South Dakota Restaurant Insurance

Because restaurants are risky but coverage doesn't have to be.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

South Dakota isn’t typically thought of as a fine dining location. But lucky for you, we’ve got all the confidence in the world that your restaurant is going to change all of that for the better. But before you do anything, let’s talk about insurance. Restaurant insurance in South Dakota, that is.

You see, restaurants are risky. But risk is good, it’ll keep you on your toes. It unfortunately also keeps you on the hook to pay when something goes wrong. With the right insurance, hand-picked by your independent insurance agent, that won’t be a problem.

What Is Restaurant Insurance?

Restaurant insurance is pretty straightforward, but there are a lot of moving parts. The basics are that you need your property, risks, and employees covered. The complications come in because there is general coverage for each of these categories, but there are a lot of specialty policies, depending on your unique circumstances.

An independent agent will help you navigate the general and specialty policies to ensure that you end up with coverage that tackles all of your risks. The best part is that you don't have to do the heavy lifting when it comes to shopping around, either.

What Type of Restaurant Insurance Coverage Do I Need in South Dakota?

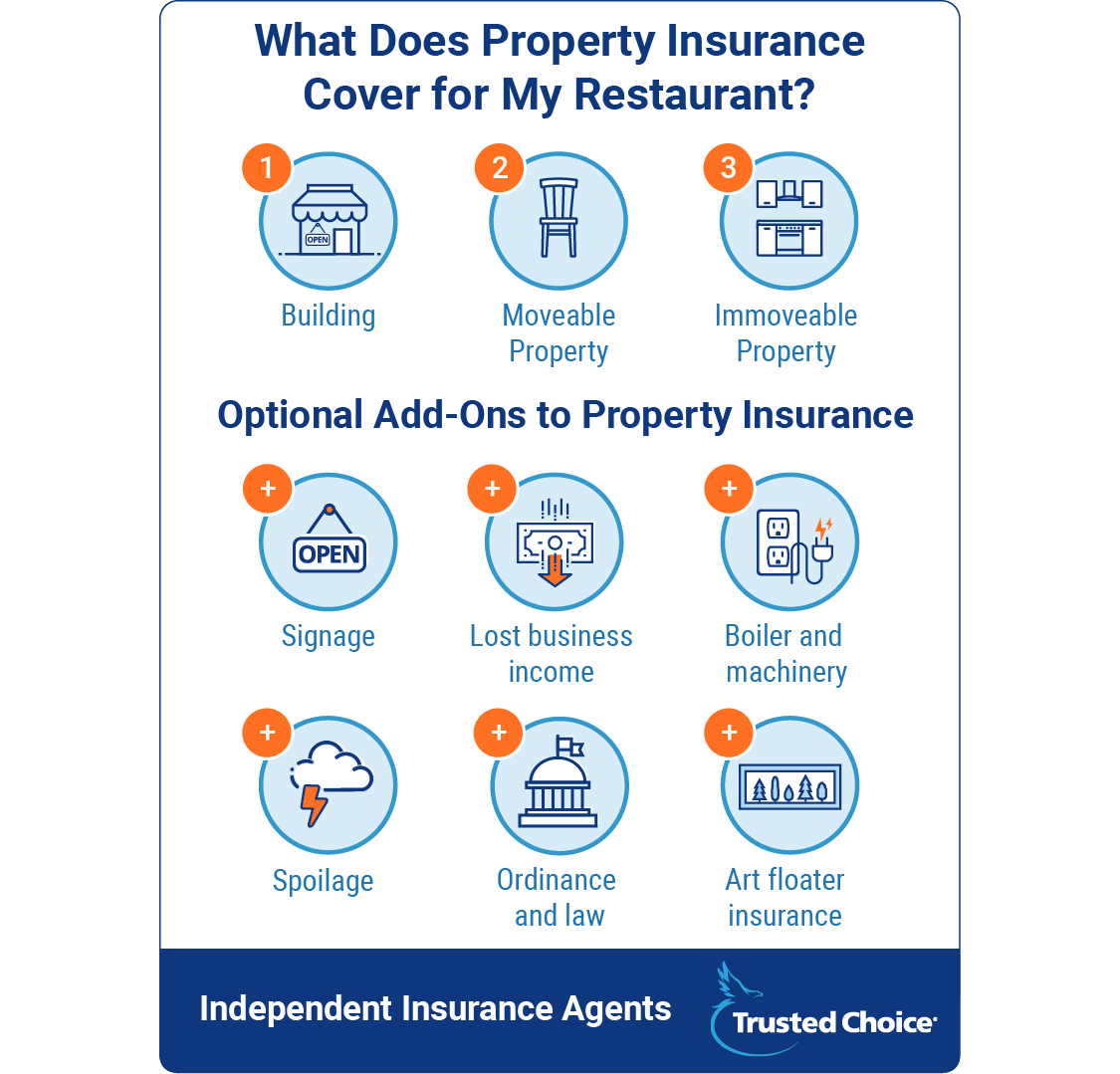

The most basic of all basic types of restaurant insurance is for property. Whether you have a food cart or a building, you’ve got property. And if you happen to be one of those restaurants in a building, a general property policy will cover the building and personal property that you can shuffle around. This means your basic tables, chairs, décor – that kind of stuff. We know you’re smart, so now you’re thinking: What about the stuff that doesn’t move? That’s generally covered under a separate policy.

It’s almost always kitchen equipment, built-in furniture, and anything else you can’t move. But harp on the kitchen equipment part of that – it’s typically what's the most expensive and what you don’t want to leave uncovered. Now all of this property isn't all that's taken into account when it comes to pricing out a policy, either. Think of your kitchen equipment.

If you're cooking over open flames, you'll pay more for property coverage than a restaurant that uses less risky cooking methods. That's because the potential for a fire (i.e., a loss) is much greater. The more risk you bring to the table, the more you'll pay. There’s other property, too. This includes things like:

- Signs: You know that massive sign that you might have sitting out front? How about the one in the drive-thru? Those combined (or separately, in some cases) could cost up to $100,000. Signs aren't covered in your general policy, so you'll need special coverage for them in case either is destroyed because of vandalism, weather, or other causes.

- Spoilage: Food is property, too. And if a refrigerator or freezer goes on the fritz, who are you gonna call? Not Ghostbusters, no. But you should’ve called your independent insurance agent so they could’ve hooked you up with coverage under a spoilage policy for the cost of the food you lost.

