How to Purchase Long-Term Care Insurance

(Long-term care insurance is essential coverage that ensures your golden years can stay truly golden, and here's the simplest way to get it)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Have you ever worried about what would happen if you needed to enter a nursing home or assisted living facility? How would you afford it? If so, you’re not alone. As Americans age, long-term care is more necessary than ever. Long-term care insurance ensures you’ll be able to pay for it.

This step-by-step guide cuts through the long-term care insurance jargon so you can shop confidently. Once you’re ready to buy, independent insurance agents are here to make the process even easier. They’re experts who specialize in helping you find the right coverage at the right price.

What Is Long-Term Care Insurance?

Long-term care insurance pays for long-term care (three months or more) if you ever need it. The most common long-term care includes stays in nursing homes, but some policies may also cover the costs of a home health aide, assisted living, or other professional long-term care arrangement.

Each insurance company does long-term care insurance a little differently. There’s a lot of variation in what these policies cost, what they cover, and when they can be used. An independent insurance agent can help you shop around between companies.

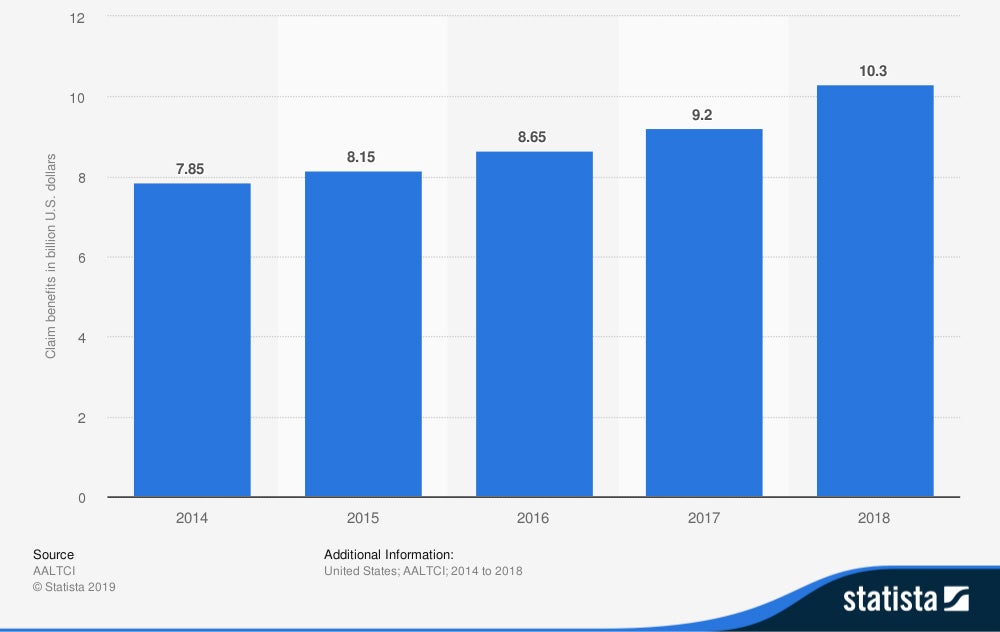

Amount paid in claim benefits to individuals by long-term care (LTC) insurance companies in the United States from 2014 to 2018 (in billion U.S. dollars)

Long-term care insurance companies paid out over 10 billion in benefits to their customers in 2018 alone. The cost of long-term care is rising, making long-term care insurance an important way to secure your retirement.

What Is Long-Term Care?

Long-term care means help with day-to-day tasks and medical care received over the course of three months or more. This includes tasks like:

- Shopping

- Cooking and cleaning

- Taking medications

- Getting to and from appointments

- Bathing and getting dressed

Long-term care can come from friends and family or from professional sources like nursing homes, assisted living facilities, and home health aides. Long-term care insurance covers the cost of professional care.

