Senior Life Insurance

(What do you want to leave behind — debt, or not a single worry in the world?)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

The end of your life should be a celebration of your journey — a chance to share unforgettable memories and stories of your wild teenage antics. It shouldn’t be spent worrying about who’s going to cover the funeral home tab or handle the debts you left behind.

That’s what life insurance is for. But if you’re a senior without any existing life insurance, getting some can be trickier than you may think at your age.

Fortunately, our independent insurance agents are here to eliminate the hassle of searching for good senior life insurance policy options on your own. They’ll walk you through a hand-picked selection of top insurance policies that best serve your goals. But first, let’s talk more about the protection you need and why you need it.

What Life Insurance Options Do Seniors Have?

Life insurance for seniors is typically a term life insurance policy designed to cover expenses that arise at the end of life, if you don't have any/enough existing life insurance when that time comes.

In exchange for you paying your insurance company a premium, they'll pay out a death benefit (the amount you select) after you pass. The most commonly purchased benefit amounts are $5,000, $10,000, and $20,000.

What's the Difference Between Senior Life Insurance Options and Whole Life Insurance?

Whole life insurance is typically purchased at a young age and kept for your whole life (get it?). Senior life insurance is a type of term life insurance, meaning that you have coverage for as long as you pay the premium.

You'll stop paying it at the time of death, and the insurance company will pay out the death benefit to your designated beneficiary — any person you choose.

The specific focus of life insurance for seniors is to cover costs for your funeral, whereas whole life insurance is typically set up to provide future financial security for your kids, or to cover a mortgage.

Funerals typically cost between $8,000 and $10,000, according to the National Funeral Directors Association, which is why $10,000 is the most popular benefit amount chosen. If you're looking to cover funeral costs and additional expenses (such as probate), you might opt for $20,000 or even $25,000 in coverage.

Why Do I Need Life Insurance?

In order to decide what kind of life insurance is best for you, you first need to know what you need it for. Many seniors already have their houses paid off and their kids have already been through college, so tuition costs and mortgages are no longer concerns.

But maybe you're looking to replace the group life insurance policy from a previous job after retirement, or you're concerned about your grandchildren's education.

Before checking into insurance policies, take stock of what expenses you're looking to cover. After you're clear on your specific needs, an independent insurance agent can help you find the exact coverage that's right for you. You can also do some research using our list of the best insurance companies for seniors.

What Other Options Do Seniors Have?

A term life insurance policy designed for seniors is helpful to many, but it might not be the route that's right for you. Your independent insurance agent will be able to help you tackle this decision, but here are a couple of specific situations in which a term policy might not make sense for you:

- You just need the money to cover funeral/burial expenses. In this case, you might want to look into a funeral expense insurance policy, instead.

- You're in good health and want a life insurance policy that you can withdraw or borrow from when you need it. In this case, a whole life insurance policy would be best.

- You already have sufficient life insurance coverage or plenty of life savings.

- You have an interest-bearing or high-yield savings account that sufficiently covers your current expenses and will continue to cover potential upcoming expenses.

- You have no financial dependents and have already set aside enough money for your personal expenses, including your funeral.

Is an Annuity Right for Me?

Another common option for seniors, an annuity, is a contract between you and an insurance company designed to cover your specific goals. Annuities are a popular option because of the amount of flexibility they afford.

Premiums are required, but you can design yours to be paid either in a single lump sum up front, or in a series of payments, depending on the type you get.

DID YOU KNOW?

Annuities allow you to set up your investment in a way that works well for you.

They can be set up to pay out at a designated time, so if a child tragically loses their parents, they can receive the payout at the time when it's needed to cover their college tuition. This kind of strategy would most likely benefit the child more than receiving the payout up front.

After you pass, the designated beneficiary can remain on the same payment schedule you had set up, or they can change it. So the flexibility not only benefits the person paying for the annuity, but also the person they ultimately want to receive the cash in the end. Your independent insurance agent can talk to you about all the different options available.

How Do I Qualify For Senior Life Insurance?