- Lost business income: Let’s say there’s a fire. After the stop, drop, and roll part will probably come at least a little while when you need to be shut down to rebuild. And if this is you, lost business income coverage is a game-changer. It pays your bills – including employee wages – while you’re shut down. It could literally save your business. And don't get it twisted: Lost business income can also cover a shutdown if it's because of a natural disaster or other issue.

- Boiler & machinery: You want this because if a piece of equipment breaks down, it could mess up your wiring or plumbing or something else like one of those two things. That can cost a lot to fix, so it’s best for most restaurant owners to just keep it covered.

- Ordinance and law: Ordinance and law coverage applies when you're in violation of state codes. Think about things like handicapped-compliant features, fire safety, and emergency exits. If you have to rebuild at any point or are building your restaurant from the ground up, this coverage applies, too.

Then there’s special value property. This is your fancy artwork or sculptures, and it's called art floater coverage. Basically anything and everything that could be worth a lot of money, but doesn’t seem like it. Get it appraised. Get it appraised now before anything goes wrong. This way, you’ll get the actual value when and if something does go wrong, like vandalism or theft.

South Dakota Restaurant Liability Insurance

General liability coverage is straightforward: If a customer gets sick from the food (i.e., food poisoning or poor preparation), or if they slip and fall because you didn’t shovel snow or left the floor wet, you’re covered for the cost of their injuries. Communicable disease coverage kicks in if an employee's poor hygiene causes a customer to get sick. It's pretty straightforward, and it's a good idea for almost every restaurant to have. Then there’s liquor liability insurance.

If you sell, brew, or distill alcohol, you need this. Because if – or let’s be real - when a customer gets overserved and gets behind the wheel, you’ll be covered for any property damage and bodily injury they cause. Smaller restaurants often buy this kind of coverage more than chain restaurants do. This is because chain restaurants often have stricter serving policies, limiting their liability to begin with. But because general liability won't cover DUI-related issues, this is something you should always discuss with your independent agent.

One last kind of liability coverage you should know about is directors and officers liability. Cities, stockholders, and employees can sue your restaurant when there’s a bad business decision. No damage required – just an apparent bad decision. This type of coverage protects you if you’re on the receiving end of one of these lawsuits.

South Dakota Dram Shop Laws

Most states have dram shop laws, but South Dakota doesn't. In fact, it's one of the few states that doesn't allow dram shop or social host liability lawsuits. As you can imagine, there are still state laws that criminalize serving alcohol to minors.

