Gym Insurance

And how you can easily get started today

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

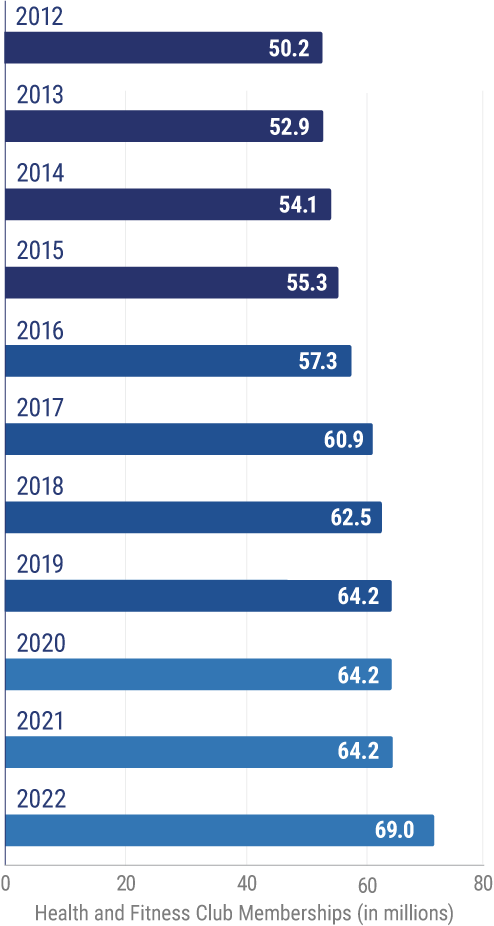

Every year, more Americans are joining the gym. From exercise-specific fitness centers like yoga, pilates, and CrossFit, to your general health center, more than 60 million people are investing their time, and money, in staying healthy and fit every year.

Total number of memberships at fitness centers/health clubs in the U.S. from 2012 to 2022 (in millions)

As a gym owner, as soon as a member steps through your doors, you're liable for them. So how can gym insurance benefit you? From protection against injuries to protecting your building and what’s in it, an independent insurance agent can help you understand and find the necessary insurance you need for your gym.

What Is Gym Insurance?

Gym insurance is business insurance with added liability insurance that protects you from a variety of incidents that could happen to, and in, your gym.

Whether you run a fitness center with equipment, a yoga studio, or a Pilates studio, gym insurance is a combination of insurance coverages, with the main coverages being business and liability insurance.

- Business insurance: Coverage that will replace or recover the value of property and assets that may be lost or damaged by a variety of causes.

- Liability insurance: Coverage that will protect a company or business from third-party lawsuits and claims.

Why Do I Need Gym Insurance?

First and foremost, if you own a physical facility where people come in and out of your space and operate equipment, then gym insurance is required to cover your equipment and all the different classes that you offer.

You also need protection in case an incident occurs to your property, like fire, theft, or property damage.

Second, while most people at the gym have good intentions, not everyone's an expert. Get a beginner on a new piece of equipment, or even a regular who just makes a mistake, and you’re left with someone under your business’s roof with an injury.

In fact, gyms are full of potential risks and without insurance paying for any incidents comes straight out of your pocket.

Common risks involved with gyms:

- Trip and fall accidents: Accidents and injuries resulting from tripping over equipment, being bumped by another person or falling over someone else’s personal items

- Major and minor injuries: Ranging from ankle strains to spinal injuries leading to disability

- Major and minor health issues: Ranging from flu from contaminated equipment to cardiac arrest while exercising in the facility

- Accused of not rendering services as promised: Clients claiming the methods and workout routines did not get the results advertised and promised

- Damaged or stolen equipment: Business property lost in a fire, water damage, or taken by thieves

- Potential shutdown of gym: Temporary or permanent closure if there is a fire, equipment failure or water damage

What Does Gym Insurance Cover?

Gym insurance is tailored to the particular risks of your business. An agent can help you narrow down what coverage is necessary for your policy and what you can pass on. Here’s what your policy could include:

- Business and property: If you're leasing space for your gym, business and property insurance is where you'll find your building coverage. This covers expenses if your building(s) and equipment are damaged by fires, theft, or natural disasters. Usually, a landlord will require that you have building coverage if you're leasing space. Business and property will also pay for repairs if a pipe bursts in the bathroom, covers exercise equipment and training tools, and even office equipment to help run the business.

