Medical Malpractice Insurance

The right coverage can allow you to continue healing the public for years to come.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

When you work in the healthcare field and lives are literally on the line, you must take numerous extra precautions to protect yourself and your career. One such action involves getting set up with the right coverage just in case of disaster. That means finding adequate medical malpractice insurance, also known as doctor's liability insurance.

Fortunately, an independent insurance agent can help you get set up with the right kind of doctor's liability insurance for your needs. Better yet, they’ll get you equipped with the proper coverage long before you ever need to actually use it. But first, here's a closer look at this crucial protection.

What Is Medical Malpractice Insurance?

Doctor's liability insurance, also called medical malpractice insurance, is a type of coverage designed for professionals who work in the medical field, including various types of healthcare providers such as physicians, dentists, pharmacists, psychologists, and more. This coverage is critical for medical professionals to guard against lawsuits for negligence resulting in accidental injuries or death.

Medical malpractice insurance is essentially a form of professional liability insurance designed to protect healthcare professionals against lawsuits relating to professional errors. Doctors and other workers in the medical field rely on this coverage to save their practice from extremely costly lawsuits that could otherwise lead to bankruptcy. An independent insurance agent can help you and your practice get equipped with the necessary doctor's liability insurance for your field.

What Does Doctor's Liability Insurance Cover?

Doctor's liability insurance is a special form of professional liability insurance designed to protect professionals in the medical field. This coverage protects medical professionals from the legal expenses required to defend and settle medical malpractice lawsuits, as well as settlement fees if they’re found to be liable for the claim.

Medical malpractice insurance usually covers the following:

- Costs of medical damages

- Costs of punitive and compensatory damages

- Costs of arbitration and settlement

- Costs of attorney and court fees (defense costs)

Your independent insurance agent can further explain the critical protections provided by medical malpractice insurance and why you need it.

The Three Main Types of Doctor's Liability Insurance

Doctor's liability or medical malpractice insurance comes in three basic forms. It's important to get your practice equipped with the type that works best for you.

Here are the major forms of doctor's liability coverage:

- Claims-made medical malpractice insurance: This coverage only reimburses the policyholder if the service is provided and the claim is made while the policy is in force. However, some policies include "tail" coverage, which extends protection for a specified amount of time, such as five years, after the policy's end date. Tail coverage is beneficial for healthcare workers who are retiring, switching positions, or changing insurance policies.

- Occurrence medical malpractice insurance: This coverage reimburses the policyholder if the service is provided while the policy is in force, regardless of when the claim gets filed.

- Modified occurrence policies: Also called tail coverage, this combines aspects of occurrence policies with aspects of claims-made policies for a type of unlimited coverage. Tail coverage ranging up to seven years is automatically included. Once this additional amount of coverage has expired, you have the option of purchasing unlimited tail coverage.

Tail coverage extends a policy's protection after its term ends. Retiring physicians often purchase tail coverage to protect themselves even after they're no longer working. An independent insurance agent can help you determine which type of medical malpractice insurance makes the most sense for you.

What Doesn't Medical Malpractice Insurance Cover?

Doctor's liability insurance unquestionably provides critical coverage for medical professionals, but it doesn’t cover everything. Coverage also comes with its own set of exclusions, which often include the following:

- Criminal acts

- Inappropriate alteration of medical records

- Intentional and dishonest acts

- Sexual misconduct liability

An independent insurance agent can help address any concerns you may have about what your doctor's liability insurance policy excludes.

Who Sells Doctor's Liability Insurance?

Many different carriers underwrite medical malpractice insurance policies. Here are just a few of our top recommendations for quality carriers.

| Top Medical Malpractice Insurance Company | Overall Carrier Star Rating |

| Liberty Mutual |

|

| Berkshire Hathaway Group |

|

| CNA Insurance Group |

|

An independent insurance agent can help you determine if the doctor's liability coverage provided by any of these leading insurance carriers is right for you.

Options for Purchasing Doctor's Liability Insurance

When shopping for doctor's liability insurance, you often have a few different options, including the following.

- Policies held by an employer, like a hospital

- Policies from a traditional private insurer, either individual or group coverage

- Policies offered through a medical risk retention group (i.e., a medical professionals organization that provides doctor's liability coverage)

Doctors and other medical professionals don't need medical malpractice insurance if they work for the Federal government, which is already self-insured against lawsuits. However, other medical professionals need to find enough coverage for themselves as employees, for their practice, and for their employees, if applicable.

Common Medical Malpractice Insurance Claims

There are numerous reasons doctors and other medical professionals are sued regularly. A doctor might prescribe a medication that makes a patient ill, who in turn decides to press charges.

