garage or carport when it got struck by a falling object like an airplane, meteorite, or drone, and one of your guests got injured. Fortunately, your homeowners insurance policy also provides liability protection in the event that they sue you. Your liability coverage pays for attorney, court, and legal fees, as well as medical payments for injuries to a third party on your property by a covered peril, like falling objects.

Are Falling Objects Ever Not Covered?

The short answer is no. Falling objects are a covered peril under standard homeowners policies across the country, under the property damage section of coverage. Independent insurance agents review claims for all kinds of weird objects striking houses each year, including “blue ice,” or the liquid that gets dispelled from airplanes’ lavatory systems mid-flight. So rest assured, no matter how strange (or upsetting) the fallen object incident was, you’re likely to be covered.

How Do Falling Objects Claims Affect Insurance Premiums?

Fortunately, they shouldn’t. Insurance companies do not tend to punish homeowners for submitting claims related to objects falling on and smashing their property. The only time this may be a concern is if you lived near an airport and this type of incident happened to you several times within a short period. At this point, the insurance company may start to view your home as a higher risk, and could decide to hike up your premium or not renew your contract as a result.

Other Common Risks You Should Consider Coverage For

Aside from falling objects, there are plenty of other, much more common, property damage risks that homeowners absolutely need to consider protecting. Fortunately, the following common perils are also covered by under the property damage section of standard homeowners insurance policies:

- Fire

- Theft

- Vandalism

- Building collapse

- Sinkhole collapse

- Automatic sprinkler leakage

- Lightning

- Volcanic action

- Most explosions

- Windstorms/hail

- Accidental fire and resulting smoke damage

- Riot/civil commotion

- Certain types of water/other liquid damage

An independent insurance agent will help to consider all risks unique to your home and ensure that you get set up with all the property damage coverage you could ever need. They’ll also be able to review your specific insurance policy and spot coverage gaps in any areas of concern. If you’re lacking protection in an area, they’ll help to patch those holes.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting your home from falling objects and all other strange incidents, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners and property insurance, deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

popsci.com

avherald.com