- General liability: This type of coverage is for all the ways clients can accidentally hurt themselves at the gym. This could be a straightforward weightlifting accident or even a lawsuit for damages after a slip and fall in the locker room. General liability will also protect a gym owner from libel.

- Professional liability: Also called errors and omissions insurance. This covers trainers, coaches and other professionals you employ at the gym. It covers legal expenses if a client claims their biceps didn’t turn out as big as promised. This differs from general liability in that it protects against a client saying they were provided poor training or advice. If someone who suffers from seizures has a seizure during a Zumba class, professional liability would cover the costs of any legal claims that might be made against the gym.

While these are the basic policies you'll want to have, there are some additional coverage options that you may want to look into.

- Cyber Insurance: This policy will provide coverage against a data breach of your gym. If you're running a gym you're most likely collecting fees from clients. That means you have a credit card and other personal information on file. If a hacker gets into your system they could steal all of your and your clients' data and cyber insurance will protect you against in this scenario.

- Equipment breakdown coverage: Sometimes equipment breakdown will be covered in business property insurance, but if it's not you'll want to get it. If a treadmill, stair-stepper, weight machine, air conditioner, or even refrigerator with snacks in it breaks down, equipment breakdown coverage will help repair it.

- Medical payments coverage: This coverage will payout in the event of third-party injuries. While injuries are also covered under general liability and business insurance, medical payments coverage can come in handy if your gym faces larger medical claims or lawsuits.

- Workers' compensation: If an employee who is working for you gets hurt on the job, then you need workers' compensation. Workers' compensation is actually required in most states as it will pay for medical costs, lost wages, and even survivor benefits if an employee dies as a result of the injury.

There’s also a number of standalone policies available. Coverage options can include protection for vehicles and equipment if you hold off-site workouts. An agent will be able to walk you through all your risks and how to protect against them.

What Does Gym Insurance Not Cover?

No matter how much coverage you get, there are still a few things that are not covered by insurance. It's important to know what you won't find coverage for when operating a gym.

- Additional health services: If your gym offers also offer massage or acupuncture, you'll need additional insurance to cover these services.

- False statements and guarantees: If you promise a client that they'll lose 20 pounds in three weeks, guaranteed, and they don't lose that weight and sue you for false guarantees, your insurance will not cover the scenario. It's best to never promise anyone they'll lose a certain amount of weight or see certain results.

- Minors in the gym: If someone under the age of 18 is injured in your gym, you will most likely not be covered.

- Supplement, oils, or other product sales: Selling private labeled products to your gym members are not covered under gym insurance.

- Specialty fitness facilities: If you're running a martial arts studio, swim center, dance studio or other something other than basic fitness you may not be covered under general gym insurance options.

An independent insurance agent can be sure that whether you're running a basic fitness center or a world-renowned training center for professional athletes that you have the right coverage.

How Much Does Gym Insurance Cost?

The cost of gym insurance depends on the policy. Liability coverage will be the most expensive, but all together you can expect your premiums to be in the thousands per year. Factors like size, location, number of clients, and employees will also play a major role.

A small gym can expect to pay between $3,000-$5,000 while a larger fitness facility can get into the tens of thousands of dollars.

What Do You Need for a Gym Insurance Quote?

When you're ready to work with an independent agent to get a gym insurance quote there are a few pieces of information that you'll need. Having this information available to hand over to your independent agent can help the process move quicker.

- Business location and industry

- Owner information and experience

- Details of business operations

- Gross annual sales

- Number of employees

- Annual payroll

- Tools and equipment valued over $1,000

- Number of claims in the past 5 years

- Date of claims

- Amount paid to settle each claim

- Any error and omissions or monetary demands

- Age of building

- Square footage

- Building construction type

- Building safety features

The Benefits of an Independent Insurance Agent

Gym insurance can be a confusing policy to understand. Thankfully, you don’t have to navigate the insurance world alone. An independent insurance agent will walk you through handpicked gym insurance options so you know exactly what you’re getting.

Most important, should you find yourself in need of making a claim, your agent will be there to help you through the entire process.