Hawaii Restaurant Insurance

Get the best insurance policy for your restaurant.

Whether you’re operating a beachfront stand or running one of the largest chain restaurants in the United States and have locations in Hawaii, you need restaurant insurance. And, if you need restaurant insurance, you need an independent insurance agent to lead the way.

Use our independent insurance agents to find the best insurance plan in your area. You tell us what you’re looking for, and our search engine will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Risks in Restaurant Insurance in Hawaii

Of course, no two restaurants are identical. Each comes with its own unique:

- Style of food

- Cooking methods

- Building

- Kitchen equipment

- Personal property, like furniture and décor

- Special property, like a sign

- Staffing needs

This means that what you need for your restaurant will never be the same as any other owner. However, an underwriter will consider all of these factors, along with others, when writing your policy. More importantly, your agent will look at all these factors to give you a range of coverage options from different providers (so you don't have to do it yourself).

Let's start at the top.

Restaurant Insurance Basics in Hawaii

Property Insurance for Your Hawaii Restaurant

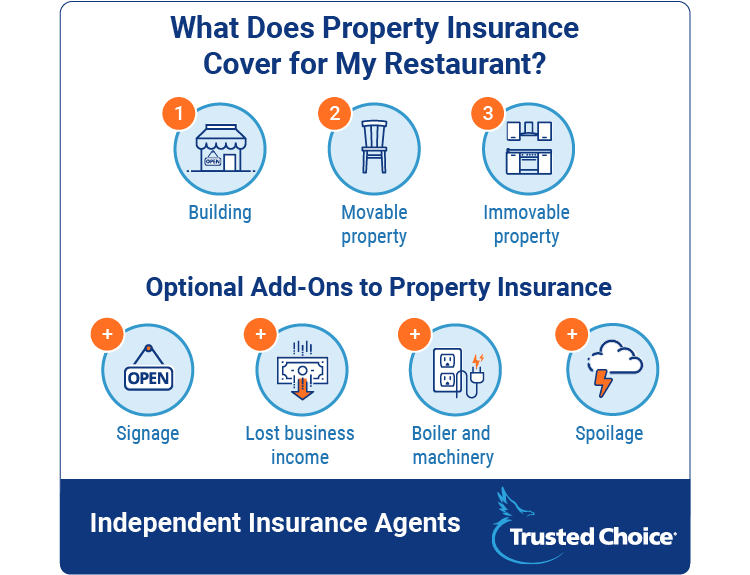

Property insurance protects you if you lose the building or property in the building. A standard property insurance policy on your restaurant will cover the replacement value of:

- The building

- Property in the building that is not nailed down or otherwise secured, like tables and chairs

However, you’re also going to have the equipment – especially in the kitchen – that is secured to the building (i.e., you can’t move it). This property technically isn’t part of the building, nor is it movable property in the restaurant, like a table or chair.

DID YOU KNOW?

When it comes to your restaurant, the most important thing you can do is speak to an independent insurance agent to determine which property is covered under your policy and where you may need additional coverage to protect your restaurant’s priciest and most important investments.

So far, under property insurance you’ve got (1) the building, (2) movable property in the building, and (3) immovable property, often kitchen equipment. However, there are other special types of property insurance that you may not know about.

Here are some of the special coverage options you may want to discuss with your independent insurance agent:

- Signage: Some restaurant signs can cost up to $100,000! Signs aren’t generally covered in a standard insurance policy, so it’s best to cover yours separately. Drive-through signs might also be an investment that you want covered, depending on how much you've spent on them.

- Lost business income: Lost business income goes to the business owner if the restaurant needs to be shut down because of a covered loss. If you have a kitchen fire and are closed for repairs, you’ll receive income to keep your employees and other expenses paid. In fact, some banks require lost business income coverage if you want a loan.

- Equipment (boiler and machinery): This covers physical damage to and financial loss from an equipment breakdown. If there is a failure in the electrical box, causing electrical damage, that damage is covered. If there is damage when the air conditioner goes out, this coverage would pay for that, too.

- Spoilage: Restaurants run on food. When they lose power, food goes bad. Depending on what kind of restaurant you’re running – especially if you’re a seafood restaurant in Hawaii – the cost of what you lose could be substantial. Spoilage coverage takes care of that potential lost money.

Commercial General Liability Insurance for Your Hawaii Restaurant

Commercial general liability insurance covers two basic problems that could arise in restaurants in Hawaii:

- Something that happens to a customer on the premises of the restaurant

- Something that happens to a customer because of an issue with the food you serve

Some common scenarios where you’ll need liability insurance include:

- Slip and fall incidents, if a customer slips on something left on the floor or on a path you left wet or otherwise uncleared.

- Trips in the parking lot, if due to an item or obstacle that you should have prevented.

Commercial general liability insurance typically has a $1 million limit. However, you might find yourself in a situation where you want or need excess coverage, which is something that you’ll figure out by working with your independent insurance agent.

In addition to your general commercial liability policy, you may need additional liability coverage for:

- Liquor-related accidents

- Directors and officers liability

Each of these is important for problems that could arise off the restaurant's premises.

You need liquor liability insurance if you sell, distill, or brew alcohol. The liquor liability policy will cover (1) property damage and (2) bodily injury that arises out of an accident that occurs due to alcohol sold or served at your restaurant. This additional policy typically has a $1 million limit, but some businesses purchase policies up to a $5 million limit. Your independent insurance agent will help you choose the right level of coverage for your Hawaiian restaurant.