The rising percentage cost of long-term care

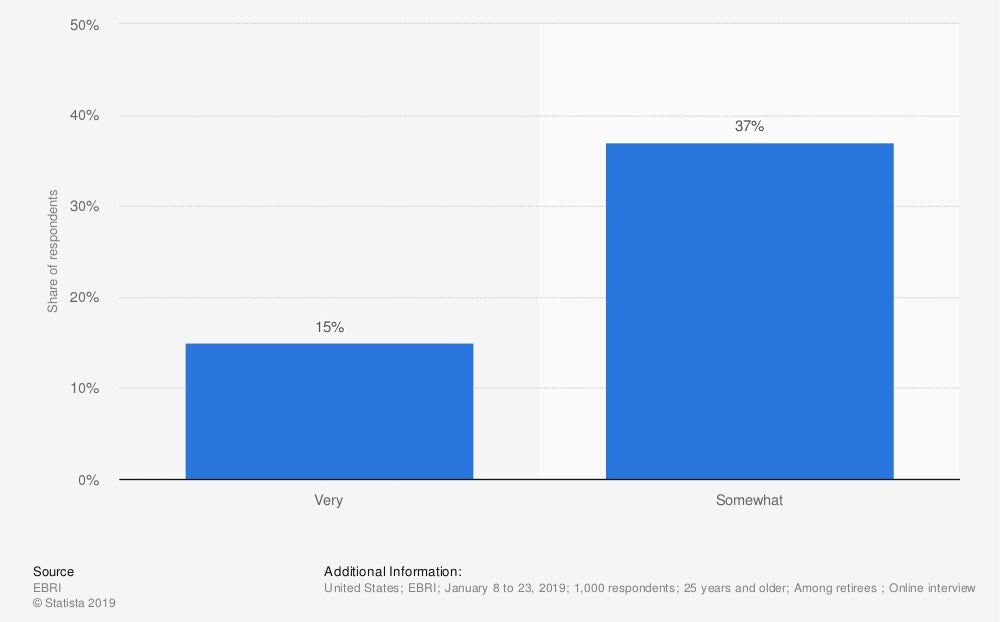

As of 2019, only 15% of retirees were “very” confident they could afford long-term care, with 37% being “somewhat” confident. That means nearly half of retirees aren’t confident about whether or not they would be able to pay for long-term care if they needed it.

Even the people who are confident they’ll be able to afford it might not be planning for the correct cost. A recent study found that more than half of Americans over 40 underestimated the average cost of one month of nursing home care ($7,000 in 2017).

Medicaid and Medicare do cover some of these long-term care costs, but it adds up to less than you might think:

- Medicare only covers the medical costs of long-term care which excludes important help with day-to-day tasks like shopping and cleaning.

- Medicaid only covers certain facilities and services and may cut off coverage after a certain number of days or months.

For all these reasons, long-term care insurance is the best way to ensure that you’ll be able to afford long-term care if you ever need it.

Who Needs Long-Term Care Insurance?

Everyone can benefit from at least considering long-term care insurance since it’s estimated that nearly 70% of today’s 65-year-olds will need long-term care.

Long-term care insurance is especially important for:

- Women: Who spend more time in long-term care than men do on average (3.7 years compared to 2.2 years)

- The middle class: Who likely do not have the savings to cover long-term care themselves (and whose family and friends may not have the resources either)

- People aged 40-65: Who are likely to be planning for retirement but not necessarily in imminent need of long-term care (meaning their premiums will be lower)

What Is the Cost of Long-Term Care Insurance?

Long-term care insurance typically costs between $1,000-$10,000 per year in premiums. Three major things affect that cost: how old you are, the amount of coverage you would like, and where you live.

- The younger you are, the cheaper it is.

- Picking a policy that has a lower daily benefit (maximum amount of coverage per day) lowers your premiums but reduces your coverage.

- The cost of long-term care varies widely from state to state. If you live in a state with more expensive care, your premiums will likely be higher than for people in other states.

For people in their 70s or older, the cost of long-term care insurance can soar well above $10,000. The earlier you can purchase long-term care insurance the better.

The perfect window to buy long-term care insurance is between 40 to 65 years old. That’s when you’re old enough to be firming up retirement plans but young enough to still get affordable coverage.

Some companies offer discounts if you buy long-term care insurance as a couple instead of individually. If you and your spouse both want long-term care insurance, try shopping jointly to save money.

The Difference between Traditional and Hybrid Long-Term Care Insurance

There are two main types of long-term care insurance: traditional and hybrid. Which one you choose affects both your premiums and your benefits.

