Traditional Long-Term Care Companies

These three companies are a great starting point for your search.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Could you afford to enter a nursing home if you needed one? As Americans age, long-term care is more necessary than ever. Traditional long-term care insurance is there to help pay for it.

Here are the top companies that sell traditional long-term care insurance. When you’re ready to buy, an independent insurance agent can help you shop around and even find discounts.

What Is Traditional Long-Term Care Insurance?

Long-term care insurance pays for long-term care (usually from a nursing home, but sometimes from assisted living or a home health aides) if you ever need it. You pay monthly or yearly premiums in exchange for that coverage.

There are two main types of long-term care insurance: hybrid and traditional.

- Traditional long-term care insurance is a stand-alone policy.

- Hybrid long-term care insurance is blended with life insurance.

Both have their perks, but traditional policies tend to be simpler and more streamlined. Hybrid policies are more flexible.

Traditional Long-Term Care Insurance Companies

Traditional long-term care insurance is typically sold by life insurance or financial planning companies. Not many companies sell it. These three companies have strong national long-term care insurance programs:

| Nationwide | Mutual of Omaha | Transamerica |

| Year founded: 1926 | Year founded: 1909 | Year founded: 1928 |

| AM Best Rating: A+ | AM Best Rating: A+ | AM Best Rating: A+ |

| 24/7 claims support | 24/7 claims support |

There are also many local companies that sell long-term care insurance. They may be able to offer you even better deals. An independent insurance agent will have these companies in their network and can shop around for you.

How to Buy Traditional Long-Term Care Insurance

Buying traditional long-term care insurance is easier than you might think. Here’s how to do it, step by step:

- Research the cost of long-term care in your area: Look for the average “per day” cost of care in your area (typically a number in the $100-$300 range).

- Determine how much of that cost you’ll be able to pay from savings and other sources: Any shortfall needs to be covered by long-term care insurance.

- Contact an independent insurance agent: They’re experts who can shop around and find you quotes that make the most sense for your situation. If you’re on the fence about buying traditional insurance, they can help you compare hybrid and traditional options.

- Fill out a medical history (and maybe get a medical exam): Your health status will affect the cost of premiums, so the insurance company will need to verify it before giving you a quote. You may be able to get this exam at home—ask your agent.

- Get quotes and compare them: Your agent will round up a series of quotes for you. The cheapest quote may not be the best one. Be sure to compare the size of the benefit and years of coverage before choosing, to make sure you’re getting the most bang for your buck.

- Sign on the dotted line It’s that easy to buy long-term care insurance. Congratulations! You’ve just secured your financial future, so your golden years can stay truly golden.

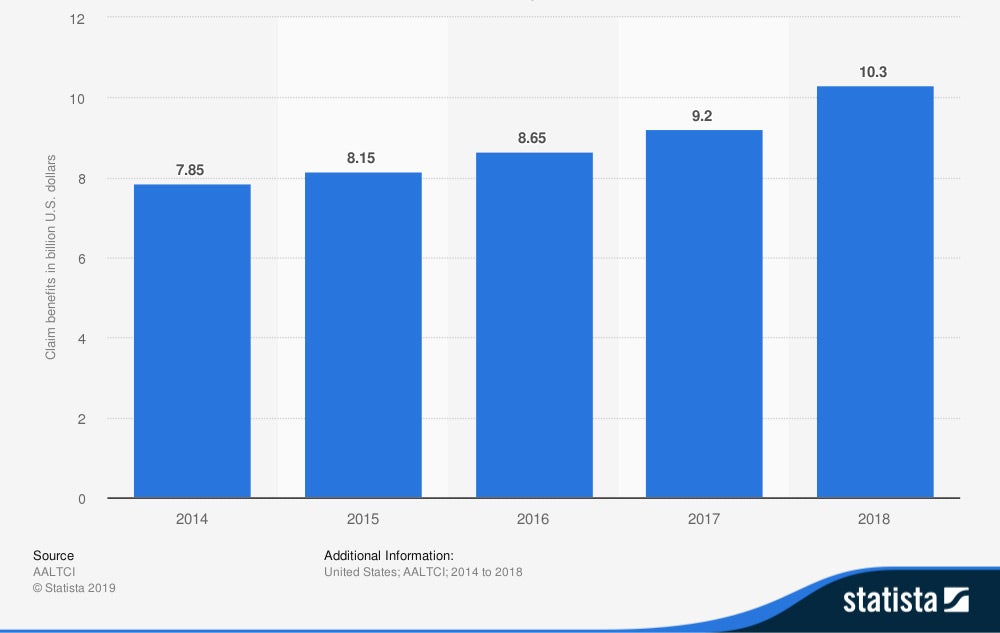

Amount paid in claim benefits to individuals by long-term care insurance companies in the United States from 2014 to 2018 (in billion US dollars)

Long-term care insurance companies paid out over 10 billion in benefits to their customers in 2018 alone, and that number is only trending up. Buying traditional long-term care insurance now secures you a piece of the pie—along with peace of mind.

Why Independent Insurance Agents?

Independent insurance agents are unique. While captive insurance agents can only sell insurance from one company, independent insurance agents can shop around with multiple companies to find the real right deal for you, not just one company’s “best” deal.

With an independent insurance agent, you can be sure you’re talking to a real expert who knows traditional long-term care insurance inside and out. Good luck shopping for this critical coverage.