Directors and officers liability is another special type of liability insurance that applies if you’re a larger restaurant. This kicks in when there isn’t an injury or damage, but when stockholders, cities, or employees sue the company’s board for a poor corporate decision. This is only necessary for certain circumstances and, as you might guess by this point, an independent insurance agent can help with that, too.

Employee-Related Insurance for Your Hawaii Restaurant

When we’re talking about employee-related insurance for your Hawaiian restaurant, we’re generally referring to workers' compensation. It covers the following when an employee is injured on the job:

- Medical expenses

- Lost wages

- Rehabilitation costs

Workers' compensation is legally required if you’re operating a restaurant in Hawaii. And if you operate a joint with flames, knives, and deep-frying, it's in your best interest to talk to your independent insurance agent about how much workers' compensation you might need. The higher the risk, the higher the premiums.

One other type of employee-related insurance that is not required, but maybe beneficial, is employment practices liability insurance. This insurance covers issues like:

- Bad behavior

- Sexual harassment

- Discrimination

- Hostile work environment

It operates by paying on behalf of the business being sued and would defend the officers of the business being sued. This way, if you ever find your restaurant in the middle of a larger dispute, you won’t have to worry about burdensome litigation costs that might otherwise compromise your day-to-day operations.

How Features of Your Restaurant in Hawaii May Affect Insurance Costs

Do you operate a drive-through window at your restaurant? What about a restaurant with waiters? How about a restaurant that only does carry-out? All of these factors may affect insurance costs and coverage or, at the very least, may bias the underwriter when they assess risk at your location.

Consider the following scenarios and whether they apply to you:

- You operate a seafood buffet: Seafood is huge in Hawaii. If you have a buffet or other type of salad bar arrangement, personal bias might cause an underwriter to increase the cost of insurance because there is more risk in food exposed to all restaurant customers.

- You operate a restaurant with a drive-through window: Drive-up windows don’t change insurance policies much; they have more of an effect on the design and management of your restaurant.

- Waiters: If you have a wait staff at your restaurant, you’ll have more employees than a restaurant without. More employees can increase the cost of employee-related insurance, but won’t change much else.

- Carry-out restaurants: This has the opposite effect of having a wait staff: With fewer employees comes less risk and lower workers' compensation coverage.

- Delivery: Insurance coverage is more cost-effective if your business provides the delivery vehicles, because underwriters can assess risks more easily (and there are fewer risks, for that matter). If your drivers use their own cars, your business must extend liability to cover the cars. And, with so much being unknown about each individual’s personal vehicle (and their condition), this can skyrocket liability coverage.

So what’s all this mean? It means that if you have a buffet and a full wait staff, expect to pay a bit more. If you have a drive-through window, not much will change, if anything. And if you deliver food, you may want to invest in company cars to save yourself the burden of excess liability coverage.

How Operating a Restaurant in Hawaii Changes Your Insurance Coverage

Not a whole lot changes from state to state when it comes to insurance coverage. In fact, state-specific insurance will differ primarily based on the:

- Type of food served

- Manner of cooking

Fresh seafood in Hawaiian restaurants comes with the issues of (1) freshness and (2) spoilage. You could make customers very sick if seafood is not stored properly or is prepared incorrectly. If you’re serving seafood raw, certain health risks and customer-related liability concerns increase even more. This could potentially mean that you pay more, too.

Seafood is often deep-fried. This increases workplace danger since employees are working with hot oil. Sharp knives fit for cutting seafood can increase workplace safety concerns, too. Or, if you have a beachside restaurant and cook over open flames, an underwriter will see that as a risk and will adjust your insurance to cover that.

How Much Is My Restaurant Insurance Going to Cost in Hawaii?

This is the question everyone wants to be answered from the start. However, there is no hard and fast rule or number here.

Generally speaking, costs will be split into:

- Property and liability insurance

- Workers' compensation insurance

Workers' compensation coverage is calculated separately from other insurance because it is calculated according to:

- Payroll (per $100)

- Risk classification (often according to the amount of risk in the kitchen)

Property and liability insurance are priced together.

On the low end, you could pay as little as $1,000 to $1,500 annually for property and general commercial liability coverage. This estimate applies to an operation like a corner taco or hot dog stand. There is low risk, few employees, and little concern that something significant will happen. And, if you’re a one-person stand, your workers' compensation coverage will be very inexpensive because you have virtually no employees.

On the high end, coverage can be astronomical. Do you have multiple locations? Are the walls of your restaurant covered with fancy artwork? If you have a unique property inside, an appraisal is vital to guarantee that if the property is destroyed, you get the proper value. If you operate a restaurant that will be on the high end for insurance costs, custom coverage is vital. More importantly, it’s impossible to approximate what it will cost until you talk to an independent agent.

DID YOU KNOW?

The most important thing to remember with cost is that while it might seem like a lot out of pocket, what you’ll pay for in lack of coverage is greater.

Working with an independent agent is vital to ensure that you’re fairly evaluating your risks, appraising your property, and prepared for any number of scenarios that might be tossed your way.

Talk to an Independent Insurance Agent about Insuring Your Restaurant in Hawaii

For your restaurant in Hawaii you need:

- Property insurance

- General commercial liability insurance

- Employee insurance

When it comes time to evaluate your policy options - independent insurance agents can help. Your agent will put together custom coverage from multiple insurers, giving you options and a cost that works for your restaurant in The Aloha State.