Wrongful diagnosis is another common claim against doctors. Whether you're actually found guilty or not, it's imperative to have enough coverage for yourself and your practice before a lawsuit ever arises. Here are some of the most common medical malpractice insurance claims:

- Surgical errors, such as wrongful site or unnecessary surgery

- Failure to diagnose

- Misdiagnosis

- Medication or dosage errors

- Premature discharge

- Aftercare and follow-up errors

- Laboratory result errors

- Failure to evaluate patient history

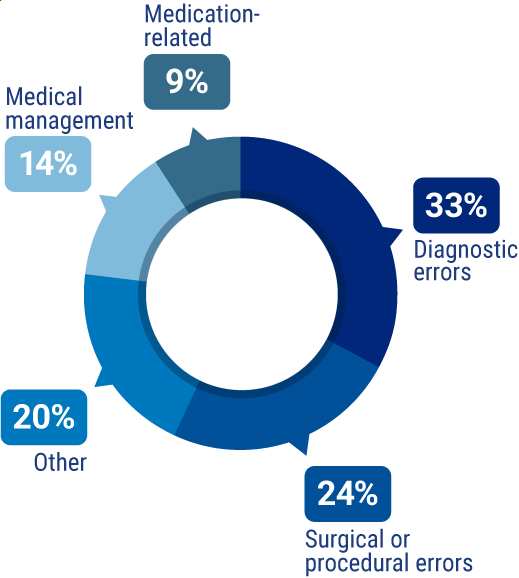

Most Common Doctor's Liability Insurance Claims

Diagnostic errors account for one-third of all doctor's liability claims. Surgical and procedural errors account for one-fourth. Fortunately, doctor's liability insurance can protect you against lawsuits relating to any of these disasters, and more.

Who Needs Medical Malpractice Insurance?

Anyone in the medical field who treats patients should have medical malpractice insurance. This crucial coverage is needed by the following professionals:

- Physicians, specialists, and surgeons

- Medical assistants

- Dentists

- Anesthesiologists

- Nurses and nurse practitioners

- Psychiatrists

- Gynecologists

- Obstetricians

- Physical therapists

- Optometrists

- Chiropractors

- Anesthesiologists

- Nursing students

Assistants to any of these professionals also need medical malpractice insurance. An independent insurance agent can help insure your whole team.

How Much Does Medical Malpractice Insurance Cost?

On average, medical malpractice insurance costs $7,500 per year. However, coverage costs for doctor's liability insurance can vary greatly, depending on your profession and more. Here are some of the key factors that go into your policy's premium.

- Your professional specialty (e.g., doctor, psychiatrist, etc.)

- How many years of experience you have

- If you work full-time, part-time, etc.

- Your claims history, or any outstanding claims

Many medical professionals pay between $4,000 to $12,000 annually for their coverage. Surgeons, however, pay quite a bit more, often anywhere from $30,000 to $50,000 annually.

Typically, healthcare professionals spend about 3.2% of their annual income on medical malpractice insurance. An independent insurance agent can find exact medical malpractice insurance quotes for your area.

Is Medical Malpractice Insurance Required?

Medical malpractice insurance is not federally required, but many states do require various professionals to have coverage. Some medical professionals opt to "go bare," meaning not to have coverage, because they believe they will be less of a target to get sued.

Other professionals opt to go without coverage because of the high costs of the premiums. Regardless of whether coverage is required, it's critical for your practice to have this protection.

How Do Medical Malpractice Insurance Limits Work?

The limits provided in your doctor's liability insurance work similarly to those included in your car insurance. Doctor's liability insurance limits often look like this: $1 million/$3 million.

- The $1 million is the maximum amount your insurance will pay out per claim.

- The $3 million is the maximum amount of coverage provided by your insurance every year.

So, if you had three claims that all needed $1 million payouts, you'd have exhausted all of your medical malpractice coverage for that year. An independent insurance agent can help you get set up with a policy that works best for you.

The Benefits of an Independent Insurance Agent

When it comes to helping insurance customers find the absolute best medical malpractice coverage, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who sell doctor's liability insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

FAQs about Medical Malpractice Insurance

Only seven states require doctors to have liability insurance by law. However, having coverage is crucial to protect yourself and your practice and employees against costly professional errors.

Technically, if you work in a state where medical malpractice insurance is not required by law, you could practice without this coverage. But the doctor would be risking their entire business operation without the right doctor's liability insurance. Just one lawsuit could cost millions of dollars to settle.

Many medical professionals pay between $4,000 to $12,000 annually for their coverage. Surgeons, however, pay quite a bit more, often anywhere from $30,000 to $50,000 annually. An independent insurance agent can find exact medical malpractice insurance quotes for your area.

Physicians, specialists, surgeons, dentists, anesthesiologists, nurses and nurse practitioners, and psychiatrists all need doctor's liability insurance. These medical professionals' assistants all need their own coverage, as well.

No, these two terms are often used interchangeably. Doctor's liability insurance is the same thing as medical malpractice insurance.

You need enough doctor's liability insurance to protect you against any possible lawsuits that may arise within the coverage period. This could mean a policy with a limit of $5 million or more. An independent insurance agent can help you determine the right amount of coverage for you.

You'll need to ask to review your company's policy, and also consult an independent insurance agent. It's always a safe idea to have more coverage from the very beginning.

In addition to negligence claims, doctors and other healthcare professionals can face lawsuits due to cyber and regulatory risks. Healthcare professionals must comply with the Health Insurance Portability and Accountability Act (HIPAA). Those who work in the medical field may also want to consider getting cyber liability insurance to protect them against the cost of lawsuits related to data breaches and other cyber risks.

Medical malpractice insurance can protect you financially if you get sued for professional errors, such as wrongful diagnoses or surgical errors that result in harm to your patients/clients. Coverage protects you from costly lawsuit expenses that you'd have to pay out of pocket otherwise and can help your coverage keep its doors open in case of a major incident.

https://physiciansthrive.com/malpractice-insurance/costs/#:~:text=On%20average%2C%20medical%20malpractice%20insurance,high%20as%20$226%2C224%20per%20year.

https://www.iii.org/article/understanding-medical-malpractice-insurance