While there's no minimum age requirement to get coverage, term life insurance for seniors is usually marketed to those 60 and over. Age 50 is probably too young to look into senior life insurance, but the older you get, the more important having coverage becomes.

Also, there aren't as many restrictions for getting coverage as there are with whole life insurance, as we'll look into next.

Can I Qualify for Coverage If I Have an Existing Health Condition?

Yes, you can, and unlike with whole life insurance, you don't have to take a medical exam before being granted coverage. The insurance company will ask the basics like your age and weight, but they won't go into as much detail as they would for other forms of life insurance. (That being said, don't lie on your application . . . it'll come back to haunt you.)

Insurance companies want this coverage to be available to a lot of people, and for it to be affordable. Which brings us to our next point.

How Much Does Senior Life Insurance Cost?

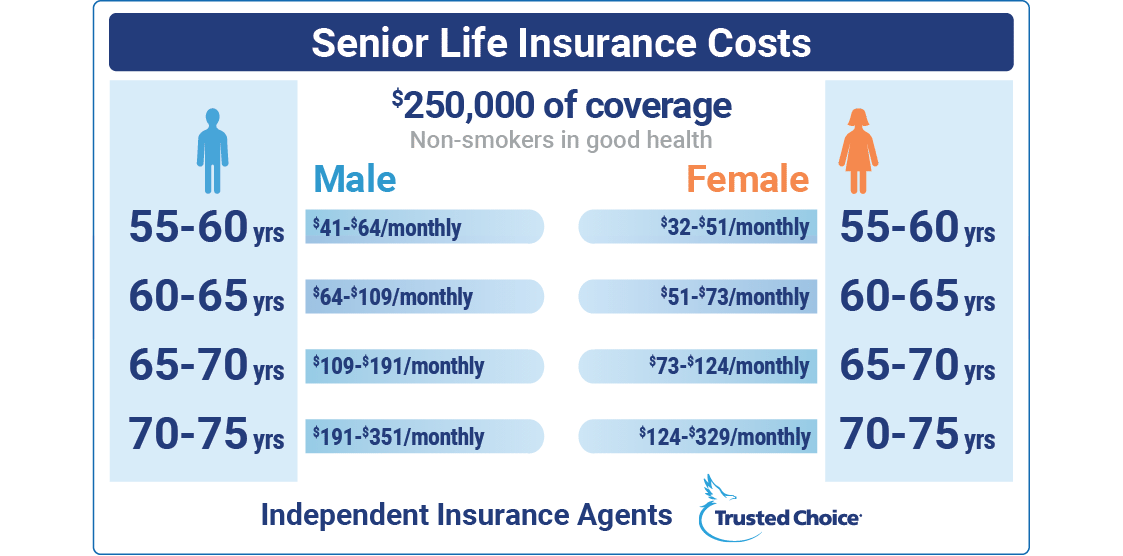

The cost of senior life insurance mostly depends on how much coverage you want and your age. The range tends to start at the low end of less than $10/month for younger folks who only want $25,000 worth of coverage. Here are some examples for $250,000 of coverage:

Is Senior Life Insurance Worth the Cost?

Depending on your needs, coverage can be absolutely worth it, and it's a good solution to a common problem seniors often run into -- not having any/enough life insurance near the end of their lives.

Coverage is pretty affordable, and it's a conscientious way to look out for your family ahead of time, so they won't be left picking up your final tab after you're gone.

What's So Great about Independent Insurance Agents?

Insurance policies can be complicated and written in language that even Merriam and Webster wouldn’t understand. Not to mention, the process of browsing through available options is unlikely to be high on your list of exciting activities for an upcoming weekend. Independent insurance agents were born to simplify the process.

They’re here to make sure you get the absolute best deal, and the one that meets your unique needs. They shop and compare insurance quotes for you, and they'll break down all the jargon so that you understand exactly what you're getting.

Finding and Comparing Life Insurance Quotes For Seniors

Our infinitely awesome and all-knowing agents will review your needs and help you evaluate which type of senior life insurance makes the most sense for you. They'll also compare policies and quotes from multiple insurance companies to make sure you have the best protection out there. They'll hook you up — in a comprehensive and affordable way.