- Traditional long-term care insurance is a stand-alone insurance product. It’s paid for separately and will go into effect separately from any other life insurance or disability insurance you buy.

- Hybrid long-term care insurance is part of a life insurance and/or annuities policy. If you don’t need long-term care, then the benefit will pay out upon your death or in annuities. If you do need long-term care, then this policy can pay for that instead.

Hybrid long-term care insurance is popular because it tends to be more cost-effective and flexible than traditional long-term care insurance. Hybrid policies guarantee you a benefit whether or not you ever need long-term care, so you’re hedging your bets by buying it.

Hybrid policies can also make more efficient use of your premiums than traditional policies can, which means you get more benefit for less money. Here’s how hybrid policies typically work:

- You pay premiums toward a death benefit, say $100,000.

- If you end up using it as life insurance or annuitizing it, your beneficiaries (or you!) would receive $100,000 or its annuitized equivalent.

- But if you need long-term care instead, the hybrid policy could pay out much more over time, say $250,000, for the same cost to you as a $100,000 death benefit.

Hybrid policies have lots of perks, but traditional long-term care insurance can still be a better choice for some people. An independent insurance agent can go over your insurance needs with you to help you decide.

How to Buy Long-Term Care Insurance, Step-by-Step

Now you know what long-term care insurance is and why you should buy it. Here’s how to actually get a policy:

1. Research the cost of long-term care in the state where you plan to retire

The government website LongTermCare.gov keeps up-to-date statistics on the average cost of long-term care. You can also do your own research on local long-term care options you’re interested in.

Then think about how much of that daily cost you’d be able to cover yourself (from savings or other sources) and for how long. If there’s a shortfall, that’s how much long-term care insurance you should buy.

2. Contact an independent insurance agent

Armed with the numbers, set up a meeting by phone or in person to discuss long-term care insurance. This is also a great time to discuss life insurance and disability insurance. All three are closely related and you may receive a discount by bundling them together.

Look for an independent insurance agent who has experience in life insurance. Many life insurance agents also offer financial planning. Be sure to take them up on it if they do! Solid financial planning will help you get the most bang for your buck with long-term care insurance.

3. Choose between traditional and hybrid long-term care insurance

This is where an independent insurance agent really shines. If you already know which one you want, they can start getting quotes right away. But if you’re not sure, they can shop around multiple offerings with you and go over the pros and cons of each.

Remember that different companies have drastically different long-term care insurance options. Having someone on your side rather than on one company’s side is a big plus when it comes to choosing either traditional or hybrid coverage.

4. Fill out paperwork and get a medical exam (if needed)

Insurance companies need your demographic and health information before they can give you a quote. (That’s because your unique health risks determine what they’ll charge you.) You can do this on paper or in an online questionnaire. This process may include a medical exam.

Sometimes you can do the exam in the comfort of your home. A doctor or nurse may be able to come to you. Be sure to ask your agent whether or not a home visit is an option.

5. Compare quotes

Once you’ve finished up the red tape, your independent insurance agent can assemble quotes. Now’s the time to read the fine print on each one with your agent’s help, if you want it. Be sure to look out for:

- The cost of premiums and how often you’re expected to pay them

- The daily benefit and whether or not it’s sufficient to cover the cost of care in your area

- The lifetime maximum of the policy (typically in the hundreds of thousands of dollars) and whether it’s large enough to meet your needs

- Any time limits on the policy (some may only cover a few years of care, while others will stay in effect permanently)

Ask lots of questions of both your agent and the insurance companies. Think of long-term care insurance as a financial investment — because it is one — and take plenty of time to make sure you’re making a good one.

Cheap premiums don’t always mean a good deal. Look at the quote holistically to make sure you’re getting as much benefit out of your premiums as possible.

6. Purchase

Once you’ve made a decision, sign the contract and breathe easy. You’ve just taken an important step toward securing your financial future.

Why Independent Insurance Agents?

Independent insurance agents are unique. While captive insurance agents can only sell insurance from one company, independent insurance agents can shop around between multiple companies to find the real right deal for you, not just one company’s “best” deal.

With an independent insurance agent, you can be sure you’re talking to a real expert who knows long-term care insurance inside and out. Good luck shopping for this critical coverage.