Texas Restaurant Insurance

(Don't work alone to insure your Lone Star State restaurant.)

Texas: The Lone Star State. Full of barbeque and bright dreams and lots of tasty restaurants serving up both. And if you’re about to do the same, isn’t it about time you spoke to an independent insurance agent about your restaurant insurance?

An insurance agent will tell you what you need, what you don’t, and will make finding the right restaurant insurance stress-free.

What Is Restaurant Insurance?

Restaurant insurance covers all of your restaurant's property and liabilities. It's coverage for the building, what's inside, what's around the building, risks to customers (like accidents and food-related illness), and employees, too.

As you can imagine, there are a lot of moving parts to this kind of insurance. More specifically, there's general coverage, but then a lot of specialty policies to fill in the cracks. Getting help to navigate all of this is important - that's where your independent agent comes in handy.

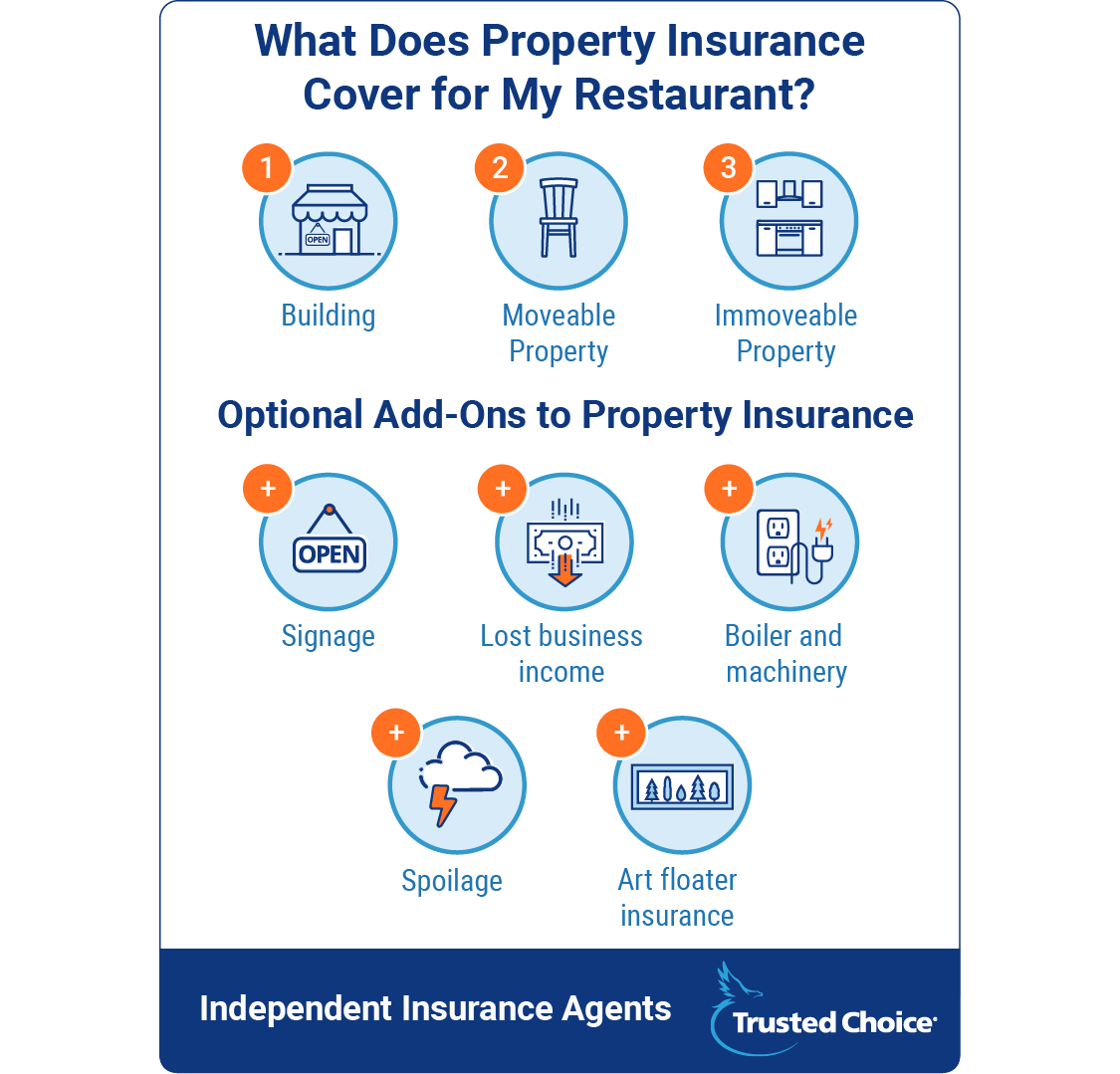

Coverage Starts with Property

First, the basics. You know you have property. This includes literal property in the real-estate-y sense, along with all of the stuff you put inside your building. But there are two types of property you put in your building: the stuff you can move and the stuff you can’t move. Your general property coverage only takes care of what you can move (tables, chairs, stuff like that).

Okay, so now you’re wondering, "What about the stuff I can’t move?" This is your heavy-duty kitchen equipment or even some built-in furniture. This is typically covered separately, but you should ask your independent insurance agent about that, too.

Pause here. The cost of your general property insurance isn't going to just depend on your building and the property you put inside it. In fact, risk comes into play, too. This makes sense because more risk makes it more likely that there'll be an accident and you'll file a claim. If you have a lot of dangerous cooking equipment, an accident is more likely. This means your coverage would cost more.

But wait, there’s more in terms of property coverage. Here are some additional policies you're practically guaranteed to need:

- Sign: Are you one of those restaurants with a big flashy sign out front? How about a drive-thru? Do you have another sign there? If you have any signs, you probably know that big flashy sign cost you tens of thousands of dollars. If you want that covered in case it's vandalized or destroyed by an accident or the weather, you need additional coverage for that.

- Spoilage: Food is technically property, too. And just think: If a freezer or refrigerator stops working, all that food will go to waste. Spoilage coverage means you get paid for the cost of the food you lose.

- Lost business income: If you’re ever shut down because of a natural disaster or some sort of fire, lost business income pays your expenses, including employee salaries.

