Car Wash Insurance

All kinds of car washes need protection against losses due to customer injuries, vehicle damage, and more.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

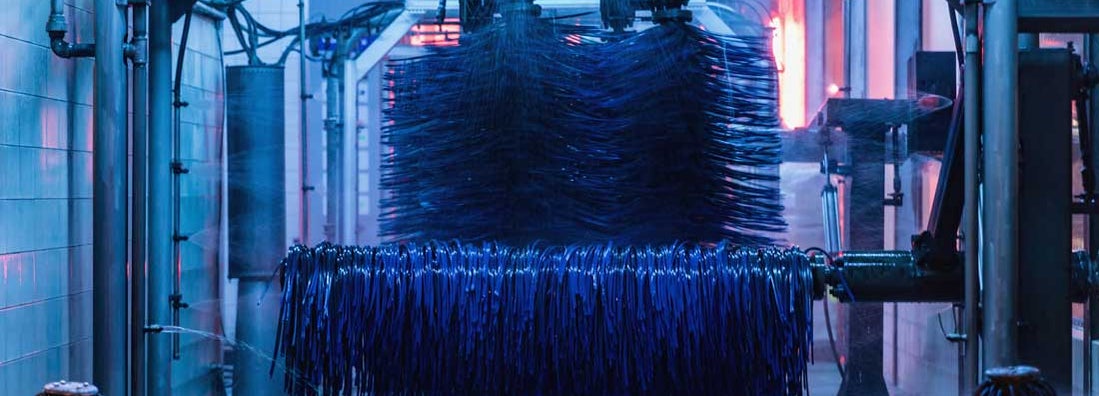

Car washes are unique environments with specific business insurance needs. No matter what type of car wash you operate, you face risks such as fire, vandalism, customer injuries, and damage to customer vehicles. Having car wash insurance can help your business avoid potentially devastating financial losses.

An independent insurance agent knows exactly which type of coverage to get your car wash set up with. They'll get you equipped with a car wash insurance policy that gets the job done right. First, though, here's an overview of car wash insurance.

Common Risks Faced by Car Wash Businesses

No matter where your car wash is located, it's not immune to risks. Possible accidents and errors that could lead to a financial loss can happen anywhere. Customer slip and fall incidents due to the wet, soapy environment must be high on your list of concerns. In addition, your business insurance should address the following risks:

- Fire damage

- Theft or vandalism

- Employee injuries and illnesses

- Weather events

- Business interruptions

- Employee theft

- Employee lawsuits for wrongful termination or harassment

- Customer vehicle damage

- Equipment and machinery breakdown

Your car wash business insurance needs to include coverage to protect against losses caused by the most common threats your company is exposed to.

Coverage for Self-Service Car Washes

Most car washes are either self-service or full-service. Self-service car washes are performed entirely by machines, with no interaction between customer vehicles and employees.

A self-service car wash cannot operate without fully functional machinery and equipment, which needs adequate protection. However, that equipment can cause damage to customer vehicles, so you also need protection for such possible incidents.

If you operate a full-service car wash or perform some services by hand, your employees may operate customer vehicles. Many full-service car washes offer additional services, such as oil changes, brake repairs, or vehicle inspections, exposing you to a variety of additional property or liability claims.

Car wash insurance needs vary depending on the type of car wash you operate and the services you provide. Self-service car wash insurance begins with fairly standard coverage, like:

- Commercial property insurance: This protects your car wash's building or structure, as well as office buildings, equipment, and inventory.

- Commercial general liability insurance: This covers the costs of lawsuits related to claims of third-party bodily injury or personal property damage caused by your car wash or its employees.

- Business interruption insurance: This covers temporary business shutdowns due to listed perils like fire damage by providing a continued stream of income and employee wages during the closure.

- Equipment breakdown insurance: This covers major equipment used by your car wash and can provide reimbursement after damage or destruction due to listed perils like vandalism or fire damage.

An independent insurance agent can help your car wash get equipped with each type of coverage it needs.

Garagekeepers Liability Insurance for Full-Service Car Washes

If you own a full-service car wash where employees get behind the wheel of your customers’ vehicles, you'll need additional protection. Garagekeepers liability insurance is a specialty business insurance coverage designed for garages that take possession of customer vehicles to perform a service. Full-service car washes can also fall under this category.

Garagekeepers liability insurance protects your business if a customer’s vehicle gets damaged due to the car wash's negligence while it's in your care. This protection is not included in commercial general liability insurance. An independent insurance agent can help you find the right kind of garagekeeper liability insurance for your full-service car wash.

Additional Coverage Needed by Car Washes

Your car wash business insurance policy may not yet be complete. Your business may still require additional types of coverage, such as the following:

- Crime insurance: This covers costs associated with dishonest employee acts against the business, including theft.

- Workers’ compensation: This protects against losses related to incidents of employee injury, illness, or death on the job or as a result of job duties or the work environment.

- Employment practices liability insurance: This covers lawsuit costs if an employee sues your car wash for discrimination, harassment, or wrongful termination.

Working together with an independent insurance agent is an easy way to ensure your car wash gets covered by every type of business insurance necessary.

How Much Does Car Wash Insurance Cost?

The cost of car wash insurance depends on a number of different factors, including the size and location of your business. It also depends on the following:

- The car wash's annual revenue

- The car wash's unique exposures

- The type and amount of coverage needed

- The business's claims history

It can be hard to offer an average figure for car wash insurance costs, but an independent insurance agent can help find quotes for coverage in your area.

Ask an Independent Insurance Agent to Help You Find Car Wash Insurance

When shopping for car wash insurance, no one's better equipped to help you find the right policy than an independent insurance agent. These agents shop and compare policies and rates from multiple carriers for you, so they're able to find you the right coverage at the best possible price. They'll also be there for you down the road if you need to file a claim or update your coverage.