File a Workers' Compensation Claim

Find out how the workers' comp claim process works and how you can easily file a claim today.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Your workers' compensation insurance is only as strong as it proves itself to be when you file a claim. As a policyholder, filing a claim is when you're most vulnerable, and it's also when your insurance company should come through for you. In the case of workers' compensation claims, it's important to know how the process works.

Having an independent insurance agent on your side is crucial to making sure your workers' compensation claims run efficiently. They can not only help you find the right workers' comp coverage for your business but also walk you through the claims process. But first, here's a closer look at workers' comp claims in general.

What Is Workers' Compensation Insurance?

Workers' compensation insurance or workers' comp (WC) provides coverage for employees' medical expenses arising from work-related injury, disability, illness, or death. It also covers the employee's wages up to two-thirds of their regular compensation while they're off work recovering. It is a type of business insurance.

Workers' compensation is also important to protect the employer. When employees are covered by workers' comp, the employer is exempt from employee lawsuits that arise from injury, illness, or death due to their job or work environment. So, workers' comp is crucial for protecting workers and employers alike.

What Are Workers' Comp Claims Used For?

Employee injuries, illnesses, and fatalities can be filed through workers' compensation as long as they meet a couple of criteria. The incidents must have either happened due to work duties while on the job, or otherwise as a result of work activities or the workplace's environment. Employee injuries, illnesses, and deaths are not covered if they're not caused by their job in some way.

Workers' comp claims can also be covered if an injury, illness, or disability develops over time. A common example of this is injury or disability that develops due to repetitive motions required at the employee's workplace. A workers' compensation policy can pay for medical treatments and provide disability benefits for injured workers or disabled workers. Workers' compensation benefits can also pay for rehabilitation costs to get an employee back to work once they've recovered.

An Overview of the Workers' Comp Claims Process

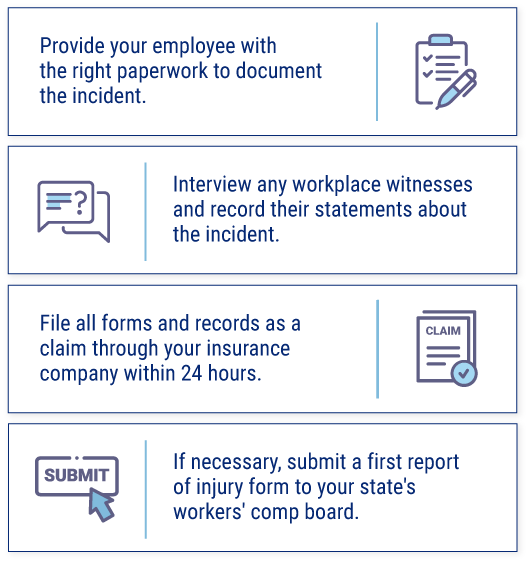

Immediately upon learning of an employee's injury or illness, it's important to not only file a workers' comp claim but also make sure your employee seeks medical attention. Follow these important steps after a report of employee injury or illness.

Though this is the general process for workers' comp claims, workers' compensation laws vary by state. With the help of your independent insurance agent, be sure to review your state's laws about workers' comp claims so your business can comply as much as possible.

When to File a Workers' Compensation Claim

It's crucial to file workers' comp claims immediately. Never let more than 24 hours pass without filing a claim when an owner, member, executive, or employee gets injured or ill due to work duties or the work environment. Waiting too long to file can result in your insurer deciding to deny your claim or lead to a complication.

The Step-by-Step Workers' Compensation Claims Process

Filing claims for workers' comp can be simple, especially with the help of an independent insurance agent. Here's an example of just how smoothly a good workers' comp claims process can run.

Step One: Prepare to File a Claim

Encourage employees to always report workplace incidents to the employer immediately. As soon as you receive a report from an injured, ill, or disabled worker, provide them with the appropriate paperwork to submit a workers' comp claim. Have the employee seek treatment from a medical professional who's approved by your workers' comp company so they can receive reimbursement. Employers should be prepared to offer employees a list of doctors, hospitals, etc. that are approved by their workers' compensation insurance carrier.

Step Two: Gather Important Information

The injured employee will need to send copies of any documents related to their medical treatment, including medical bills and prescription medication receipts. When an employee prepares to file a claim, they'll also need to provide recent wage or earning statements and possibly other documentation that proves their current work status.

Step Three: File the Claim

Now it's time for the employee to complete a claims form accurately. They'll want to include their personal and employer's contact information, including their name and address, as well as their insurance company's contact information. The employee must document the injury, illness, or disability in detail, including when and why the incident occurred. The claimant will also make a formal request for specific benefits, such as reimbursement for medical expenses or partial wage replacement. They may request a hearing or mediation if they wish.

Next, the employee will officially file the claim through their state's workers' compensation board or division of workers' compensation (DWC), which may be part of the division of labor. They can submit their claim form by mail or in person. Make sure the employee makes copies of all documents for their insurance carrier and their employer.

Step Four: Get a Decision

Administrators from the WC board will contact the employee with any questions they may have about the claim. The employee will then receive a notification of whether their request for benefits was approved or denied. If the claim is approved, the employee will be provided with a detailed explanation of what benefits they're receiving. In the event the claim is denied or the employee feels they didn't receive the full benefits they were entitled to, they can request a hearing from the WC board.

The employee must comply with any medical treatments or rehabilitation services dictated by the WC board's decision. Failure to comply with these orders can result in the employee forfeiting their benefits. The employee is also required to return to work, whether at their previous employer or a new one, once their physician says they're sufficiently recovered.

The Benefits of an Independent Insurance Agent

When it's time to find the right workers' comp insurance to protect your employees, no one's better equipped to help than an independent insurance agent. These agents have access to multiple workers' comp insurance companies, so they're free to shop and compare policies and rates for you. They'll get you matched to a policy that offers the best blend of coverage and cost. And down the road, your agent will still be there to help update your coverage as your business's needs evolve and can even file workers' comp claims for you.

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

https://georgia.gov/file-workers-compensation-claim