Delaware Hotel Insurance

For when your risks are more than just bedbugs.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’re ready to open a hotel in Delaware, where beach lovers and tax-free shoppers alike gather to get away from the real world. But first, you need to get the proper protection for your business, because Delaware’s sandy coast can offer something a little more risky than a sunny beach day.

That’s where our independent insurance agents come in. They’ll break down hotel insurance options, talk about important add-ons, and ultimately make sure you, your property, your guests, and your staff have nothing to worry about other than having an unforgettable experience. Before we do that, let’s learn more about hotel insurance.

What Is Hotel Insurance?

In short, hotel insurance is a set of policies designed to cover all the tricky little components involved in your hotel's operation, from your property (i.e., the building, furniture, etc.) and employees, to services offered, and your guests. Obviously, all hotels offer different amenities and frills (or lack thereof), and your business's unique assortment of risks will demand coverage tailored specifically to you.

What Types of Hotel Businesses Need Insurance?

The easy answer is: all of them. Every business should have its property and employees protected. And in your line of work, dealing with as many customers as you do, it’s extremely important to keep your business going strong. Our independent insurance agents can help all types of hotel businesses, including:

- Premier and full service hotels: These hotels require the most comprehensive insurance packages, due to having such high occupancy spread across several hundred rooms, as well as offering tons of different services and amenities.

- Boutique hotels: With much lower occupancy rates, typically fewer than 100 rooms, and the lack of premier services or amenities (e.g., room service and fitness centers), these hotels carry less risk and don't require quite as much coverage.

- Condo hotels: These high-rise properties consist of rooms typically owned as vacation homes that are rented out for short-term stays. Coverage requirements vary, and are determined by the allotted length of guest stays, how the unit is owned (by an individual or group), and the location of the hotel (which is usually a major city).

- Hotel management companies: Employee benefit strategies that help reduce claim costs and risk management are factors in the coverage needed by these companies.

Top 5 Hotel Insurance Claims in Delaware

When you think of a coastal vacation, Delaware may not be the first place to pop into your mind, but it has more than 350 miles of shoreline to play on. That also means it has 350 miles of potential weather risks for hotels located near the ocean. But even if your hotel is inland, there are still some common insurance claims to be aware of:

- Windstorm damage: Delaware’s coast is small but mighty and susceptible to all the fun storms that come off the ocean.

- Flood damage: Whether it’s slow and steady or flash flooding, much of Delaware is susceptible to flooding.

- Liability claims: Claims extend to all kinds of injuries or property damage, but the most common cases include stolen personal property and minor accidents like slips and falls.

- Data breach: In this digital age, the number of data breach claims is continually rising. Credit card breaches are among the biggest threats for hotel owners today.

- Business interruption: Regardless of a hotel's location, it's always prone to attacks by Mother Nature. No matter what type of natural disaster forces you to temporarily close your doors, you run the risk of losing income during this time.

With the proper coverage in place, however, you can help minimize your risks and protect your hotel from unexpected catastrophes.

What Does Hotel Insurance Cover?

A hotel insurance policy is typically the easiest route to take when it comes to navigating the right coverage for your business. This package offers most of the liability and property coverage you'll need, and your independent insurance agent can hook you up with any additional coverage your business needs, depending on your scope of services.

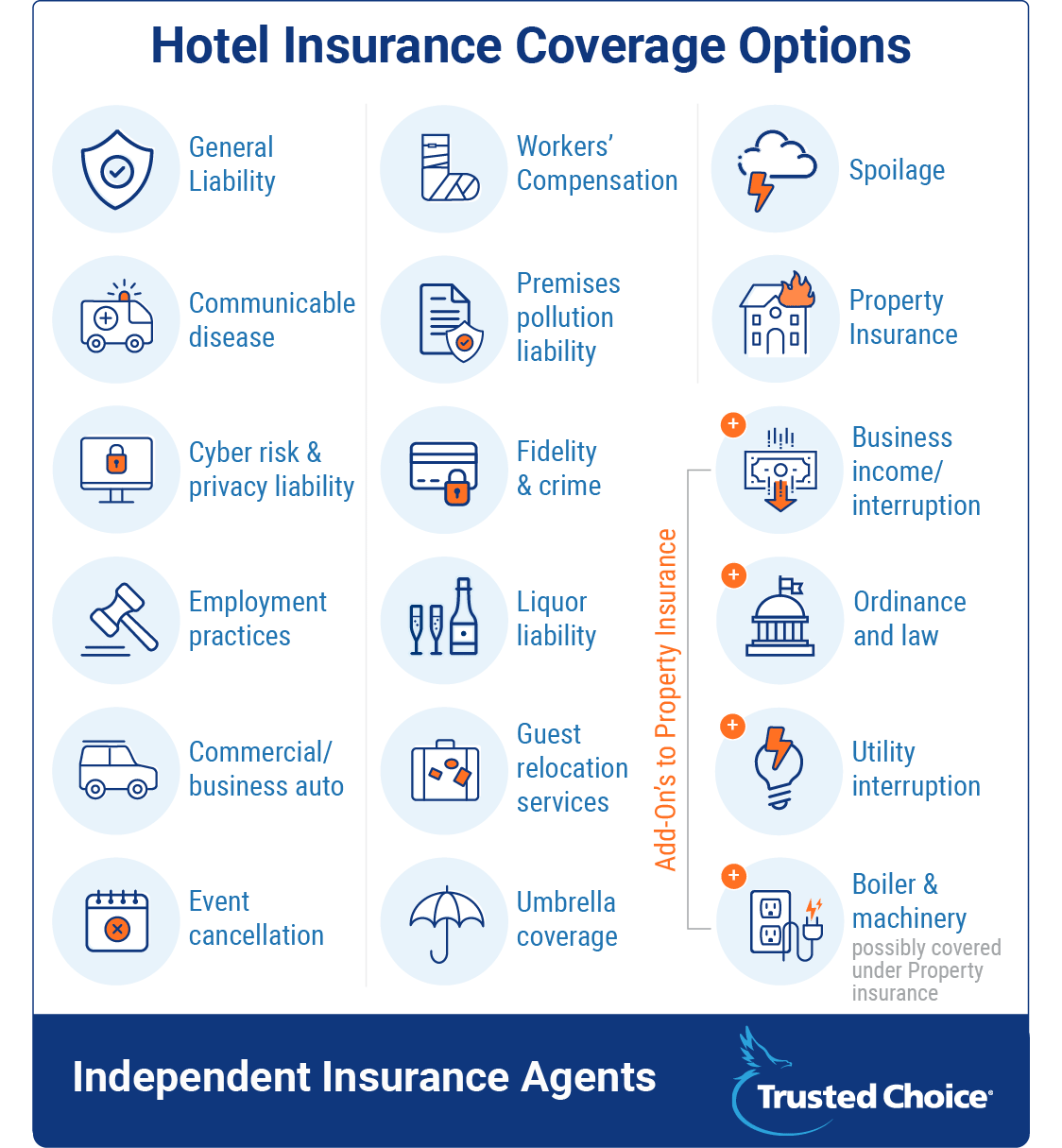

Insurance coverage options for your hotel:

- General liability: This coverage is mandatory and protects against lawsuits related to injury or property damage done by the business. Things like food poisoning claims would also fall under this category. Up to $1 million in coverage per hotel room is recommended.

- Workers' compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in Delaware, as well as most other states.

- Property insurance: This covers any damage to your hotel's physical building, as well as the property inside it (e.g., furniture, carpeting, electronics, décor, etc.) in case of fire, etc. The type of cooking equipment used in your hotel's kitchen will contribute to the risk of fire damage, and may influence the cost of your policy. Coverage limits are typically $250 million per hotel location.

- Business income/interruption: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Flood coverage: Covers your property and any loss of income in the case of flooding.

- Wind coverage: Specifically for coastal hotels in Delaware, wind coverage protects hotels from high wind dangers that come with thunderstorms.

- Ordinance and law: Another part of property insurance, it covers the financial ramifications if your building is found to be behind current state codes. Handicapped-compliant features, fire safety equipment, and emergency exits are all factors here.

- Boiler & machinery: Also known as "equipment breakdown insurance," it covers electric equipment in the building (e.g., AC units, kitchen appliances, computers, etc.) that breaks down due to power surges, etc. Property insurance may cover this stuff, but not always.

- Utility interruption: An add-on to property insurance, this coverage applies to utility outages (e.g., phones, Internet, gas/electric/water, etc.) that cause damage to your property or result in a consequential loss.

- Spoilage: This coverage takes care of the replacement costs of food that spoils due to power outages caused by storms, surges, etc.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of your employees.

- Premises pollution liability: Covers medical bills and cleanup costs if one of your guests becomes ill as a result of exposure to mold or other airborne pollutants.

- Cyber risk & privacy liability: Covers the financial ramifications if your hotel suffers a data breach resulting in the compromise of your guests' personal information. Coverage limits typically run up to $2 million.

- Fidelity & crime: Covers losses due to employee theft, computer fraud, credit card fraud, and stolen/damaged property.

- Employment practices: Covers court fees, should a disgruntled employee file a claim against you.

- Liquor liability: If your employees serve too much alcohol to a customer who ends up harming other guests or your property, general liability won’t protect you. So if you serve alcohol, liquor liability coverage is a must-have.

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters.

- Guest relocation services: Covers fees required in the event that your guests must be relocated due to an on-site incident.

- Event cancellation: Covers the financial ramifications in case a scheduled event must be cancelled.

