Mobile Home Insurance Discounts

(Savings as sweet as your home, sweet mobile home)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Bigger isn’t always better. In fact, mobile homes offer a bunch of benefits, from cheaper utilities to lower taxes to refreshing cross-breezes in summertime. And the cherry on top: You can get discounts on your mobile home insurance, and it could be as simple as a quick ol’ phone call.

The truth is that everything from your job, to your car, to your marital status could save you money on your mobile home insurance. Our independent insurance agents can figure out the details for you and lower your bills so you can get back to the good things in life, like yard flamingo collecting.

But let’s talk just a bit about mobile home insurance discounts, what they are and how you get ‘em. Hold on tight, this is gonna be fun.

What Are Mobile Home Insurance Discounts?

It’s simple, mobile home insurance discounts help lower your premiums. But most insurance discounts don’t work quite as easily as coupons. They’re more like little factors inside a humongous math equation that the insurance company uses to calculate how likely your home is to get damaged. The less likely damage is, the less you’ll pay.

It’s important to remember that not all discounts will be spelled out clear as day in your policy, even if they’re still saving you money. You’ll probably know if you’re getting a military or veterans discount, but you might not realize you’re getting a marriage discount, too. It’s all part of the magic of mathematics.

What Mobile Home Insurance Discounts Are Available?

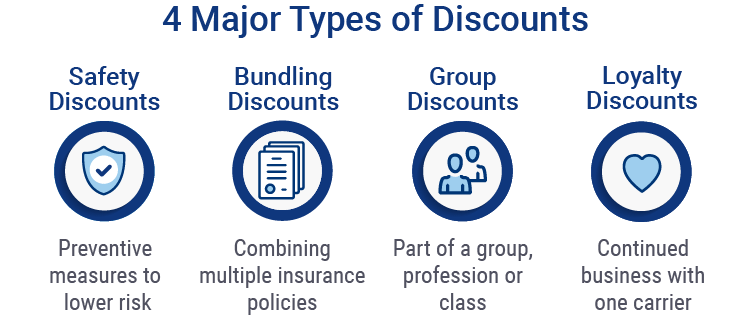

There are almost as many insurance discounts available as there are insurance companies, but they all boil down to these four types:

- Safety discounts: These are given if the insurance company sees that you take good care of your mobile home. Just about anything that reduces risk, like installing an up-to-date alarm system in your mobile home, could potentially net you a nice little safety discount.

- Mobile homes are extra-susceptible to things like fire, hurricanes, floods and tornadoes. That means safety discounts can be harder to secure—but not impossible—for mobile home owners.

- Bundling discounts: These are discounts you can get if you buy multiple types of insurance with the same company. Say you need to insure your car AND your mobile home. If you get both protected with the same company, they’ll likely cut you a deal.

- Group discounts: These are discounts you can get if you belong to a certain association or profession. Common group discounts include military discounts, teacher discounts and government employee discounts. Other niche discounts include ones for farmers, clergy and even dentists.

- Loyalty discounts: These are pretty self-explanatory: they reward customers who stay with the same insurance company for a long time. You might also get discounts for referring friends and family to your insurance company. So tell a friend or twenty and get yourself some cash back.

How Hard Is It to Get Mobile Home Insurance Discounts?

For the most part, it’s pretty easy. But certain types of discounts can be harder to get. Safety discounts can be a real bear because a mobile home’s size and construction makes it more vulnerable to fire and disaster. So chasing other discounts, such as bundling, group and loyalty, will typically lead to better luck.

How Do I Get Mobile Home Insurance Discounts?

Chances are you’ll get a few discounts automatically whether you ask for them or not. Many of these discounts aren’t explicitly spelled out in your policy and are based on things you can’t always control, like your location or credit score.

If you want to go beyond the automatic stuff, though, you can maximize your potential discounts by following these easy steps while you bargain-hunt:

- Take notes: Write down all the information you think the insurance company will need. That includes the age and size of your mobile home, details about your property and any other special features. Also note your age, marital status, occupation and any special memberships you have.

- Talk to an agent: Make an appointment by phone or in person. Bring your notes with you, because your agent will be asking a number of questions to get to know you better. And make sure you answer honestly and thoroughly, because the more they know, the more discounts they can help you qualify for.

- Compare and ask questions: When you get your quotes, don’t go for the lowest price right away. Ask your agent about what discounts have been applied. One of those higher-priced quotes could actually be offering more discounts—and better coverage.

- Keep your agent updated: Did you switch jobs? Get a new car? Buy a speedboat? Dropping your agent a quick line during these life changes can save you big money in the long run. They’ll help you find new discounts to make the coverage you need more affordable than ever.

The Benefits of an Independent Insurance Agent

Look, you’re busy. So why do all that hard work yourself? Our independent insurance agents stay on top of the industry and all the latest discounts so you don’t have to. That means they’ll help you find the right coverage for you at the right price.

They’re not just there at the beginning, either. If disaster strikes and you need to file a claim, they’ll be with you every step of the way, helping you meet deadlines and maximize your benefits. And who doesn’t want all that?

iii.org