- Equipment (boiler and machinery): Equipment coverage is a bit more counterintuitive than it sounds. It covers damage to internal systems caused by equipment failure. So it won’t fix the equipment itself, but it will fix damage to wiring, plumbing – that sort of stuff.

- Art floater coverage: If you have special value property, like artwork, you need an additional policy for that. Getting the artwork appraised, and covered, is the only way you'll get the actual value if it is stolen or vandalized.

Hurricane Property Coverage

Note that Texas is sometimes on the receiving end of hurricane-type weather, too. General property coverage often doesn't extend to hurricane damage. This means you should talk to your independent agent about adding a hurricane policy, and how much coverage you might want to purchase.

Next, Cover Customer Liability

Customer liability is next. Liability is fancy legal-speak for risk. There’s risk when customers come to your restaurant because they might eat something that makes them sick or slip and fall on your property. Your general liability insurance will tackle both situations.

One of the most common types of liability policies is a communicable disease. It kicks in when your employee doesn't take the "wash your hands before returning to work" sign seriously and makes a customer sick.

Liquor liability is a specialty policy that almost every restaurant needs. That’s because most restaurants sell, distill, or brew alcohol. And if you do, you need this coverage. It’ll pay for the overserved customer who gets behind the wheel and causes property damage and bodily injury. Remember, general liability coverage will not pay for DUI-related incidents. Liquor liability is also more common for smaller restaurants because larger establishments have stricter serving policies to limit their risk. Regardless, it's important that you discuss liquor liability with your independent agent.

Another type of liability coverage is directors and officers liability. This may sound complicated, but the idea behind it is simple. Employees, shareholders, and cities can bring lawsuits against companies – restaurants included – for bad business decisions. This could mean literally anything, and there doesn’t need to be any damage. The bright side is that this policy covers the cost of the lawsuit. The brighter side is that if you don’t know whether you need this coverage, your independent insurance agent will.

Texas Dram Shop Laws

Texas falls squarely in the majority of states that have dram shop law coverage. This means that if you serve a minor or someone who is visibly or obviously intoxicated, you are liable to a third party who is injured by that intoxicated customer (or on the receiving end of property damage, too).

Specifically, a person bringing a claim in Texas must show that the restaurant was more than 50% responsible for the third party's injuries to recover. Thus, your restaurant won't be automatically liable, and you'll only be liable for the proportion of responsibility the jury assigns.