While it's a Class 1 misdemeanor for an alcohol vendor to sell alcohol to anyone who is "obviously intoxicated," the vendor cannot be civilly liable for injury, death, or property damage caused by the intoxicated person. This is good news for your South Dakota restaurant, and something you should discuss with your independent agent in greater detail.

Workers' Compensation Insurance for South Dakota Restaurants

There are two types of employee insurance you should know about: one that you legally have to buy, and one that you don’t (but maybe should). Workers' compensation is the one you don’t get to choose. All it means is that if an employee gets injured on the job, they’re not paying for what it takes to get better. This means medical bills, lost wages, and rehabilitation costs are all covered.

Now there’s one other type of employee insurance, but it ain’t for employees, it’s for you. It’s called employment practices liability insurance, and it’s the coverage you buy just in case you find yourself on the receiving end of a lawsuit. Whether it’s for sexual harassment or some other type of discrimination, these suits do happen, and if they do, having the legal costs covered could save your business.

More Features to Consider

Now you know there are three types of insurance you generally need for your restaurant. That isn’t the end of the story. After all, you aren’t opening just any cookie-cutter restaurant. You’re opening something unique. And unique features = unique coverage situations. This is the part where you should be grateful you have an independent insurance agent on your side.

Let’s get the simple stuff out of the way, first. Buffets and drive-thrus are basically non-factors. Sure, some underwriters hate buffets. It makes sense: There’s food out in the open, people can touch it, sneeze on it, etc. But all this means is that there’s some serious personal bias that’ll jack up your premium, but only slightly. Drive-thrus also change coverage, but only slightly. You'll need some additional property coverage for the cost of your sign and the pavement you pour for the whole "drive-through" part.

Then there are some factors that actually do affect how much and what kind of coverage you’ll need. First, there's having a dine-in place vs. just carry-out. If you are just serving up carry-out, you have a smaller building, no wait staff (so fewer employees), and less liability because customers aren’t coming in and spending hours at a time at your place. So this means less property insurance, less liability coverage, and less workers' compensation.

Delivery is different, too. Having to insure vehicles means liability coverage goes up. It might go up even more if you just decide that you’ll let your employees drive their own vehicles. After all, these cars have more risk, are more run-down, etc. If you decide to fork over some cash and invest in your own vehicles, sure you’re paying more up front, but the cars won’t cost as much to cover. If you're operating a food truck, you'll need to extend your liability coverage to the truck as well.

How Much Does Restaurant Insurance Cost in South Dakota?

Now you’re probably wondering: What’s all this add up to? You aren’t wrong to wonder. But we have bad news: You’re going to be wondering for quite some time. Well, at least until you talk to your independent insurance agent. Your insurance costs are going to split up two ways:

- Workers' compensation

- Property and liability

Workers' compensation is paid for separately because it’s priced out separately. The calculation is pretty straightforward: (1) it increases per $100 of payroll and (2) it increases depending on your restaurant’s risk classification. Risk classification is fancy insurance talk for the level of risk. It could be high if your kitchen is packed with sharp objects, hot oil, and open flames.

It could be low if there’s minimal food prep going on in the back. Property and liability is a whole different story. The range can be anywhere from $10,000 annually to $100,000 annually. But pick that jaw up off the floor, because you’ll more than likely fall in the middle of these extremes.

The low end is your corner food cart. You won’t have much equipment, it won’t be too dangerous to prepare the food, you probably won’t have many employees, and you can tie up everything in a neat little bow without too much hubbub with extra specialty policies.

This means a food truck or corner stand is the safest and cheapest way to make your way into the restaurant business. The high end ($100,000, or more) is if you’re opening a restaurant with multiple locations. It’s probably dine-in, so you have more employees and more risk of customers being in the building for longer periods of time.

You probably have a fancy sign out in front of each building. You definitely serve alcohol, so you need that liquor liability insurance. And maybe you even have some special value property (let’s just hope you took our advice and got it appraised).

This is risky and expensive, but it can pay off in the long run. Again, you probably aren’t a food cart, nor are you opening a restaurant that’s going to be a multi-location hit right off the bat. So when you want a more accurate idea of cost, turn to your independent insurance agent. We promise you’re better off getting the details from him.

Independent Insurance Agents in SD Can Help

You just got a crash course in South Dakota restaurant insurance. But that doesn’t mean that you’re going to piece together a policy for yourself. Instead, it means that you’re going to call your independent insurance agent and figure out a plan. So go ahead…make that call. Seriously, it’s about time that you had someone do the heavy lifting for you to find a policy that works at a price that makes sense for your bottom line.