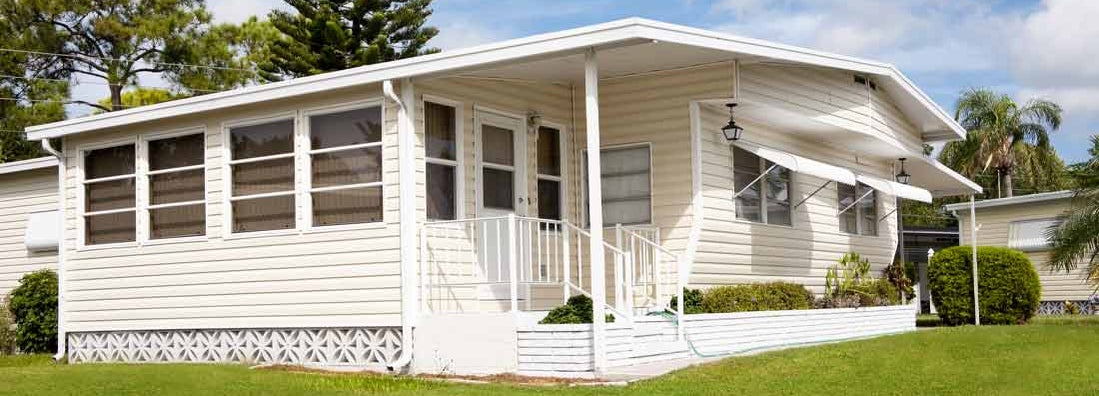

Kansas Mobile Home Insurance

Find the right home insurance policy for you.

As of the most recent U.S. Census, there were 72,953 occupied mobile homes here in the Sunflower State. These homes provide an affordable way for many of Kansas’s citizens to become homeowners, particularly in a faltering economy. A comprehensive mobile home insurance policy can help protect the investment that many residents have made in a mobile or manufactured home. If you are among the 6.4 percent of Kansas residents who own this type of home, comparing manufactured home insurance quotes can enable you to save money by ensuring that you are getting the most affordable policy.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our search engine will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Mean Price of Mobile Homes in Major KS Cities

- Wichita: $49,057

- Overland Park: $114,094

- Kansas City: $92,177

- Topeka: $36,188

- Olathe: $60,389

- Lawrence: $28,279

- Shawnee: $17,619

What Is a Mobile Home Insurance Policy?

Mobile home insurance is a specific type of homeowners insurance policy designed to meet the unique coverage needs and risks faced by owners of manufactured or modular homes. Mobile homes have evolved over the years, and most of the newer ones look much more like traditional homes than trailers.

Companies build manufactured homes in a factory and then transport them by truck in large pieces to their intended permanent location. There they are assembled into a home and anchored to the ground. Although these anchors are quite strong, homes that lack a belowground foundation are more susceptible to wind damage, particularly in the event of a tornado.

Like their traditional home insurance counterparts, mobile home insurance policies also protect residents of Kansas from liability claims, including libel and slander. If a guest suffers injuries on your property because of negligence on your part or if your children or pets cause injuries or property damage to others, your mobile home insurance may provide the necessary compensation to cover medical and repair costs, as well as any court costs and legal fees you may accrue.

Mobile Home Insurance Covers Damage from Kansas Weather

Thanks to "The Wizard of Oz," Kansas is usually the first place people think of when they hear the word “tornado.” Of course, tornadoes are certainly a threat in Kansas, where an average of 5 tornadoes touch down each year.

Inclement weather events such as tornadoes, hail and thunderstorms can cause serious damage to these manufactured homes built with lighter materials because strong winds can cause their anchoring mechanisms to loosen or break.

Another risk faced by mobile homeowners is flood damage. While floods are not an overly common occurrence in this state, they do happen. When floods strike homes built on slabs, the water frequently damages the living areas of the home. This can destroy furniture, expensive electronic equipment and major appliances. Mobile or manufactured home insurance in Kansas does not cover flood damage. The only way to get protection from this type of disaster is by supplementing your policy with a flood insurance policy.

Burglaries per 1,000 Residences in Major KS Cities

- National average: 6.70

- Overland Park: 2.68

- Kansas City: 12.45

- Topeka: 13.46

- Olathe: 2.05

- Lawrence: 5.69

- Shawnee: 2.54

Mobile Home Insurance Covers You Against Property Crimes

The most recent statistics place the national burglary rate at about 6.70 burglaries per every 1,000 residences. Kansas’s overall burglary rate of 6.50 is slightly lower than the average; but in areas such as Kansas City and Topeka, the rate is nearly double. Because your policy will compensate you for losses that result from property crimes, owning a mobile home in a high-crime area is likely to elevate your mobile home insurance rates.

You can protect your home by installing and using deadbolt locks, burglar alarm systems and motion-sensitive lighting. This will significantly decrease your chances of becoming the victim of a home invasion. As an added bonus, these precautions may also earn you lower rates on your mobile home insurance policy through discounts.

If someone burglarizes your home, ensure that you and your family are safe, and then call the police to file a report. You will need a copy of this report, as well as a list of all your stolen property when you contact your mobile home insurance company to file a claim.

How High Are Mobile Home Insurance Quotes in Kansas?

Kansas is among the most expensive states in which to insure a home. Mobile home policies are generally less expensive than traditional home policies because manufactured homes cost much less to rebuild if a catastrophe, such as a tornado, destroys them. The cost of your particular policy will vary according to a number of factors including these:

- The location of your home: Homes in areas of Kansas that have high property-crime rates will cost more to insure.

- The amount of coverage purchased: This includes the amount of insurance purchased for each of the three coverage types:

- Structural coverage

- Contents coverage

- Liability coverage

- Your deductible: As with any insurance policy, the lower your deductible, the higher your premiums will be and vice-versa.

- Your credit score: Many people are surprised to learn that a high credit score can result in reduced insurance rates.

You may also qualify for discounts on your insurance policy if you do the following:

- Combine your mobile home insurance with another policy, such as car or ATV insurance

- Install antitheft devices such as deadbolts and burglar alarms

- Opt for automatic monthly payments directly from your bank account

- Renew your policy after being claims-free for a given amount of time

Different insurance companies will offer different discounts. Be sure to ask about possible discounts every time you request manufactured or mobile home insurance quotes.

Compare a Variety of Mobile Home Insurance Quotes in Kansas

Obtaining a variety of manufactured home insurance quotes in Kansas can often be time-consuming and frustrating. Working with an insurance agent in the Trusted Choice® network can make comparison-shopping much easier. Local agents understand the unique risks faced by members of their Kansas communities and are therefore best equipped to help you obtain a suitable policy that meets both your coverage and budgetary needs.

Find a Trusted Choice independent agent near you to learn more about your mobile home insurance coverage options.