This is why liquor liability coverage is important, and a topic you shouldn't shy away from when you're talking to your independent insurance agent.

Cover Your Employees with Workers' Compensation Insurance

If you’re opening a restaurant in Texas, there’s one benefit to doing so: no legally required workers' compensation coverage. Texas is literally the only state where this is the case. However, that doesn’t mean you shouldn’t get covered.

If you opt for coverage, the law sets limits on compensation that an employee injured on the job can receive. If you don’t provide any coverage, an injured employee can sue for personal injury and the costs could be unlimited. We’ll let you think that one over…but you should probably talk to your independent insurance agent about it, too.

The other type of employee-related coverage is employment practices liability insurance. This is the insurance that kicks in when an employee sues your company. It could be for sexual harassment. It could be for discrimination. It could really be for anything. And note that these suits can be dragged out at times. So if yours ever is, you can have peace of mind knowing that you’re covered.

Special Coverage Features

Features can make a big difference in coverage. The reason is that features could affect the property you own, customer risk, or even the number of employees you have. Now, that’s not to say that every single feature will affect coverage. But it should tell you that you should think about these things before, during, and even after you speak with your independent insurance agent.

Let’s eliminate the stuff that doesn’t matter much, first. One thing that will make no difference in coverage is whether you have a drive-thru. If you want one, go for it. All you'll pay is a bit extra in property coverage for the pavement and the sign. Buffets are another thing that shouldn’t affect coverage, but sometimes can. This is only because some underwriters are scared of too many hands on the food and the passing sneeze affecting customers getting sick.

Then there are the factors that actually affect insurance coverage. The most pronounced is whether you’re a dine-in restaurant or you only offer carry-out. Dine-in restaurants require more coverage because you’ve got more employees (to wait the tables), more risk (because customers are staying on your restaurant’s premises for longer), and more property (because you need a big dining room and furniture to put in it).

The opposite is true if you’re a carry-out restaurant. You don’t need as big of a restaurant or as much property, and won’t have customers sitting on your restaurant’s premises for hours at a time.

Then there’s delivery. Delivery affects your liability coverage because you have to insure the vehicles. The catch is that if you allow your employees to use their own vehicles, it’ll probably cost you more in coverage. After all, delivery vehicles are hardly ever the newest cars on the block.

If you invest more up front and get the cars yourself, you’ll save on the insurance front. It’s up to you – and probably your independent agent – to decide which is better. Additionally, if you're in the food truck business (or are about to get in it), you'll need this type of liability coverage for the truck.

How Much Does Restaurant Insurance Cost in Texas?

You probably came to this article looking for cost. We can kind of give you an answer. Well, sort of anyway.

We can tell you this. Costs are broken up two ways – (1) workers' compensation and (2) property and liability coverage. Again, this is if you choose to pay for workers' compensation insurance.

Property and liability will vary depending on the kind of restaurant you have, your features, and more. So the short version is that we can’t give you an answer as to what this is going to cost you. But we can give you a range and some facts so you can price yours out a bit better.

On the low end, restaurant insurance in Texas could cost you as little as $10,000 annually. This is if you’re working a food cart or truck or corner stand. You’ll have very little property, there’s little risk in cooking up hot dogs or serving tacos, and you won’t have many employees. This means that if you're looking for a safe bet that doesn't cost a fortune, this is probably the way to go.

On the high end, restaurant insurance in Texas could cost $100,000 or more annually. This high figure is more likely if you're opening a chain restaurant that is dine-in and you have lots of employees, lots of property, and lots of risk. The larger the restaurant, the more likely it is that you'll need specialty policies, too. This could be anything from sign coverage to building and ordinance and liquor liability, among others.

Chances are, your restaurant will fall in the middle somewhere. And lucky for you, your independent insurance agent will know what that looks like for you.

Get Covered with an Independent Insurance Agent

Your independent insurance agent is the best resource you have to get covered. They’ll make sure your Lone Star State restaurant has everything you need to keep your risks under control and get you covered, too. Better yet, they'll do the heavy lifting so you have none of the guesswork and can get covered quickly and efficiently.

Call your independent insurance agent to get the ball rolling. Trust us, you'll be glad you did.