- Umbrella coverage: This coverage provides a buffer against excess liability charges that reach beyond your existing liability policies' limits. Up to $100 million in this coverage may be added.

Your hotel insurance package will be assembled by selecting the coverages that work for your unique business from a comprehensive list of available options. Coverage limits define the maximum amount an insurance company will pay out for financial losses. Coverage applies to everything from lost business revenue to potential legal/court fees.

How Much Does Hotel Insurance Cost in Delaware?

Short answer? It depends. On a lot. An older inn near the coast might pay around $5,000/year. But a fancy high-rise hotel just a few miles away might pay as much as $1,000,000/year.

To make things even more interesting, if these same two hotels were located just 10 miles further inland, their premiums might drop by half. In another state altogether, further away from the coast, the tiny one might pay $1,200/year, while the big one might pay $150,000/year. Really, it all depends on a (large) number of factors, like:

- The age of the hotel: The older a property is, the more of a risk it is to an insurance company. Newer hotels will get more slack with their premiums. Also, the type of construction, as well as whether the building is up to current state codes, may have been influenced by the time period the hotel was constructed in.

- The location of the hotel: If the hotel is located in a region of the country prone to a certain type of natural disaster, the premium will be much higher. But costs are determined down to the specific community surrounding the hotel (if it's in a safer neighborhood, this will present less risk). Also, every state has marked flood zones in it, and these high-risk areas will have higher premiums.

- The hotel's last update/renovation: The status of the building, as well as its furnishings and security systems, will really influence the cost of coverage. The more up-to-date and up-to-code everything is, the more lenient the cost.

- The number of safety/security features: The more security/safety features a hotel has, the less risk it presents to an insurance company. Hotels with current security systems, as well as safety features like sprinkler systems and handicapped-compliant features, will be favored by an insurance company.

- The age/condition of the roof: Older/more decrepit roofs are a higher risk to the hotel guests and the building itself, and therefore more of a risk to an insurance company.

- The size of the hotel: The square footage of the hotel, as well as the number of rooms, will influence coverage costs. Obviously, more rooms means more guests, which increases liability risk, and therefore means a higher premium.

- If rooms are rented out by other companies: If the hotel has community rooms that get rented out for meetings by other companies, this will increase the liability risk, and therefore costs, as well.

- If there is cooking on the premises: Hotels with kitchens present a risk for fire damage, and hotels with cooking equipment in the guest rooms further increase that risk — by a ton. However, fire safety features in the rooms and kitchen can help to decrease this risk (and cost).

- The parking lot's security: More security features in the hotel's parking lot can reduce the risk of claims filed by guests who experience damage or theft of their vehicles.

- If there is valet parking: Valet parking is another unique feature that increases liability needs, since the guests' vehicles are literally being driven by hotel staff.

- The experience level of the management: Insurance companies are interested in all kinds of details, including how experienced the hotel's managers are. Managers with more extensive training in risk prevention/crisis response can greatly reduce claims made by the property.

- The type/number of recreational features: If a hotel has a pool or a gym, obviously the risk of injury (or even death) increases, creating a need for more coverage.

- If the hotel serves/sells alcohol: If there is alcohol on the premises, liquor liability coverage will be necessary.

- If the hotel has any existing/past claims: Just like with any other type of insurance, if a hotel has any existing/past claims, the cost of coverage will increase.

Top 5 Ways to Score Hotel Insurance Discounts in Delaware

Every business owner loves to save a buck or two wherever they can. And fortunately there are some strategies available that may help you to significantly lower your premium, like:

- Create a risk management action plan: Having a written plan of action to maintain the safety of your staff and guests in the event of an emergency can seriously impress an insurance company. Give your independent insurance agent a copy of the plan before they start hunting for quotes.

- Maintain your roof: Since roofs are among the most costly features of a property to replace, it might not be surprising that they can significantly influence insurance costs. Keep your hotel's roof in the best possible condition to help lower your premium.

- Keep your hotel up-to-date: The age of a hotel is one of the most influential factors when it comes to the cost of hotel insurance. Also, the older your property is, the more prone it becomes to breaking down or creating other hazards. Update your property, furnishings, and security systems (physical and cyber), and make sure that your building is always up to state codes.

- Make safety a priority: The safer your hotel, the less risk there is that a guest will become injured, and therefore, the less risk you will be to an insurance company. Install and maintain all safety equipment (like smoke detectors), keep elevators in working order, provide and label multiple exits, and oversee proper food handling procedures.

- Install a sprinkler system: Since fire damage is one of the top hotel insurance claims, reduce your hotel's risk (and premium cost) by installing an indoor sprinkler system.

Compare Delaware Hotel Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From insurance packages to add-on policies, our wise and helpful independent insurance agents will help you determine which types of coverage make the most sense for you.

Our independent insurance agents stay on top of the industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

https://www.visitdelaware.com/

https://www.preparede.org/natural-hazards/