What is in a Work Comp Policy

And more importantly, how do you find the right one?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Workers in your business are an important part of the overall operation. But employees are vulnerable to injuries and illness on the job even in the safest workplaces. That’s what makes workers' compensation insurance so critical to the success of your business.

Luckily, an independent insurance agent can help you get set up with all the workers’ comp your workplace needs to stay safe and afloat for years to come. Even better, they’ll get you covered long before you need to file a claim. But for starters, here’s a closer look at this important coverage.

What Is Workers' Compensation Insurance?

Workers’ compensation insurance, or workman's comp, is an important part of a standard business insurance policy. Coverage is designed to protect your staff from injuries, illness, and even death on the job or due to work-related activities. Workers' comp offers benefits to employees who end up sick or injured from job duties or the work environment itself.

Workers' comp provides disability benefits and offers replacement for lost wages while an employee is out of work. Death benefits can also be paid out by workers' comp if an employee gets killed on the job. Further, workers’ comp protects the employers from employee lawsuits for claims of job place or work-related incidents resulting in illness or injury.

The Workers' Compensation Breakdown

After understanding what workers' compensation policy is meant to be used for, learning how it works and when coverage applies is equally as important.

Here's the breakdown of workers' compensation:

| Step 1: Industry Type | Some workers' comp insurance companies have a more comprehensive approach while others narrow in on one specific industry. Knowing which carrier is right for your business should be discussed with your independent insurance agent. |

| Step 2: Classification AKA Class Codes | Next, your independent insurance agent will work with you and the insurance carriers to assign the class codes, or four-digit numbers, your employees fall under to determine the overall coverage rate. The riskier the job duties, the more premium will be charged to accommodate for that risk. |

| Step 3: Experience Modification Rating AKA MOD | MODs help insurance companies determine your premiums, and go up or down based on your claims frequency. You will not be assigned a MOD unless you have had a minimum of three years' of workers' comp and your annual premiums are $5,000 or more. |

| Step 4: Safety Factors | Hosting safety trainings for employees and having a safety manager will get your business points with your insurance company. They love it when you minimize their risk by making the workplace safer. Your independent insurance agent can offer further tips and insights about how to save money on your coverage. |

| Step 5: Premiums | When it comes to premiums, each industry is different and every business has its own risk factors that determine their workers' comp premiums. Though it may be tough to figure out your policy's cost on your own, an independent insurance agent can rate multiple insurance companies that specialize in your industry. |

What Does Your Workers' Compensation Policy Cover?

In short, your worker's compensation policy covers injuries sustained on the job, or as a result of job-related activities, or the work environment itself. Coverage applies to employees, subcontractors, and even employers.

For employers, workers' comp coverage can protect your company from expensive employee lawsuits and reimburse you for several costs related to these cases.

Workers’ comp covers the following:

- Injury or illness: Employees are protected from injury and illness related to workplace equipment or materials, as well as other disasters like workplace violence, terrorist attacks, and natural disasters.

- Medical care: Workers’ comp reimburses for employee medical treatment for workplace injuries or illnesses.

- Legal protection: If your business gets sued by an injured employee, workers’ comp can reimburse for attorney, court, and settlement fees.

- Death and disability benefits: If an employee gets killed or becomes disabled due to their work, workers’ comp may pay out a lump sum death or disability benefit.

- Employee wages: Workers’ comp may reimburse for lost employee wages while they are out of work recovering from an injury or illness.

- Funeral costs: If an employee gets killed on the job or as a result of job duties, workers’ comp may also cover funeral costs.

An independent insurance agent can further explain what all is covered by workers' compensation, and help you find the right policy for you.

Who Needs Workers' Compensation Insurance?

Depending on your state's workers' comp laws, your business likely needs workers' comp coverage if you have at least one employee on payroll. However, certain industries need coverage more than others.

Hotels, restaurants, and construction sites file more workers' comp claims than any other type of business due to the nature of their activities and environments. If your business falls into one of these three industries, it's critical to get set up with a policy ASAP.

What Doesn't a Workers’ Compensation Policy Cover?

Workers’ comp offers a ton of critical protection for businesses across the country. However, no single workers' comp policy can cover everything. In fact, workers' comp often specifically excludes these types of disasters:

- Incidents that occur due to intentional or dishonest acts by employees.

- Incidents that occur while employees travel to or from the workplace.

- Incidents that occur due to employee negligence.

If an employee adheres to company guidelines for safety, it's likely that the claims they file against the business for job-related injuries or illness will be approved. But employees who behave negligently often find their claims get denied.

What Common Incidents Lead to the Most Workers' Comp Claims?

It's critical to not only have workers' comp coverage, but to understand when and why your business may end up using it. Check out some of the most common workers' comp claims below.

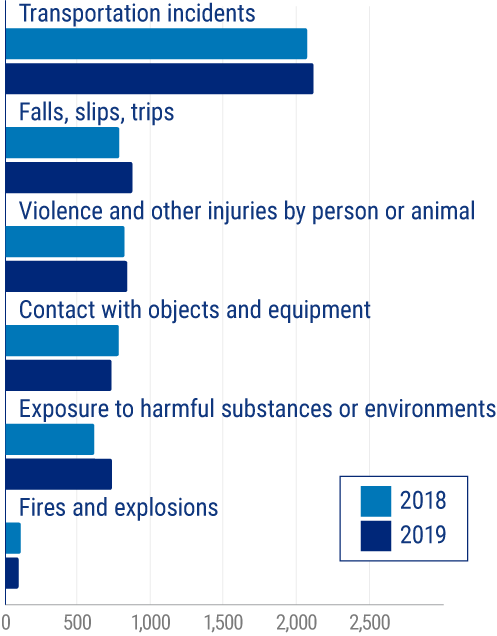

Fatal work injuries by major event or exposure

The most common fatal workplace events in recent years were caused by transportation incidents. Second-highest are fatal workers' comp claims from trips, falls, and slips, and violence and other injuries by a person or animal.

More common workers' comp claims include contact with objects and equipment, and exposure to harmful substances or environments. Your independent insurance agent can further explain which incidents could lead to your business needing to file a workers' comp claim.

Why Are Independent Insurance Agents Awesome?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best workers' compensation coverage, accessibility, and competitive pricing while working for you.

https://www.bls.gov/news.release/pdf/cfoi.pdf

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance